Get the free Certificate of Insurance Coverage Form

Get, Create, Make and Sign certificate of insurance coverage

Editing certificate of insurance coverage online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificate of insurance coverage

How to fill out certificate of insurance coverage

Who needs certificate of insurance coverage?

Certificate of Insurance Coverage Form: How-To Guide

Understanding the certificate of insurance coverage form

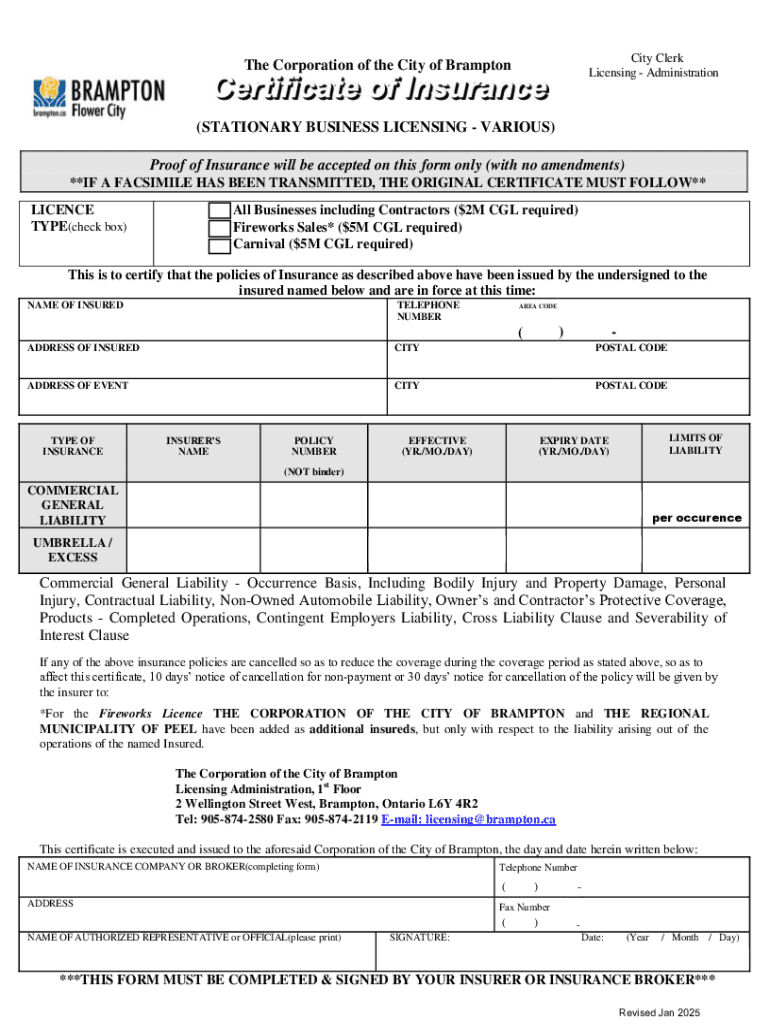

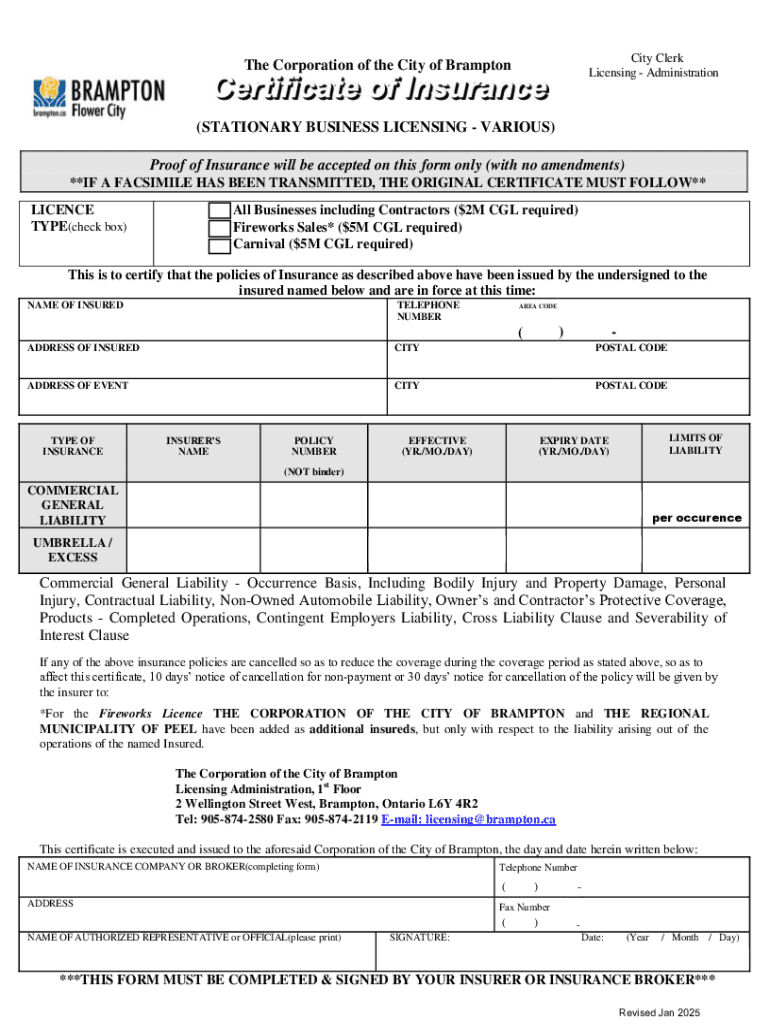

A certificate of insurance (COI) is a critical document that provides proof of insurance coverage for various stakeholders. It's important because it verifies that individuals or businesses carry the necessary insurance required by law or contractual obligations. Common scenarios for needing a COI include construction projects, rental agreements, and business contracts.

This form serves as a snapshot of insurance coverage, detailing the types and limits of insurance held by the policyholder. For example, contractors may need to present a COI to demonstrate their liability coverage before starting a job. It plays a vital role in mitigating risks associated with unanticipated incidents.

Benefits of using the certificate of insurance coverage form

Using a certificate of insurance coverage form streamlines communication among stakeholders. By having a standardized form, all parties can easily access and understand the insurance status of the involved entities. This clarity not only fosters trust but also simplifies administrative processes.

Moreover, the COI acts as proof of valid coverage, ensuring that businesses are prepared to handle any accidents or claims that may arise. This is particularly crucial for businesses operating in high-risk environments like construction or event planning, where uncertainties can have significant financial implications.

Who needs a certificate of insurance coverage form?

The stakeholders requiring a certificate of insurance coverage form span a wide range. Individuals such as freelancers or those who are self-employed often need a COI when providing services that require liability coverage. Homeowners and renters may also need a COI when dealing with landlords or insurance policies.

On the business side, various sectors demand a COI, including contractors and construction firms needing proof of liability before commencing work. Event organizers must provide insurance details to venues or distributors, while service providers may require a COI for contractual obligations with clients.

Step-by-step guide to filling out the certificate of insurance coverage form

Filling out a certificate of insurance coverage form doesn't need to be an overwhelming task. Begin by preparing to fill out the form, which involves gathering necessary information such as policy details, coverage types, and policyholder information. All related documents should be within reach to ensure the accuracy of the COI.

Once you have the required information, you can proceed to fill out the form. Start with the policyholder information, including the name, address, and contact details. Then, provide the insurance provider's details, followed by listing the types of coverage and their respective limits.

Editing and customizing your certificate of insurance coverage form

Customization of the certificate of insurance coverage form is crucial for meeting specific needs. pdfFiller offers various tools that allow you to add or remove sections from the form based on your requirements. If you need to provide additional information or tailor the COI to fit unique circumstances, these customizable options will save you time and effort.

Additionally, you can insert digital signatures for quick approvals and add notes or comments for clarity. This feature is beneficial when sharing the document with multiple stakeholders, ensuring everyone is on the same page regarding insurance coverage.

Signing and collaborating on the form

Once the certificate of insurance coverage form is filled out and customized, it’s time to sign and collaborate. pdfFiller facilitates eSigning options that allow multiple parties to add their signatures securely. This feature ensures that all necessary approvals are obtained in a streamlined manner, reducing delays in the verification process.

Collaboration features available within pdfFiller enable real-time document editing. Participants can offer feedback or leave comments directly on the document, fostering a productive working environment where all concerns can be addressed without back-and-forth emails.

Managing your certificate of insurance coverage form

After obtaining signatures, it's essential to manage the certificate of insurance coverage form efficiently. Storing and organizing documents in cloud storage ensures that they are easily retrievable from anywhere. This setup is beneficial when you need immediate proof of insurance for clients or projects.

Best practices for document management include regular updates and renewals of coverage. It is vital to keep the certificate current to avoid any lapses in coverage that could expose you or your business to financial risk. Keeping a version control allows you to track changes over time and maintain an organized record.

Frequently asked questions about the certificate of insurance coverage form

Understanding the nuances of a certificate of insurance coverage form can often raise several questions. A common inquiry is about the length of time it takes to obtain a COI after making a request. Typically, it can vary based on the provider but usually is available within a few days.

Another frequent concern is what to do if there are discrepancies in the requested coverage versus what is provided in the COI. In such cases, communicating directly with the insurance provider is crucial to rectify any mistakes. Managing these questions proactively can lessen confusion and optimize process efficiency.

Best practices for using the form in various scenarios

When working with different stakeholders, having a well-prepared certificate of insurance coverage form can make a significant difference in relationship management. Service providers, for instance, should tailor their COI to match the industry's insurance requirements as clients may have specific standards they expect you to meet.

Presenting the form effectively can further enhance interactions, so consider including a cover letter or additional documents explaining the COI. Familiarize yourself with legal requirements in your area so that the information provided adheres to all necessary regulations, leading to smoother transactions.

Conclusion of the certificate of insurance coverage process

Ensuring the accuracy of the certificate of insurance coverage form is paramount. A single error can lead to complications later, especially in critical situations. Ongoing maintenance of your insurance documentation, including timely renewal of policies and keeping the COI updated, plays a vital role in protecting your interests.

Staying proactive in managing your certificates will not only keep you compliant with regulations but will also build trust with clients, partners, and stakeholders. Regular reviews ensure potential issues are caught early, allowing you to address them promptly.

Interactive tools and resources on pdfFiller

pdfFiller provides users with a variety of interactive tools for managing their certificate of insurance coverage form effectively. By accessing templates specifically designed for COIs, you can easily customize your documents to reflect your information accurately.

In addition, pdfFiller's platform integrates with other software seamlessly, offering features like automated reminders for policy renewals. This helps ensure that you never miss important updates to your coverage. Utilize these resources to enhance your document management skills.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find certificate of insurance coverage?

Can I create an eSignature for the certificate of insurance coverage in Gmail?

How do I complete certificate of insurance coverage on an Android device?

What is certificate of insurance coverage?

Who is required to file certificate of insurance coverage?

How to fill out certificate of insurance coverage?

What is the purpose of certificate of insurance coverage?

What information must be reported on certificate of insurance coverage?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.