Get the free Customer Identification Verification Form

Get, Create, Make and Sign customer identification verification form

Editing customer identification verification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out customer identification verification form

How to fill out customer identification verification form

Who needs customer identification verification form?

Customer Identification Verification Form - How-to Guide

Understanding customer identification verification

A customer identification verification form is crucial for various industries as it ensures the identity of the individuals engaging in a transaction or receiving services. This form collects essential information to prevent fraud and uphold compliance with legal requirements, fundamentally strengthening trust in business operations. By verifying a customer's identity, businesses mitigate risks associated with identity theft and financial crimes.

Numerous industries, such as banking, healthcare, real estate, and e-commerce, require customer identification verification to comply with regulations and protect their interests. For instance, financial institutions follow the Know Your Customer (KYC) procedures that mandate verifying customer identities to avoid money laundering activities. With increasing cybersecurity threats, having rigorous identification processes assures customers that their data is handled responsibly.

Legal requirements surrounding identification verification vary by industry and jurisdiction, emphasizing the need to understand local laws. Typically, businesses must document the procedures they follow, ensure accuracy in information gathering, and retain records of identification verification efforts. Compliance with these guidelines not only protects businesses from liabilities but also enhances customer trust.

Common uses of customer identification verification forms

Customer identification verification forms find applications across several critical sectors. Each industry has tailored its use of these forms to meet regulatory compliance and business-specific requirements. Here are some of the most common applications:

Overview of pdfFiller’s customer identification verification form

pdfFiller's customer identification verification form is designed to simplify the process of gathering and verifying customer identities. The platform provides a user-friendly interface that allows users to navigate easily through required fields, making it accessible for individuals and teams alike. A cloud-based access system supports collaboration, enabling multiple users to review and complete forms simultaneously from different locations.

The key features of pdfFiller's form include enhanced collaboration tools, seamless integration with other applications, and secure storage for essential documents. By utilizing pdfFiller, organizations can achieve significant time savings in their verification processes and ensure compliance more effortlessly.

The benefits of using pdfFiller for identification verification extend beyond user convenience; the platform guarantees the security and privacy of sensitive customer information. pdfFiller employs advanced security measures to protect data, ensuring businesses can maintain compliance with laws and customer expectations.

Step-by-step guide to fill out the customer identification verification form

Filling out the customer identification verification form is a straightforward process when using pdfFiller. Follow this step-by-step guide for a smooth experience:

Frequently asked questions

As users navigate the customer identification verification process on pdfFiller, several common questions arise. Here are answers to some frequently asked queries:

Troubleshooting common issues

Users might encounter issues while accessing or submitting the customer identification verification form. Familiarizing yourself with common troubleshooting tips can be beneficial. Here are a few scenarios to be aware of:

Best practices for customer identification verification

Adhering to best practices for customer identification verification is crucial for maintaining efficiency and compliance. Consider implementing the following approaches:

Additional features of pdfFiller for document management

Beyond the customer identification verification form, pdfFiller integrates numerous features that enhance document management and collaboration among team members. Users can benefit from:

Interactive tools and resources available on pdfFiller

pdfFiller not only offers customer identification verification forms but also provides resources that enhance user experience. Interactive tools include:

Getting started with pdfFiller

Getting started with pdfFiller is an easy and straightforward process. Here’s how to quickly integrate pdfFiller into your verification procedures:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send customer identification verification form to be eSigned by others?

How do I edit customer identification verification form online?

Can I edit customer identification verification form on an Android device?

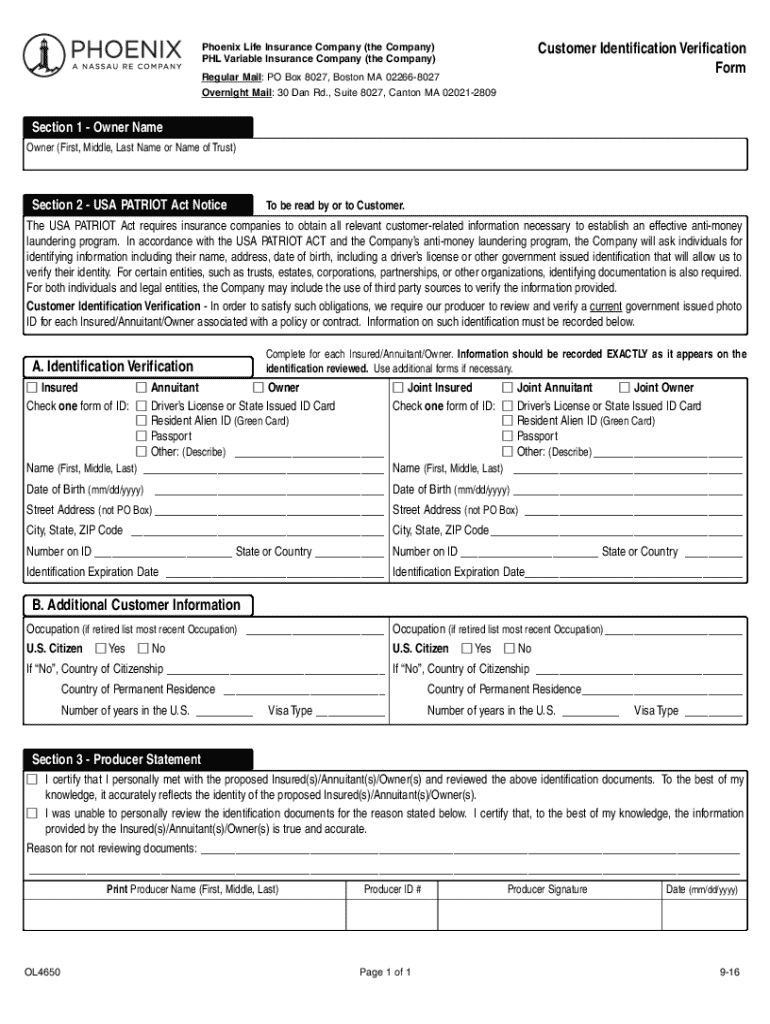

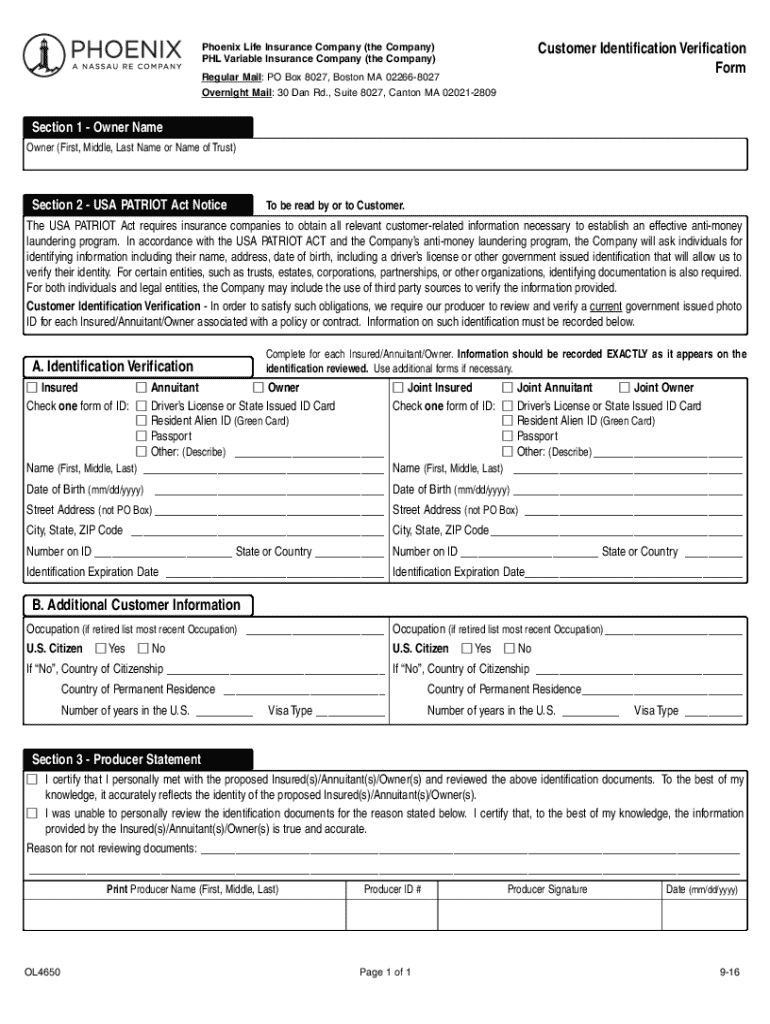

What is customer identification verification form?

Who is required to file customer identification verification form?

How to fill out customer identification verification form?

What is the purpose of customer identification verification form?

What information must be reported on customer identification verification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.