Get the free Ct-2

Get, Create, Make and Sign ct-2

How to edit ct-2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-2

How to fill out ct-2

Who needs ct-2?

CT-2 Form: A Comprehensive How-To Guide

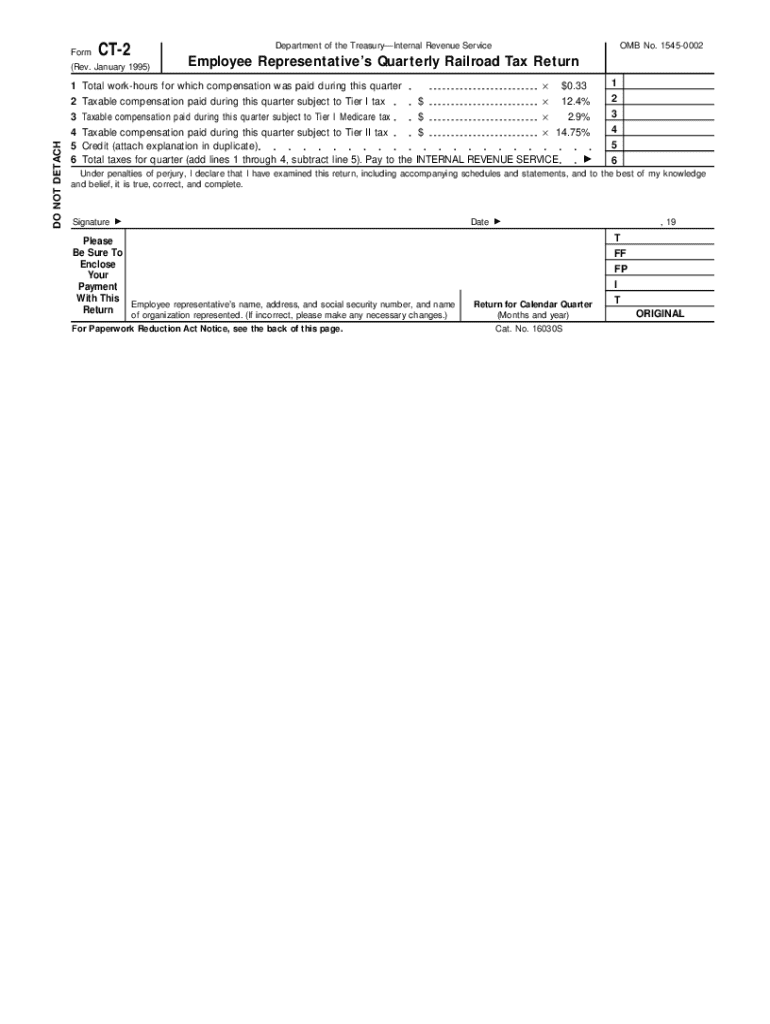

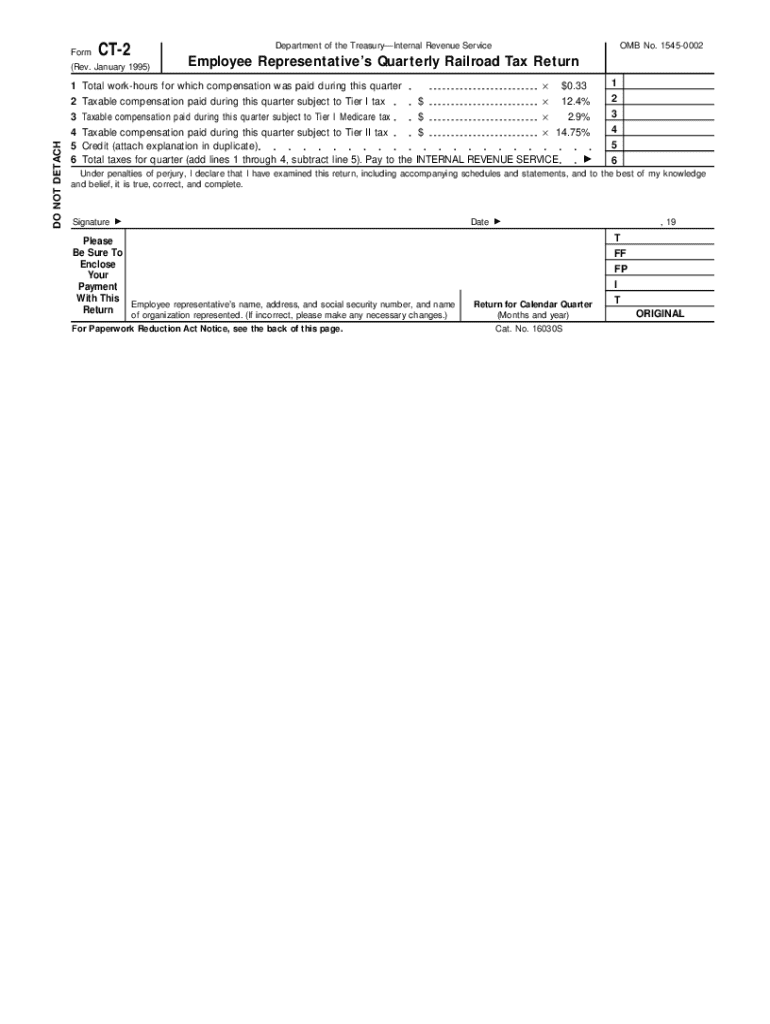

Understanding the CT-2 form

The CT-2 form, also known as the 'Employer's Annual Federal Unemployment (FUTA) Tax Return,' is essential for businesses in reporting their unemployment tax obligations to federal authorities. It serves as the vehicle through which employers not only report their wages but also calculate the tax they owe for the year. Accurate filing is crucial, as it affects an employer’s liability and compliance status.

Filing the CT-2 form is particularly important in various scenarios, such as when an employer has paid wages subject to FUTA tax. Businesses may also need to report employment data even if no taxes are owed. Accurate reporting affirms an employer's commitment to compliance and avoids unnecessary penalties.

Key 2023 changes to the CT-2 form

In 2023, several adjustments were made to the CT-2 form that aim to simplify the filing process and improve clarity for users. Updates include modifications to how employers report certain wages and exemptions, which reflect the evolving landscape of tax regulations. These changes potentially impact how businesses calculate their obligations, making it essential for users to familiarize themselves with the new requirements.

Understanding these changes is vital, as inaccuracies can lead to misfiling, which increases the risk of penalties. Employers should remain vigilant about their filing to ensure that their submissions meet the updated standards laid out by the IRS.

Who needs to file the CT-2 form?

To determine eligibility for filing the CT-2 form, it's crucial to assess the business structure and payroll details. Generally, any employer who has paid employees and meets the wage threshold set by the IRS is required to file this form. Specifically, businesses that pay $1,500 or more in wages in a calendar quarter are obligated to submit the CT-2.

Certain groups, like churches and governmental units, may be exempt under specific conditions, yet they must still acknowledge reporting requirements in case of non-exemption. Engaging in proper classification of employees and regular review of payroll records ensures compliance and eliminates confusion regarding the applicability of the CT-2.

Penalties for non-compliance

Failure to file the CT-2 form accurately or on time can expose businesses to significant penalties. These can vary significantly depending on the nature and severity of the violation but can include monetary fines and the accrual of interest on unpaid taxes. In extreme cases, persistent non-compliance may result in legal ramifications or increased scrutiny from the IRS.

Step-by-step instructions for completing the CT-2 form

Completing the CT-2 form requires an organized approach. Before diving into the form itself, it is essential to gather all required information. Employers should have access to various records such as employee wages, tax deductions, and any adjustments from the previous filing year. This preparation is vital for ensuring accuracy and completeness in the final submission.

Once the necessary documentation is collected, users can begin filling out the CT-2 form. The form is divided into several sections, each demanding clear input. One key aspect is understanding the required figures for total wages and applicable taxes, which are critical for proper calculations. It’s strongly advised to check figures thoroughly; mistakes can lead to penalties or require amendments.

Detailed breakdown of sections in the CT-2 form

Each section of the CT-2 form has specific requirements. Starting with the 'Company Information' section, accurate data including the employer’s name, address, and identification numbers must be included. Following this, the form requires input on total taxable wages and any adjustments that have occurred throughout the year. Users should avoid common mistakes such as transposing numbers or forgetting to sign at the end, which can delay processing.

Using pdfFiller for CT-2 form completion

pdfFiller offers a user-friendly solution for completing the CT-2 form online. Users can access the form directly by navigating to the pdfFiller homepage, where they can utilize the search function to locate the CT-2 form without hassle. This online platform allows for easy editing, making it convenient to adapt the form to reflect accurate employer data.

After locating the CT-2 form, users can interact with the editing features, which include text boxes, annotations, and auto-fill options to streamline the completion process. These features significantly enhance the user experience, allowing for quick adjustments and revisions as needed to maintain accuracy.

Signing and submitting your CT-2 form

One of the standout features of pdfFiller is the ability to electronically sign the CT-2 form. This is particularly useful for teams who require multiple signatories. After filling out the form, users can opt for an electronic signature, ensuring that the submission adheres to all legal standards. Additionally, pdfFiller provides various submission options, including direct electronic filing with tax authorities or downloading for mail submission.

Managing your CT-2 form and related documents

Once the CT-2 form is completed, managing your documents is pivotal to maintaining organization. pdfFiller allows users to save the CT-2 form in the cloud, ensuring documents are secure yet easily accessible from anywhere. This not only streamlines storage but also promotes collaboration among team members when multiple individuals are involved in the filing or approval process.

Sharing options through pdfFiller enable users to share the form with others for feedback or approval, strengthening a collaborative work approach. Keeping track of the submission status is also essential; pdfFiller provides tools to monitor filing and confirm receipt from the relevant tax authorities, which further ensures compliance and peace of mind.

Resources and tools for CT-2 form users

pdfFiller enhances the CT-2 form experience by offering additional resources such as editing tools and document management capabilities, making it an invaluable platform for users. Beyond simple editing, pdfFiller provides templates and is equipped with automation features, which reduce the time spent on repetitive tasks, thus increasing overall efficiency.

For users who may have questions or need further guidance, pdfFiller hosts a variety of tutorials, including video walkthroughs and support pages. This ensures users can find the information they need quickly, answering common queries related to the CT-2 form. Accessing these resources promotes better understanding and compliance with the required procedures.

Stay updated on CT-2 form guidelines

Keeping abreast of changes to the CT-2 form is vital for employers to maintain compliance and avoid unnecessary penalties. Tax laws are subject to frequent revisions, making it crucial to stay informed about the latest requirements. Regularly checking the IRS website and subscribing to updates from the relevant authorities can be beneficial.

Employers can easily subscribe for notifications regarding changes to the CT-2 form guidelines or any new requirements. This includes setting alerts for important dates and deadlines that may impact filing. Such proactive measures not only demonstrate compliance but also help in avoiding hasty submissions during peak filing periods.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ct-2 for eSignature?

How can I edit ct-2 on a smartphone?

How do I complete ct-2 on an Android device?

What is ct-2?

Who is required to file ct-2?

How to fill out ct-2?

What is the purpose of ct-2?

What information must be reported on ct-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.