Get the free Ct-2

Get, Create, Make and Sign ct-2

How to edit ct-2 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-2

How to fill out ct-2

Who needs ct-2?

CT-2 Form How-to Guide

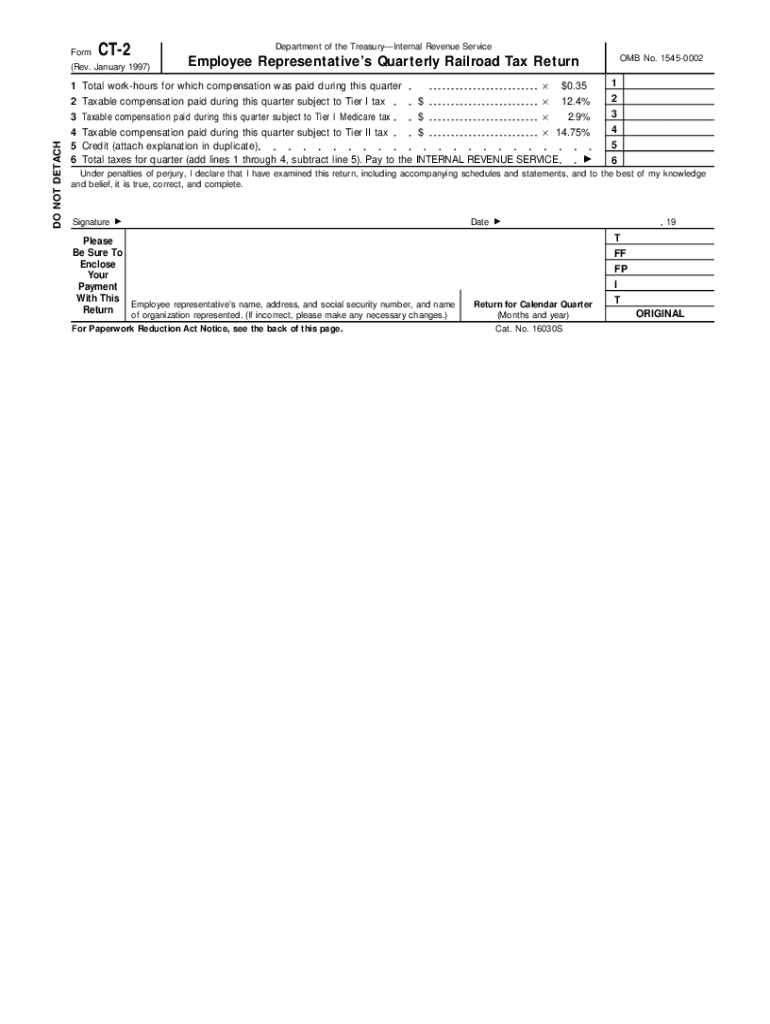

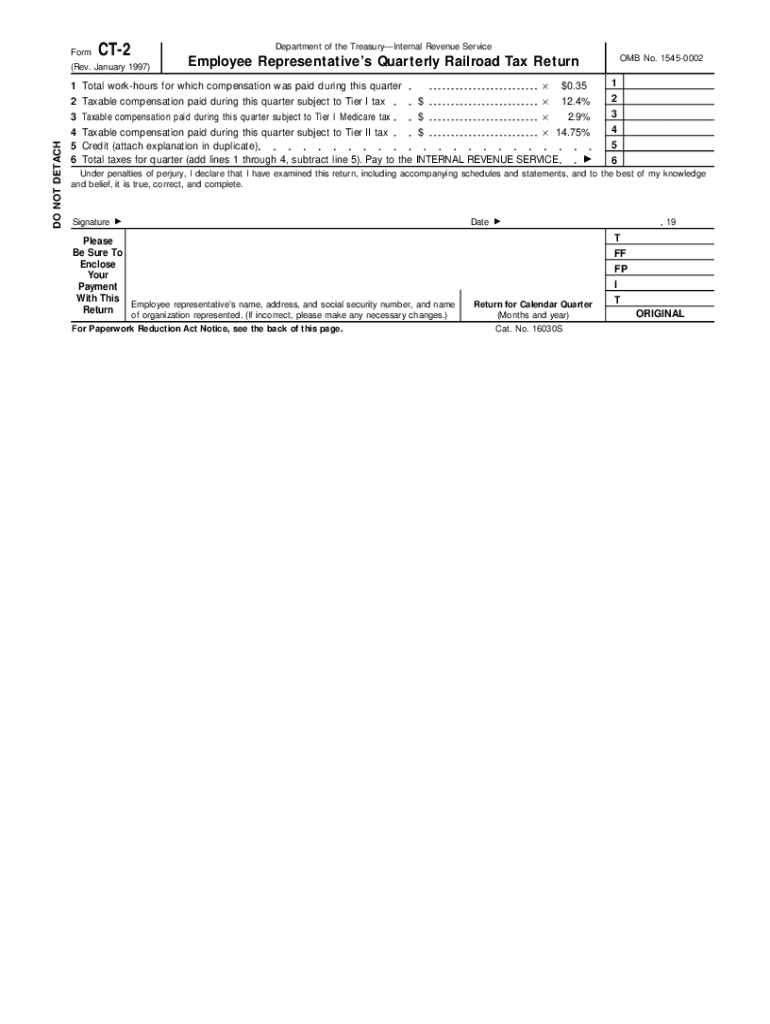

Overview of the CT-2 form

The CT-2 Form is an essential document used primarily for tax reporting purposes within the United States. It is specifically designed to assist corporations in reporting their income, deductions, and other tax-related information to the IRS. Understanding the significance of the CT-2 Form is crucial for tax compliance and for optimizing the overall tax filing process.

This form serves multiple functions: it ensures accurate tax filings, helps prevent penalties due to misinformation, and is crucial for maintaining transparent records of financial activities. Staying compliant with tax obligations through the use of the CT-2 Form can save businesses considerable time and money, making it an indispensable part of corporate operations.

Who should use the CT-2 form?

The CT-2 Form is intended for use by various business entities, including corporations, partnerships, and limited liability companies (LLCs) that operate as corporations for tax purposes. This form is particularly important for businesses with multi-state operations as it helps report their income from different jurisdictions correctly.

Specific scenarios that warrant the use of the CT-2 Form include filing annual tax returns, claiming deductions for business expenses, and ensuring compliance when receiving IRS refunds. It's a common misconception that sole proprietorships are required to fill out this form; however, they primarily use Schedule C instead.

How to obtain the CT-2 form

Obtaining the CT-2 Form can be accomplished through several methods, ensuring you have access to the most accurate and up-to-date version of the document. One of the most straightforward ways is to download it directly from PDFfiller, where you can also leverage their editing and signing features to fill out the form effectively.

Alternatively, you can access official sources such as the IRS website to get the latest form version. When searching for the CT-2 Form, ensure you check the publication date to avoid using outdated documents, which could hinder your tax filing process.

Step-by-step instructions for filling out the CT-2 form

Filling out the CT-2 Form effectively can seem daunting, but by breaking it down into manageable sections, you can navigate the process with ease. Each section requires specific information that contributes to the overall tax calculation and filing process.

Section 1: Basic information

This section requires you to input your personal or business details, including your name, address, and Employer Identification Number (EIN). Avoid common mistakes such as entering incorrect EINs or misspelling your business name, as these errors can lead to delays or issues with your tax filing.

Section 2: Tax calculation

Understanding tax rates is vital for accurate calculations. This section allows you to determine your total tax liability based on the income you've reported. For instance, if your corporation earns $100,000 in taxable income in one state with a 6% tax rate, your calculated liability would be $6,000.

Section 3: Additional deductions and credits

Identifying qualifying deductions can significantly reduce your tax burden. This may include expenses like employee wages, rent, and materials costs. Proper documentation is essential; retain receipts and statements to support your claims.

Section 4: Signing and submission

Before submitting the form, ensure you electronically sign it through PDFfiller if you're filing online. For physical copies, mail it to the address specified on the form, ensuring it is postmarked by the deadline to avoid penalties.

Editing the CT-2 form before submission

One of the advantages of using PDFfiller is the robust editing tools available for the CT-2 Form. After filling out the form, leverage features like annotations and notes to clarify entries if necessary. This can be particularly useful for complex deductions or calculations where additional context may benefit the reviewers.

Saving your edits is critical; PDFfiller allows you to save and revisit your work at any time. Check your document for inconsistencies or errors before finalizing it for submission to minimize any potential issues with the IRS.

Strategies for managing your CT-2 form

Effective document management strategies can save you time while ensuring all your tax-related documents are organized and accessible. Consider using cloud storage solutions through PDFfiller to store your CT-2 Form along with supporting documents securely. Organizing your documents in clearly labeled folders will make them easier to find when needed.

Maintaining document version control helps in tracking changes or updates. If you're collaborating with advisors or tax professionals, utilize PDFfiller’s sharing features for seamless communication on document revisions.

Frequently asked questions about the CT-2 form

Common issues often arise during the completion of the CT-2 Form, such as questions regarding tax rates, what qualifies as a deduction, and submission deadlines. It is essential to clarify these points either through IRS resources or trusted tax professionals to avoid complications.

Additionally, many taxpayers are unclear about the timeline for refunds or what to do if a mistake is made after submission. Seeking guidance from tax professionals can reduce stress and ensure precision in your filings.

Assistance and resources

If you require further assistance while navigating the CT-2 Form, resources are readily available. The IRS provides extensive guidance through its website, including FAQs and direct contact information for query resolution. Additionally, engaging with tax professionals can offer personalized advice tailored to your corporate structure.

Consider joining online communities or forums dedicated to tax preparation, where you can gain insights from peers and experienced professionals alike. Utilize additional tools on PDFfiller for document management, ensuring your tax documents are accurately filed and stored.

Related forms and resources

Understanding the CT-2 Form can also be enhanced by familiarizing yourself with other related tax forms. For instance, corporations might also require forms such as the 1120 or 1120-S, depending on their structure and tax categorization. Comparing the CT-2 Form with these forms clarifies which documents are needed under varying circumstances.

This knowledge is invaluable for comprehensive tax filing, helping to streamline processes and ensure that you meet all compliance deadlines without overlooking necessary documentation.

Language assistance and accessibility options

For non-native English speakers, accessing multilingual resources can significantly reduce barriers in understanding tax documents like the CT-2 Form. PDFfiller supports multiple languages, ensuring broader accessibility to crucial tax-related information.

Additionally, PDFfiller offers a range of accessibility features that ensure every user has a seamless experience when filling out or analyzing documents. This is particularly important for individuals needing assistance with document navigation or comprehension.

Current updates and changes to the CT-2 form

Tax laws are periodically amended, influencing the CT-2 Form and its requirements. Staying informed about recent changes ensures your filings remain compliant and minimizes the risk of incurring fines. Key dates for filing vary, and it’s pertinent to mark deadlines on your calendar.

Future trends in document management will likely integrate even more digital solutions, making the process of tax filing more efficient through technology.

Connect with us for more information

For any further inquiries regarding the CT-2 Form or for assistance in using PDFfiller, you can engage with our support team. Engage via our social media platforms to join a community of users and stay updated on the latest features and document management strategies.

Subscribe to our newsletters for valuable insights and updates that will enhance your experience and knowledge in filing the CT-2 Form and other important tax documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ct-2?

How do I complete ct-2 on an iOS device?

Can I edit ct-2 on an Android device?

What is ct-2?

Who is required to file ct-2?

How to fill out ct-2?

What is the purpose of ct-2?

What information must be reported on ct-2?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.