Get the free Ct-12

Get, Create, Make and Sign ct-12

How to edit ct-12 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-12

How to fill out ct-12

Who needs ct-12?

Comprehensive guide to the ct-12 form: Everything you need to know

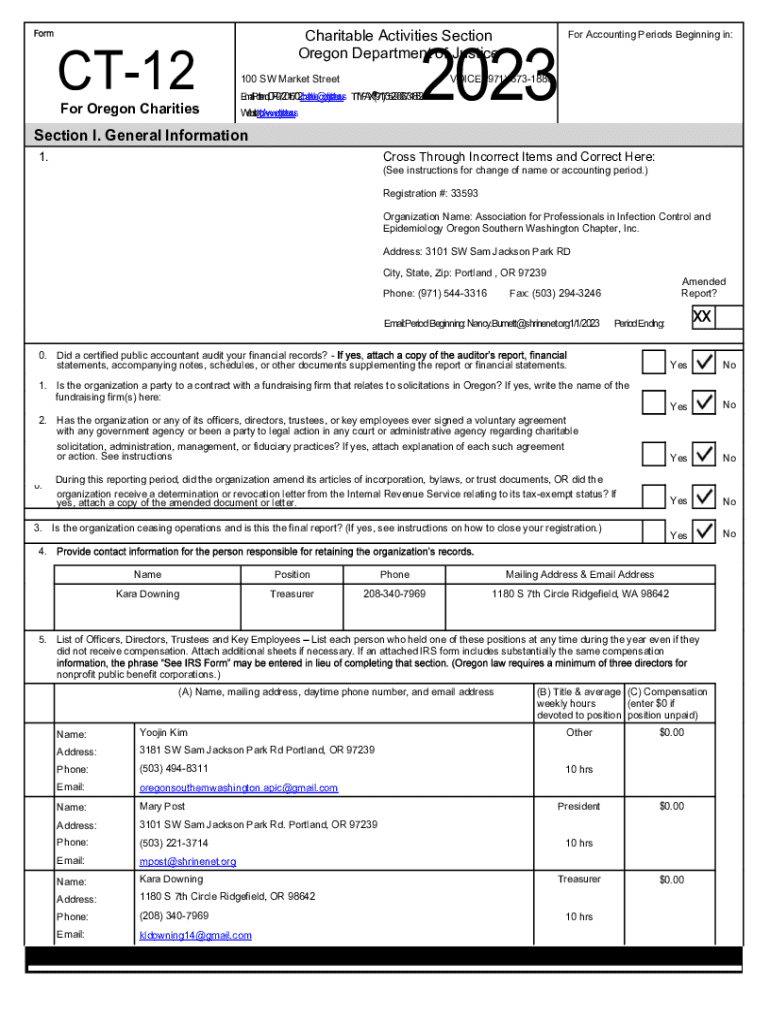

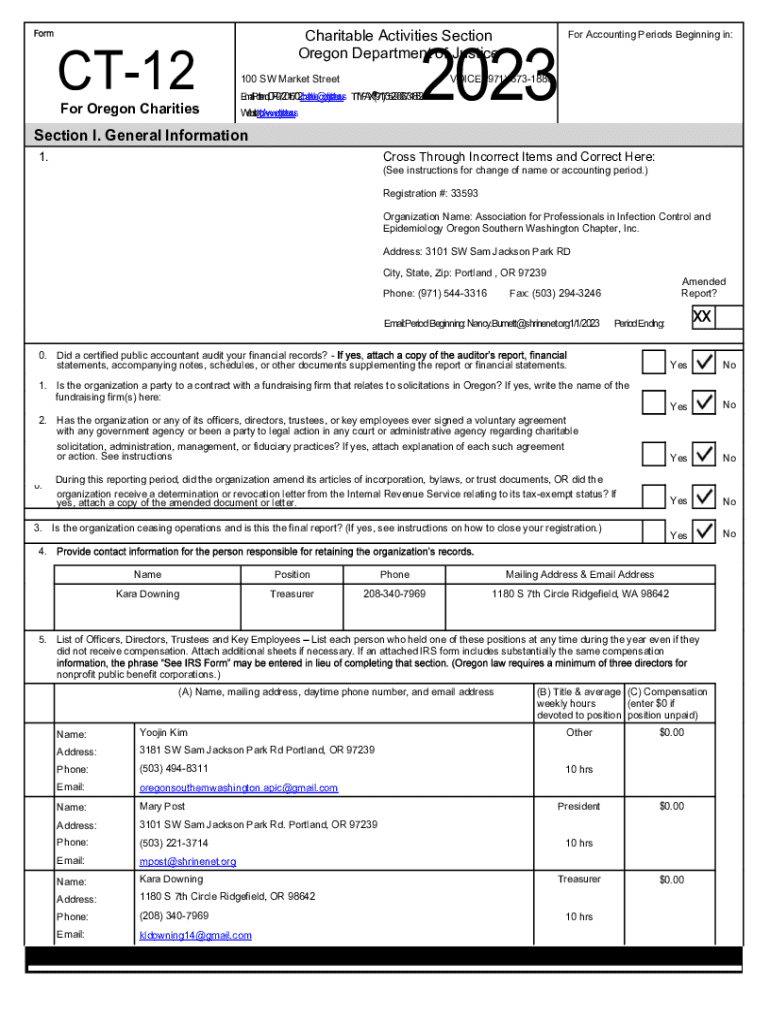

Understanding the ct-12 form: An overview

The ct-12 form is a crucial document utilized primarily for reporting tax information related to certain financial activities within various organizations. This form provides the framework for taxpayers to detail their income, deductions, and any applicable credits to ensure compliance with tax regulations.

In general, anyone who has earned an income in the designated fields, such as self-employment, partnerships, or has received miscellaneous income, may be required to complete the ct-12 form. This form serves the dual purpose of informing the tax authority and facilitating an accurate calculation of any taxes owed.

Preparing to fill out the ct-12 form

Before diving into filling out the ct-12 form, it’s essential to gather all necessary information and documentation. This preparation can streamline the process, minimizing errors that could lead to delays in submission or misunderstanding during audits.

Necessary information and documentation

Common mistakes to avoid while preparing include omitting essential items, miscalculating income, or failing to attach supporting documents like W-2s or 1099s. Always double-check your entries and calculations.

Step-by-step instructions for completing the ct-12 form

Filling out the ct-12 form can appear overwhelming, but breaking it down into sections makes it manageable. Here, we will walk you through the main sections that you will encounter.

Section 1: Personal and contact information

Begin by entering your accurate personal and contact information. Be sure to verify that every detail is correct, as errors can lead to significant processing delays and potential follow-up inquiries from the tax authority.

Section 2: Income and deductions

Next, you'll detail your income and any relevant deductions. When calculating income, ensure you aggregate all sources clearly. For instance, if you work multiple jobs, list the income from each independently.

Identifying eligible deductions can significantly reduce your total tax liability. Make sure to consult the latest tax guidelines or a tax professional if in doubt.

Section 3: Signatures and declarations

In the final section, you’ll be required to sign and date the form. Signatures denote your affirmation of the accuracy of the information contained within, making this section critical. If you're opting for electronic submission, familiarize yourself with the available eSignature options, which carry their own requirements for verification.

Editing and customizing your ct-12 form

Once you complete the ct-12 form, it’s a good idea to review it for any mistakes or clarifications. pdfFiller offers tools to assist with this process, providing you with essential features that enhance the document's quality.

How pdfFiller helps in form customization

eSigning the ct-12 form efficiently

After editing, the next step is to eSign your ct-12 form. The convenience of eSigning is essential for those seeking to save time and ensure their forms are processed promptly.

Steps to eSign the ct-12 form using pdfFiller

The platform prioritizes security, employing measures to verify eSignatures, ensuring that your digital signatures are legally binding and secure against potential fraud.

Submitting your ct-12 form

Now that your ct-12 form is completed and signed, the next crucial step is submitting it. Understanding the available methods for submission ensures that you select the one that best suits your needs.

Available submission methods

Be sure to track your submission status, whether you go for online or mail-in options, to confirm that your ct-12 form has been correctly received and processed.

Managing your ct-12 form post-submission

After submitting your ct-12 form, it's vital to manage your documentation effectively. Having access to copies of submitted forms is beneficial if any questions or issues arise later.

Accessing your submitted ct-12 form

If submitted electronically through pdfFiller, you can easily access your forms within your account. For those who mailed in their submissions, save copies of all materials submitted to refer back to if needed.

Options for editing or amending your submission

If you realize a mistake or wish to amend your submission, most tax authorities offer processes to address this. Familiarize yourself with any forms related to amendments and timelines to avoid issues.

Understanding response times and follow-up

It's important to be aware that response times can vary based on the tax authority's backlog. Setting reminders to follow up can help ensure that you do not miss any communications regarding your submission.

Troubleshooting common issues

While completing the ct-12 form is relatively straightforward, issues can arise both during submission and post-submission. Understanding how to troubleshoot common problems can save time and reduce anxiety.

Common submission errors and how to resolve them

Common errors can include missing signatures, incorrect recipient addresses, and incomplete information. Checking twice before submission can help mitigate these problems, but if they occur, promptly reach out to customer support for guidance.

What to do if your ct-12 form is rejected

In the unfortunate event that your ct-12 form is rejected, carefully review the feedback provided by the tax authority. Often, this feedback will indicate the specific errors that need rectifying. Correct those issues and resubmit your form promptly.

FAQs about the ct-12 form

Many users have questions about the ct-12 form, from its requirements to its implications. Having a reference for frequently asked questions can help alleviate concerns and clarify processes.

For more personalized advice, consider consulting with tax professionals who can guide you through the nuances of the ct-12 form.

Leveraging pdfFiller for document management

Using pdfFiller not only simplifies the process of filling out the ct-12 form but also enhances document management overall. With a cloud-based platform, users achieve seamless access and collaboration regardless of location.

Overview of pdfFiller's tools tailored for form management

The ability to manage documentation effectively ensures that all team members are on the same page, promoting efficiency in the filing process.

User testimonials: Success with the ct-12 form

Countless individuals have reported success stories regarding the use of the ct-12 form, particularly when they leveraged pdfFiller’s features to simplify their filing process. User testimonials highlight time savings and reduced stress when navigating their tax obligations.

Additional tips and insights for a smooth process

Lastly, to ensure a seamless experience when filling out your ct-12 form, consider keeping your documents organized. A dedicated folder for all tax-related documents can mitigate stress during filing seasons.

Setting reminders for future form filings

Establishing a reminder system for future filings, whether through digital calendar alerts or physical planners, can enhance your tax readiness each year. Staying organized contributes significantly to a hassle-free filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in ct-12?

How do I make edits in ct-12 without leaving Chrome?

How can I fill out ct-12 on an iOS device?

What is ct-12?

Who is required to file ct-12?

How to fill out ct-12?

What is the purpose of ct-12?

What information must be reported on ct-12?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.