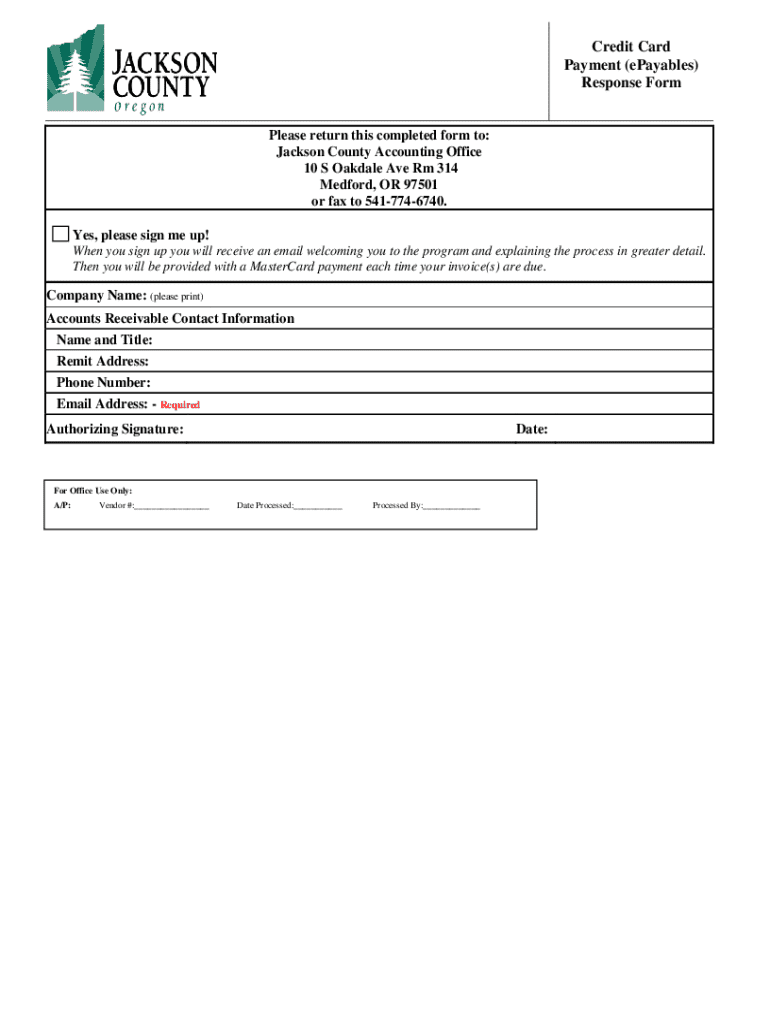

Get the free Credit Card Payment (epayables) Response Form

Get, Create, Make and Sign credit card payment epayables

How to edit credit card payment epayables online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card payment epayables

How to fill out credit card payment epayables

Who needs credit card payment epayables?

Understanding the Credit Card Payment ePayables Form: A Comprehensive Guide

Understanding the credit card payment epayables form

The credit card payment ePayables form is an essential tool for businesses seeking to streamline their payment processes. This digital form enables organizations to manage credit card transactions efficiently, allowing for prompt payments without the hassle of manual methods. The ePayables form typically includes user-friendly features such as auto-fill capabilities, fields for entering card details, and real-time validation to ensure all information entered is accurate.

In today's fast-paced business environment, where cash flow management is pivotal, the significance of this form cannot be overstated. Having an online system for managing credit card payments helps companies maintain better control over their expenditures and ensures that transactions are executed swiftly.

The benefits of utilizing credit card payment epayables

Utilizing a credit card payment ePayables form has profound implications for financial management. By streamlining payment processes, businesses can significantly enhance operational efficiency. The ability to process transactions swiftly eliminates bottlenecks and expedites the procurement cycle. Additionally, ePayables tend to reduce reliance on paper invoicing and manual data entries, consequently minimizing errors and improving accuracy.

Another compelling benefit of ePayables is improved financial control. Enhanced tracking and reporting capabilities allow businesses to get a detailed view of their spending habits. This real-time data facilitates streamlined expense management and simplifies reconciliation processes, ensuring that financial records are precise and up to date.

How to fill out the credit card payment epayables form

Filling out the credit card payment ePayables form may seem straightforward, but a methodical approach ensures success. Follow these steps to complete the process accurately.

**Step 1: Gathering required information** - Before beginning the form, ensure you have all necessary data, including credit card details, billing address, and transaction specifics. Accurate information is key.

**Step 2: Completing the form fields** - Enter details into the designated fields, carefully reviewing each one to avoid errors. Pay special attention to the credit card number, expiry date, and CVC code, as common mistakes often occur here.

**Step 3: Reviewing and verifying your submission** - Once the form is completed, take the time to double-check all information. Cross-reference details with the original documents. Ensuring that everything is correct before submitting will save you from possible complications later.

Interactive tools for managing your epayables

Effective management of ePayables necessitates using interactive tools that facilitate collaboration and document handling. Many platforms, including pdfFiller, offer integrated document editing, letting users collaborate in real-time.

These platforms also feature eSigning capabilities, which streamline the approval processes. Engaging with an intuitive interface enhances productivity, allowing users to manage forms efficiently while ensuring all necessary stakeholders remain informed.

Best practices for using credit card payment epayables

Implementing best practices in credit card payment ePayables use ensures long-term success. Regularly monitoring and updating credit card information is critical. Keeping payment information current minimizes errors and ensures continuity in transactions.

Additionally, leveraging analytics and reporting features can provide valuable insights into spending patterns. These insights can inform strategic decision-making, enabling businesses to allocate resources more effectively and anticipate future financial needs.

Common issues when using credit card payment epayables

Despite its benefits, using a credit card payment ePayables form can come with challenges. Validation errors often arise due to incorrect data entry. These can usually be resolved by double-checking the form for accuracy before submission.

Discrepancies in payment records also pose challenges, particularly when multiple users manage the process. In such instances, it’s crucial to maintain clear internal communication and documentation to swiftly resolve any issues.

Integrating credit card payment epayables with your existing systems

Integrating credit card payment ePayables with existing accounting software could significantly enhance a business’s financial management capabilities. Compatibility allows for seamless data synchronization, ensuring that all transactions are accurately reflected in financial systems.

Furthermore, the integration of ePayables with other tools can drive workflow efficiency through automation, reducing the manual efforts required in transaction processing and record-keeping. This not only leads to enhanced productivity but also allows teams to focus on strategic initiatives.

Future trends in credit card payment epayables

As technology continues to evolve, so too do the capabilities of credit card payment ePayables. The introduction of artificial intelligence and machine learning into payment processing is set to revolutionize how businesses manage their transactions. These innovations promise to enhance security, improve fraud detection, and streamline processes.

Furthermore, trends related to mobile payments and online transactions are increasing. Businesses that stay attuned to changing regulations and advancements will position themselves to capitalize on these innovations, ensuring their ePayables processes remain future-ready.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my credit card payment epayables in Gmail?

How do I edit credit card payment epayables online?

How do I make edits in credit card payment epayables without leaving Chrome?

What is credit card payment epayables?

Who is required to file credit card payment epayables?

How to fill out credit card payment epayables?

What is the purpose of credit card payment epayables?

What information must be reported on credit card payment epayables?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.