Get the free Ct-706/709

Get, Create, Make and Sign ct-706709

How to edit ct-706709 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ct-706709

How to fill out ct-706709

Who needs ct-706709?

CT-706709 Form: Comprehensive Guide to Completing Your Estate and Gift Tax Return

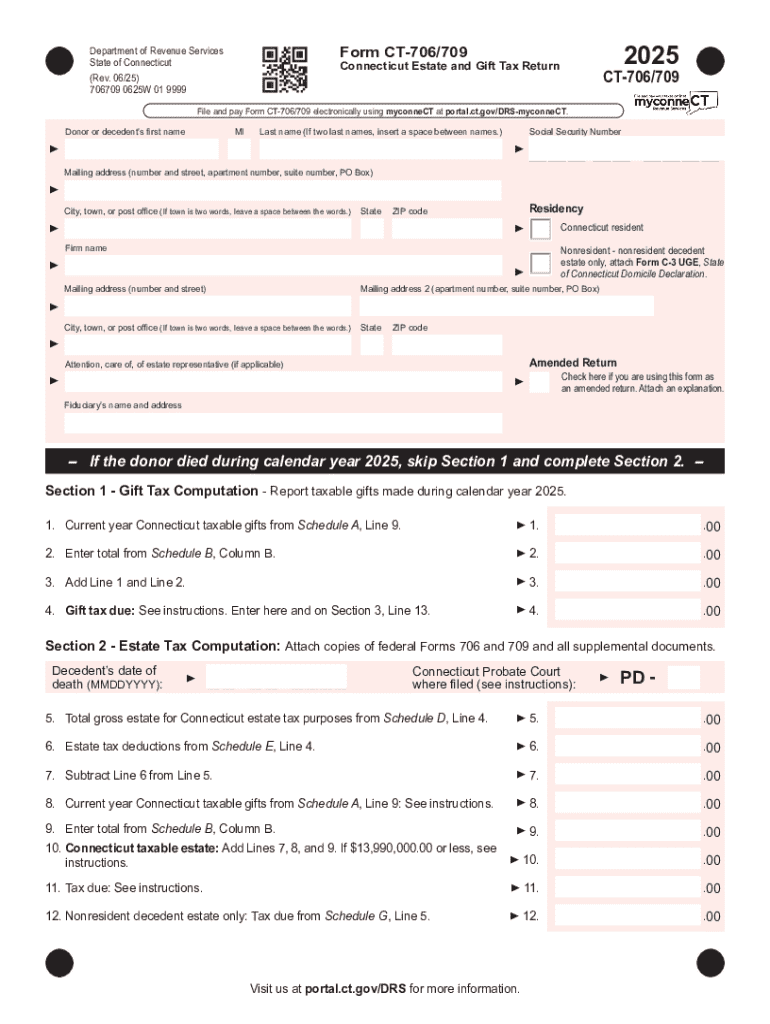

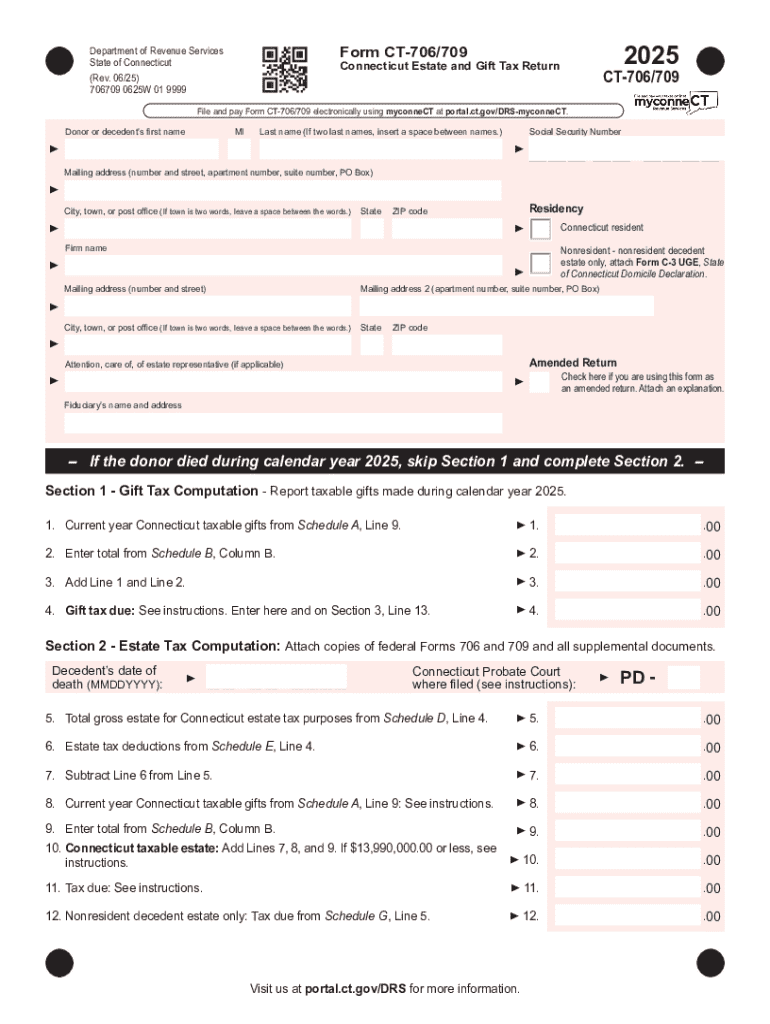

Overview of the CT-706709 Form

The CT-706709 form plays a crucial role in the delicate balancing act of estate and gift taxation within Connecticut. This form is essential for reporting the estate tax portion and the lifetime gift tax portion of a decedent's estate. Understanding its purpose is pivotal not only for compliance with tax regulations but also as a significant aspect of effective estate planning.

Estate and gift taxes are imposed to ensure that the transfer of wealth does not go untaxed; thus, the CT-706709 form serves to document the taxes owed. In Connecticut, the effective management of such taxation can significantly influence the final value of an estate, making this form critical for both individuals and their beneficiaries.

Who must file the CT-706709 form

Filing the CT-706709 form is mandatory for estates exceeding the Connecticut estate tax exemption threshold, which is $12.92 million as of 2023. This means that individuals who manage an estate valuing above this amount must ensure this form is accurately completed and submitted.

However, not every estate needs to file. There are exemptions for specific situations, such as instances where the assets are gifted during the decedent's lifetime and are below the cumulative gift exemption limit. It's vital to consult with a tax professional to ascertain specific obligations.

Key features of pdfFiller for CT-706709 form

Choosing the right platform for form processing can make a significant difference in efficiency. pdfFiller offers unique features tailored for the CT-706709 form, ensuring users can navigate through the complexities of estate and gift tax returns seamlessly.

One of the standout features of pdfFiller is its ability to facilitate seamless editing of PDF forms. Users can easily modify sections of the CT-706709 form, ensuring accuracy and compliance by editing text, adding fields, or correcting errors directly online.

Additionally, the eSignature capabilities ensure that signatures are collected quickly and efficiently, eliminating the hassle of printing and scanning documents. This feature is especially beneficial when multiple parties are involved. Furthermore, pdfFiller’s collaboration tools enable teams to work together in real time, making it easier to manage document workflows as they fill out the CT-706709 form.

Step-by-step instructions for filling out the CT-706709 form

Completing the CT-706709 form requires thorough preparation. Before diving in, ensure you have all the necessary information ready. Begin by gathering essential documents, including the decedent's will, a list of all assets, and prior tax returns. The more organized you are, the smoother the process will be.

In the first section of the CT-706709 form, you will fill out the decedent’s information, including full name, date of birth, and social security number. It is essential to enter these details accurately to avoid any confusion or delay in the processing of the tax return.

Moving to Section 2, asset inclusion is crucial. Identify every asset tied to the decedent, including real estate, bank accounts, stocks, and personal property. Be specific and detail-oriented. It is equally vital to provide accurate information regarding any liabilities, as this will affect the estate’s net value and tax obligations.

The deductions and credits section allows filers to lower their taxable estate. Common deductions related to debts, funeral expenses, and charitable contributions are permissible. Then, as beneficiaries are noted in Section 4, be sure to list their accurate contact information to prevent any future complications in asset distribution.

Related forms and additional documentation

Completing the CT-706709 form often goes hand-in-hand with several related forms. Familiarizing yourself with associated documents can streamline the filing process significantly. For instance, forms like the CT-706 and CT-709 often accompany or are referenced within the CT-706709. These forms handle various facets of estate and gift tax reporting.

In addition to the primary form, supporting documentation is critical. Organizations need to prepare a comprehensive checklist of supporting documents including appraisals of property, estate tax returns, proof of debts and liabilities, and documentation confirming any lifetime gifts made by the decedent. Collecting these documents early can facilitate a smoother filing experience.

Tips for successful filing

A successful filing hinges on attention to detail and proactive avoidance of common mistakes. Review your form multiple times before submission to catch any inaccuracies or omissions. A frequent error involves misreporting asset values or failing to include potential tax deductions.

Deadlines play a key role in filing the CT-706709 form. Connecticut generally requires forms to be filed within nine months of the decedent’s date of death. Late filings can incur penalties, so being aware of these deadlines and planning ahead can save significant costs in fines.

Form preview: get familiar with the CT-706709 layout

Visual familiarity with the CT-706709 form can enhance the filing experience. By utilizing the interactive preview feature within pdfFiller, users can navigate through each key section without the anxiety of unexpected surprises during the actual completion.

The layout typically includes clear divisions for each section, allowing you to approach your data entry systematically. Highlighting common pitfalls within sections can guide the user, ensuring each critical detail is captured and facilitating better outcomes.

Frequently asked questions (FAQs)

Common queries regarding the CT-706709 form can save time and reduce confusion. For instance, understanding specific filing deadlines is crucial for compliance and avoiding penalties. When submitting your form, always ensure it reaches the state’s Department of Revenue Services on time.

Should there be a need to amend a submitted CT-706709 form, knowing the correct procedure for revisions is essential. Submitting an amended return will require specific documentation and a clear explanation of the corrections made to avoid issues in the future.

Customer support and contact information

Having access to robust customer support can enhance your experience while filing the CT-706709 form. pdfFiller understands the complexities of document management and provides a support team ready to assist you with any questions related to your estate and gift tax return.

Contacting support is made easy with various options available such as chat, email, or phone. The support team operates during standard hours, ensuring you receive timely assistance, whether you have a simple question or require in-depth guidance.

Conclusion: maximizing your experience with pdfFiller

Using pdfFiller for your CT-706709 form can significantly enhance your filing efficiency. The platform combines features designed for seamless editing, e-signature capability, and collaborative tools, making it easier to manage all forms related to estate and gift taxation.

In summary, the comprehensive functionality of pdfFiller not only simplifies filling out the CT-706709 form but also positions it as an essential tool for anyone managing estate documents. Maximizing its utilization can lead to fewer errors, expedited submissions, and overall improved document management as you navigate your estate planning needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ct-706709 in Chrome?

Can I create an electronic signature for the ct-706709 in Chrome?

How do I edit ct-706709 on an Android device?

What is ct-706709?

Who is required to file ct-706709?

How to fill out ct-706709?

What is the purpose of ct-706709?

What information must be reported on ct-706709?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.