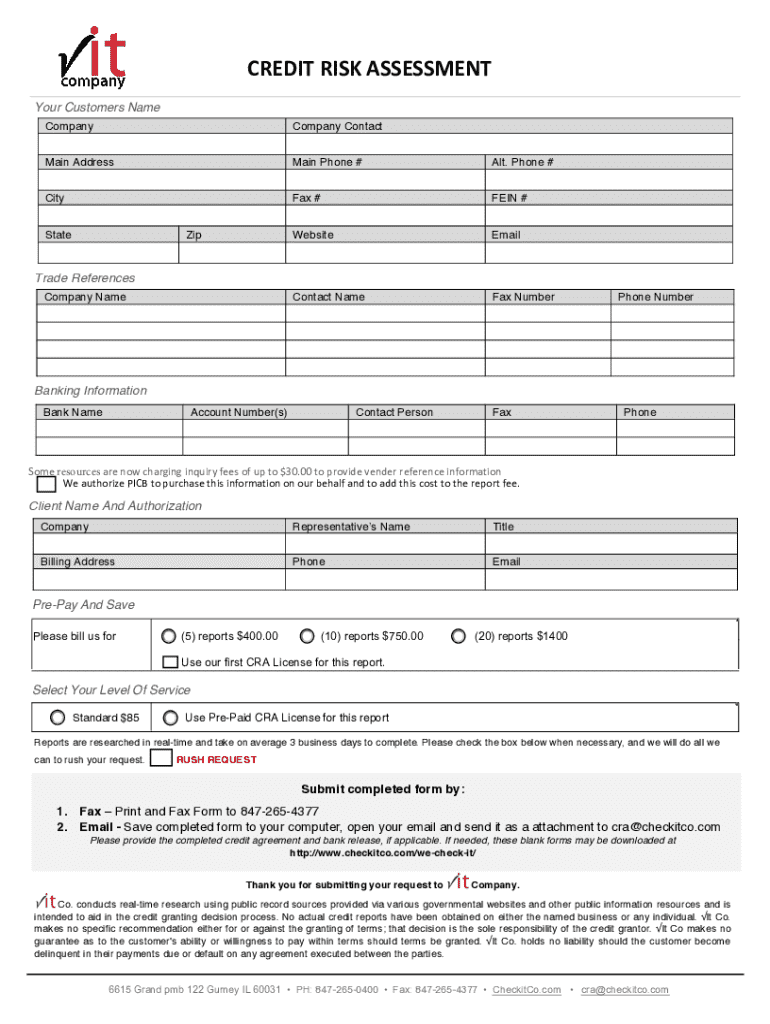

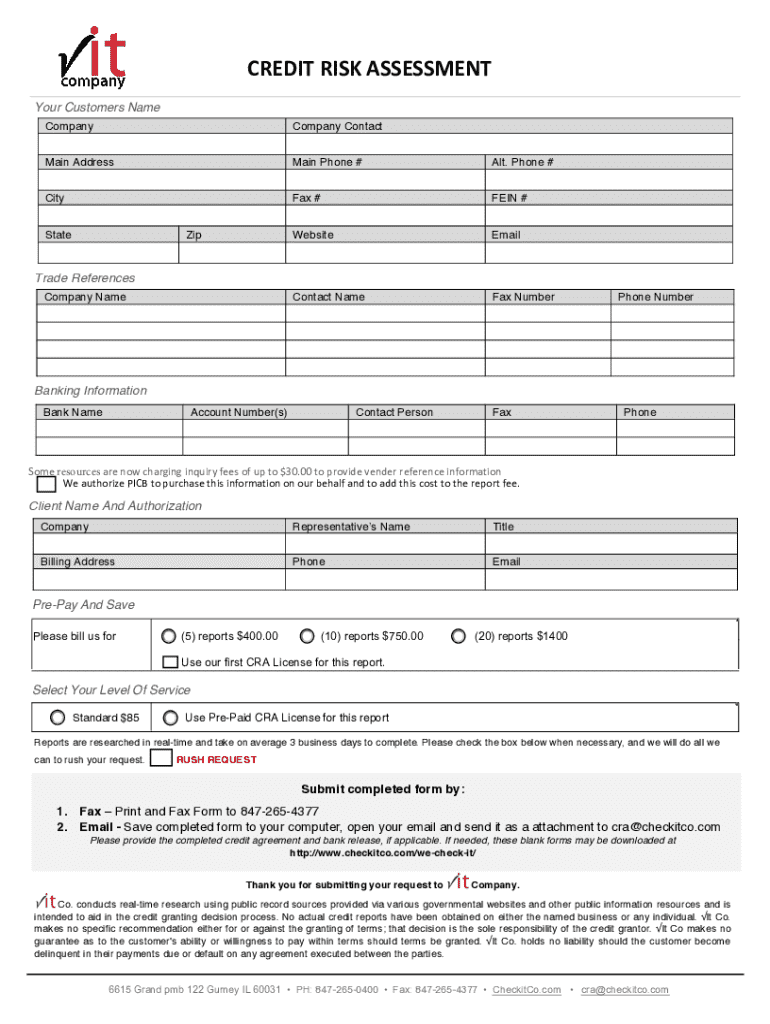

Get the free Credit Risk Assessment

Get, Create, Make and Sign credit risk assessment

Editing credit risk assessment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit risk assessment

How to fill out credit risk assessment

Who needs credit risk assessment?

Understanding and Using the Credit Risk Assessment Form

Understanding the credit risk assessment form

A credit risk assessment form is a crucial document in the lending process, designed to evaluate the financial stability and creditworthiness of a borrower. This assessment helps lenders determine the likelihood that a borrower will default on a loan. Given that defaults can significantly impact a lender's bottom line, this form plays an essential role in risk management strategies. Credit risk assessment forms are not only fundamental for banks and financial institutions but also for small businesses and individual lenders looking to mitigate financial exposure.

Key components of a credit risk assessment form include borrower information, financial statements, and credit history. Understanding these components is vital for an accurate assessment. Categories of borrower information typically include personal and contact information, as well as details about their business or employment. Financial statements such as income statements and balance sheets provide insight into the economic health of the borrower. Lastly, a comprehensive view of the borrower's credit history can give an indication of their borrowing behavior, which is crucial for risk evaluation.

Completing the credit risk assessment form

Filling out a credit risk assessment form may seem daunting, but it can be simplified by following structured steps. The first step involves identifying the borrower's details. This includes capturing their name, contact information, and relevant business profile, which provides context to their financial activities. Make sure all information is current and accurate. Inaccuracies can lead to misjudgment in the evaluation.

Next, it’s essential to collect the necessary financial statements. The types required typically include the balance sheet, income statement, and sometimes the cash flow statement. Borrowers can obtain these documents from their accountants or financial software. These statements are vital as they showcase the borrower's financial health, enabling a true reflection of their capability to repay the loan.

After gathering financial statements, analyze them for key indicators such as liquidity and profitability. Liquidity assessments help determine whether the borrower can meet short-term obligations. Profitability metrics measure the borrower's capacity to generate earnings relative to their expenses over time.

Calculating financial ratios is the next crucial step. Ratios such as the debt-to-equity ratio and current ratio provide insights into the borrower's financial leverage and ability to meet short-term liabilities. Finally, assessing the borrower's credit history through credit reports adds another layer to understanding their behavior in past borrowing.

In-depth analysis of the borrower’s financial position

Estimating the borrower's current financial position is inherently tied to evaluating their assets versus liabilities. This helps to understand whether they possess sufficient resources to cover their obligations. A well-prepared balance sheet is crucial here, as it offers a snapshot of what the borrower owns and owes at any given moment. Additionally, assessing cash flow statements reveals how money moves in and out of the business—critical for understanding operating efficiency.

Predicting the future income or profits of a borrower requires using reliable forecasting methods. This may involve examining industry trends, economic indicators, and the borrower’s historical performance. Various factors, such as competition, market conditions, and internal operations, can significantly influence future profitability. An awareness of these dynamics can help lenders make informed decisions regarding to loan approval or the terms of the proposed loan.

Loan purpose and risk assessment

Understanding the loan purpose is critical in the credit risk assessment process. Loans can be categorized into various types, including personal loans, business expansion loans, or equipment financing. Each type presents unique risks and potential returns for lenders. For instance, a personal loan might be less risky than a business expansion loan, which typically involves larger sums and uncertain returns.

Evaluating collateral, when applicable, is another crucial component of this assessment. Different types of collateral can significantly affect the perceived risk level. For example, loans secured by real estate might be considered lower risk compared to those secured by inventory or equipment, given the stability and liquidity aspects associated with property. Understanding the implications of collateral can aid in making more refined lending decisions.

Utilizing interactive tools for enhanced assessment

In an increasingly digital world, utilizing interactive tools for credit risk assessment has become essential. pdfFiller provides various features that can significantly streamline the process, such as document editing and management capabilities. Users can collaborate in real-time, share the credit risk assessment form effortlessly, and make necessary edits or adjustments easily. This collaborative approach can lead to more precise evaluations and a more efficient workflow.

Additionally, eSignature capabilities enable users to finalize documents without the tedious process of printing, signing, and scanning. This not only speeds up the process but also enhances security and compliance. Integrating interactive tools enhances the ability to process, evaluate, and manage documents from anywhere, making it an ideal solution for individuals and teams seeking comprehensive and flexible document creation solutions.

Best practices for credit risk assessment

Applying best practices when filling out the credit risk assessment form is vital for both accuracy and efficiency. Regularly updating financial data ensures that all assessments are based on the most current information available. This can make a significant difference in the evaluation's outcome and support informed lending decisions. Additionally, maintaining detailed records will aid in subsequent assessments and promote transparency should questions arise later.

Avoiding common mistakes is just as crucial. Incomplete information can lead to improper risk evaluations, and skipping vital analysis can expose lenders to bond defaults. Neglecting to review all relevant data, such as market indicators and borrower credit history, can lead to misguided judgments. Establishing a checklist can eliminate this risk and improve the process’s integrity.

Maximizing the use of the credit risk assessment form in decision-making

The completed credit risk assessment form serves a crucial role in lending decisions. Lenders can utilize the comprehensive evaluations to make informed choices regarding loan approvals, interest rates, and repayment terms. By carefully considering the financial position, the intended use of the loan, and the borrower’s credit history, lenders can create a well-rounded picture of potential risks and rewards.

Integrating results from the credit risk assessment into overall financial planning and risk management strategies is essential for informed business practices. Such integration supports proactive decision-making and long-term sustainability. By aligning lending practices with a thorough understanding of credit risk, lenders can strategically manage their portfolios and reduce potential losses associated with defaults.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify credit risk assessment without leaving Google Drive?

How can I edit credit risk assessment on a smartphone?

Can I edit credit risk assessment on an iOS device?

What is credit risk assessment?

Who is required to file credit risk assessment?

How to fill out credit risk assessment?

What is the purpose of credit risk assessment?

What information must be reported on credit risk assessment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.