Get the free Cd-429 Pte

Get, Create, Make and Sign cd-429 pte

How to edit cd-429 pte online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cd-429 pte

How to fill out cd-429 pte

Who needs cd-429 pte?

Understanding the -429 PTE Form: A Comprehensive Guide

Understanding the -429 PTE Form

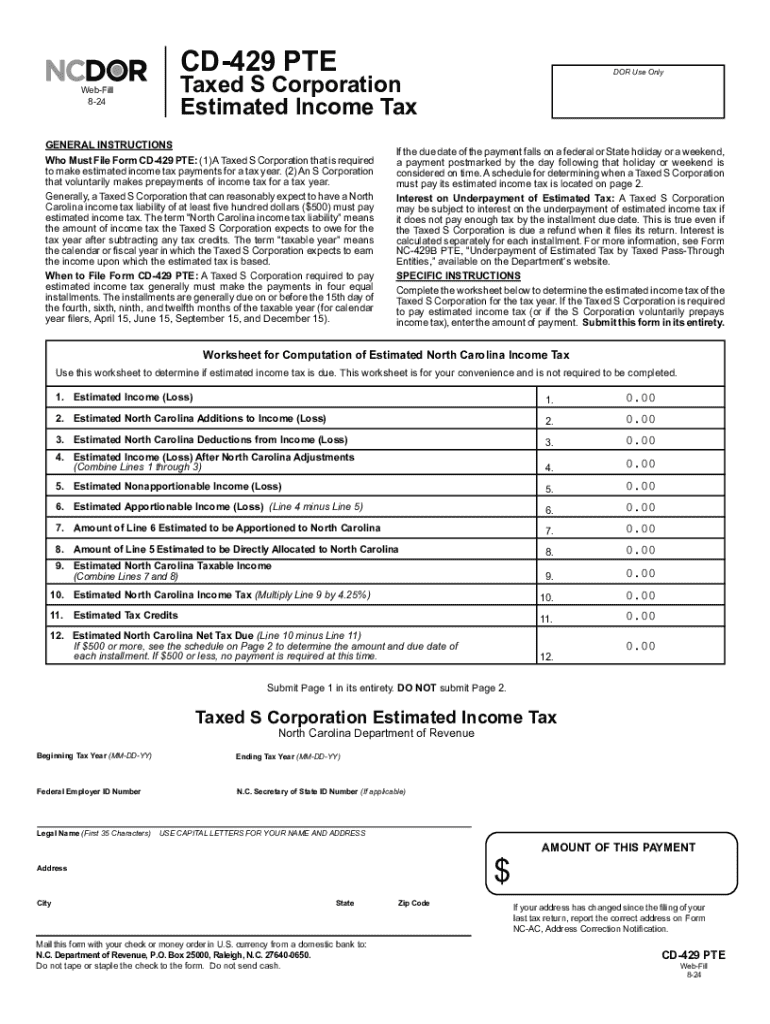

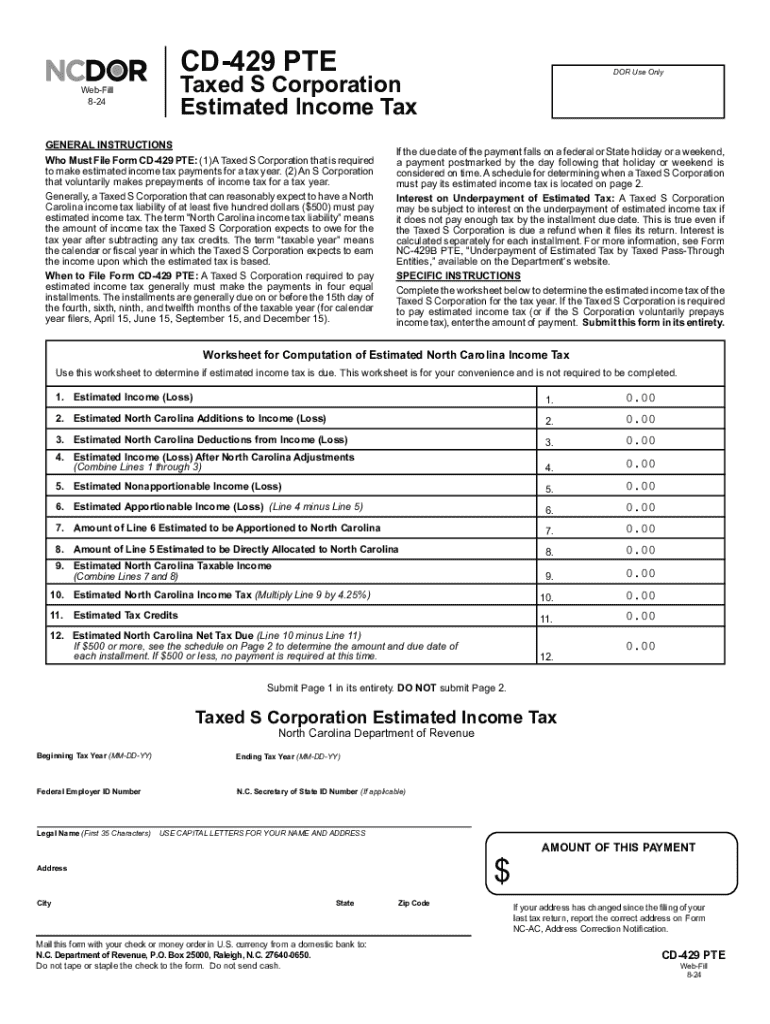

The CD-429 PTE form, commonly referred to as the PTE Income Tax Payment Voucher, is an essential document that facilitates estimated income tax payments for partnerships, limited liability companies, and other pass-through entities that are subject to taxation. The primary purpose of this form is to ensure that businesses can manage their tax obligations effectively, thereby avoiding penalties and interest that can arise from late payments. By accurately submitting the CD-429 PTE form, entities ensure compliance with state tax laws while maintaining proper financial health.

This form plays a crucial role in the corporate estimated income tax payment process, serving as both a declaration and a method of payment to state authorities. It helps in calculating and remitting the expected tax liabilities of a business for the current year based on anticipated profits. For many businesses, particularly smaller ones, the CD-429 PTE form is a lifeline that allows them to break down tax obligations into manageable payments throughout the year.

Who Needs the -429 PTE Form?

The CD-429 PTE form is primarily designed for partnerships, limited liability companies, and other pass-through entities that are not taxed at the entity level. Instead, these entities pass income, deductions, and tax credits through to their owners or members, who report them on their individual tax returns. Therefore, any entity that intends to make estimated tax payments on behalf of its members would need to utilize this form. It's essential for these entities to understand their eligibility criteria, which primarily includes their classification under tax law.

Applying scenarios such as changes in revenue projections or new business ventures might necessitate the submission of the CD-429 PTE form. Businesses projecting an increase in income throughout the year may want to file this form to avoid underpayment penalties. Additionally, new partnerships or LLCs should utilize the CD-429 PTE form to register for estimated income tax payments right from the start, ensuring compliance from day one.

Benefits of filling out the -429 PTE form

Filing the CD-429 PTE form online presents numerous advantages over traditional paper filing methods, including enhanced speed and efficiency in submission. One significant benefit is the ability to submit payments instantly through a secure online platform, which means your payment can be processed immediately, reducing the waiting time associated with mailing checks and ensuring timely reporting.

Another notable benefit of online filing is immediate confirmation and the ability to track your submission progress. Once submitted, users receive instant confirmation of their submission, along with easy access to their filing history. It's also notable that submitting the form via the website eliminates postal delays and risks associated with checks being lost in the mail.

Cost-effectiveness is another compelling reason to consider utilizing the online filing option with pdfFiller. When you choose to file online, you can significantly lower the costs associated with printing, mailing, and potential errors that have associated penalties. In comparison, traditional methods require additional resources better allocated for core business activities.

Moreover, enhanced security measures provided by pdfFiller ensure that sensitive information, such as payment details and tax identification numbers, are protected. With encryption and data protection processes in place, users can feel confident that their information remains confidential and secure during the filing process.

Detailed instructions for completing the -429 PTE form

Filling out the CD-429 PTE form requires careful attention to detail. Start by gathering necessary information, which includes required financial details such as revenue projections, previous income tax payments, and identification numbers like your Employer Identification Number (EIN). This preparation stage is crucial as it lays the groundwork for accurate and successful filing.

Next, access the form on pdfFiller. Navigate to the CD-429 PTE form available on the pdfFiller website. Once there, you will find an easy-to-use online interface designed to streamline the filling process. It’s intuitive, making it simple for users with varying levels of tech-savvy to complete the form.

As you fill in the required fields, ensure that you pay close attention to the details in each section of the form. Many potential mistakes could occur, such as incorrectly entering tax amounts or failing to double-check the calculation of estimated income. To prevent these errors, pdfFiller provides helpful tips within the interface to guide you through each section, minimizing the risk of costly mistakes that could later lead to penalties.

Before submitting your form, review and edit as necessary using pdfFiller’s expansive editing tools. This may include correcting figures, updating personal and business information, or confirming that all supporting documents are uploaded correctly. Finally, utilize the electronic signature options available on pdfFiller, as eSigning is a legal and valid method to affirm that the form has been accurately completed.

Managing your completed -429 PTE form

After successfully submitting your CD-429 PTE form, it's crucial to effectively manage your document. Begin by saving and storing your completed form and payment confirmation in a secure digital format, ideally on cloud storage solutions. This ensures you have easy access in the future, whether for reference, audits, or record-keeping purposes.

Tracking your submission is also vital. After filing the CD-429 PTE form, users can easily check the status of their tax payment through the online platform. This transparency enables entities to confirm payment receipt and avoid potential confusion or risks of penalties due to assumed non-payment.

In instances where corrections or amendments are necessary, pdfFiller makes it straightforward to update your submitted CD-429 PTE form. Users can revisit their account, edit the necessary information, and resubmit the updated form. It’s essential to keep track of all amendments to maintain compliance with tax regulations.

FAQs about the -429 PTE form

Several common questions arise regarding the CD-429 PTE form, primarily concerning filing deadlines and representation. One frequent query is, 'What if I miss the filing deadline?' In such situations, it’s crucial to submit your payment as soon as possible. Late payments typically incur penalties, but addressing your tax obligations promptly can mitigate further repercussions.

Another common question is whether someone can file the form on behalf of another entity. The answer is yes, but the individual filing must have authorization and meet all compliance requirements outlined by respective tax authorities. Additionally, users often wonder if there's a fee associated with filing the CD-429 PTE form. While the form itself may not incur a direct fee, processing fees for digital submissions or payment gateways may apply.

Lastly, there are special cases to consider, such as guidance for non-traditional filers, including partnerships and trusts. Each entity type may have specific requirements related to the CD-429 PTE form that must be adhered to in order to ensure compliance with state laws.

Related topics and further insights

Navigating corporate taxation can be complex, and understanding the CD-429 PTE form is just one part of the larger taxation landscape. An overview of corporate tax obligations and tax planning strategies can provide valuable insights into the financial responsibilities involved in running a business. It’s vital for business owners to grasp the implications of their tax status and how proper filing can aid in strategic planning.

In addition to the CD-429 PTE form, there are alternative forms that businesses may encounter, such as the CD-430 and CD-431 forms. Familiarity with these forms and their relevance to your business's financial reporting can help streamline the compliance process. Utilizing tools like pdfFiller can significantly ease the burden of document management for these additional forms, facilitating effective business operations.

With pdfFiller, users can leverage additional features for document management beyond the CD-429 PTE form. Exploring the platform's capabilities will empower users not just to file tax documents but to handle a wide array of document management needs seamlessly.

User experiences and testimonials

Numerous success stories highlight how individuals and businesses have improved their filing processes with pdfFiller. Many users report significantly reduced filing times, easier tracking of submissions, and overall enhanced efficiency in managing their tax obligations. User testimonials often emphasize how the transition to online filing has not only simplified their documentation process but also provided reassurance through timely confirmations and error-reducing features.

Additionally, users share valuable tips for efficient form submission, such as ensuring all necessary documentation is prepared in advance and utilizing pdfFiller’s editing tools to verify accuracy before submission. These insights highlight the platform's adaptability and effectiveness in meeting the needs of its users, transforming tax filing from a cumbersome task into a streamlined process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cd-429 pte directly from Gmail?

How do I edit cd-429 pte straight from my smartphone?

How do I complete cd-429 pte on an iOS device?

What is cd-429 pte?

Who is required to file cd-429 pte?

How to fill out cd-429 pte?

What is the purpose of cd-429 pte?

What information must be reported on cd-429 pte?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.