Get the free Comparison FormReplacement of Annuities (AR)

Get, Create, Make and Sign comparison formreplacement of annuities

Editing comparison formreplacement of annuities online

Uncompromising security for your PDF editing and eSignature needs

How to fill out comparison formreplacement of annuities

How to fill out comparison formreplacement of annuities

Who needs comparison formreplacement of annuities?

Comparison form replacement of annuities form

Overview of annuities and their importance

Annuities are financial products designed to provide regular income payments, typically as a means of saving for retirement. They are contractually binding agreements between the investor and an insurance company. Annuities can be categorized into various types, such as fixed, variable, and indexed, each serving distinct financial needs. Understanding the nuances of these products is essential, particularly when considering their replacement. Annuity replacement can offer opportunities to enhance investment returns, adjust financial strategies, or adapt to changing financial circumstances.

The importance of understanding annuity replacements cannot be overstated. People often outgrow their initial investment strategies or discover better products that align more closely with their long-term financial goals. Common reasons for replacing an annuity include a desire for higher potential returns, shifting market conditions, or changes in personal circumstances which may necessitate a different investment approach.

Understanding the replacement of annuities

Replacing an annuity involves the process of terminating an existing contract to purchase a new one. This often depends on evaluating performance, terms, and overall suitability of the current annuity in relation to the investor's current needs. While switching may seem straightforward, it requires careful analysis of both products to ensure alignment with one’s financial goals.

The benefits of replacing an annuity can be significant. First, there may be potential for higher returns through a new investment option that has more favorable market performance. Second, improved terms and conditions, such as lower fees or better liquidity, can enhance the overall investment experience. However, it's vital to recognize potential risks, which include surrender charges that can diminish returns if the contract is terminated too soon, as well as tax implications that could arise from withdrawing funds from an annuity before maturity.

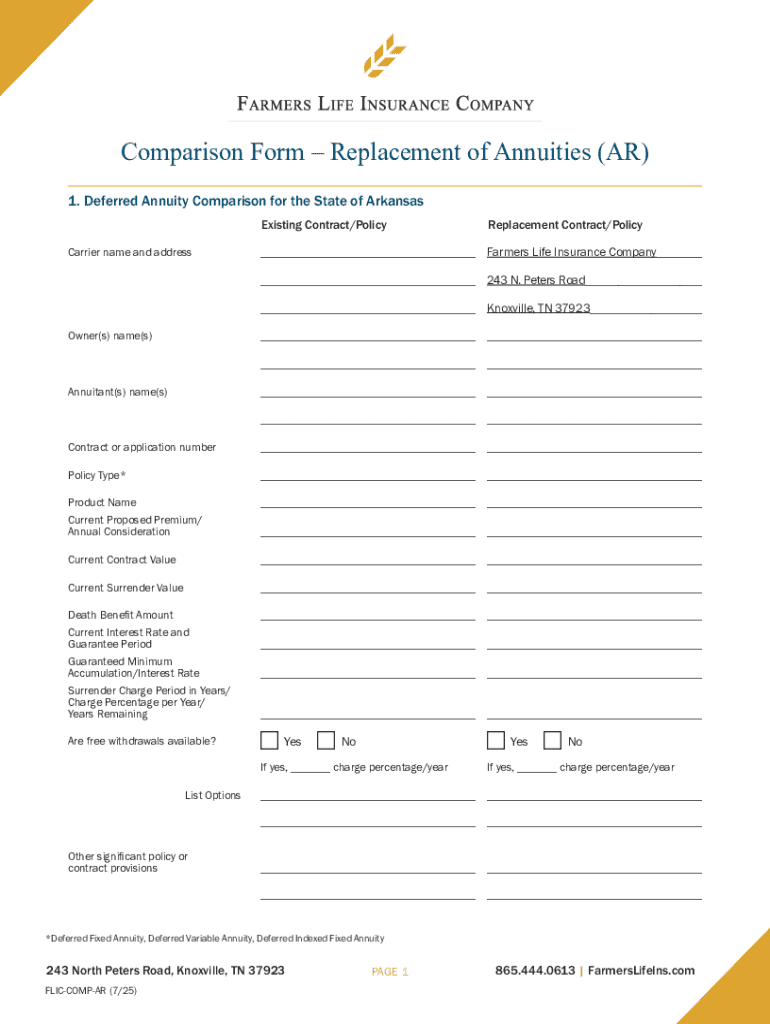

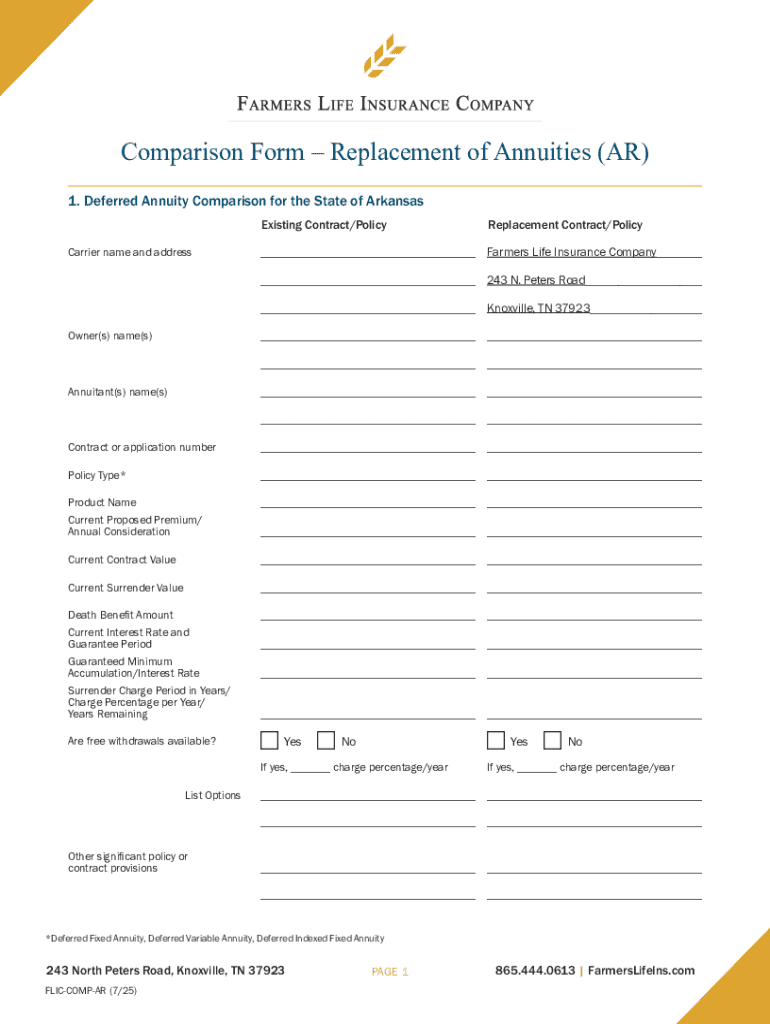

The role of the comparison form in annuity replacement

A comparison form is a crucial tool used in the replacement process of annuities. This document serves as a structured outline, allowing investors to systematically assess and compare their current annuity against potential new annuities. By having all relevant information organized in one format, investors can make informed decisions with confidence.

The importance of utilizing a comparison form cannot be overstated. It simplifies the replacement process by consolidating information, making it easier to pinpoint differences in fees, features, and benefits. In a landscape saturated with options, having a clear layout helps potential buyers weigh their choices methodically.

Key components of the annuities comparison form

Understanding what to look for in a comparison form is vital for effective evaluations. The form typically features sections that allow for laddered comparisons of current versus proposed annuities. For instance, one section may offer side-by-side tables summarizing essential factors such as interest rates, payout options, and fees.

Moreover, it might include a fees and charges comparison, listing annual fees, mortality and expense charges, and surrender fees. A thorough policy features and benefits analysis is likewise integral to ensure that all factors are comprehensively considered. Familiarity with critical terms like 'guaranteed minimum income' and 'surrender period' is also beneficial for understanding how these factors impact your financial future.

Step-by-step guide to filling out the comparison form

Preparing to fill out the comparison form starts with gathering all necessary documents, including the current annuity contract and any promotional materials for the new annuity. Understanding your existing annuity details, such as the type of annuity and policy numbers, will help facilitate a smoother evaluation.

Essential tips for effective annuity comparisons

Identifying your financial goals and needs is the first step to effective annuity comparisons. Consider whether you are looking for long-term income, cash flexibility, or potential growth. Understanding the different types of annuities—fixed, variable, indexed—will also guide your selection. This knowledge is crucial as the benefits can differ greatly between each.

Additionally, assess the long-term benefits compared to short-term gains. This often involves looking beyond initial offers or promotional rates and evaluating the product’s overall performance potential. Utilizing pdfFiller’s interactive tools can also enhance this process, allowing you to create, edit and manage your documents efficiently, reducing errors along the way.

Frequently asked questions about annuities and their replacement

A common question individuals face is how to determine if replacing their annuity is a wise decision. Consider factors such as performance, fees, and guaranteed payments to evaluate whether a current annuity meets your expectations.

Another concern pertains to fees associated with annuity replacements. Be aware of surrender charges, as these can significantly impact your overall value during a transition. Ensuring a smooth transition to a new annuity requires thorough communication with both receiving and relinquishing companies, as well as following up to address any changes in policies or services.

Using pdfFiller for your annuity comparison form

pdfFiller streamlines the document management process for your annuity comparison form. One of the key benefits of using pdfFiller is its user-friendly interface, which allows you to fill out, edit, and manage forms from anywhere, at any time. The platform provides tailored features for annuity comparisons, including eSigning capabilities, which allow for quick and secure signing of documents.

Additionally, pdfFiller offers collaborative features that allow for input from multiple team members or financial advisors, ensuring comprehensive evaluations and informed decisions. Specific templates designed for annuity comparisons are also available, enabling users to navigate the process seamlessly.

Mistakes to avoid when completing the annuities comparison form

One of the biggest pitfalls in completing the annuities comparison form is overlooking fine print in policy details. This often leads to unexpected fees or conditions that can affect your investment negatively. Additionally, be cautious not to verify the calculators or tools used for comparisons, as inaccurate data can lead to flawed decision-making.

Finally, failing to consult with a financial professional can be detrimental. Their expertise can provide valuable insights into market trends, tax implications, and individual strategies, ensuring your decisions are well-informed and beneficial.

Strategies for successfully managing your annuity transition

After submitting your annuity comparison form, follow a few simple strategies to ensure a successful transition. First, stay proactive by monitoring the performance of your new annuity. Understand that performance can fluctuate based on market conditions and economic factors.

It’s also vital to conduct regular reviews to confirm that your new annuity aligns with your financial goals. Changes in your lifestyle or market circumstances may warrant adjustments to your investment strategy, so remain flexible and informed over time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify comparison formreplacement of annuities without leaving Google Drive?

How do I edit comparison formreplacement of annuities on an Android device?

How do I fill out comparison formreplacement of annuities on an Android device?

What is comparison formreplacement of annuities?

Who is required to file comparison formreplacement of annuities?

How to fill out comparison formreplacement of annuities?

What is the purpose of comparison formreplacement of annuities?

What information must be reported on comparison formreplacement of annuities?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.