Get the free Certificates of Insurance in a Nutshell

Get, Create, Make and Sign certificates of insurance in

Editing certificates of insurance in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out certificates of insurance in

How to fill out certificates of insurance in

Who needs certificates of insurance in?

Understanding Certificates of Insurance in Form

Understanding certificates of insurance

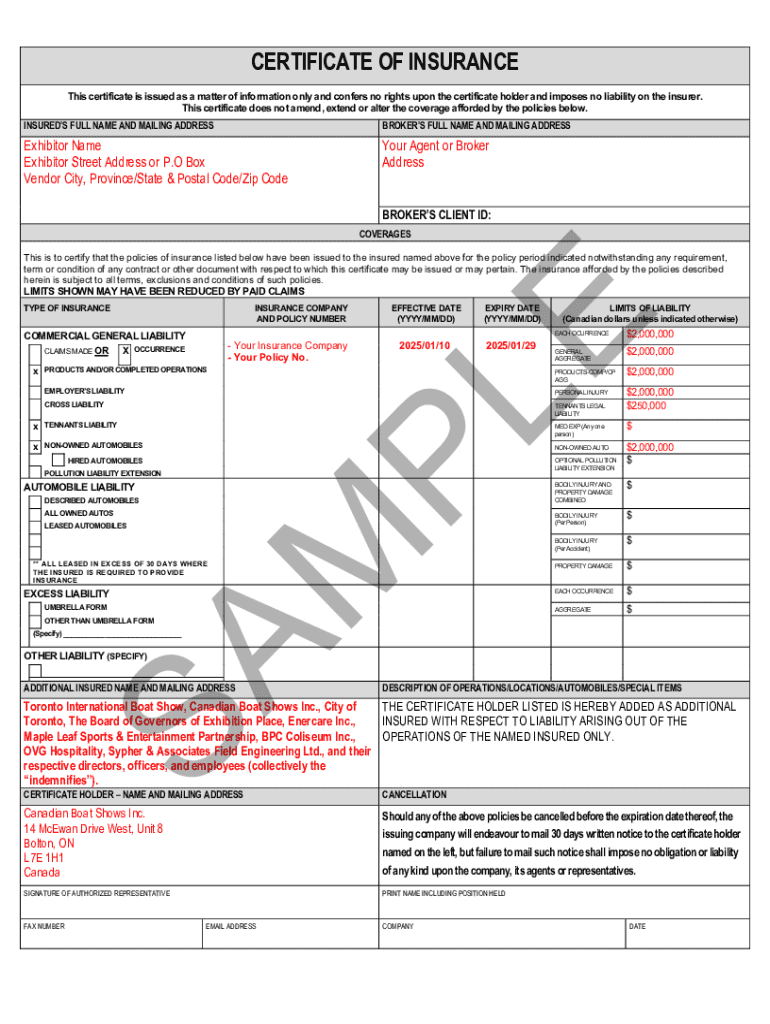

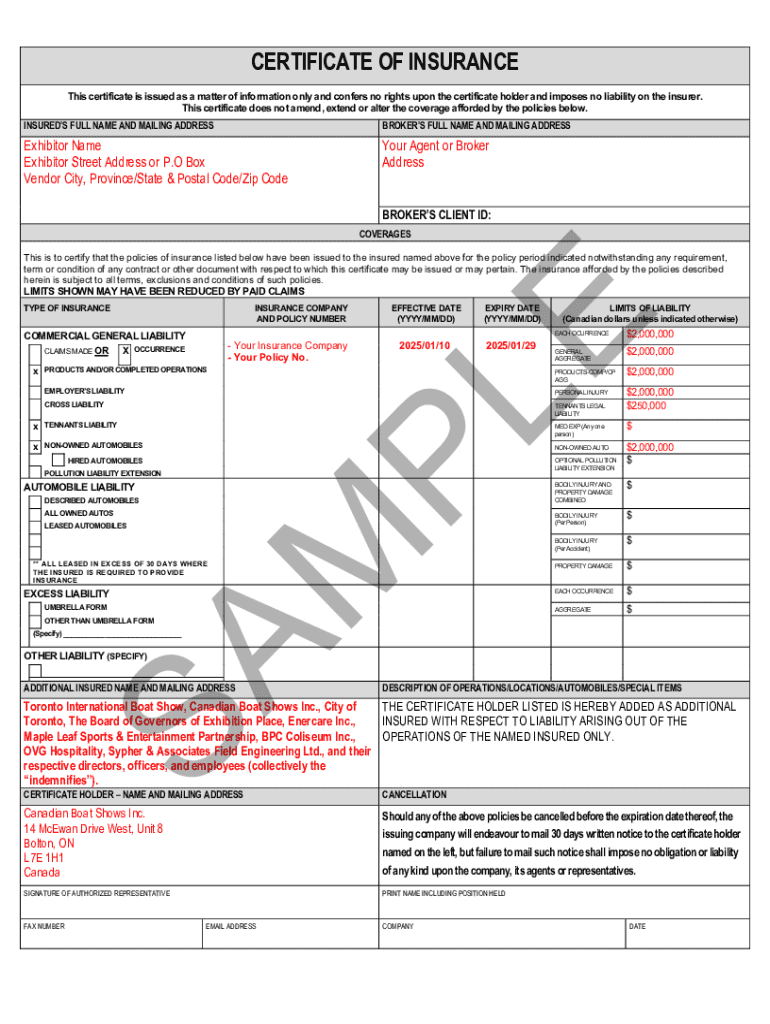

A Certificate of Insurance (COI) serves as proof that an individual or a business has an active insurance policy. Typically issued by an insurance company, this document summarizes relevant insurance coverage, limits, and effective dates. Certificates of insurance in form function as a crucial intermediary document, primarily used to confirm the existence of certain types of insurance, particularly liability insurance, to third parties.

Understanding the importance of certificates of insurance in various industries is vital. For contractors, event planners, and landlords, a COI can act as a safety net, ensuring that they are protected against potential risks and liabilities stemming from their business operations.

Many people hold misconceptions about COIs, with the most common being that they provide the same coverage guarantees as an insurance policy itself. In reality, while a COI outlines policy details, it is not a comprehensive contract or a guarantee of coverage. Rather, it merely illustrates that the named insured holds the specified coverage.

Key elements of a certificate of insurance form

A solid understanding of the critical sections in a certificate of insurance form is essential for both insurance providers and holders. The main elements include:

Common terminology found in certificates of insurance can also include terms like 'additional insured,' 'waiver of subrogation,' and 'primary insurance,' all of which can impact coverage and liability.

When and why you need a certificate of insurance

There are specific situations where obtaining a certificate of insurance becomes necessary. Situations including:

Having a certificate of insurance is not just a formality; it provides peace of mind and protects all parties involved. The presence of a COI can facilitate smoother business transactions and enable more effective risk management.

How to obtain a certificate of insurance

Obtaining a certificate of insurance is usually a straightforward process. The following steps can guide you in requesting a COI from your insurance provider:

It’s also important to note the differences between commercial and personal certificates of insurance. Commercial policies often have more extensive coverage options and might require additional disclosures than typical homeowners' insurance.

How to fill out a certificate of insurance form

Correctly filling out a certificate of insurance form is crucial to ensure that the document meets legal and contractual requirements. Here’s a step-by-step guide to assist you:

Common mistakes to avoid when filling out the form include overlooking policy limits, providing inaccurate dates, or failing to include the correct names of all parties involved.

Reviewing a certificate of insurance

Reviewing a certificate of insurance for compliance and accuracy is essential before submission. Here’s a checklist to guide your review:

If you discover errors or omissions in the certificate, promptly contact your insurance provider to rectify the inaccuracies.

Certificates of insurance vs. insurance policies

It’s important to distinguish between certificates of insurance and insurance policies. While a COI provides a snapshot of certain insurance coverages in force, an insurance policy is the actual contract that stipulates specific terms, conditions, coverages, and exclusions.

Understanding the role each document plays in risk management can help businesses make informed decisions. A COI is often used to reassure third parties about insurance coverage, whereas an insurance policy serves as the legally binding agreement between the insurer and the insured detailing what is and isn’t covered.

Top professions and industries that utilize certificates of insurance

Certificates of insurance are prevalent in various sectors, especially those that inherently involve risk. The construction industry frequently requires COIs to safeguard against accidents and liabilities on job sites.

In addition to construction, event management professionals often request COIs from vendors to ensure that adequate liability insurance is in place during events. Similarly, real estate and property management professionals rely on COIs to protect against potential claims arising from property use or maintenance.

Tailoring certificates of insurance for specific industries can greatly enhance legal protections and foster smoother operations. Different sectors may have unique requirements, and understanding these can prove invaluable.

Best practices for managing certificates of insurance

Managing your certificates of insurance effectively is crucial for risk management. Keeping organized records is essential, as certificates can expire or need updates based on changes in coverage or company needs. Here are some best practices:

By adhering to these best practices, businesses can navigate the complexities of certificates of insurance more efficiently and effectively.

Interactive tools and resources

Leveraging digital tools can significantly improve the process of creating and customizing certificates of insurance. Many platforms offer templates and editing capabilities to streamline the creation of COIs.

Online tools like pdfFiller allow users to fill out, edit, and sign COIs seamlessly. By accessing expert templates, individuals and businesses can simplify their processes, ultimately enhancing efficiency.

Utilizing pdfFiller's platform for efficient document handling can make managing certificates less daunting, providing a central hub for all your document management needs.

Seeking expert guidance

When in doubt about insurance coverage or navigating certificate requirements, consulting an insurance professional can be invaluable. They can provide tailored advice, ensuring that your documents are compliant with industry standards.

Expect to receive free expert advice through consultations and reviews, which can clarify significant aspects of coverage and associated liabilities. Having the right information at your disposal is critical to effective risk management and decision-making.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in certificates of insurance in?

Can I create an eSignature for the certificates of insurance in in Gmail?

How can I fill out certificates of insurance in on an iOS device?

What is certificates of insurance in?

Who is required to file certificates of insurance in?

How to fill out certificates of insurance in?

What is the purpose of certificates of insurance in?

What information must be reported on certificates of insurance in?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.