Get the free CONCENTUS WEALTH ADVISORS - Investment Adviser ...

Get, Create, Make and Sign concentus wealth advisors

How to edit concentus wealth advisors online

Uncompromising security for your PDF editing and eSignature needs

How to fill out concentus wealth advisors

How to fill out concentus wealth advisors

Who needs concentus wealth advisors?

Comprehensive Guide to the Concentus Wealth Advisors Form

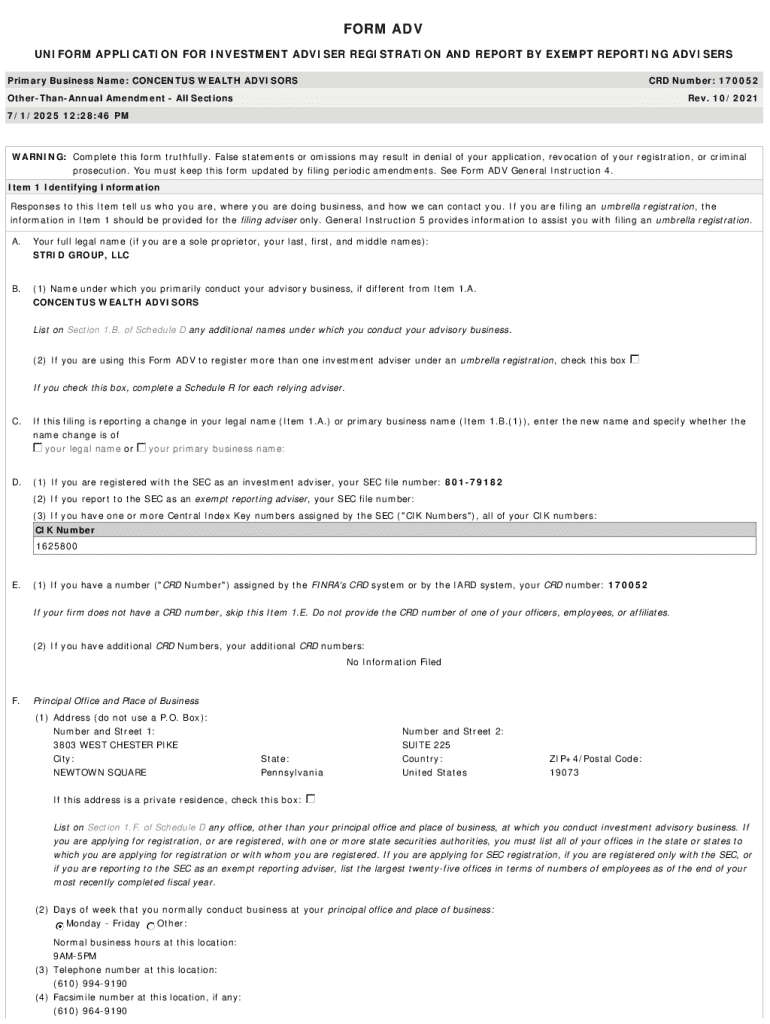

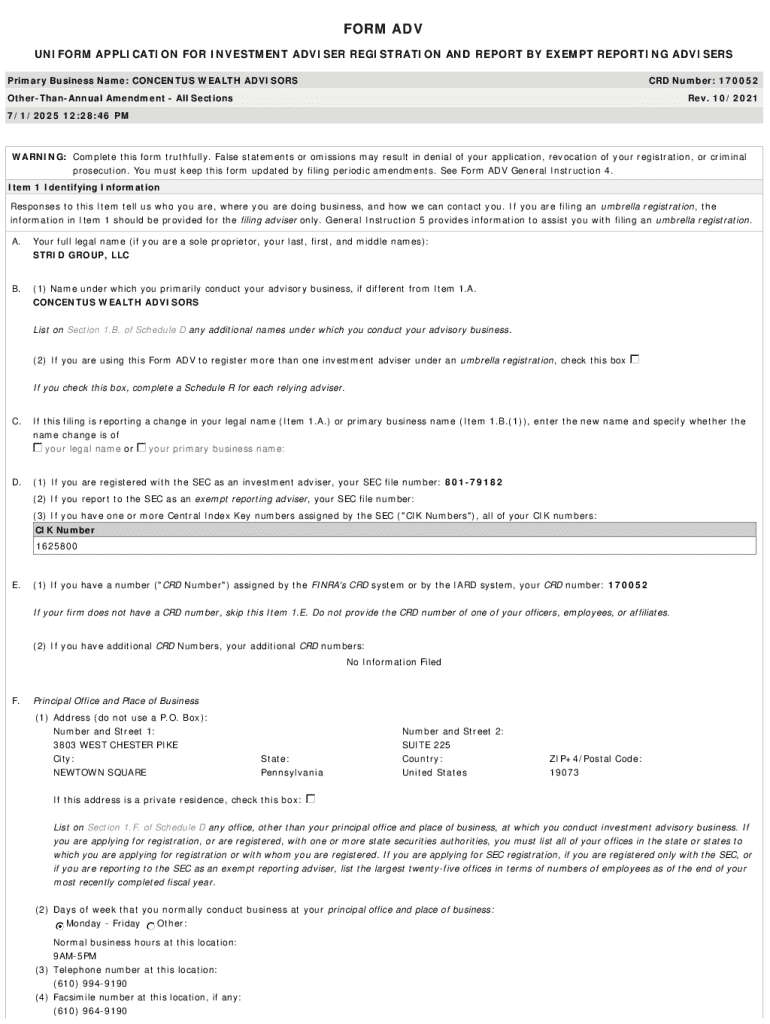

Understanding the Concentus Wealth Advisors form

The Concentus Wealth Advisors form serves as a vital tool for individuals seeking personalized financial guidance. It encapsulates essential details about a client’s financial landscape, allowing advisors to tailor their strategies to meet specific needs. In a world where financial wellness is paramount, this form helps bridge the gap between aspirations and actionable steps towards achieving those goals.

The importance of the Concentus Wealth Advisors form cannot be overstated. It lays the groundwork for effective financial planning by offering a comprehensive view of a client’s situation and objectives. The insights garnered from this form enable advisors to apply their fiduciary responsibility, ensuring wise stewardship over client funds and investments.

Key features of the Concentus Wealth Advisors form

The Concentus Wealth Advisors form consists of several critical sections aimed at understanding a client's needs. The first section is dedicated to personal information. Here, clients provide key identifiers like name, contact details, and financial dependents, allowing advisors to develop a holistic view of the client's circumstances.

Next, the form delves into financial goals and objectives. This section encourages clients to articulate their aspirations, whether it's saving for retirement, purchasing a home, or funding a child's education. The clarity offered by well-defined goals can significantly influence investment strategies and performance expectations.

Finally, clients express their investment preferences. This section addresses risk tolerance and desired investment horizons. Such insights help advisors align portfolios with clients' comfort levels, which is crucial for fostering confidence throughout the investment journey. Each section of the form is designed to capture vital information, ensuring a user-friendly experience as clients navigate what may feel like complex financial decisions.

How to access the Concentus Wealth Advisors form

Accessing the Concentus Wealth Advisors form is a straightforward process on pdfFiller, a platform designed for document creation and management. Users can easily locate the form by navigating to pdfFiller’s search bar and entering the keyword 'Concentus Wealth Advisors Form.' In just a few clicks, users will gain access to this essential financial tool.

One of the standout features of pdfFiller is its compatibility with a variety of devices. Whether using a desktop, tablet, or smartphone, users can access the form from anywhere, ensuring that financial planning remains convenient and accessible.

Filling out the Concentus Wealth Advisors form

Filling out the Concentus Wealth Advisors form begins with preparation. **Step 1**: Gather pertinent financial documents such as income statements, tax returns, and records of existing investments. This groundwork will ease the process and ensure accurate information is provided.

In **Step 2**, complete the personal information section thoroughly. Including details such as your address, phone number, and dependents is crucial. Providing correct information here lays a strong foundation for your financial advisor's understanding.

Moving to **Step 3**, it’s time to articulate your financial goals. Clearly distinguish between short-term goals, like building an emergency fund, and long-term objectives, such as saving for retirement. This section is instrumental in ensuring that your advisor tailors your financial strategies accurately.

Lastly, in **Step 4**, specify your investment preferences. Discuss your risk tolerance openly; are you more conservative, or do you prefer aggressive investing? Identifying your investment horizon—be it short-term or long-term—will vastly improve the performance and comfort of your investment strategy.

Using interactive tools for efficient completion

Utilizing pdfFiller's interactive tools enhances the form-filling experience. The platform provides features for document editing that are user-friendly, enabling easy adjustments to entries as needed. This interactivity not only simplifies the process but also reduces the likelihood of errors in submission.

Users can take advantage of pre-existing templates for the Concentus Wealth Advisors form, streamlining the completion process. Furthermore, pdfFiller allows users to invite team members or financial advisors to review the form collaboratively, ensuring that every detail aligns with your financial objectives. This emphasis on partnership illustrates the importance of involving those you trust in your financial journey.

Editing and signing the form

Once you have completed the Concentus Wealth Advisors form, pdfFiller allows for easy editing. If mistakes are caught after submission, the platform’s features enable users to make necessary adjustments efficiently. This ensures that your document reflects the most current and accurate information.

eSigning the form is equally straightforward. Simply select the eSign option within pdfFiller, allowing you to digitally sign your completed form. This quick and secure approach eliminates the need for printing and scanning. Ensuring data privacy and protection is paramount, so always use strong passwords and familiarize yourself with pdfFiller's security protocols as a best practice.

Managing and storing your form

After filling out and signing the Concentus Wealth Advisors form, managing and storing it effectively is essential. Users have various options within pdfFiller to save their forms, including direct cloud storage solutions, which facilitate easy access from any device. This flexibility is particularly beneficial for individuals and teams working across different locations.

Version control is another important aspect to consider. pdfFiller's capabilities allow users to maintain updates to the Concentus Wealth Advisors form over time. This ensures that your financial documentation reflects any changes in your situation or goals, thus fostering continued alignment with your overall financial strategy.

Common questions and troubleshooting

When working with the Concentus Wealth Advisors form, questions inevitably arise. For instance, what should you do if you make a mistake on the form? The best course of action is to edit the specific section as allowed by pdfFiller, thus ensuring the correction is camouflaged seamlessly into the existing document.

Another common inquiry revolves around sharing the completed form with an advisor. Users can easily generate shareable links or send forms directly from pdfFiller to ensure that their advisors receive accurate and timely information. If you encounter any technical issues while filling out the form, pdfFiller’s user support is readily available to guide you through troubleshooting steps.

The benefits of using pdfFiller for financial documentation

pdfFiller stands out for its seamless integration of editing, signing, and managing documents in a single, cloud-based platform. This organizational tool empowers users by providing functionality that streamlines the workflow, particularly when handling vital forms like the Concentus Wealth Advisors form.

Moreover, the advantages of a cloud-based solution cannot be overstated. Teams can collaborate on financial documentation regardless of their physical locations, which enhances productivity and efficiency in financial planning endeavors. This unrestricted access reinforces the importance of financial health and positions users to make informed, timely investment decisions.

Real-life cases: success stories with the Concentus Wealth Advisors form

Clients who have used the Concentus Wealth Advisors form often report transformative experiences in their financial planning journeys. For instance, one individual leveraged the insights gained through the form to reallocate their investments, achieving substantial growth within a short period. Testimonials from users consistently highlight how the structured approach provided by the form leads to clearer, actionable plans.

Another success story features a family that used the form to communicate their collective financial objectives to their advisor. By articulating their joint goals, they built a stronger partnership with their advisor, leading to strategies that profoundly aligned with their values and aspirations. Cases like these underscore the critical role the Concentus Wealth Advisors form plays in fostering effective communication and partnership.

Next steps after completing the form

Completing the Concentus Wealth Advisors form is just the beginning. The next step involves preparing for your meeting with a financial advisor. Bring the form, along with any supporting documents that provide additional context for your financial situation. Being well-prepared will enable a more productive discussion about your investment strategy and desired outcomes.

Planning actionable financial steps based on the insights derived from the form can lead to informed decision-making. This proactive approach not only instills confidence in your financial journey but also aligns your efforts with your most deeply held financial goals. Remember, your advisor’s role is to act as an ally, guiding you toward continual peace of mind in your financial affairs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the concentus wealth advisors form on my smartphone?

Can I edit concentus wealth advisors on an iOS device?

How do I edit concentus wealth advisors on an Android device?

What is concentus wealth advisors?

Who is required to file concentus wealth advisors?

How to fill out concentus wealth advisors?

What is the purpose of concentus wealth advisors?

What information must be reported on concentus wealth advisors?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.