Get the free CalMatters Form 990 2021

Get, Create, Make and Sign calmatters form 990 2021

How to edit calmatters form 990 2021 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out calmatters form 990 2021

How to fill out calmatters form 990 2021

Who needs calmatters form 990 2021?

Understanding CalMatters Form: A Comprehensive Guide for Nonprofits

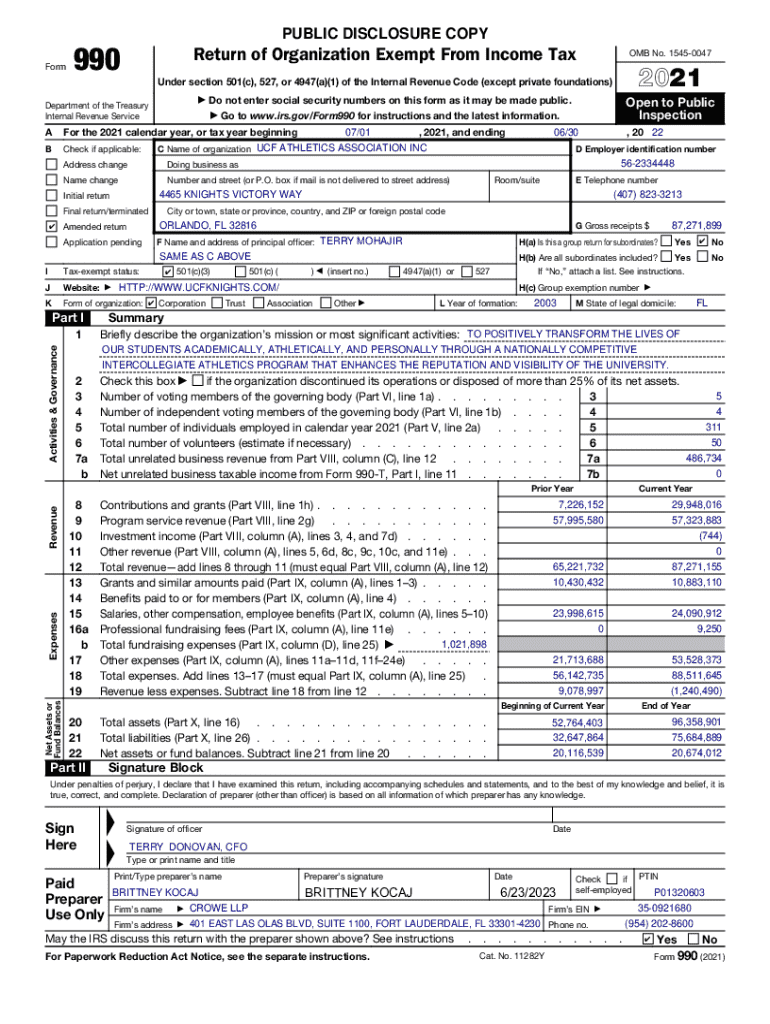

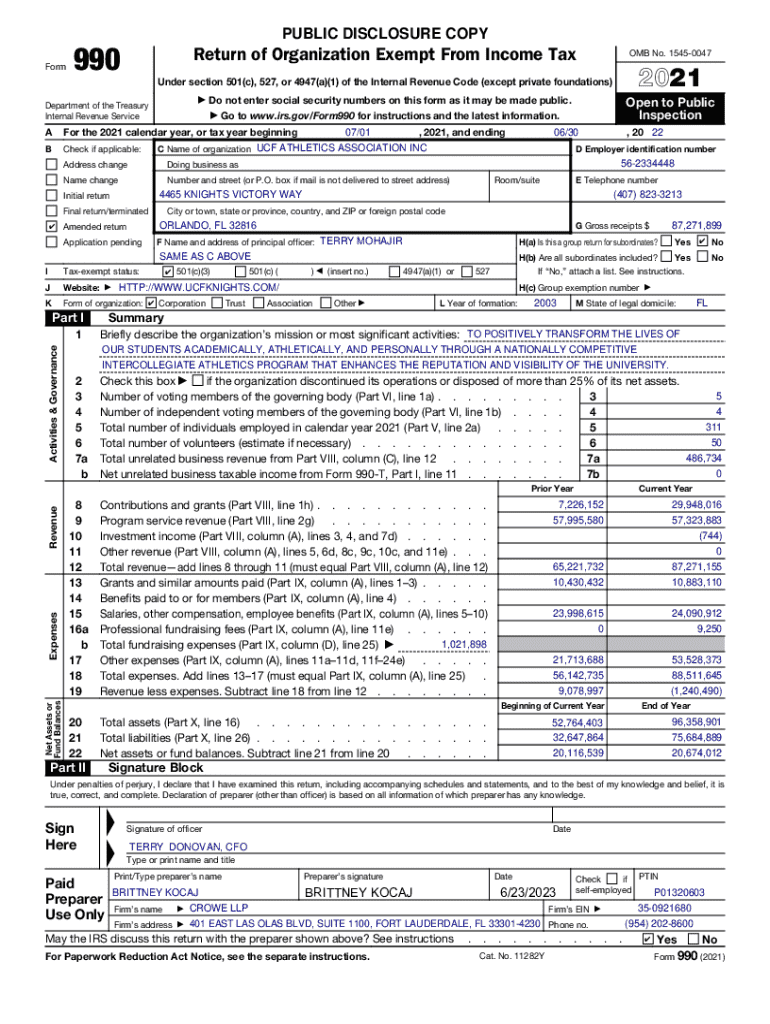

Understanding Form 990: An overview

Form 990 serves as a critical financial document for nonprofits, including organizations like CalMatters, a journalism outlet focused on public interest reporting in California. This form not only supplies information about a nonprofit's financial health, but it also plays a vital role in ensuring transparency within the sector. Nonprofits, which often rely on the goodwill of donors, must be transparent to attract funding and maintain public trust. As such, the significance of Form 990 cannot be overstated, as it provides insight into how nonprofit organizations utilize their resources.

The 2021 Form 990 includes sections that highlight financial data, operational achievements, and governance structure. Within these components, users will find essential information that reflects the organization's values and operational effectiveness. Given that nonprofits like CalMatters depend on tax-deductible donations, having accurate and transparent financial reporting bolsters credibility with current and prospective donors.

Navigating the 2021 Form 990

The layout of the 2021 Form 990 is structured for ease of use, though the complexity can still be daunting for first-time filers. The introductory sections identify the organization, ensuring that the IRS and the public can track its endeavors easily. As one navigates through the document, key sections reveal crucial insights into the nonprofit’s financial status and operations.

Noteworthy sections include the Identification of the Organization, which presents vital information, and the Financial Information segment, where revenue and expenses are detailed. Additionally, the Statement of Program Service Accomplishments showcases how the organization utilizes its resources to meet its mission. Lastly, Governance, Management, and Disclosure provide transparency in organizational structure and decision-making processes, essential for establishing a nonprofit's credibility.

Step-by-step guide to completing the 2021 Form 990

To complete the 2021 Form 990, organizations need to gather several critical documents. Financial statements from the current and previous years are essential to provide a thorough overview of the organization’s financial performance. Moreover, having access to prior year’s tax returns helps to ensure consistency in reporting and compliance with IRS regulations.

Filling out the form involves a methodical approach. Starting with Part I, which summarizes the organization's mission and key statistics, filers can set the stage for deeper financial insights. This is followed by the Signature Block, where authorized individuals confirm the accuracy of information provided. The Statement of Program Service Accomplishments, outlined in Part III, allows the organization to illustrate its impact. Continuing with Part IV, organizations check their compliance with public charity requirements, and Part V addresses any other IRS filings and tax compliance matters.

To maximize accuracy and compliance, it is crucial to be aware of common pitfalls, such as misreporting financial information or failing to include required disclosures. Utilizing tools such as pdfFiller can significantly enhance the accuracy of form completion and promote good practices.

Important considerations for nonprofits

The landscape for nonprofit reporting includes strict deadlines to ensure timely filings of Form 990. Nonprofits must stay aware of specific dates to avoid penalties, as late filings can incur fines ranging from $20 to $100 per day, depending on the organization’s size. In California, where many nonprofits operate, strict adherence to these deadlines is particularly crucial for maintaining donor confidence.

Organizations falling under the Category of public charities are mandated to file Form 990, whereas private foundations submit Form 990-PF. Incorrect or late filings can have serious repercussions, potentially leading to loss of tax-exempt status or damaging financial credibility. Therefore, being meticulous and proactive in handling Form 990 is essential for nonprofits, especially for organizations that rely heavily on contributions from donors.

Leveraging pdfFiller for your Form 990 needs

pdfFiller is an invaluable resource for nonprofits navigating the complexities of Form 990 preparation and submission. The platform allows users to easily edit and customize forms, ensuring that all information presented is accurate and up to date. The eSigning capabilities support quick approvals, vital for meeting tight deadlines, while collaborative tools enable team members to review and provide input efficiently.

Additionally, the cloud-based nature of pdfFiller offers unparalleled convenience for organizations managing Form 990 from anywhere at any time. This flexibility is particularly relevant for California-based nonprofits that may need to collaborate with various stakeholders across the state. Through digital means, nonprofits can streamline their documentation processes while fostering greater accountability and transparency among their members and donors.

Understanding the impact of your Form 990

Form 990 goes beyond compliance; it plays a crucial role in building public trust. Organizations can utilize data from Form 990 to analyze their financial health and make informative decisions that can enhance their operational effectiveness. By providing a clear overview of expenditures, income sources, and achievements, nonprofits can establish credibility with existing donors and attract new ones.

A transparent Form 990 can be a powerful tool for fundraising and grant applications. When potential funders see a well-prepared Form 990, they gain confidence in an organization’s financial management and mission-driven objectives. Furthermore, utilizing data from the form can illustrate how funds are allocated and the impact of initiatives, appealing to donors and grantors who seek to support transparent and effective nonprofits.

FAQs about Form 990

Many nonprofits inquire about the eligibility thresholds for filing Form 990. Organizations that gross less than $200,000 in total revenue and have less than $500,000 in total assets typically don't need to file, making it critical for small nonprofits to stay informed about their filing obligations. If a previously submitted Form 990 requires amendments, organizations can complete Form 990-X to rectify any discrepancies and submit it to the IRS.

Compliance resources are available through various organizations and platforms that specialize in nonprofit governance and reporting. Many states, including California, host seminars and workshops focused on Form 990 compliance to enhance the ability of nonprofits to navigate this crucial document.

Keeping abreast of changes in nonprofit reporting

It is vital for nonprofits to stay informed about changes and amendments to Form 990. The IRS periodically revises this form to improve reporting clarity and compliance measures. Organizations should regularly check IRS Notices and utilize nonprofit conferences as venues for updates on best practices in nonprofit reporting.

Engagement in professional organizations and online communities can also serve as valuable resources for remaining updated on form changes. Networking with peers can provide insights into effective strategies and common challenges in the nonprofit sector, ensuring organizations are always prepared for the shifting landscape of tax compliance.

Encouraging engagement and community support

Promoting financial transparency is crucial for nonprofits aiming to build strong connections with their stakeholders. Engaging donors and the community with financial insights from Form 990 can foster a sense of trust and accountability, encouraging ongoing support for the organization’s mission. Organizations can host workshops or create informational materials that breakdown the key elements of their Form 990, ensuring that it is accessible to all stakeholders.

Communicating insights derived from Form 990 directly to donors and the public holds great potential. By showcasing how donations are utilized effectively, organizations can create narratives that resonate with their audience. Additionally, fostering a culture of accountability within the organization can lead to shared values that amplify community support and engagement. Nonprofits should strive to involve their members in discussions about financial practices and transparency, shaping a united front that emphasizes responsible stewardship of resources.

Success stories: How effective use of Form 990 can elevate your nonprofit

Numerous organizations have reaped the benefits of transparent reporting through Form 990. Nonprofits that have utilized this form effectively report greater trust from their community, leading to increased funding and engagement. For instance, a California-based nonprofit focused on education improvement found that by sharing detailed program accomplishments along with their Form 990, they could attract new donors eager to support mission-driven objectives.

Moreover, organizations employing pdfFiller for their Form 990 submissions have noted enhanced accuracy and ease of use, leading to streamlined processes that save valuable time. Testimonials affirm the value of using a cloud-based document management solution, illustrating how effective reporting can transform donor relations and ultimately elevate nonprofit missions. By boasting clear data and well-documented achievements, nonprofits can further their impact within the community.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit calmatters form 990 2021 in Chrome?

How do I edit calmatters form 990 2021 on an iOS device?

How do I edit calmatters form 990 2021 on an Android device?

What is calmatters form 990 2021?

Who is required to file calmatters form 990 2021?

How to fill out calmatters form 990 2021?

What is the purpose of calmatters form 990 2021?

What information must be reported on calmatters form 990 2021?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.