Get the free Corporate Ownership Statement for Bankruptcy Case

Get, Create, Make and Sign corporate ownership statement for

How to edit corporate ownership statement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate ownership statement for

How to fill out corporate ownership statement for

Who needs corporate ownership statement for?

Corporate Ownership Statement for Form: A Comprehensive Guide

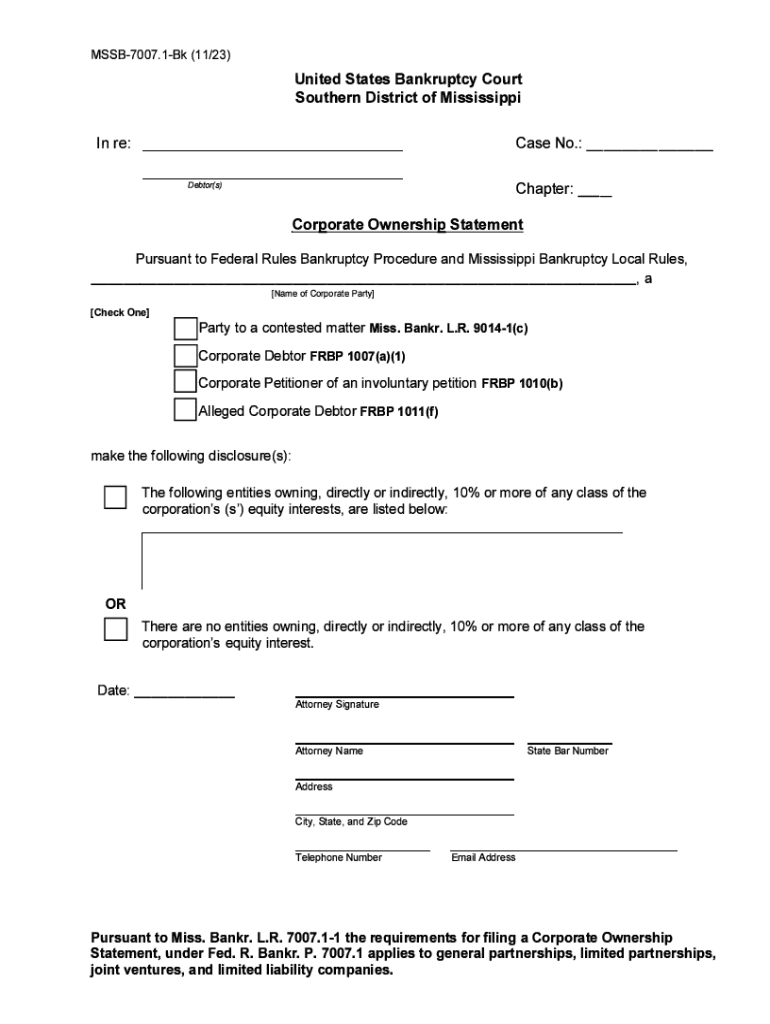

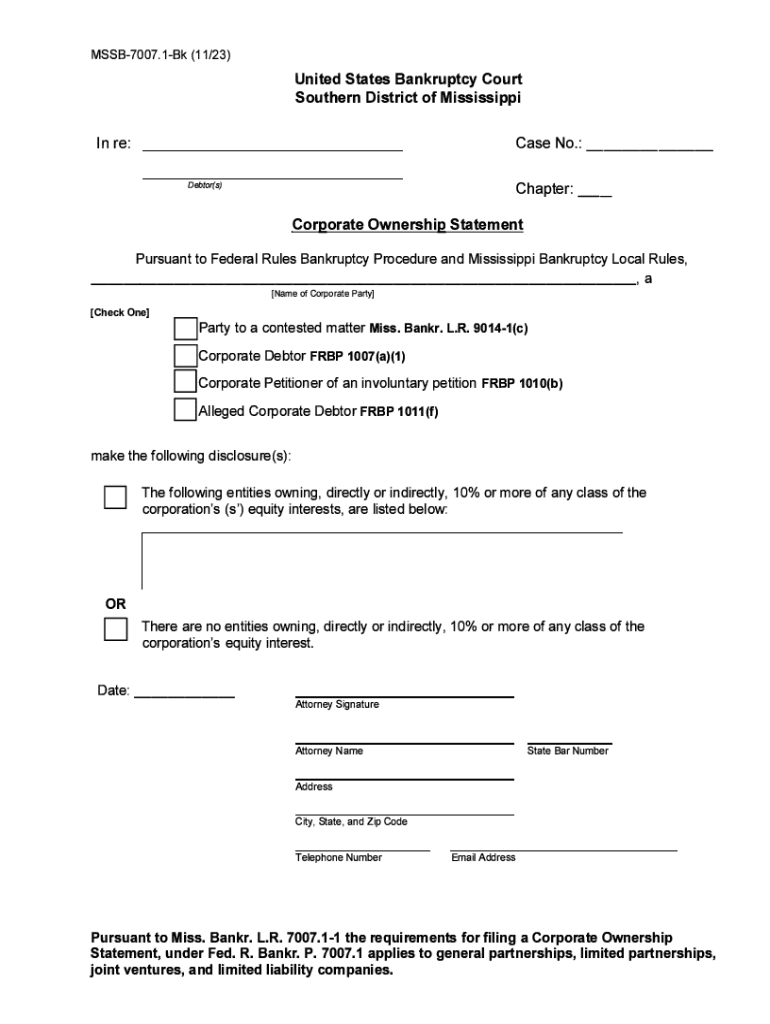

Understanding the corporate ownership statement

A Corporate Ownership Statement is a formal document that outlines the ownership structure of a corporation. This statement is essential for regulatory compliance and ensures transparency regarding who holds stakes in a business. Typically, this statement contains detailed information about the individuals or entities that hold shares in the corporation, as well as the number of shares they possess.

The importance of this document cannot be understated, as it plays a crucial role in corporate governance and accountability. It is often a requirement for various regulatory filings and can significantly affect a company’s ability to secure financing or enter into contracts.

Relevant regulations and compliance

Corporations must adhere to various regulations when filing Corporate Ownership Statements. Rule 7007.1 outlines the requirements for such statements, particularly in jurisdictions that demand transparency in corporate governance. Compliance requirements can vary depending on the type of corporation—whether it's a C corporation, S corporation, or Limited Liability Company (LLC)—thus it’s vital to understand the specific obligations applicable to your business structure.

Failure to comply with these regulations can lead to severe consequences including legal penalties, fines, or even the dissolution of the corporation. For example, if a corporation fails to file its Corporate Ownership Statement on time, it could be barred from conducting business in certain jurisdictions.

Key components of a corporate ownership statement

A comprehensive Corporate Ownership Statement must include several key components to ensure full compliance and transparency. Essential information starts with the legal name of the corporation, which is often accompanied by specific identifying numbers such as the Employer Identification Number (EIN). The ownership structure must also clearly reflect who owns the business.

Details about shareholders should be meticulously documented, stating not only their names but also the exact number of shares they possess. Additional supporting documentation may be necessary, such as shareholder agreements or certificates. Ensuring accurate and complete information helps prevent common pitfalls such as missing a shareholder or misreporting share quantities, which could lead to regulatory scrutiny.

Step-by-step guide to filling out the form

Filling out the Corporate Ownership Statement requires careful preparation. Begin by gathering all necessary documentation such as your formation documents, shareholder agreements, and any prior filings. This will simplify the process and ensure you have all pertinent information at your fingertips.

Each section of the form will require detailed completion, so here’s a detailed outline on how to effectively fill out each part of the document:

Ensure accuracy and completeness throughout this process by double-checking figures and details. Any discrepancies can lead to compliance issues or additional inquiries from regulatory bodies.

Editing and customizing your corporate ownership statement

Once the initial draft of the Corporate Ownership Statement is completed, the editing phase begins. Utilizing pdfFiller’s editing tools allows users to seamlessly modify the document based on organizational needs. You can add notes, clarify terms, or even incorporate estate planning considerations for substantial shareholders. This adaptability is crucial for businesses that may experience ownership changes frequently.

Collaboration within team members is encouraged when customizing the document. Establish a clear feedback loop, and utilize pdfFiller’s features to incorporate comments, track changes, and finalize the statement efficiently.

Signing and submitting the corporate ownership statement

Following the final edits and approvals, the Corporate Ownership Statement must be signed. pdfFiller offers multiple options for eSigning the document, ensuring a swift process. Electronic signatures are accepted in many jurisdictions, but verification requirements may vary, so always check local laws.

Submitting your Corporate Ownership Statement to the appropriate regulatory bodies is the next step. This often requires submission through specific online platforms or direct filing with a corporate registry. Maintaining accurate records of your submission enhances compliance, so utilize pdfFiller’s tracking features to monitor the submission process.

Managing your corporate ownership documents

Proper management of your Corporate Ownership Statement and associated documentation is essential. Establish best practices for storing corporate documents, favoring digital solutions that offer security and accessibility. pdfFiller’s cloud-based platform provides secure document storage, enabling easy access for authorized personnel.

Regular updates to your Corporate Ownership Statement are also crucial. Any changes in share distribution or new shareholders must be reflected promptly to avoid compliance issues. Utilizing cloud tools not only facilitates easy updates but also ensures that everyone involved has access to the latest information.

FAQs about the corporate ownership statement

Several common questions arise regarding the Corporate Ownership Statement. For instance, businesses may query what to do when a shareholder leaves the company or how to handle errors found post-submission. Understanding these nuances can greatly assist in maintaining compliance and operational integrity.

Recent changes in regulations may also raise concerns among corporate officers regarding the accuracy of their filings or potential penalties. Staying informed about regulations can streamline the filling process and avoid pitfalls.

Leveraging pdfFiller for document solutions

pdfFiller stands out among document management platforms, offering a plethora of features tailored specifically for corporate documentation. Users can easily create, edit, eSign, and manage their Corporate Ownership Statements in a single, integrated environment. The cloud-based nature of pdfFiller ensures that users can access their documents from anywhere, which is especially beneficial for teams operating remotely.

Success stories from users highlight the ease with which businesses can adapt their documentation processes with pdfFiller. From streamlining approval workflows to improving compliance tracking, utilizing pdfFiller can enhance the overall efficiency of managing corporate documents.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get corporate ownership statement for?

How do I edit corporate ownership statement for on an Android device?

How do I complete corporate ownership statement for on an Android device?

What is corporate ownership statement for?

Who is required to file corporate ownership statement for?

How to fill out corporate ownership statement for?

What is the purpose of corporate ownership statement for?

What information must be reported on corporate ownership statement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.