Get the free CS Tax return for year 2023 - 990##US - IASC Commons

Get, Create, Make and Sign cs tax return for

How to edit cs tax return for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cs tax return for

How to fill out cs tax return for

Who needs cs tax return for?

CS Tax Return for Form: A Comprehensive Guide

Understanding the CS tax return

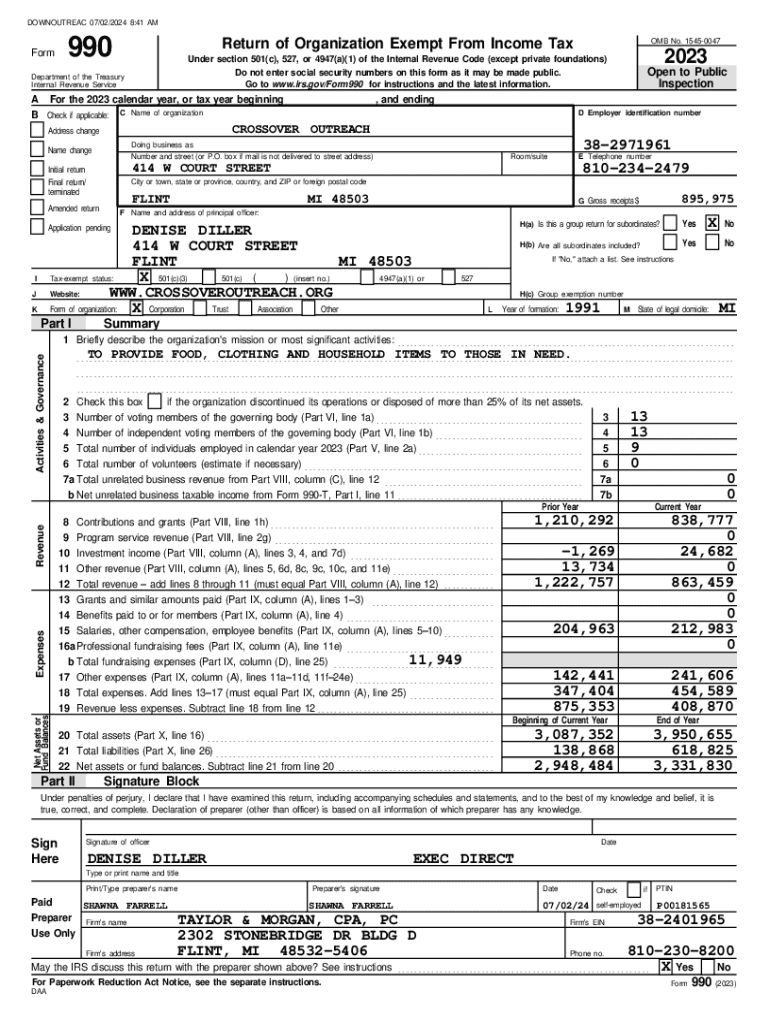

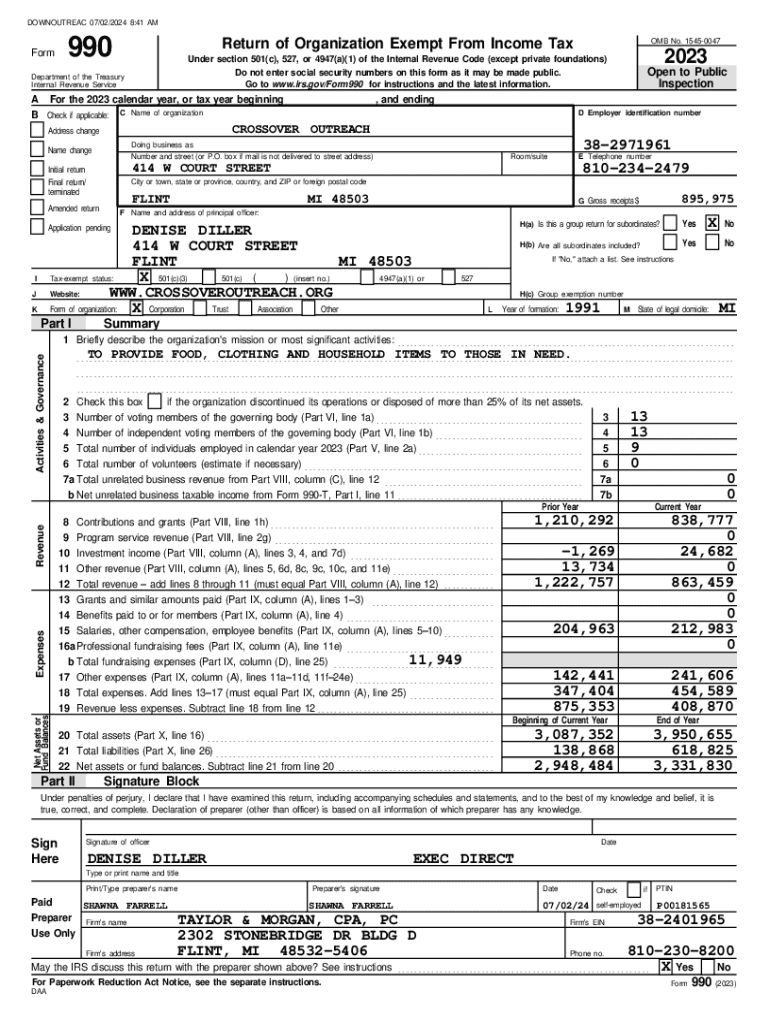

The CS tax return is a crucial document that individuals and organizations must submit to comply with tax obligations. This form plays a pivotal role in ensuring that all necessary income and deductions are accurately reported to tax authorities, facilitating the correct calculation of tax liabilities. Understanding the CS tax return, its purpose, and how it fits into the broader tax landscape is essential for effective tax management.

The CS tax return not only serves as a declaration of earnings but also provides insights into the specific financial activities of a taxpayer. This information helps in evaluating tax rates and liabilities, which are critical to maintaining compliance with local and national tax laws. By completing this form correctly, filers can avoid penalties and ensure they take advantage of allowable deductions.

Distinction between Form -S, -S (Lite), and

There are multiple variants of tax forms used for reporting purposes, notably Form C-S, C-S (Lite), and C. Each form caters to different types of taxpayers and their specific needs. Form C-S is typically used by small business owners or self-employed individuals, allowing them to report business income and expenses in detail. On the other hand, C-S (Lite) is streamlined for smaller earnings or those with fewer deductions, simplifying the reporting process.

Form C is often utilized by larger corporations and businesses with complex financial situations requiring comprehensive reporting. Understanding the key differences is vital for selecting the appropriate form. Incorrect filing can lead to confusion and potentially costly errors, making it imperative to choose wisely based on your financial circumstances.

Eligibility criteria for filing the CS tax return

Determining eligibility for filing Form C-S is the first step toward successful tax compliance. In general, any individual or entity that has earned income within a specified time frame is eligible to file. This includes small business owners, freelancers, and others whose income is not reported through traditional W-2 forms. Ensuring you meet the eligibility requirements is crucial to avoid complications during the filing process.

Special circumstances may also affect eligibility to file the CS tax return. For instance, non-residents may have different obligations based on jurisdiction. It's important to consult local tax rules and regulations, as these can dictate whether and how often a form must be submitted. Unique financial situations or joint filing statuses can also present specific criteria worth noting.

Step-by-step instructions for completing the CS tax return

Preparation is paramount when filing the CS tax return. The first step involves gathering all essential documents, such as income statements, tax deductions, and any relevant receipts. Organizing these documents will simplify the filing process and ensure that you're not missing crucial information that could impact your tax liability. Understanding the relevant tax laws and regulations also aids in ensuring your tax return is filed correctly.

Filling out the CS tax return can seem daunting initially, but breaking it down section by section can make it manageable. Each field is designed to capture specific information relating to your income and expenses. It's advisable to follow the instructions provided for each part of the form carefully to avoid mistakes that could lead to audits or penalties.

Utilizing platforms like pdfFiller can significantly ease this process. This tool offers features for editing and managing PDF forms effectively, allowing for an interactive experience while you complete your CS tax return. Utilizing smart features within pdfFiller, such as pre-fill options, can save time and minimize errors.

eSigning and submission process

The submission of your CS tax return isn't complete until it has been signed. Signatures play a vital role in confirming the authenticity of the document. eSignatures are formally recognized and provide the same legal validity as traditional handwritten signatures, reducing the need for printing and scanning. Understanding this shift towards digital solutions is essential in streamlining the filing process.

When using pdfFiller, adding your signature to the CS tax return is straightforward. The platform guides users through the steps of inserting their eSignature, ensuring that every submitted document maintains integrity and compliance. Once signed, proper saving and submission are just a few clicks away.

Managing your CS tax return

Once your CS tax return is filed, managing the document effectively becomes vital. Keeping a clear record after filing is indispensable. It’s a good practice to maintain copies of all filed forms along with receipts and supporting documents for several years, as authorities may ask for these during assessments or audits. Organizing these documents efficiently not only assists during inquiries but also eases the stress associated with future filings.

pdfFiller offers extensive support for managing tax documents long after filing. Its features for document lifecycle management help streamline your workflow, whether you're collaborating with accountants or simply retaining information for personal use. By leveraging pdfFiller’s comprehensive toolset, you can ensure your documentation stays well-organized and readily available when needed.

Common FAQs about the CS tax return

When filing the CS tax return, several common questions often arise. One concern is the procedure for correcting any errors made on the form. Should you discover a mistake after submission, it's important to follow stipulated guidelines for amendments. Generally, amendments can be made, but it's essential to adhere to the deadlines and procedures to avoid complications.

Additionally, maintaining awareness of filing deadlines is crucial. These timelines can vary based on individual circumstances and local legislation. Regular check-ins on requirements can help in ensuring your submission is timely, which can lead to smoother processing and lower risks of penalties.

Related content and further reading

To further enhance your understanding and effectiveness when dealing with CS tax returns, exploring related forms such as Form C-S and C can provide additional insights. Various articles and guides on tax preparation, filing systems, and best practices can also serve as valuable resources.

Engaging with pdfFiller's range of features offers best practices for document management, ensuring compliance and reducing stress related to filing. Consider exploring additional templates that pdfFiller provides to simplify your tax preparation efforts further.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cs tax return for on a smartphone?

How do I edit cs tax return for on an Android device?

How do I fill out cs tax return for on an Android device?

What is cs tax return for?

Who is required to file cs tax return for?

How to fill out cs tax return for?

What is the purpose of cs tax return for?

What information must be reported on cs tax return for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.