Get the free Consistent Consolidated Financial Statements for First ...

Get, Create, Make and Sign consistent consolidated financial statements

How to edit consistent consolidated financial statements online

Uncompromising security for your PDF editing and eSignature needs

How to fill out consistent consolidated financial statements

How to fill out consistent consolidated financial statements

Who needs consistent consolidated financial statements?

Consistent Consolidated Financial Statements Form: A Comprehensive How-to Guide

Understanding consolidated financial statements

Consolidated financial statements are vital documents that present the financial position and performance of a parent company and its subsidiaries as a single economic entity. They provide a holistic view of a company's financial health, essential for stakeholders who require accurate financial data for decision-making. These statements enhance transparency, making it easier for analysts, bankers, and investors to assess the overall stability and performance of a group of companies under unified leadership.

Key components of consolidated financial statements include:

The role of the consistent consolidated financial statements form

The consistent consolidated financial statements form serves as a standardized template for financial reporting. It is essential to maintain uniformity across different reporting periods, ensuring that all information is presented accurately and consistently. This form simplifies the process of compiling and analyzing financial data across multiple subsidiaries, making it easier for management to track performance and make informed decisions.

Benefits of using a standardized format include:

Key stakeholders involved in the preparation of this form include financial analysts, accountants, and management teams responsible for ensuring accuracy and consistency.

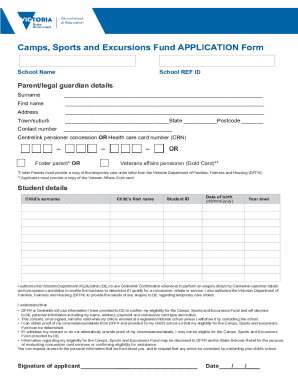

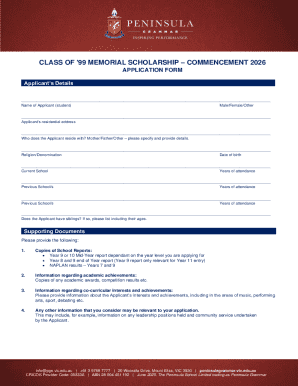

How to fill out the consistent consolidated financial statements form

Filling out the consistent consolidated financial statements form requires careful preparation. Here’s a detailed step-by-step guide to effectively complete the form:

Best practices for creating consistent consolidated financial statements

Creating high-quality consolidated statements relies on adherence to best practices, which include ensuring data integrity and maintaining compliance with established accounting standards, such as GAAP and IFRS. Data integrity is critical; therefore, companies should implement strong internal controls to minimize errors in data collection and reporting.

Effective collaboration among teams is also paramount. Utilizing collaborative platforms allows teams to share insights and data seamlessly, culminating in a more accurate representation of the financial status of the organization. Regular training on financial reporting standards and systems can enhance the skills of team members, promoting accuracy in financial statements.

Tools for managing consolidated financial statements

Managing consolidated financial statements can be complex; however, tools like those offered by pdfFiller streamline the process significantly. This cloud-based solution provides everything needed for effective document management, including document editing, eSignature capabilities, and tracking features.

Specifically, pdfFiller empowers users by allowing:

These tools not only save time but also ensure that the preparation process remains organized and compliant.

Real-world examples and case studies

Numerous organizations have successfully implemented consistent consolidated financial statements to great effect. For example, a multinational corporation facing regulatory scrutiny used standardized forms to consolidate their statements efficiently, ultimately improving their compliance standing with stakeholders and analysts. This not only increased their credibility but also showcased a commitment to transparency.

However, challenges can arise. The integration of new subsidiaries might complicate consolidation efforts. Learnings from organizations that faced difficulties include establishing a structured approach to reporting standards and investing in software tools that accommodate complex financial structures.

Regulatory considerations

Compliance with laws and regulations is crucial when preparing consolidated financial statements. Laws such as the Sarbanes-Oxley Act impose strict requirements on financial reporting, ensuring accuracy and transparency. Additionally, the SEC regulations play a significant role in shaping the requirements for public companies, emphasizing the importance of maintaining high standards in financial reporting.

Companies must regularly review updates on these regulations to avoid penalties and maintain stakeholder trust. Awareness of changes not only aids in compliance but positions organizations as leaders in their respective industries.

Frequently asked questions (FAQ)

Understanding the common challenges around preparing consistent consolidated financial statements can ease the process. Here are some frequently asked questions:

Advanced topics in consolidated financial statements

As businesses evolve, advanced topics around consolidated financial statements become relevant. For instance, mergers and acquisitions can significantly impact consolidation strategies, requiring a clear understanding of how these changes will affect overall financial reporting.

Furthermore, understanding non-controlling interests is essential, particularly in joint ventures where not all subsidiaries are wholly owned. Finally, staying ahead of future trends in financial reporting, such as increased automation and the role of AI in creating more accurate financial models, can position organizations well against competitors.

Interactive and educational resources

To support the process of creating consistent consolidated financial statements, pdfFiller offers interactive resources that can enhance learning and engagement. Users can access templates, fillable forms, and real-life examples of the financial statements they need to prepare.

In addition, pdfFiller provides webinars and workshops directed at financial professionals to cover best practices in preparation, regulatory requirements, and effective use of tools. Providing access to these resources supports teams in staying informed and compliant with changing financial landscapes.

Conclusion

The consistent consolidated financial statements form is indispensable for any organization operating with multiple subsidiaries. By following the outlined steps, adhering to best practices, and utilizing resources like pdfFiller, companies can ensure accuracy, compliance, and transparency in their financial reporting. This not only addresses stakeholder needs but also positions the organization for future growth and leadership in its sector.

Closing notes

Regularly updating financial statements is a necessity to align with evolving regulations and internal corporate changes. Keeping abreast of these updates ensures that your financial reporting remains relevant and trustworthy. With pdfFiller, you can streamline this process through your cloud-based document management, empowering your teams to create accurate, consistent consolidated financial statements.

Footer section

For further assistance in your financial reporting needs, visit pdfFiller for resources and support. Be it for templates, editing, or management, pdfFiller is equipped to enhance your document handling processes efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send consistent consolidated financial statements for eSignature?

How do I complete consistent consolidated financial statements online?

How do I fill out consistent consolidated financial statements using my mobile device?

What is consistent consolidated financial statements?

Who is required to file consistent consolidated financial statements?

How to fill out consistent consolidated financial statements?

What is the purpose of consistent consolidated financial statements?

What information must be reported on consistent consolidated financial statements?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.