Get the free Instructions for Form 4897 Corporate Income Tax (CIT) Data ...

Get, Create, Make and Sign instructions for form 4897

How to edit instructions for form 4897 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out instructions for form 4897

How to fill out instructions for form 4897

Who needs instructions for form 4897?

Instructions for Form 4897: A Comprehensive Guide

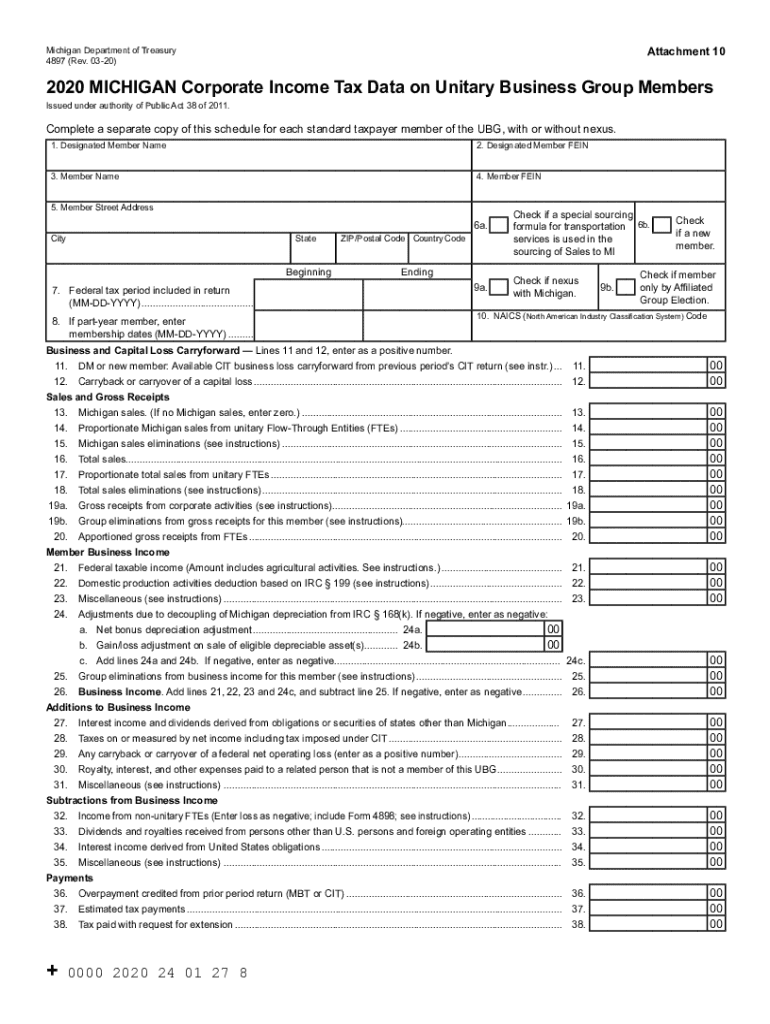

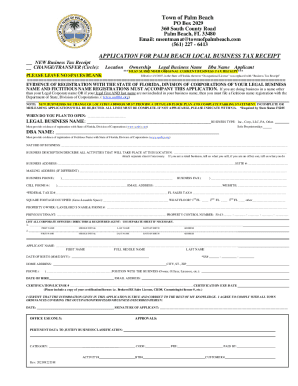

Understanding Form 4897

Form 4897, also known as the 'Sales and Other Dispositions of Capital Assets,' is a crucial document for reporting the sale of qualified assets. This form is utilized primarily for tax purposes, enabling individuals and entities to accurately report transactions that involve selling or exchanging capital assets. The key information captured by Form 4897 includes details about the asset sold, the date of the transaction, sale price, and the cost basis, which is essential for calculating any capital gains or losses.

Understanding who needs to use Form 4897 is vital. This form is targeted at individuals or entities that have engaged in the sale of property or other assets that could impact tax obligations. Common situations necessitating the completion of Form 4897 include selling stocks, bonds, real estate, or other significant personal or business assets.

Preparing to fill out Form 4897

Before starting to complete Form 4897, gather all necessary information. This includes the details of the asset being sold, such as its description, acquisition date, and selling price. Additionally, you’ll need records of the purchase price or the cost basis of the asset, as well as any associated selling expenses. It’s advisable to have your previous tax returns handy since they can aid in fetching relevant details.

Deciding between manual and digital completion is another important preparatory step. While you can fill out Form 4897 by hand, using a digital tool like pdfFiller offers numerous advantages. The platform provides user-friendly editing, allows for easy document management, and ensures that you have access to the form anytime, from anywhere, thus streamlining your filing process.

Step-by-step guide to filling out Form 4897

Accessing Form 4897 through pdfFiller is straightforward. Simply visit the pdfFiller website, create an account if you don’t have one, and search for Form 4897 in the template library. Upon locating the form, click to open it, and you’re ready to start filling it out. pdfFiller offers several features that facilitate form completion, such as text fields for easy input and automatic calculations for certain entries.

Filling out Form 4897 involves several detailed sections. Section 1 requires your personal information, including your name, address, and taxpayer identification number. Make sure to double-check every detail before proceeding to Section 2, which focuses on property information. Here, you’ll enter the specifics about the asset sold, including when it was acquired and sold. In Section 3, you’ll detail your financial information—specifically, the sale price and your cost basis—allowing you to calculate gains or losses clearly. Finally, Section 4 is where you’ll sign the form, confirming the accuracy of the information provided.

Editing and customizing Form 4897

One of the advantages of using pdfFiller is its robust editing features. Should you need to make changes to your Form 4897, the platform allows you to add or remove information seamlessly. Utilize features for auto-fill options to streamline data entry and ensure consistency throughout the form. This not only saves time but also reduces the likelihood of errors.

Collaboration is made easy with pdfFiller. If you need additional input from colleagues or partners, you can share the form directly on the platform. This enables joint editing and review before finalizing the document. Additionally, tracking changes is simplified with the version history feature, allowing all collaborators to manage workflow efficiently.

Signing and submitting Form 4897

Once completed, eSigning Form 4897 is a straightforward process. On pdfFiller, simply click the signature option, where you can create an electronic signature or upload one. Remember, electronic signatures are legally valid and recognized in many jurisdictions, making them a convenient option for document signing.

Submission guidelines are crucial to follow. After signing, you need to submit Form 4897 to the appropriate tax authorities. In the U.S., this typically means sending it along with your tax return to the IRS. Ensure that you keep a copy for your records and confirm that your submission follows any specific state requirements, which may vary. To avoid delays, double-check that the form is filled out completely and accurately before you submit it.

Managing your Form 4897 with pdfFiller

After submitting Form 4897, managing your document effectively is crucial. pdfFiller enables you to securely save your completed form directly to your account. Implementing best practices for document organization, such as using folders and labeling files clearly, can enhance your ability to retrieve necessary documents quickly.

Tracking document progress is another key feature. With pdfFiller, you can monitor submission status and stay updated on responses from tax authorities. This feature is particularly beneficial during tax season or when dealing with time-sensitive documents, ensuring that you are always informed. Moreover, thanks to cloud storage, you can access your documents anytime, anywhere, via any device with internet access.

Troubleshooting common issues

When filling out Form 4897, avoiding common mistakes is crucial for ensuring a smooth process. Key errors include misreporting the sale price or miscalculating the cost basis, which can significantly impact tax liabilities. To correct such mistakes, always review each entry carefully and use resource guides to cross-check data before submission.

Addressing frequently asked questions about Form 4897 can also provide clarity. Common queries often revolve around eligibility for using the form, specific requirements for capital asset reporting, and the impacts of capital losses. Always ensure that you consult the latest IRS guidelines or trusted resources to get accurate and updated information.

Leveraging pdfFiller for additional document needs

PdfFiller is a comprehensive document management solution that extends beyond just Form 4897. You can manage a multitude of other forms efficiently on pdfFiller, from tax returns to legal agreements. This versatility makes it an invaluable tool for individuals and teams alike.

Using a comprehensive solution like pdfFiller not only aids in filling out tax forms but also enhances overall document management. The benefits include a centralized platform for all your document needs, efficient collaboration features, and time-saving options for document creation and editing, making it a go-to choice for anyone looking to streamline their paperwork processes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send instructions for form 4897 to be eSigned by others?

Where do I find instructions for form 4897?

How do I complete instructions for form 4897 on an Android device?

What is instructions for form 4897?

Who is required to file instructions for form 4897?

How to fill out instructions for form 4897?

What is the purpose of instructions for form 4897?

What information must be reported on instructions for form 4897?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.