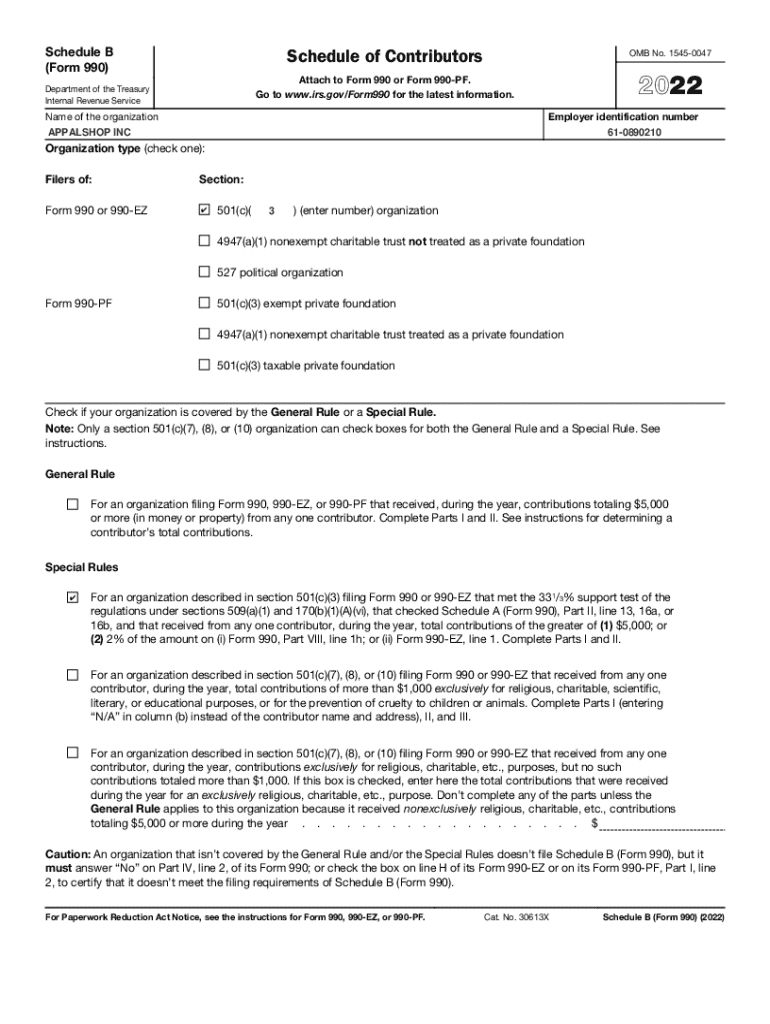

Get the free Schedule B (Form 990) (Rev. December 2024)

Get, Create, Make and Sign schedule b form 990

How to edit schedule b form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule b form 990

How to fill out schedule b form 990

Who needs schedule b form 990?

A comprehensive guide to Schedule B of Form 990

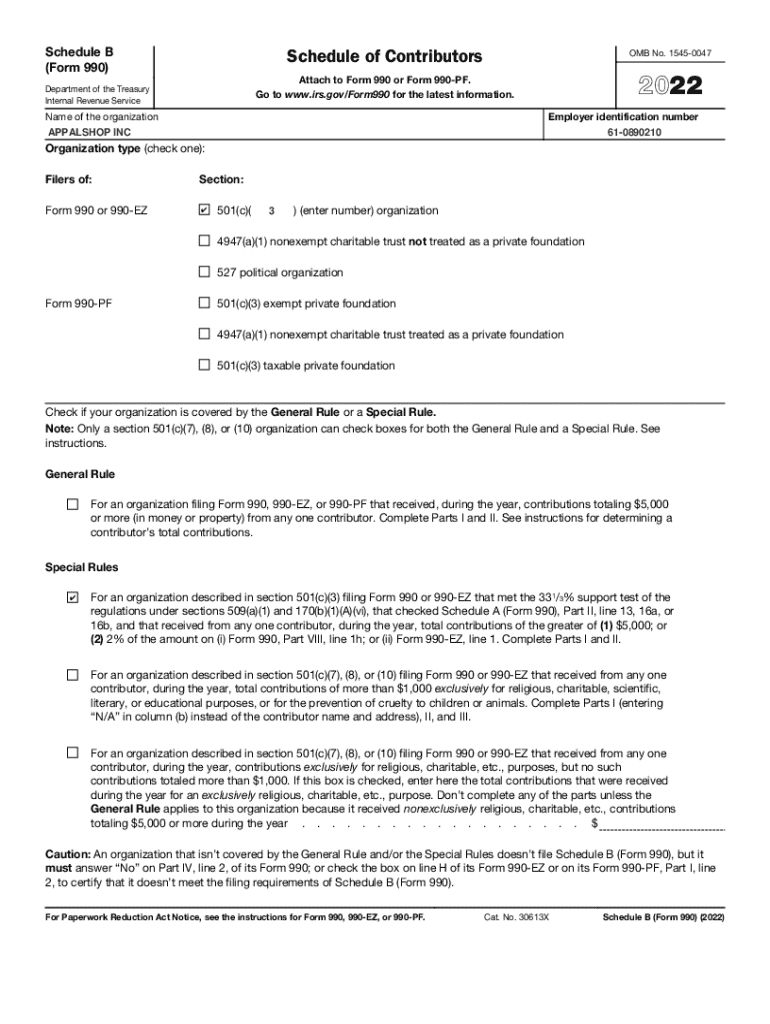

Understanding Schedule B of Form 990

Schedule B of Form 990 plays a crucial role in the financial reporting of nonprofit organizations. This form is specifically designed to provide the IRS with detailed information about the organization’s contributors and donations. By doing so, it fosters transparency and accountability among nonprofits, enabling stakeholders, including donors and the public, to understand how funds are sourced and utilized.

The emphasis on transparency is essential as nonprofits often operate without profit motives. This great responsibility requires organizations to ensure that their financial activities are reported accurately and comprehensively. Schedule B serves not only as a compliance requirement but also as an essential tool for reinforcing the trust placed in nonprofits by their supporters.

Legal requirements for filing Schedule B

Filing Schedule B is not merely a suggestion; it is a legal requirement for many nonprofit organizations. The IRS mandates that certain tax-exempt organizations attach Schedule B to their Form 990, which is the annual information return for exempt organizations. This legal framework ensures that nonprofits provide the IRS with pertinent details about their donors and contributions.

Failing to file or inaccurately completing Schedule B can result in severe consequences. Organizations may face penalties, including fines or loss of tax-exempt status, which can tarnish their reputation and limit their operational capabilities. It's crucial for these organizations to recognize the importance of compliance and ensure that all information reported is precise and complete.

The structure of Schedule B

Schedule B consists of several key sections, each requiring specific information from organizations. Understanding the structure is crucial for accurate reporting. The first section typically requires an overview of all contributions received, while subsequent sections delve into details about individual donors.

Each part of Schedule B has its own requirements, including the names and addresses of significant contributors. This ensures that organizations maintain thorough records of their funding sources. Additionally, there are guidelines in place surrounding anonymous donations, which provide exceptions to regular reporting, ensuring that organizations adhere to appropriate privacy standards.

Who needs to file Schedule B?

Not every nonprofit organization is required to submit Schedule B. Specifically, organizations classified as 501(c)(3) and sometimes 501(c)(4) must file this schedule with their Form 990 to detail their financial activities. Understanding the criteria for required filings can prevent organizations from unnecessary penalties or compliance issues.

However, some organizations may be exempt from filing Schedule B altogether. For example, certain smaller nonprofits or those without significant contributions may not need to complete this schedule. It's important for organizations to carefully assess their activities and contributions to determine if this reporting requirement applies to them.

How to fill out Schedule B: A step-by-step guide

Filling out Schedule B may seem daunting, but breaking it down into manageable steps can simplify the process significantly. Begin by gathering all relevant documents necessary for the completion of the form. This includes a complete list of donors, contributions, and any other pertinent financial data.

Once this information is organized, proceed to fill out each section of Schedule B. Pay careful attention to line-by-line instructions to avoid common pitfalls. Additionally, it is crucial to review the information for accuracy before submission to prevent penalties and ensure compliance.

Utilizing pdfFiller for Schedule B Form 990

pdfFiller is an invaluable tool when it comes to managing and filing Schedule B of Form 990. It simplifies the process of editing, allowing users to make necessary changes directly to the digital form without the hassle of printing and scanning. With features like e-signatures and collaborative editing capabilities, teams can work together seamlessly, ensuring accuracy and efficiency.

The platform also provides interactive tools that aid in document creation. Being cloud-based, it allows teams to access and collaborate on files from anywhere, reducing the barriers associated with remote work. Utilizing pdfFiller means that organizations can focus more on their mission and less on administrative tasks.

Common mistakes to avoid when filing Schedule B

While filing Schedule B may be standardized, many nonprofits still make common mistakes that can lead to compliance issues. One frequent error includes failing to report all significant contributions, which can have serious ramifications. Organizations need to be thorough and ensure all contributors are accounted for.

Another common pitfall is inaccurate contact information for donors, which can lead to communication issues or questions from the IRS. To avoid these and other errors, organizations should prioritize accuracy and completeness in reporting, helping to maintain their credibility. This diligence is not only beneficial for regulatory compliance but also enhances the organization's reputation among stakeholders.

Frequently asked questions (FAQs)

Organizations often have questions about Schedule B and its nuances. One common query is regarding the specifics of filing requirements and deadlines associated with the form. It’s essential for organizations to familiarize themselves with these regulations to avoid any last-minute compliance issues.

Clarifications regarding IRS regulations related to Schedule B are also frequent. Nonprofits need to understand the rules surrounding donor anonymity along with discussions about what constitutes a significant donation. Emphasizing these points can help clarify the process and ensure accurate filing.

Additional considerations for 2024 reporting

As we approach 2024, it is vital for organizations to stay updated on changes and updates concerning Schedule B. Any new regulations impacting Schedule B filings should be monitored closely to ensure compliance, highlighting the importance of staying informed in a constantly evolving regulatory environment.

Planning ahead for these changes will not only aid in compliance but also enhance overall organizational preparedness. Strategies such as attending IRS webinars or utilizing resources from customer support teams specializing in nonprofit tax returns can help ensure that nonprofits remain compliant as new guidelines emerge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit schedule b form 990 online?

How do I edit schedule b form 990 straight from my smartphone?

How do I fill out the schedule b form 990 form on my smartphone?

What is schedule b form 990?

Who is required to file schedule b form 990?

How to fill out schedule b form 990?

What is the purpose of schedule b form 990?

What information must be reported on schedule b form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.