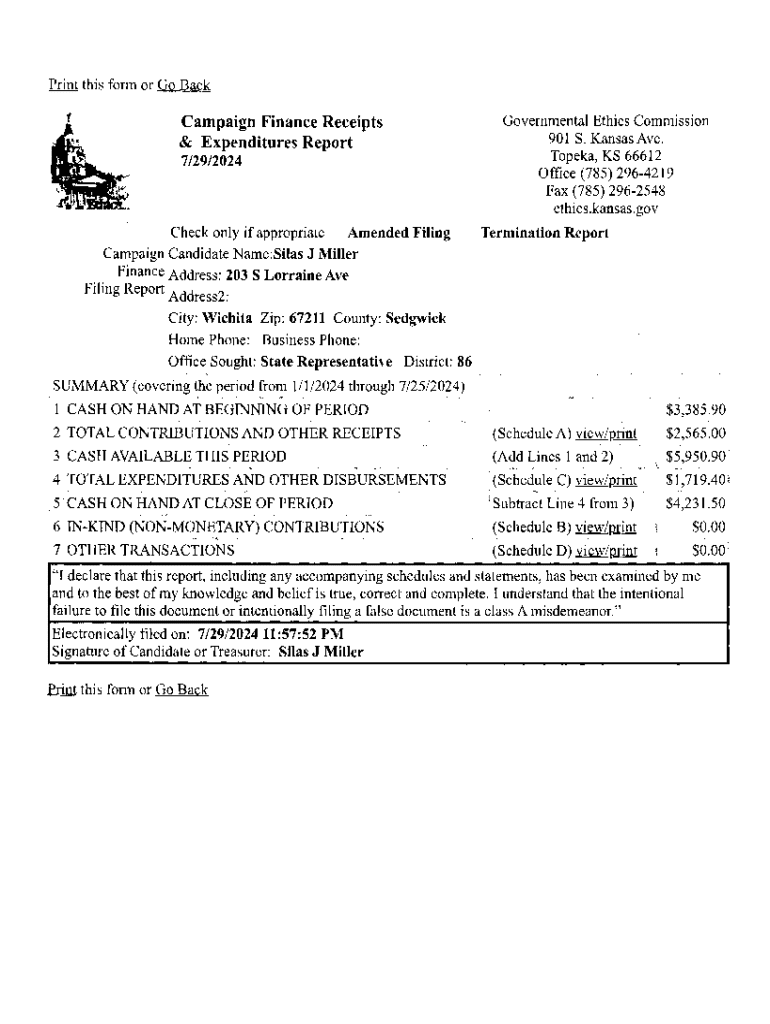

Get the free Finance Address: 203 S Lorraine Ave

Get, Create, Make and Sign finance address 203 s

How to edit finance address 203 s online

Uncompromising security for your PDF editing and eSignature needs

How to fill out finance address 203 s

How to fill out finance address 203 s

Who needs finance address 203 s?

A Comprehensive Guide to the Finance Address 203 S Form

Understanding the Finance Address 203 S Form

The Finance Address 203 S Form is a critical document used for financial reporting, particularly in New York State. This form facilitates the communication of important tax-related information to the New York State tax department, namely regarding shareholder returns. By filing the 203 S Form, individuals and entities ensure compliance with state tax regulations, thus avoiding potential penalties and optimizing their tax strategies.

The importance of the Finance Address 203 S Form cannot be overstated. It acts as a necessary conduit for reporting key financial details that can affect taxation and compliance status. In particular, its relevance highlights the obligations of shareholders in providing accurate and up-to-date address information, which is crucial for timely correspondence and tax assessment.

General information about the form

To be eligible for filing the Finance Address 203 S Form, individuals must be recognized as shareholders under New York State tax regulations. This includes both resident and nonresident shareholders who may hold shares in corporations or other taxing entities. It’s imperative that all involved parties ensure eligibility before proceeding with the form to avoid unnecessary complications or rejections.

Filing requirements for the 203 S Form are outlined by the New York State tax department, with specific deadlines stipulated for submission. Typically, shareholders should aim to file the form annually, aligning with their overall tax submissions. Missing deadlines may lead to penalties, which might escalate depending on the duration of the delay. It's prudent for shareholders to be proactive in good record-keeping and filing in a timely manner.

Specific instructions for completing the Finance Address 203 S Form

Completing the Finance Address 203 S Form requires attention to detail and understanding of what each section promises to convey. The cover page must collect essential information, including the taxpayer’s name and the corresponding tax identification number, ensuring accuracy to avoid processing delays. Furthermore, the financial details section demands thorough input reflecting revenues, deductions, and taxable properties.

Moving to address verification, this part is critical for maintaining the transparency and accuracy of the address information for shareholders. Any inconsistencies can lead to confusion and complications in communication with the tax authorities. Lastly, signatory information must be coherently documented, as this validates the submission of the form and demonstrates an acknowledgment of the information submitted.

Interactive tools for seamless document management

Using pdfFiller's interactive capabilities significantly eases the burdens associated with filling out the Finance Address 203 S Form. One such feature is the auto-fill capabilities that can pre-load data based on user input. This feature saves time and reduces the risk of human error in data entry — a common pitfall that can lead to complications with tax submissions.

Moreover, pdfFiller’s real-time tracking of changes allows users to monitor edits made by collaborators, ensuring everyone is on the same page. The electronic signature options further expedite the approval process, making document signing less of a hassle, especially for teams handling multiple forms throughout the filing season.

Submission process for the Finance Address 203 S Form

Submitting the Finance Address 203 S Form can be done electronically or via paper filing, with each method presenting its own set of advantages. Electronic submissions are generally recommended as they provide immediate confirmation of receipt along with tracking capabilities. On the other hand, paper filing necessitates diligent postal service tracking and may extend processing times significantly.

After submission, it's crucial for shareholders to anticipate follow-up actions based on the type of submission. Electronic filers will receive a confirmation email, while paper submitters should keep copies of their submissions and utilize certified mailing services to ensure delivery. Being vigilant in follow-up actions assists in maintaining proper records and facilitates any necessary inquiries relating to the submission.

Need help? Support options available

When encountering difficulties with the Finance Address 203 S Form, pdfFiller’s customer support offers a valuable resource. Users can access comprehensive assistance, ranging from guidance on form completion to specific inquiries about the filing process. This accessibility ensures that individuals and teams can navigate the complexity of tax documentation without feeling overwhelmed.

Common FAQs are also available for pre-emptive troubleshooting, addressing queries about eligibility, filing deadlines, and submission processes. For those seeking to deepen their understanding further, pdfFiller provides resources that extend beyond the immediate needs of filing the form, including insights into effective document management.

Approval to file a group return

Filing a group return related to the Finance Address 203 S Form involves specific criteria that must be met by all participating shareholders. Generally, a group return can be filed when all members are residents, and the group agent is designated to manage submission. Understanding these criteria is critical in ensuring collective compliance and avoiding complications arising from individual submissions.

Appointing a group agent involves a straightforward process in which one member assumes responsibilities for communication with the New York State tax department. Additionally, the group must document these appointments formally, often necessitating a signed powers of attorney. Having proper documentation ensures that obligations remain clear among the group members and with the tax authorities.

Qualified nonresident shareholder considerations

Qualified nonresident shareholders occupy a unique position regarding the Finance Address 203 S Form. These are typically individuals who earn income from shares in New York State yet do not reside in the state. Understanding their tax implications is crucial, as there are distinct benefits and responsibilities in comparison to resident shareholders. Filing the Finance Address 203 S Form correctly positions nonresident shareholders to benefit from various tax agreements and exemptions.

Additionally, special considerations for nonresident filers may include how withholding taxes impact overall tax liabilities. Nonresident shareholders should be acutely aware of their filing obligations to optimize their tax affairs. Utilizing tools available through pdfFiller can help these shareholders navigate the complexities involved in ensuring compliance with the New York State tax department.

Best practices for document management and organization

Implementing effective document management practices is vital for shareholders managing their Finance Address 203 S Form along with other financial documents. Keeping financial information organized is necessary not only for compliance with regulations but also for personal reference during filing seasons. Utilizing digital storage solutions, such as those offered by pdfFiller, can enhance efficiency and streamline access to documents anytime, anywhere.

Adopting cloud-based document management offers numerous benefits, including heightened security and collaboration capabilities. Shareholders can store their documentation safely and share them easily with any involved parties. Additionally, maintaining an organized digital filing system allows shareholders to access needed information rapidly, reducing the stress often associated with tax filing deadlines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send finance address 203 s to be eSigned by others?

How can I get finance address 203 s?

How can I fill out finance address 203 s on an iOS device?

What is finance address 203 s?

Who is required to file finance address 203 s?

How to fill out finance address 203 s?

What is the purpose of finance address 203 s?

What information must be reported on finance address 203 s?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.