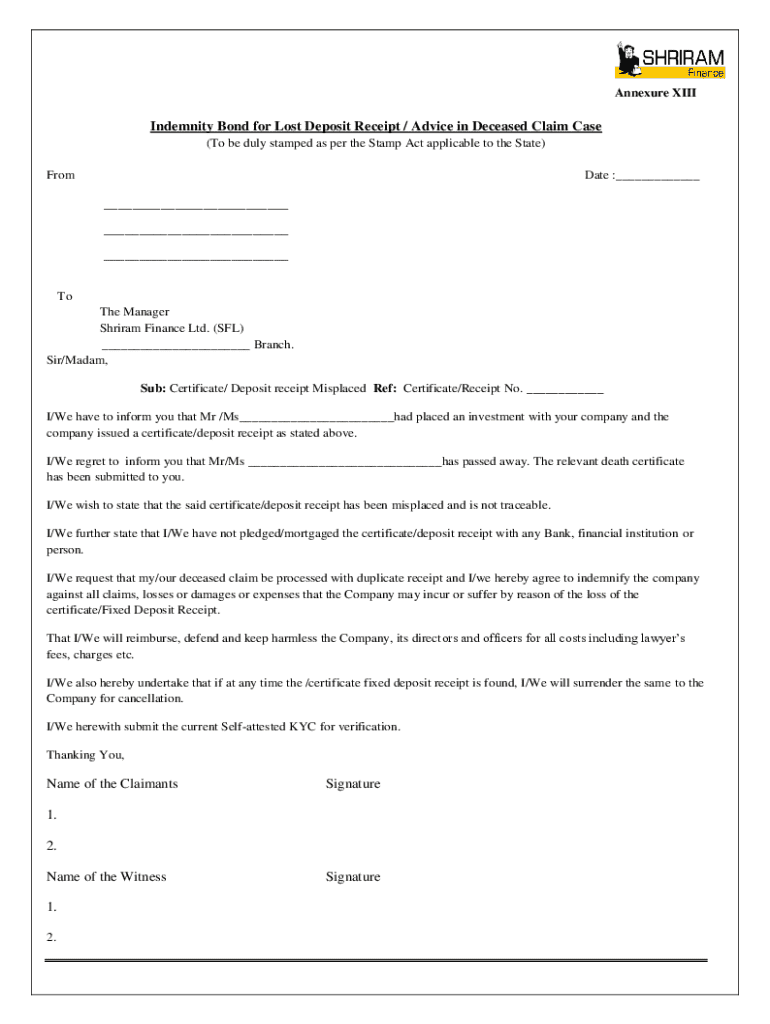

Get the free INDEMNITY BOND for Certificate misplaced - Annexure XIII ...

Get, Create, Make and Sign indemnity bond for certificate

Editing indemnity bond for certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indemnity bond for certificate

How to fill out indemnity bond for certificate

Who needs indemnity bond for certificate?

Indemnity Bond for Certificate Form: A Comprehensive Guide

Understanding indemnity bonds

An indemnity bond is a legally binding contract that involves two parties — the indemnitor (the one who provides the bond) and the indemnitee (the one who is protected by the bond). This bond serves as a financial guarantee that the indemnitor will cover any losses incurred by the indemnitee due to specified events or claims. The importance of indemnity bonds cannot be overstated; they provide peace of mind to individuals and businesses by ensuring that obligations will be met, especially in situations where the risk of loss exists.

The purpose of indemnity bonds stretches far beyond mere compliance with legal requirements. These bonds are critical in various sectors, including finance, construction, and education, where they act as a safety net for transactions, ensuring that parties fulfill their contractual obligations. Common scenarios requiring indemnity bonds include securing loans, obtaining business licenses, or protecting against claims arising from lost documents.

Overview of the indemnity bond for certificate

A certificate indemnity bond specifically safeguards against losses associated with lost or stolen certificates, such as stock certificates, bonds, or any other financial instruments. This specialized bond acts as a form of insurance that provides protection to the certificate issuer, ensuring that they are not held liable for any transactions involving the lost certificate.

Unlike standard indemnity bonds that may cover a broad range of liabilities, certificate indemnity bonds focus on a narrower scope, primarily dealing with the implications of certificates being misplaced or incorrect. These bonds are particularly important in financial sectors where ownership needs to be verified, as they provide a mechanism for replacing lost certificates without the issuer sustaining significant financial risk.

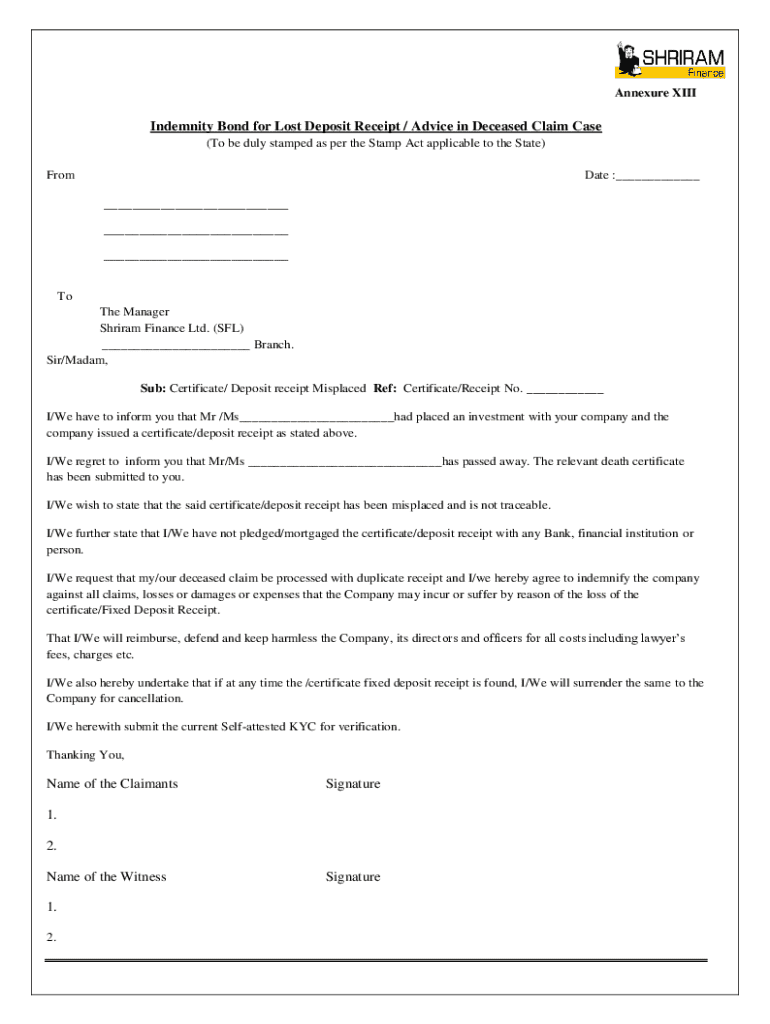

Key components of an indemnity bond for certificate form

Creating an indemnity bond for certificate requires careful attention to key components, ensuring clarity and legality. Essential information includes the personal details of the involved parties, such as the name, address, and identification credentials. Accurate details of the certificate itself, including its type, issuer, and a unique serial number, are vital to avoid confusion or disputes regarding the bond's scope.

Obligations of both parties involved in the bond must also be clearly outlined. The indemnitor agrees to cover any losses or claims related to the lost certificate, while the indemnitee is tasked with reporting the loss promptly and potentially taking steps to secure their interests. Additionally, the bond will encompass conditions under which it can be enforced, providing a structured approach to handle potential claims.

Steps to fill out the indemnity bond for certificate form

Filling out the indemnity bond for certificate form can be straightforward if the necessary steps are followed. Begin by gathering all essential information and documents. This will likely include your identification (ID), proof of ownership of the certificate, and any other relevant paperwork that proves ownership or authority to issue the bond.

Next, accessing the form is crucial. You can find and download the indemnity bond for certificate form directly from pdfFiller. Once you have the form, proceed to fill it out. Pay close attention to each section, ensuring that you input accurate information, especially regarding the certificate and parties involved.

After completing the form, take the time to review it thoroughly. Ensure that all information is correct and legible before submission. Finally, you can submit your completed form either electronically or by mailing it to the appropriate issuer or financial institution, depending on the exact requirements.

Editing and managing your indemnity bond form

With pdfFiller, editing and managing your indemnity bond form have never been easier. The platform offers comprehensive tools for customization, allowing users to add, remove, or alter information as needed. The cloud-based nature of pdfFiller contributes significantly to document management, promoting real-time collaboration and ensuring that your forms are easily accessible from any location.

Another notable feature of pdfFiller is its cloud-based document management system. This ensures that you can always access and update your documents anytime, anywhere. Whether you need to make minor adjustments to your bond or collaborate with team members, pdfFiller provides a seamless experience that optimizes efficiency.

Understanding signatures in indemnity bonds

Signatures play a critical role in the validity of indemnity bonds, ensuring that both parties agree to the terms laid out in the contract. An eSignature, which is becoming increasingly accepted, allows users to sign documents electronically, providing convenience and efficiency, especially in today's digital landscape.

To legally sign your indemnity bond using pdfFiller, simply use the platform's intuitive eSignature feature. This process not only ensures that your bond has a legally verified signature but also enhances the speed of execution, allowing transactions to be completed much faster than traditional methods. Subsequently, understanding how your signature is verified adds another layer of assurance for all parties involved.

Frequently asked questions (FAQs)

As many users are uncertain about indemnity bonds, common concerns revolve around their legal implications, the associated costs, and the time required to process them. Understanding these elements is essential when considering whether to pursue a certificate indemnity bond, especially in urgent situations where time is of the essence.

Here are some frequently asked questions: How much does an indemnity bond typically cost? What are the legal implications of committing to an indemnity bond? How long does it take to process the bond? Addressing these inquiries can provide valuable clarity to individuals and teams looking to navigate this process effectively.

Best practices for utilizing indemnity bonds

To optimize the use of indemnity bonds, it's crucial to implement best practices in documentation and record-keeping. Proper documentation enhances not just tracking but also efficiency in the event of any claims. Adopting a systematic approach to record management can significantly mitigate risks associated with product losses or claims.

Moreover, compliance with local regulations is critical when engaging with indemnity bonds. Familiarizing yourself with such regulations can safeguard you against potential legal pitfalls in the future. It is also essential to regularly review your records and maintain open lines of communication with all involved parties, ensuring everyone is informed and aligned with the bond's terms.

Troubleshooting common issues

In instances where your indemnity bond is denied or you experience complications, taking swift and informed action is essential. If your bond is rejected, begin by reviewing the reasons for denial—often attributed to incomplete information, discrepancies, or failure to meet specific criteria. Understanding these factors can guide you in resolving the issues and successfully reapplying.

Beyond denials, incorrect submissions can also create hurdles. If faced with this situation, ensure that you address the discrepancies immediately to prevent further complications. In extreme cases where disputes arise, legal avenues may be necessary to protect your interest in the indemnity bond.

Leveraging additional benefits of pdfFiller

As a comprehensive document management tool, pdfFiller offers additional features that can significantly enhance your experience with indemnity bonds and other documents. The platform’s collaborative features allow multiple users to work on forms simultaneously, promoting efficiency and effectiveness in document management, especially for teams.

Moreover, pdfFiller allows for the integration of various document types into your project. This means that whether you need to manage invoices, contracts, or indemnity bonds, you can do so seamlessly, ensuring that all needed documents are coherent and professionally managed under one roof. This integrated solution minimizes the hassle of juggling multiple platforms and contributes to more efficient workflows.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in indemnity bond for certificate?

How do I edit indemnity bond for certificate in Chrome?

Can I sign the indemnity bond for certificate electronically in Chrome?

What is indemnity bond for certificate?

Who is required to file indemnity bond for certificate?

How to fill out indemnity bond for certificate?

What is the purpose of indemnity bond for certificate?

What information must be reported on indemnity bond for certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.