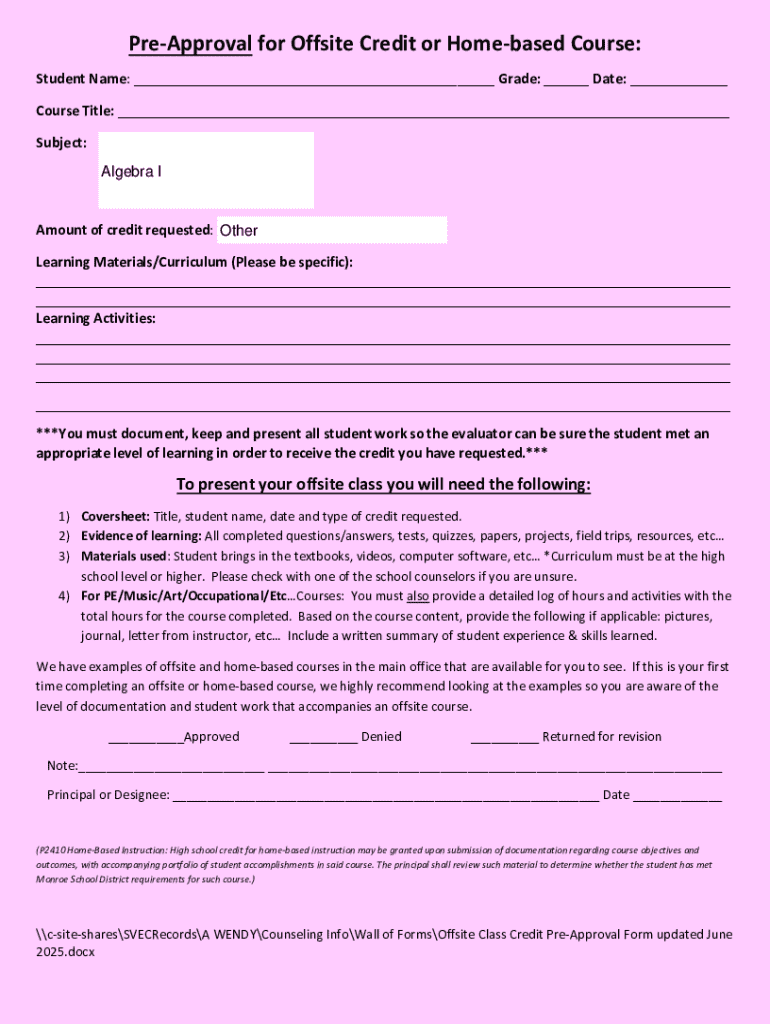

Get the free Pre-Approval for Offsite Credit or Home-based Course:

Get, Create, Make and Sign pre-approval for offsite credit

How to edit pre-approval for offsite credit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pre-approval for offsite credit

How to fill out pre-approval for offsite credit

Who needs pre-approval for offsite credit?

A comprehensive guide to pre-approval for offsite credit forms

Understanding the offsite credit form

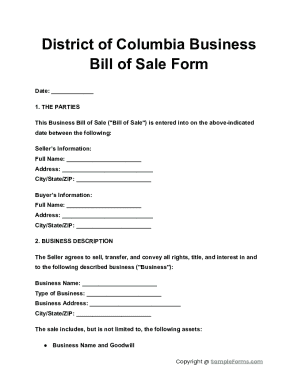

The offsite credit form is an essential document used by businesses and individuals to apply for credit outside of the traditional retail environment. It serves as a formal request to access credit, allowing users to manage finances more effectively. Pre-approval in offsite credit requests plays a critical role in determining eligibility and credit limits, giving applicants a clearer understanding of their financial standing before they make commitments.

Understanding how offsite credit forms work includes recognizing that they are typically provided by credit institutions or online platforms such as pdfFiller. These forms collect crucial information about the applicant’s financial condition, credit history, and the specific credit they are seeking. A well-prepared offsite credit form can significantly streamline the approval process, making it easier for credit providers to assess and respond to applications.

Preparing for your offsite credit request

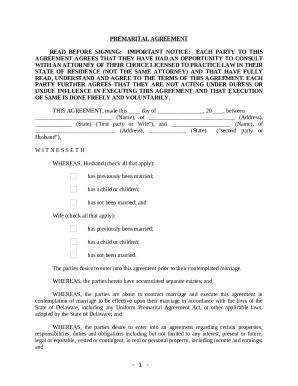

Preparation is vital when requesting pre-approval for offsite credit forms. To enhance your chances of approval, gather essential documents. These typically include identification documents, like a government-issued ID, proof of income, such as pay stubs or tax returns, and detailed financial statements that reflect your current financial status.

Evaluating your credit eligibility is another critical step. Regularly managing your credit and understanding your credit score can significantly influence your chances of approval. To streamline this process, access tools for checking your credit score. Many services provide complimentary credit reporting, allowing you to address any discrepancies and enhance your score prior to applying.

Accessing the offsite credit form

Accessing the offsite credit form is straightforward. Platforms like pdfFiller offer users seamless access to the form online. Navigating to the pdfFiller website allows you to search for the offsite credit form using their comprehensive document library. The interactive features provided by pdfFiller enhance user experience, ensuring accessibility from any location at any time.

One of the pivotal advantages of this platform is its compatibility across devices. Whether you are using a desktop, tablet, or smartphone, pdfFiller ensures that you can access and complete forms without hindrance. The user-friendly interface is designed to be intuitive, guiding users through the process, making it an excellent resource for both individuals and teams looking to manage documents efficiently.

Step-by-step guide to filling out the offsite credit form

Step 1: Gathering your information

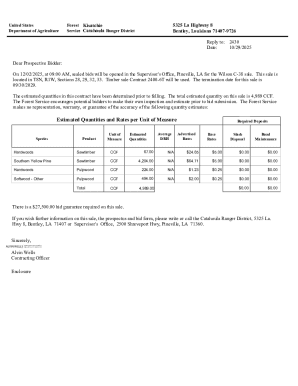

To ensure your application is thorough, gather all necessary information before starting. Required data often includes your full name, contact details, employment details, financial history, and the amount of credit you are requesting. Pay attention to formatting your data clearly and concisely for easy submission, which helps credit providers process applications faster.

Step 2: Using pdfFiller to edit the form

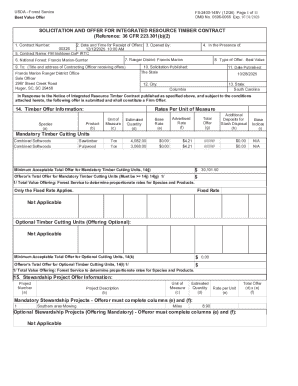

pdfFiller provides various editing tools to help fill out the offsite credit form efficiently. After accessing the form, familiarize yourself with the editing suite, including text insertion, checkbox selection, and dropdown menus. Efficiently adding your data ensures accuracy and enhances the legibility of your application.

Step 3: eSigning the offsite credit form

Using the eSignature feature on pdfFiller is simple and ensures legal compliance. This functionality allows you to affix your signature digitally, making it valid for submission without the need for printing. Ensure that you follow the prompts carefully to complete your eSignature process correctly, cementing your commitment to the application.

Submitting the offsite credit form

When it comes to submitting your offsite credit form, you have several options. Many users choose online submission for its convenience, allowing for immediate processing. Alternatively, you may prefer downloading and mailing the completed form, which might be suitable for those who require physical documentation for their records.

Before submission, double-check your information. Ensuring all data is accurate and all required fields are filled can help you avoid common mistakes that may delay the approval process. For example, confirming your contact details and ensuring your credit history information is up-to-date can eliminate potential issues later on.

Managing your pre-approval application

After submitting your offsite credit form, tracking your application status becomes crucial. With tools available on pdfFiller, you can easily monitor the progress of your pre-approval application, keeping you informed every step of the way. Communication with credit providers is also vital; contact them periodically to inquire about your application or clarify any uncertainties.

Understanding what to expect after submission will assist in managing your expectations. Typically, feedback from credit institutions takes a few days to weeks, depending on their processing protocols. Being prepared for potential issues, such as requests for additional documentation, can streamline the follow-up and enhance communication between you and the provider.

Troubleshooting common issues

During the completion of your offsite credit form, you may encounter common errors. These can range from misspellings and incorrect financial data to omitted sections. Recognizing and correcting these issues promptly can be the difference between approval and denial.

For technical difficulties on pdfFiller, the support team is readily available to assist with any concerns. If you experience issues navigating the platform, contacting support will facilitate resolution and enhance your user experience. Emphasizing responsiveness in these interactions can ensure that your document management is smooth and efficient.

Enhancing your document management skills

To maximize your usage of pdfFiller, develop effective document management skills. Organizing your documents systematically will allow for quick retrieval when needed. Utilizing folders and tags within the platform facilitates teamwork by allowing team members to collaborate on the pre-approval process efficiently.

Additionally, it is essential to implement best practices for document security. Securing sensitive information through password protection and encrypted access can protect you against unauthorized access. Focused efforts in these areas will not only foster efficiency but also enhance your integrity as a user in the digital world.

Frequently asked questions (FAQ)

How long does pre-approval take? The timeline for pre-approval varies among providers, but many aim to respond within one to three business days. What happens if I'm denied pre-approval? If denied, it’s essential to ask for feedback from the credit provider to understand the reasons and take corrective steps. Can I edit my application after submission? Typically, modifications can be made but inquire with the provider on their specific policies to avoid complications.

Conclusion

The pre-approval process for offsite credit forms is fundamental for anyone looking to manage their finances efficiently. Engaging with platforms like pdfFiller not only streamlines the process but also brings security and collaboration to your document management needs. By preparing thoroughly, utilizing available tools, and following up appropriately, you can enhance your chances of a successful pre-approval. Make the most of what technology has to offer as you navigate your credit needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send pre-approval for offsite credit for eSignature?

How do I edit pre-approval for offsite credit in Chrome?

Can I edit pre-approval for offsite credit on an iOS device?

What is pre-approval for offsite credit?

Who is required to file pre-approval for offsite credit?

How to fill out pre-approval for offsite credit?

What is the purpose of pre-approval for offsite credit?

What information must be reported on pre-approval for offsite credit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.