Get the free REVENUE AND FINANCE DEPARTMENT

Get, Create, Make and Sign revenue and finance department

How to edit revenue and finance department online

Uncompromising security for your PDF editing and eSignature needs

How to fill out revenue and finance department

How to fill out revenue and finance department

Who needs revenue and finance department?

A comprehensive guide to the revenue and finance department form

Understanding the revenue and finance department form

The revenue and finance department form serves a crucial role in modern financial management, providing a structured approach to tracking an organization's income, expenses, and overall financial health. Its primary purpose is to ensure that financial transactions are accurately reported and documented. The accuracy in these reports holds significant weight in decision-making processes, regulatory compliance, and strategic financial planning.

Accurate financial reporting underscores the vitality of any organization's operations. As stakeholders, including management, auditors, and regulatory bodies, increasingly rely on precise financial data, maintaining the integrity of this form becomes essential. Everyone involved in financial dealings within an organization, from accountants to department heads, is required to utilize this form. Proper training in the form's use ensures compliance with relevant state laws and enhances the financial literacy of all team members.

Key features of the revenue and finance department form

The revenue and finance department form includes several essential sections that cater to the various facets of financial management. It encompasses revenue information, expenditure tracking, and budget forecasting, enabling organizations to effectively manage their finances. Each section serves a unique purpose, allowing users to organize and interpret financial data with ease.

Integrating with tools like pdfFiller, users can enhance their efficiency by utilizing interactive features that streamline the form-filling process. Features such as auto-fill and easy document sharing make the task significantly less cumbersome. Moreover, compatibility with various document types ensures that users can adapt this form to their specific needs, whether they’re dealing with applications, invoices, or other financial documents.

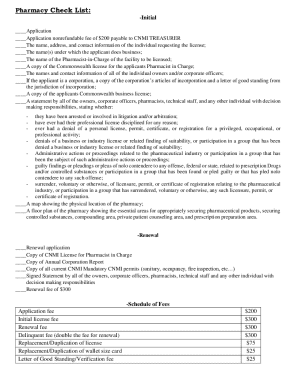

Step-by-step instructions for filling out the form

Before embarking on filling the revenue and finance department form, it’s essential to gather all necessary information and documents. This includes financial statements, transaction records, and previous budget forecasts. Preparation ensures that individuals or teams are not scrambling for details while filling out the form, which can lead to inaccuracies.

Filling out the form should be approached systematically, starting with revenue data. It’s important to ensure that all income sources are accurately represented, without omissions. Next, accurately inputting expenses is crucial; categorize them as operational, administrative, or extraordinary costs to keep clarity. Special cases, like loans and grants, involve unique considerations — such as repayment schedules or conditions attached to funds — and should be noted in dedicated fields.

Common mistakes to avoid include misclassifying revenue or expenses, failing to double-check figures, and neglecting requirement checks based on state law. Make it a point to review before finalizing the submission.

Editing and modifying your completed form

Once the form is completed, utilizing pdfFiller’s editing tools is essential to ensure that all data is accurate and professionally presented. These tools allow for text edits, which can be crucial if any changes are required after the initial submission. Moreover, adding annotations and comments can help clarify information or contribute additional context where necessary.

Formatting options are essential to enhance clarity and professionalism. Ensuring that the document adheres to best practices in layout and structure helps present the information effectively. Users should always strive to maintain a clean, readable format that is uniformly organized, as it reflects positively on the organization.

Signing and securing your form

With the eSigning feature in pdfFiller, signing the revenue and finance department form has never been more straightforward. This tool ensures that all necessary approvals are obtained quickly and securely, facilitating a smoother workflow with fewer delays. Document security is paramount; therefore, utilizing pdfFiller’s features helps maintain compliance with important regulations and protects sensitive financial data from unauthorized access.

When collaborating on forms with team members, utilizing shared access allows for real-time updates and discussions, which enhances teamwork. It’s advisable to monitor sharing permissions closely to ensure that only authorized personnel can view or edit sensitive sections of the document.

Managing and storing your documents

Organizing forms within the pdfFiller dashboard simplifies document management immensely. By categorizing forms logically and utilizing tags, users can enhance their ability to find and retrieve documents when needed. Document retention best practices should also be adhered to, ensuring that completed forms are stored securely and are easily accessible for audits or future reference.

The cloud storage capability of pdfFiller allows users to access their forms from anywhere, anytime, which is exceptionally advantageous for remote teams or individuals frequently on the go. This flexibility contributes to improved productivity and provides peace of mind knowing that important documents are safe and always at hand.

Troubleshooting common issues

Despite best efforts, users might encounter various issues with the revenue and finance department form. Common errors include incorrect entries due to misunderstanding of fields or overlooking specific requirements. Understanding the troubleshooting guide provided by pdfFiller can alleviate many submission woes, as it addresses frequent submission problems and how to resolve them efficiently.

To assist users further, a dedicated FAQ section can clarify misconceptions and provide quick answers to pressing concerns. Being aware of these resources can save time and avoid frustration during the document submission process.

Additional support and resources

When facing any difficulties, reaching out for support is essential. Direct links to customer support provided by pdfFiller can connect users with trained professionals who can offer guidance tailored to their specific issues. Additionally, community forums and user guides provide valuable insights from experienced users and can help clarify many uncertainties related to form usage.

For multilingual users, language assistance is readily available to ensure that everyone can benefit from the features offered by pdfFiller. Ensuring that all users can understand and use the tools effectively maximizes the platform's utility for diverse teams.

Why choose pdfFiller for your document needs?

Choosing pdfFiller for document management offers significant advantages over traditional methods. The ability to edit PDFs, eSign, and collaborate on forms from a centralized, cloud-based platform streamlines processes that would otherwise be cumbersome. Users appreciate the efficiency gains that modern, tech-driven approaches provide.

Real user testimonials highlight how pdfFiller has transformed their document management experience, aiding them in simplifying finances and enhancing reliability. As organizations move towards embracing cloud-based solutions, pdfFiller stands out as a visionary leader in this realm, combining convenience with powerful functionalities.

Connecting with pdfFiller

Understanding pdfFiller's mission to empower users with robust document management solutions enhances the product's appeal. The company is committed to delivering user-friendly experiences for all, fostering innovation within the finance and documentation sectors. Engaging with pdfFiller through their social media channels, email, and live chat support allows users to stay up-to-date with the latest developments and features.

Moreover, scheduling for upcoming webinars and training sessions assists users in maximizing their understanding and skills, ensuring all members are equipped to utilize the platform to its fullest potential. A proactive engagement with pdfFiller leads to enhanced productivity and a more streamlined operation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my revenue and finance department in Gmail?

How can I edit revenue and finance department from Google Drive?

How can I fill out revenue and finance department on an iOS device?

What is revenue and finance department?

Who is required to file revenue and finance department?

How to fill out revenue and finance department?

What is the purpose of revenue and finance department?

What information must be reported on revenue and finance department?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.