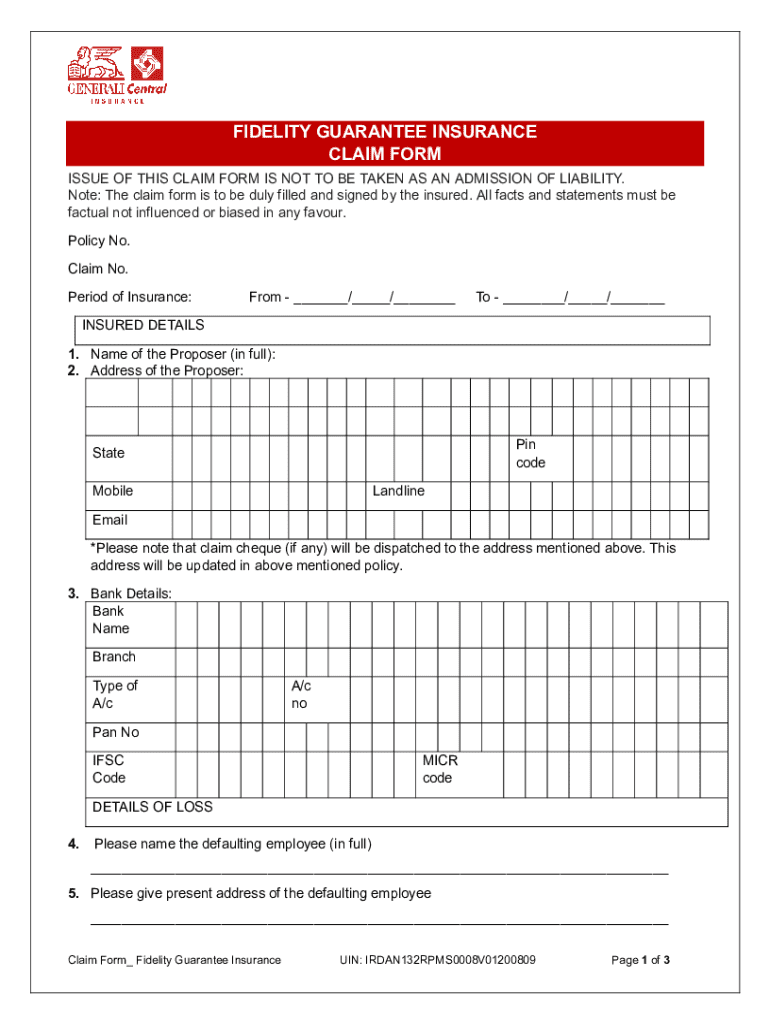

Get the free FIDELITY GUARANTEE INSURANCE POLICY - Claim Form

Get, Create, Make and Sign fidelity guarantee insurance policy

How to edit fidelity guarantee insurance policy online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fidelity guarantee insurance policy

How to fill out fidelity guarantee insurance policy

Who needs fidelity guarantee insurance policy?

Fidelity Guarantee Insurance Policy Form - How-to Guide Long-read

Understanding fidelity guarantee insurance

Fidelity guarantee insurance serves as a crucial safeguard for businesses and individuals against employee dishonesty, fraud, or theft. This type of insurance is designed to reimburse the insured for financial losses arising from such wrongful acts committed by employees. The need for this insurance has become increasingly recognized as organizations strive to protect their assets and maintain their reputation in an unpredictable economic climate.

Businesses, whether small or large, must understand this insurance product's importance, as it not only covers financial losses but also fosters trust and credibility amongst clients and stakeholders. Without this protection, businesses can expose themselves to significant risks that may jeopardize their ongoing operations and stability.

Common scenarios for use

Fidelity guarantee insurance is applicable in a variety of situations. Common scenarios include potential embezzlement by an employee responsible for handling finances, financial advisers misappropriating client funds, or employees committing fraud by falsifying company records. Each of these situations highlights the potential financial damages that can occur from employee misconduct.

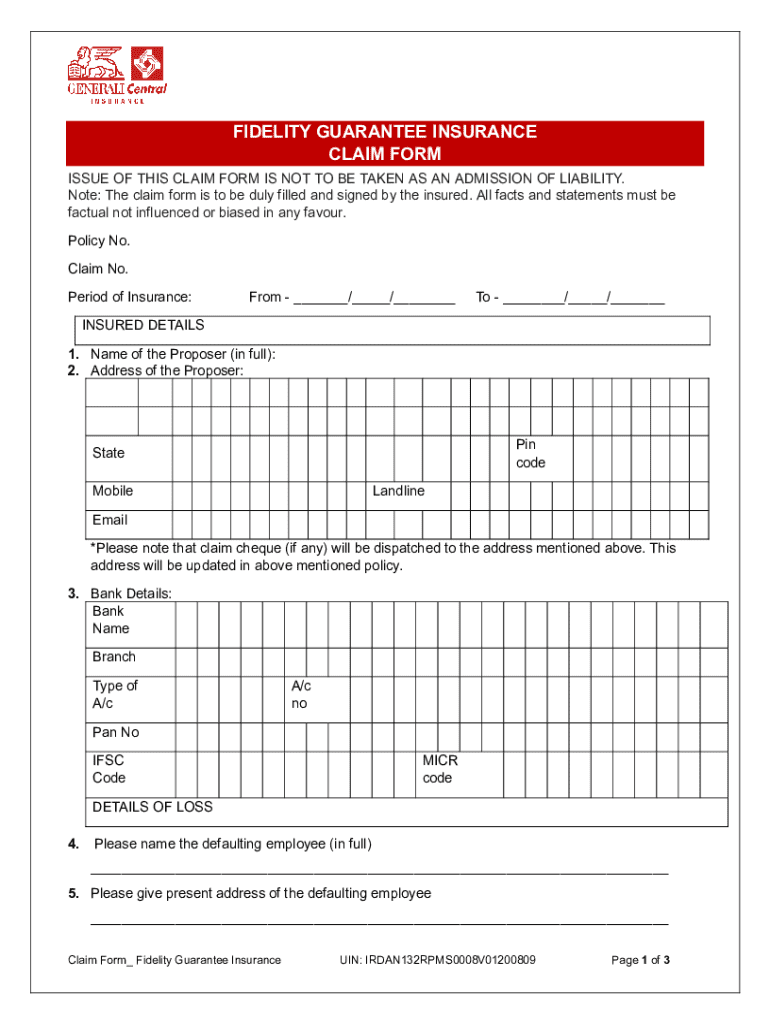

The importance of the fidelity guarantee insurance policy form

The fidelity guarantee insurance policy form plays a pivotal role in formalizing the agreement between the insurer and the insured. It serves as a legally binding document that outlines the specific details of the coverage provided, ensuring that both parties are aware of their rights and obligations. Using the correct policy form is essential as it protects the interests of the insured parties and helps prevent disputes in the event of a claim.

An accurate fidelity guarantee insurance policy form clearly states coverage details, exclusions, and the specific terms and conditions applicable to the insurance. This clarity is essential in understanding what is insured and what is not, thereby reducing potential surprises and disagreements over claims.

Key components of the policy form

Step-by-step guide to filling out the fidelity guarantee insurance policy form

Filling out the fidelity guarantee insurance policy form requires careful attention to detail. It’s vital to gather all necessary information before beginning the process, ensuring that everything is accurate to facilitate smooth processing of your application.

Gather required information

Section-by-section instructions

Editing and customizing your fidelity guarantee insurance policy form

Once you have filled out the fidelity guarantee insurance policy form, you may want to make edits or customize specific sections. Using tools like pdfFiller can streamline this process. The platform offers a user-friendly interface that allows you to make modifications to your document seamlessly.

With pdfFiller, users can easily upload their policy forms and utilize various editing features such as text editing, image insertion, and annotation tools. This flexibility is essential, ensuring that the document reflects any changes in circumstances or information regarding your business.

Collaboration features

pdfFiller also offers collaboration features, allowing you to share the form with relevant stakeholders and gather feedback. This capability is crucial for teams when reviewing a fidelity guarantee insurance policy form, as it enables multiple perspectives and insights to enhance the document’s accuracy and completeness.

eSigning your fidelity guarantee insurance policy form

The process of finalizing your fidelity guarantee insurance policy form can be expedited with electronic signatures (eSigning). This method enhances speed and efficiency and reduces the need for physical paperwork. With pdfFiller, you can apply eSignatures to your forms easily, ensuring a secure and quick endorsement process.

eSigning not only facilitates a fast-paced workflow but also enhances security. With encryption and compliance with relevant legal regulations, your digital signature maintains its validity and integrity.

How to implement eSigning using pdfFiller

Managing your fidelity guarantee insurance policy post-submission

After submitting your fidelity guarantee insurance policy form, it’s essential to keep track of your policy status. Monitoring ensures you are aware of any updates, approvals, or required actions. Regular follow-ups with your insurer can aid in understanding the timeline and any pending requirements.

Keeping track of your policy

Establishing a systematic approach to record-keeping post-submission is vital. This includes saving copies of your forms, acknowledgment receipts, and previous communications with the insurer. Such diligence will support any future claims or inquiries about your policy.

Making changes or renewals

Throughout the policy period, you may need to update policy details or prepare for renewals. Staying informed of renewal timelines is essential, as ensuring continuous coverage protects your business from unforeseen losses. Contact your insurance provider to discuss any changes in coverage needs or adjustments based on shifting business circumstances.

Frequently asked questions (FAQs)

Common queries about fidelity guarantee insurance

Many people have questions regarding fidelity guarantee insurance, especially when first considering this type of coverage. Here are some typical inquiries:

Troubleshooting common issues

When filling out or managing the fidelity guarantee insurance policy form, you might encounter common challenges. Here are some solutions to frequently faced issues:

Contact us for custom support

For anyone requiring assistance with the fidelity guarantee insurance policy form, pdfFiller offers dedicated support to address your queries. Whether you have questions about filling out the form, accessing features, or understanding your policy, our team is here to help.

Live chat and online resources

pdfFiller provides various means for you to access support. You can utilize our live chat feature for immediate assistance or explore additional resources available on our website to help you navigate the fidelity guarantee insurance policy form. Our comprehensive support ensures that you are well-equipped to manage your document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fidelity guarantee insurance policy straight from my smartphone?

How do I fill out the fidelity guarantee insurance policy form on my smartphone?

How do I complete fidelity guarantee insurance policy on an Android device?

What is fidelity guarantee insurance policy?

Who is required to file fidelity guarantee insurance policy?

How to fill out fidelity guarantee insurance policy?

What is the purpose of fidelity guarantee insurance policy?

What information must be reported on fidelity guarantee insurance policy?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.