Get the free Execution-Garnishment Application And Order :: Missouri :: Civil ...

Get, Create, Make and Sign execution-garnishment application and order

Editing execution-garnishment application and order online

Uncompromising security for your PDF editing and eSignature needs

How to fill out execution-garnishment application and order

How to fill out execution-garnishment application and order

Who needs execution-garnishment application and order?

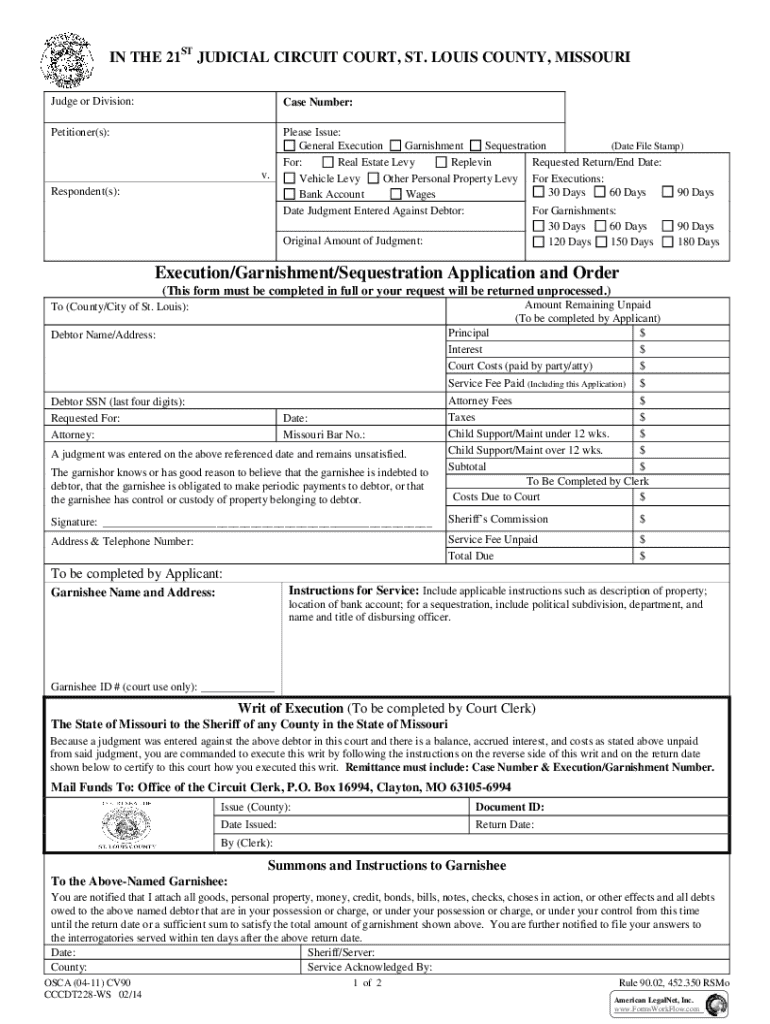

Comprehensive Guide to Execution Garnishment Application and Order Form

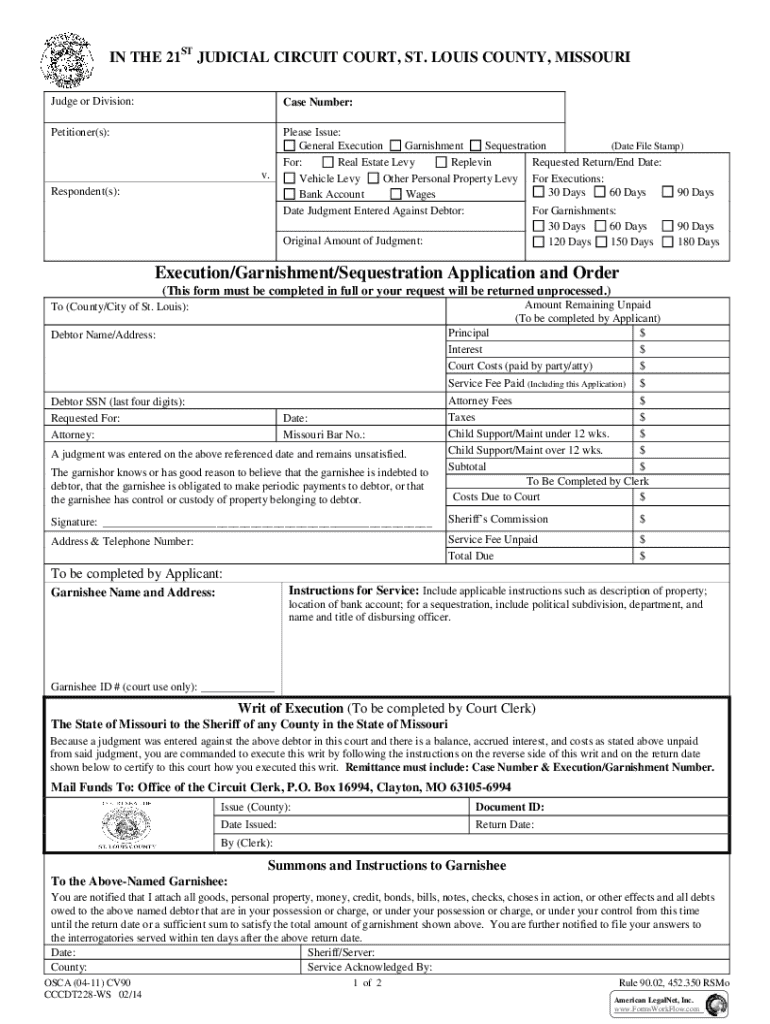

Understanding execution garnishment

Execution garnishment is a legal process that enables creditors to collect debts by seizing a portion of a debtor's earnings or bank accounts. This mechanism is crucial in debt collection, allowing creditors to enforce a judgment awarded by the court. Understanding its significance is essential, as it provides creditors with a means to recover amounts owed, ensuring financial accountability.

Key terms associated with execution garnishment include 'debtor,' referring to the individual or entity that owes money; 'creditor,' the party to whom the debt is owed; and 'garnishee,' the third party, such as an employer or bank, responsible for holding the debtor's assets. Each term plays a pivotal role in the garnishment process.

Types of garnishments

Garnishments can take various forms, primarily focusing on wages or bank accounts. Wage garnishment involves deducting a portion of a debtor’s paycheck until the debt is repaid.

It generally begins with a court order requiring the employer to withhold a set amount from the debtor's wages. This process can take several weeks to initiate after the court's approval, and the garnishment usually lasts until the debt is fully satisfied or an appeal is filed.

Bank account garnishment, on the other hand, allows creditors to freeze the debtor's bank funds directly. This garnishment requires a legal process to ensure compliance with banking regulations, alongside notification to the debtor.

Legal grounds for execution garnishment

The legal foundation for execution garnishment is primarily governed by state laws, which outline the circumstances under which garnishments can be filed. For instance, creditors must hold a valid judgment against the debtor to proceed with garnishment applications. These laws vary greatly by state, with some jurisdictions imposing restrictions on the amounts that can be garnished or specific requirements for notifying debtors.

Furthermore, it’s important to understand the conditions under which garnishments can be enacted, typically requiring that all other collection methods have been exhausted. Each state may also have exemptions that protect certain income levels, allowing debtors to retain sufficient funds to cover essential living expenses.

The execution garnishment application process

The process of applying for an execution garnishment involves several critical steps that must be carefully followed to ensure compliance with legal requirements.

Step 1 involves preparing the application, which requires basic information about the creditor and debtor, as well as detailed financial disclosures. Essential documents include the judgment statement and calculations related to the amount owed. Collecting accurate information is fundamental to a successful application.

Step 2 focuses on formatting the application correctly. Applications typically need to follow state-specific templates, and it's crucial to avoid common mistakes such as incomplete sections or inaccurate data. Each part of the application should express clear, factual information.

After submission: What to expect

Once you submit the execution garnishment application, the court will review your request. The timeline can vary, but generally, you can expect a response within a few weeks. During this review period, the court assesses the validity of the application based on the provided documents and evidence. If approved, the garnishment order will be issued, detailing how the garnishee should proceed with withholding the debtor's assets.

Should the court deny the application, you'll receive an explanation, allowing you to address any deficiencies or reconsider your approach. Understanding the potential outcomes ensures creditors are well-prepared for implementation following approval, including engaging with the garnishee to manage the process effectively.

Modifying or challenging a garnishment order

There are instances when a garnishment order may need modification or could be challenged. Conditions for modifying an existing order often arise from changes in the debtor’s financial circumstances, requiring creditors to reassess the amount being garnished to reflect the new situation.

Challenges to a garnishment can occur if the debtor believes the garnishment violates legal regulations or fair practices. Grounds for such challenges vary and may include incorrect details in the original application or the debtor’s claim for exemptions. Filing a motion to modify or contest the order requires specific procedures, often involving presenting additional evidence in court.

Tools for managing garnishment documents

Managing garnishment-related documents can be streamlined using tools like pdfFiller. This platform offers users an efficient way to create, edit, eSign, and collaborate on garnishment forms. Key features include customizable templates for execution garnishment applications, making it easy to ensure that all relevant information is accurately captured.

Moreover, pdfFiller supports real-time collaboration, allowing multiple stakeholders to review applications and provide input simultaneously. Users can also track document changes and updates, ensuring everyone stays informed throughout the execution process. The ability to eSign documents securely enhances the credibility of submissions while maintaining a straightforward process.

Common FAQs about execution garnishments

Execution garnishments often raise numerous questions among creditors and debtors alike. For instance, if a garnishee ignores a court order, the creditor can file a motion to compel compliance, holding the garnishee accountable for non-compliance with the garnishment order.

Debtors may wonder if they can contest a garnishment, and the answer is yes; they have rights to challenge it under various grounds. Additionally, there are limits on how much can be garnished, often dictated by state regulations, ensuring that debtors retain a reasonable standard of living during the repayment period.

Navigating the aftermath of garnishment

After a garnishment has been executed, debtors should understand their rights and options. They may need to communicate with creditors regarding the remaining balance owed and reorganize their finances accordingly. Creditors must also consider how this process will affect future dealings and maintain appropriate records of all transactions.

Rebuilding credit after a garnishment can be challenging but is crucial for both debtors and creditors moving forward. Resources for financial counseling and support can aid individuals in mastering their financial situation post-garnishment. Establishing a solid financial footing helps prevent future reliance on garnishments.

Interactive tools for users

pdfFiller offers various interactive tools to enhance the user experience when managing garnishment documents. Accessing a garnishment calculator can help users quickly determine potential withholding amounts based on the debtor's wages or bank account balances.

Step-by-step video tutorials guide users in navigating the process of creating and managing garnishment forms effectively. Additionally, a user community is available where individuals can share experiences and tips, fostering a supportive environment for anyone dealing with the intricacies of execution garnishment application and order forms.

Legal assistance and considerations

Navigating the complexities of execution garnishment can be daunting, and knowing when to seek legal counsel is vital. If there are uncertainties in the application process or if disputes arise, consulting legal professionals can provide clarity and guidance. They can help ensure that all legal processes are followed correctly, protecting both creditor and debtor rights.

Resources for finding legal help often include local bar associations or legal aid organizations, which provide support to those unable to afford traditional legal services. Addressing disputes properly is essential for the successful resolution of garnishment-related issues.

Additional information on related forms

In addition to the execution garnishment application and order form, various related forms exist that may assist in the garnishment process. These include applications for modification of garnishment orders, claims for exemptions, and documents needed for appeals or challenges.

It is beneficial to familiarize oneself with these forms, as they can provide essential information related to the garnishment process. A comparison table could help in identifying the specific requirements of each document, making the whole process more manageable. Collecting the necessary additional documents ensures full compliance with legal standards and strengthens your case.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in execution-garnishment application and order?

How do I make edits in execution-garnishment application and order without leaving Chrome?

How can I edit execution-garnishment application and order on a smartphone?

What is execution-garnishment application and order?

Who is required to file execution-garnishment application and order?

How to fill out execution-garnishment application and order?

What is the purpose of execution-garnishment application and order?

What information must be reported on execution-garnishment application and order?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.