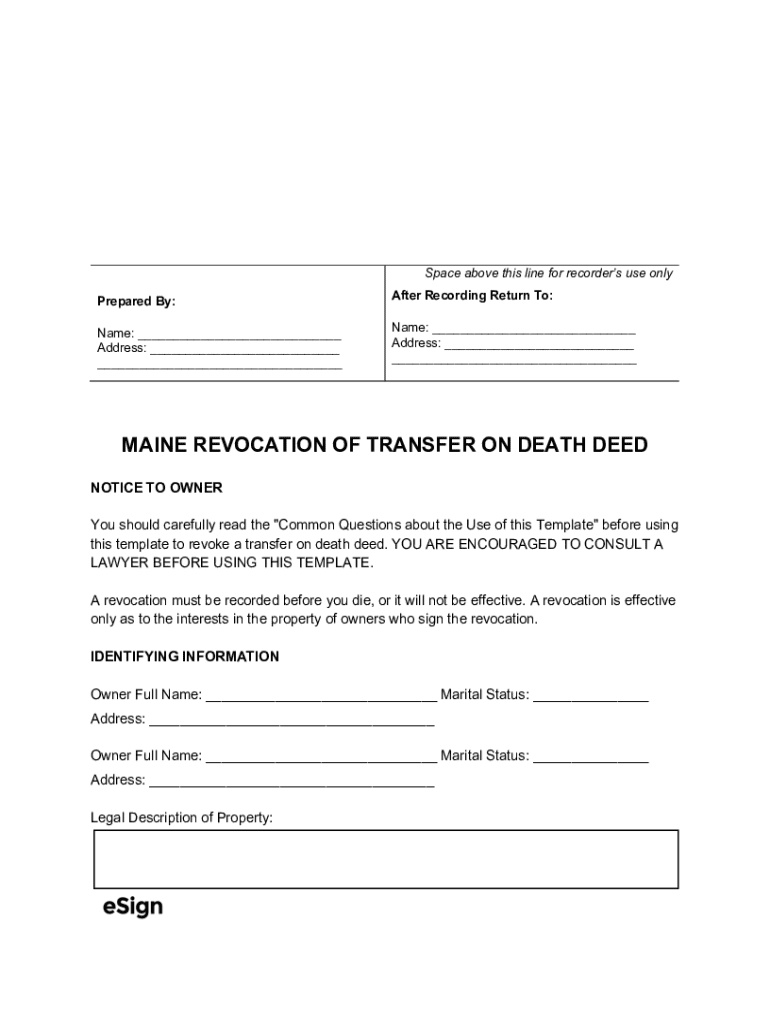

Get the free Maine Revocation of Transfer on Death Deed Form

Get, Create, Make and Sign maine revocation of transfer

Editing maine revocation of transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maine revocation of transfer

How to fill out maine revocation of transfer

Who needs maine revocation of transfer?

Understanding the Maine Revocation of Transfer Form

Understanding the Maine revocation of transfer form

The Maine Revocation of Transfer Form is a vital legal document used to annul previous asset transfers. This form allows individuals to regain control over their property or assets that may have been transferred to another party through a previous transaction. Its legal implications are significant, as it serves to clearly communicate the grantor's intent to revoke any prior agreements. Whether due to changing personal circumstances or strategic estate planning, utilizing this form is an essential step in managing one's assets effectively.

Revocation in estate planning plays a crucial role in ensuring that individuals retain control over their assets. Such control becomes necessary when one wishes to alter existing estate plans, reflect life changes such as divorce, or manage emerging financial realities. The process of revocation thus guarantees that an individual's wishes are respected and upheld, fostering a sense of security concerning their estate.

Legal context and requirements

Maine's legal framework outlines specific statutes governing the revocation of transfers, integrating these into the broader context of estate law. According to Maine law, all revocations must be clearly documented and communicated to relevant parties to be recognized legally. Understanding these regulations is vital for ensuring the validity and enforceability of the revocation.

Eligibility to utilize the Maine Revocation of Transfer Form primarily encompasses individuals who originally executed the transfer. This includes those who may have transferred property through a will, trust, or another legal arrangement but now wish to rescind that decision. Failing to utilize the form appropriately could lead to unintended legal or financial repercussions, including disputes among beneficiaries or stakeholders. Thus, the importance of adhering to the legal requirements cannot be overstated.

When to use the Maine revocation of transfer form

There are several common scenarios that may necessitate the use of the Maine Revocation of Transfer Form. Life events such as marriage, divorce, relocation, or the acquisition of new assets can all trigger the need to revoke prior asset transfers. Additionally, a desire to change beneficiaries, modify estate plans, or rectify mistakes in previous transfers underscores the form's relevance.

Moreover, certain indicators may suggest that it's time to act. These may include drastic changes in personal circumstances—such as the passing of a family member, a deteriorating financial situation, or new relationships forming—that warrant reevaluating how assets are distributed. Recognizing these signs early can safeguard against complications in the future.

Step-by-step instructions to complete the form

Prior to filling out the Maine Revocation of Transfer Form, it's essential to gather necessary documents and information. This includes the original transfer documentation, personal identification, and any related legal documents that would support the revocation process. Having all pertinent information on hand enhances the efficiency of completing the form.

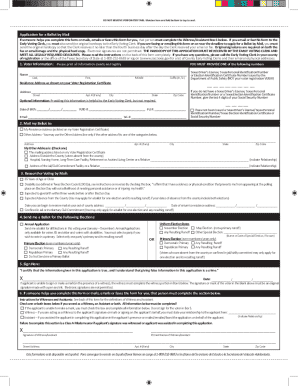

To ensure accuracy while completing the form, follow these detailed instructions for each section: 1. **Personal Information**: Clearly state your full name, current address, and any other necessary identification details that affirm your identity. 2. **Details of the Transfer Being Revoked**: Provide a clear and comprehensive description of the assets or property that you wish to revoke. Include the date of transfer and names of involved parties to eliminate any potential ambiguity. 3. **Signatures and Dates**: Ensure that your signature appears alongside the date of completion, confirming your intent to revoke the transfer formally.

While filling out the form, it's crucial to avoid common missteps. Mistakes such as incorrect names, unclear descriptions, or failure to include signatures can invalidate the form. Double-check your work for any errors before submission to ensure that your revocation is effective and legally binding.

Editing and customizing the form

Utilizing tools like pdfFiller can significantly streamline the editing process for the Maine Revocation of Transfer Form. This platform offers user-friendly interfaces where individuals can easily make changes to the form without compromising its integrity. Modifying text, adjusting layouts, or correcting errors can be accomplished seamlessly, making pdfFiller an invaluable resource.

Additionally, adding digital signatures through pdfFiller enhances the form's professional appeal. Users can follow straightforward steps to eSign, ensuring a legally recognized validation of their intentions while expediting the submission process. This feature addresses the inconvenience of delays in traditional signing methods, making document management more efficient.

Filing the revocation of transfer form

Once the Maine Revocation of Transfer Form is completed, you need to submit it to the appropriate state office. Depending on the nature of the asset being revoked, this could include the Maine Secretary of State or local registry offices. Knowing where to file your form correctly is essential; any misdirection can lead to unnecessary delays.

Timing is another critical consideration. Submitting the form promptly after completion minimizes the risk of complications. Best practices suggest submitting the revocation form as soon as possible to legally ensure all parties are informed and to reset your estate planning effectively. Keeping a record of your submission can also help track the progress of your revocation.

Tracking the revocation's progress

Confirming the receipt and processing of your Maine Revocation of Transfer Form involves contacting the relevant offices. Most state offices provide online portals or phone services that allow individuals to check the status of their submitted documents. Understanding typical timelines for document processing is essential, as this varies by office and can influence your planning accordingly.

Maintaining documentation of the revocation is equally important. Keep copies of the form, submission receipts, and any correspondence with state offices in your personal files. This documentation serves as proof of your intent and can alleviate potential disputes in the future, further solidifying your claims regarding the revocation.

Frequently asked questions

One common query relates to situations where the original transfer was made to multiple parties. Revoking such joint transfers can introduce complexity; typically, all parties involved must be notified. Clear communication is necessary to ensure that all parties recognize and accept the revocation.

Another frequently asked question is whether a revocation can be reversed. If circumstances change later, re-establishing a revoked transfer is indeed possible but requires careful legal navigation. Engaging an attorney specialized in estate law during this process can provide clarity and direction as you consider restoring a former arrangement.

Using pdfFiller for document management

The benefits of cloud-based document solutions like pdfFiller extend far beyond simple editing tasks. Its capabilities include storing all your important documents in a secure online space that is easily accessible from anywhere, promoting efficiency in document management. Users can maintain control over their document workflows, ensuring they can handle various forms, including the Maine Revocation of Transfer Form, from any device.

Collaboration features also enhance the user experience within pdfFiller. Team members can work together on the form, sharing insights and ensuring that all necessary details are accurately captured. This collaborative environment is especially beneficial when multiple parties must contribute to or verify a revocation, reducing the likelihood of refined errors and fostering teamwork.

Additional considerations

Keeping your estate plan updated is paramount, especially as personal circumstances evolve. Regularly reviewing your plans in light of changing relationships, evolving financial situations, or additional assets ensures that your intentions are clearly reflected. This proactive approach helps safeguard against potential discrepancies in the future.

Besides the Maine Revocation of Transfer Form, other legal methods and forms may offer additional solutions for asset management. These can include trusts, wills, and various financial agreements tailored to your unique needs. Exploring alternative options allows individuals to optimize their estate planning strategies and maintain comprehensive control over their assets.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute maine revocation of transfer online?

How do I make changes in maine revocation of transfer?

Can I create an electronic signature for signing my maine revocation of transfer in Gmail?

What is maine revocation of transfer?

Who is required to file maine revocation of transfer?

How to fill out maine revocation of transfer?

What is the purpose of maine revocation of transfer?

What information must be reported on maine revocation of transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.