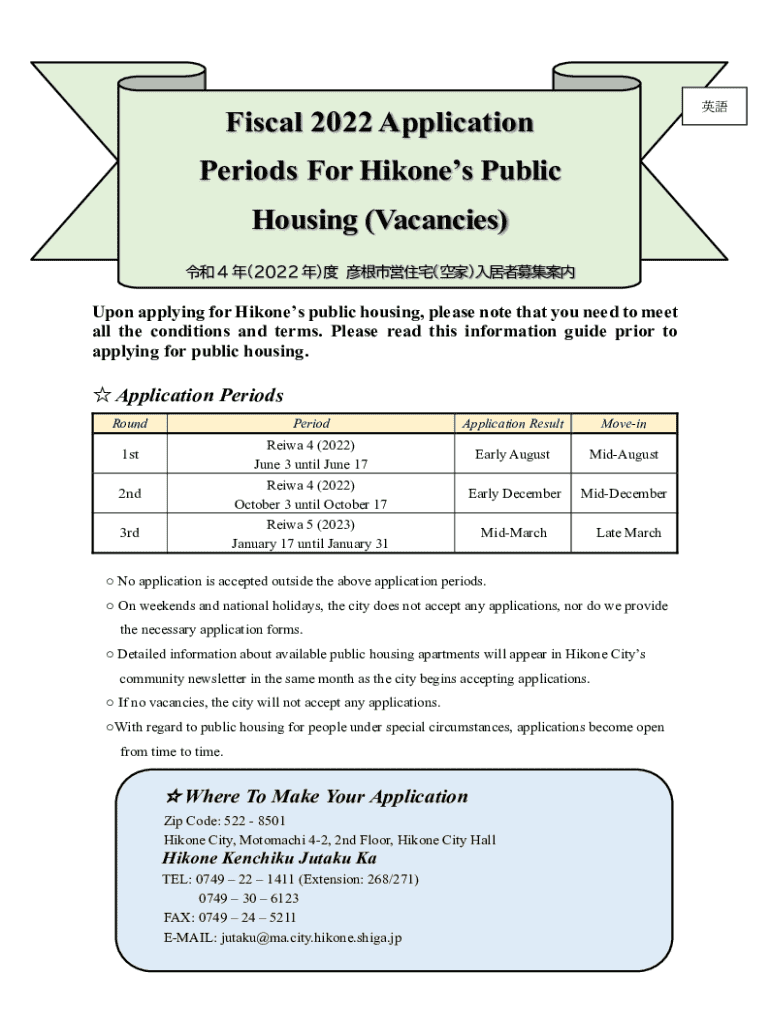

Get the free Fiscal 2022 Application Periods For Hikone's Public Housing ...

Get, Create, Make and Sign fiscal 2022 application periods

Editing fiscal 2022 application periods online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fiscal 2022 application periods

How to fill out fiscal 2022 application periods

Who needs fiscal 2022 application periods?

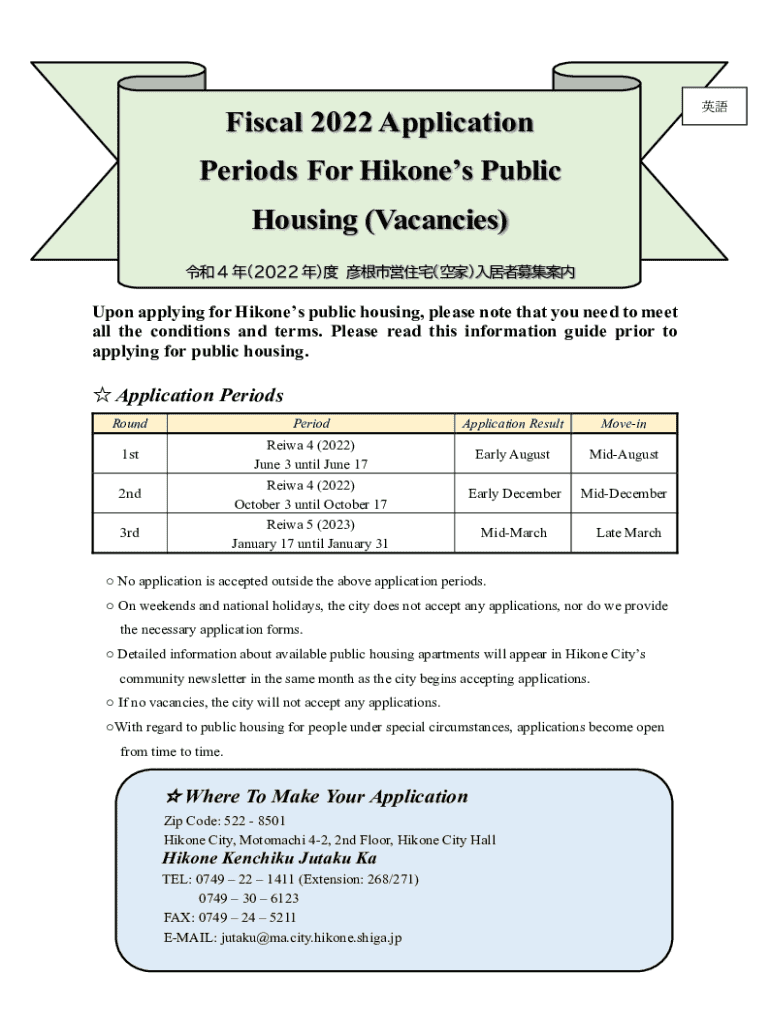

Understanding the Fiscal 2022 Application Periods Form

Understanding the fiscal 2022 application periods form

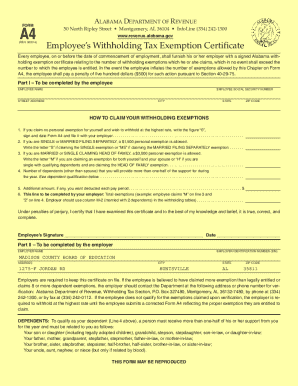

The fiscal 2022 application periods form holds considerable significance for both individual taxpayers and organizations. Unlike calendar year reporting, fiscal year reporting is based on a 12-month period ending on a date other than December 31. Understanding this difference is crucial for accurate tax planning and compliance. For instance, many businesses opt for a fiscal year aligned with their operational cycles, which may influence their tax strategies dramatically.

The fiscal 2022 application periods form is designed to facilitate the management of tax liabilities, exemptions, and credits for various taxpayers. This utility is especially salient in light of unique challenges presented in recent years, making it a crucial document for compliance. Not to mention, it bears key changes from previous years, reflecting legislation adjustments and fiscal policies tailored to evolving economic conditions.

Eligibility criteria for submission

To understand who must fill out the fiscal 2022 form, it's essential to recognize various types of taxpayers affected, including individuals, corporate entities, and even expatriates. Generally, any citizen or resident who has taxable income must apply using this form. This requirement extends to those living in Puerto Rico, where specific guidelines apply to local and federal taxes.

Certain exemptions exist for low-income taxpayers or individuals not meeting filing thresholds set by the IRS. However, failure to complete the form accurately can lead to penalties such as fines or increased scrutiny during audits. Late submissions might hinder tax benefits and refund delays, underscoring the necessity for timely and accurate completion.

Key dates and deadlines

Awareness of filing dates is critical for taxpayers using the fiscal 2022 application periods form. This year, the regular submission period typically aligns with the traditional tax deadlines, with applications generally due on April 15. However, it's pivotal to note that specific businesses and filers with an automatic extension can have varying deadlines. Missing these could jeopardize potential tax benefits.

Setting reminders for these deadlines is advisable. Notifications and calendar alerts can prevent last-minute rushes and associated errors, enabling a smoother filing experience.

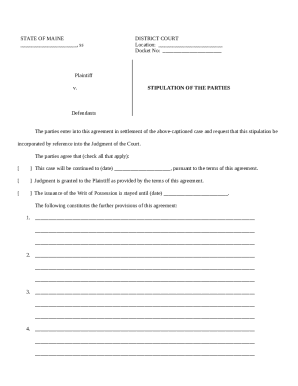

Detailed instructions on completing the form

Completing the fiscal 2022 application periods form involves several discrete steps. Initially, gathering all required documentation, including W-2s, 1099s, and any other relevant financial statements, is paramount. Ensuring you have standardized and complete records can save time and mitigate the risk of errors.

Navigating the form itself can be daunting. Each section serves a distinct purpose, from personal identification to income reporting and deductions. Common pitfalls include misreporting figures or failing to sign the document. Even minor errors can lead to delays or penalties.

Illustrative examples can further simplify this process, showing taxpayers what a completed form looks like, revealing typical input formats and calculations.

Editing and modifying the fiscal 2022 form

pdfFiller provides a seamless solution for editing and modifying the fiscal 2022 application periods form. Users can easily upload their forms and utilize editing tools to make necessary changes, ensuring the data remains accurate and up-to-date. This feature is particularly useful for teams that need to collaborate on submissions, allowing multiple stakeholders to review adjustments dynamically.

Using interactive tools enhances usability and ensures you're not overwhelmed by complicated processes. Features such as drop-down menus and auto-fill options discernibly simplify the completion process, making it efficient and user-friendly.

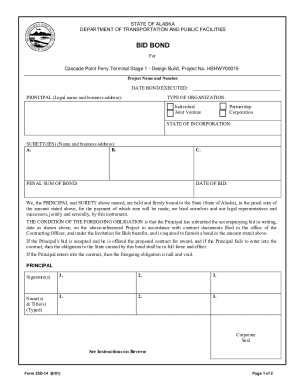

eSigning the fiscal 2022 application periods form

eSigning is revolutionizing how taxpayers finalize their documents. This digital signature tool confirms your agreement while securing the integrity of the form. With enhanced compliance standards for digital signatures now recognized legally, using eSignatures minimizes risks associated with traditional signing methods.

The process with pdfFiller is straightforward. Users can upload their forms, navigate to the signature field, and utilize the eSigning feature to authenticate the document. Ensuring that all parties involved access the document securely is crucial for compliance and validity.

Managing your documentation

Effective management of fiscal 2022 application documents is essential for smooth operations. Completing the form is just one part of the equation; organizing these submissions can save time and reduce stress when it comes to retrieval. Create a dedicated folder structure for storing submissions, allowing for quick access and ensuring documents remain secure.

pdfFiller’s platform offers secure sharing options, ensuring that sensitive financial information is exchanged without compromise. Moreover, utilizing cloud storage can enhance accessibility, so that both individuals and teams can retrieve documents from various locations effortlessly.

Troubleshooting common issues

Even seasoned taxpayers occasionally face issues when dealing with the fiscal 2022 application periods form. Common problems range from technical glitches in form submission to misunderstandings about eligibility requirements. A well-structured FAQ section can guide users through regular concerns and provide immediate solutions.

When errors arise on submitted forms, timely action is essential. Contacting customer support is a practical solution for unresolved issues, offering a direct line to assistance from form professionals who can help navigate complex challenges.

Additional tips for a smooth submission experience

Additional tips can provide taxpayers with an even smoother experience. Staying updated on changes in tax regulations is crucial for compliance, particularly for expats or citizens flexibly navigating different jurisdictions. Utilizing available resources, including IRS updates and trusted tax advisors, can dispel uncertainties surrounding tax matters.

Improving workflow efficiency through these strategies can not only streamline the form completion process but can ultimately lead to better financial outcomes as well.

User testimonials and success stories

Hearing from users who navigated the fiscal 2022 application periods form can provide invaluable insight into the process. Many individuals have shared positive experiences, highlighting how using pdfFiller simplified their document management and submission experience. These testimonials speak volumes about the platform's effectiveness in reducing stress and enhancing accuracy.

For teams, collective experiences often demonstrate how collaboration is optimized through shared tools, significantly reducing the time that's typically wasted on formatting and approvals. Actual success stories showcase the tangible benefits of utilizing pdfFiller, reinforcing its value as a comprehensive cloud-based solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send fiscal 2022 application periods for eSignature?

How do I make changes in fiscal 2022 application periods?

How do I fill out fiscal 2022 application periods using my mobile device?

What is fiscal 2022 application periods?

Who is required to file fiscal 2022 application periods?

How to fill out fiscal 2022 application periods?

What is the purpose of fiscal 2022 application periods?

What information must be reported on fiscal 2022 application periods?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.