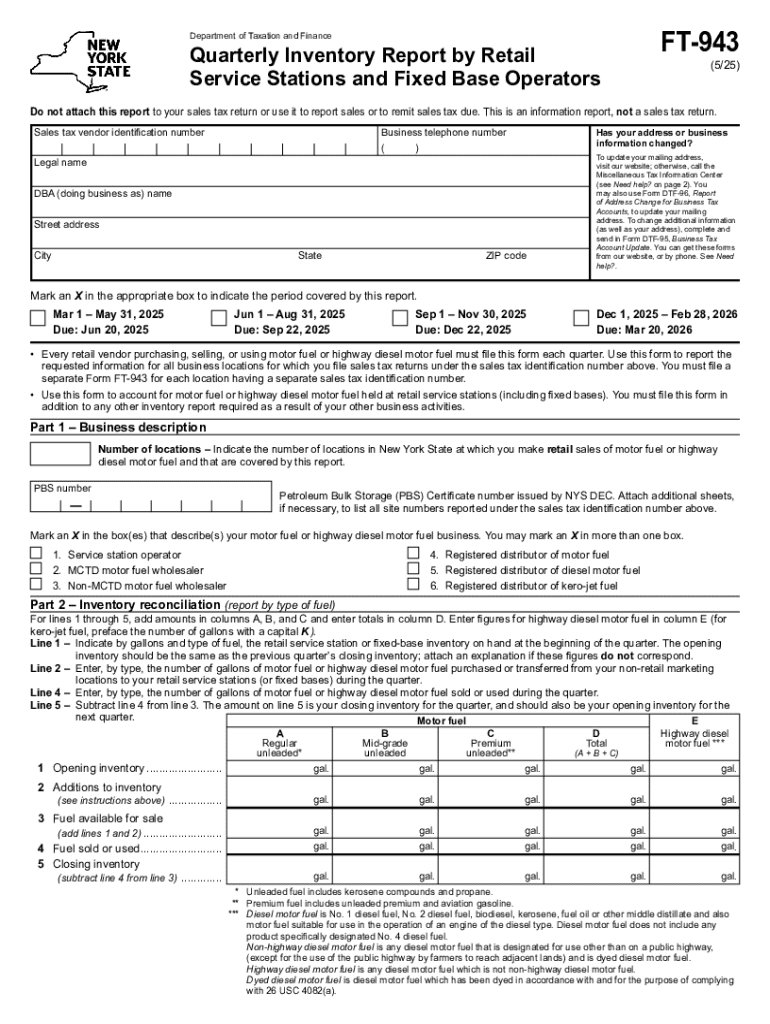

Get the free Form FT-943 Quarterly Inventory Report by Retail Service Stations and Fixed Base Ope...

Get, Create, Make and Sign form ft-943 quarterly inventory

How to edit form ft-943 quarterly inventory online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form ft-943 quarterly inventory

How to fill out form ft-943 quarterly inventory

Who needs form ft-943 quarterly inventory?

Comprehensive Guide to the FT-943 Quarterly Inventory Form

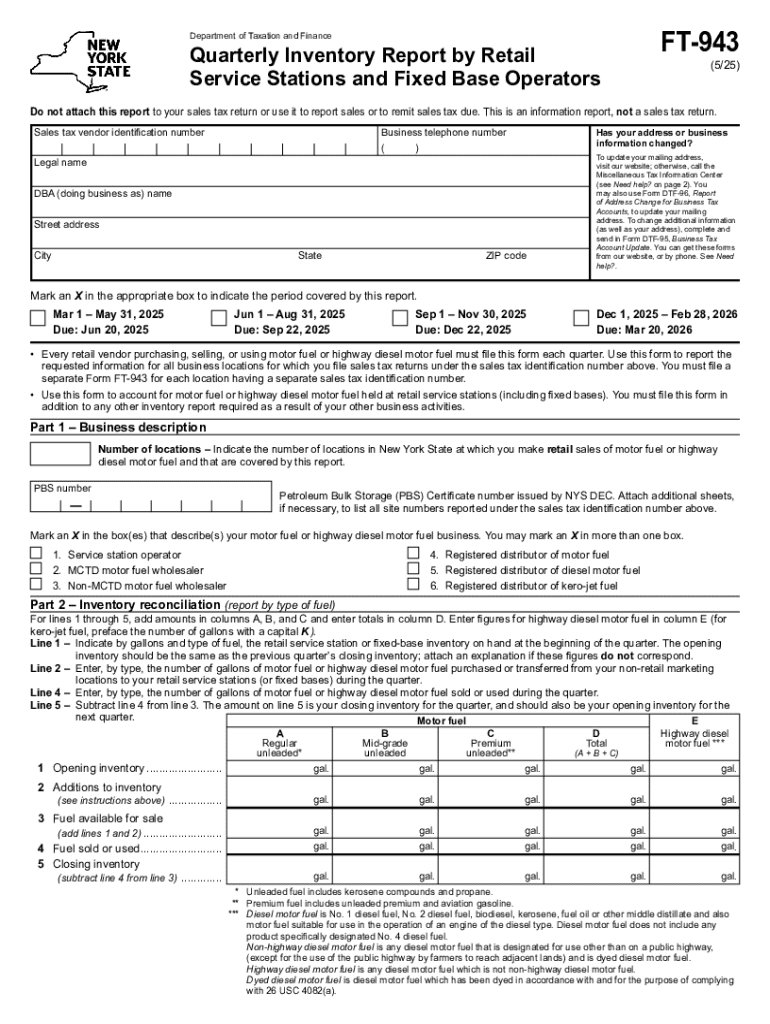

Understanding the FT-943 quarterly inventory form

The FT-943 Quarterly Inventory Form is a crucial tool for businesses to report their inventory levels to the appropriate regulatory bodies. Designed to ensure accurate record-keeping, the FT-943 serves as a compliance measure, helping organizations avoid financial discrepancies and penalties associated with inaccurate reports. By mandating regular inventory assessments, this form assists businesses in maintaining transparency and accountability over their stock and assets.

Compliance with the FT-943 is not merely a guideline; it is a legal requirement for many businesses that handle significant inventory. Failing to submit accurate forms or neglecting to file them on time can result in serious consequences, including audits and fines. Therefore, understanding and correctly utilizing this form is pivotal for business operations and financial health.

Who needs to use the FT-943 form?

The FT-943 form is utilized primarily by both individual and corporate entities that manage inventory as part of their operations. This includes retailers, manufacturers, wholesalers, and other businesses that regularly buy and sell stock. For instance, a local grocery store would need to file an FT-943 quarterly to report their inventory levels to comply with tax regulations.

Specific scenarios necessitating the FT-943 include businesses that experience fluctuations in inventory due to seasonal sales or promotional events. Additionally, companies preparing for investment rounds or audits may find that maintaining accurate inventory reports through the FT-943 not only aids in compliance but also strengthens their operational integrity when presenting to stakeholders.

Key components of the FT-943 form

The FT-943 form is systematically structured to facilitate accurate reporting. Each section is designed to capture critical information about a company's inventory. Understanding these sections is crucial for effective completion. The form typically consists of fields for business information, detailed inventory lists, reporting periods, and any necessary calculations that summarize totals for reporting.

Familiarity with common terminology used in the form enhances clarity. Terms such as 'opening inventory', 'closing inventory', 'cost of goods sold', and 'net inventory' are integral to reporting accuracy. A glossary at the end can help users navigate these technical definitions and avoid potential confusion when submitting their forms.

Step-by-step guide to filling out the FT-943 form

Successfully completing the FT-943 form requires thorough preparation. Start by gathering essential information and documentation. Businesses should collect their inventory records, financial statements related to inventory purchases, and previous FT-943 forms to ensure consistency and accuracy in reporting.

As you dive into filling out the form, it is crucial to understand the instructions for each section.

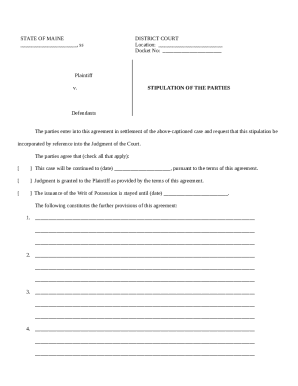

Section 1: Business Information

This section requires basic details about your business, including the name, address, and tax identification number. It’s important to fill in these fields accurately as discrepancies can lead to processing delays or issues later.

Section 2: Inventory Details

In this section, accurately report your inventory by listing all products on hand. The ft-943 form may require quantity and valuation of each inventory item. Ensure your calculations reflect an up-to-date and comprehensive analysis of your stock levels as this affects overall financial reporting.

Section 3: Reporting Period

You’ll need to specify the reporting period for the inventory being reported. This can often coincide with quarterly business cycles. Ensuring that your reporting is aligned with your accounting practices simplifies the process.

Section 4: Calculations and Totals

Finally, you’ll calculate totals based on the data provided in earlier sections. It is crucial to double-check all math to avoid common errors like transposed numbers or miscalculating totals. This baseline information will form the basis of your financial analysis.

Common pitfalls include failure to review for completeness, incorrect data entries, and missing deadlines. To prevent these issues, encourage regular reviews of inventory processes and reporting mechanisms.

Editing and customizing the FT-943 form

Editing the FT-943 form is simplified using pdfFiller. This online platform allows users to make real-time adjustments to PDF documents. Begin by uploading your FT-943 form to the pdfFiller platform. As you review the form, familiarizing yourself with the available tools, you can make necessary edits or modifications directly.

In addition to editing text fields, pdfFiller also allows you to add electronic signatures and annotate documents when required. This feature not only expedites the signature collection process but also ensures that all changes and approvals are documented for transparency.

Finalizing and submitting your FT-943 form

Once you have completed the form, it’s imperative to conduct a final review. A comprehensive review checklist should include verifying all sections are completed, ensuring accurate calculations, and confirming that all required signatures are present. It's advisable to work methodically through this checklist to catch any omissions that could delay processing.

Submission of the FT-943 can be done either electronically or via traditional paper methods. Electronic submissions typically provide faster processing and confirmation, while paper submissions might require additional time for handling. When using pdfFiller, the electronic method is streamlined, allowing forms to be sent directly to the required destination, which can be particularly beneficial for fast-paced business environments.

Managing your forms with pdfFiller

Effective document management is critical for businesses handling multiple forms. pdfFiller offers users the ability to organize and store completed FT-943 forms in a centralized location, promoting easy retrieval and reference. Utilize folders and tagging features to keep your forms orderly and accessible.

Collaboration is another significant aspect of working with forms in pdfFiller. Team members can work together on the same document, providing comments, suggestions, and edits in real time. Additionally, tracking features maintain an audit history of changes, ensuring all modifications are recorded and transparently available for future review.

Frequently asked questions (FAQs)

The FT-943 form often raises questions about filing deadlines, acceptable practices, and how it integrates with other business filings. Common inquiries include what steps to take if an error is discovered after filing and whether amended forms are acceptable. It's essential to consult relevant tax authorities or financial advisors to clarify these aspects.

In terms of using pdfFiller, users frequently ask about how the platform integrates with existing workflows and what specific features can assist in form management. By offering comprehensive support and easy-to-navigate functionalities, pdfFiller empowers businesses to streamline their processes and improve compliance.

Understanding compliance and legal implications

Accurate reporting through the FT-943 is more than just fulfilling a requirement; it plays a pivotal role in maintaining operational integrity. Misreporting can lead to expensive audits, regulatory scrutiny, or legal issues. Understanding the compliance landscape is integral for businesses to navigate the complexities of inventory reporting efficiently.

Using pdfFiller not only aids in the actual filling and submission of the FT-943 form but also provides features that ensure compliance. Automatic reminders for deadlines, real-time collaboration, and secure signatures help businesses uphold standards and mitigate risks associated with non-compliance.

Testimonials and case studies

Numerous users of the FT-943 form have shared positive experiences highlighting how crucial it has been for their inventory management processes. For example, a regional distribution company implemented a structured approach to filing the FT-943 and reported a 30% decrease in time spent on inventory reporting. Through streamlined processes, they also experienced fewer errors, leading to enhanced overall compliance.

Likewise, clients utilizing pdfFiller consistently remark on the platform's efficiency and effectiveness. Feedback emphasizes the user-friendly interface and collaborative features that make group projects more manageable, particularly when dealing with complex forms like the FT-943.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form ft-943 quarterly inventory in Gmail?

How can I edit form ft-943 quarterly inventory on a smartphone?

How do I fill out the form ft-943 quarterly inventory form on my smartphone?

What is form ft-943 quarterly inventory?

Who is required to file form ft-943 quarterly inventory?

How to fill out form ft-943 quarterly inventory?

What is the purpose of form ft-943 quarterly inventory?

What information must be reported on form ft-943 quarterly inventory?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.