Get the free Simple IRA - New Account Package

Get, Create, Make and Sign simple ira - new

How to edit simple ira - new online

Uncompromising security for your PDF editing and eSignature needs

How to fill out simple ira - new

How to fill out simple ira - new

Who needs simple ira - new?

Simple IRA - New Form: A Comprehensive Guide

Understanding SIMPLE IRA: An Overview

A SIMPLE IRA (Savings Incentive Match Plan for Employees Individual Retirement Account) is a retirement plan specifically designed for small businesses with 100 or fewer employees. It provides a straightforward way for employees to save for retirement while offering attractive tax benefits for both employees and employers. Unlike traditional 401(k) plans, the SIMPLE IRA is less complex to set up and maintain, making it an appealing choice for many companies.

Key features of the SIMPLE IRA include employee contribution limits, employer matching options, and distinct tax advantages. Employees can contribute a portion of their earnings, up to a set limit that is adjusted annually. Employers are required to match these contributions up to a certain percentage, promoting a collaborative saving environment. These plans also allow for tax-deferred growth, meaning both contributions and earnings can grow free of current taxes until withdrawal.

Why consider a SIMPLE IRA for your business?

When evaluating retirement plan options, small businesses should consider the many advantages of a SIMPLE IRA. This plan is not only cost-effective compared to other retirement solutions but also serves as a powerful tool for attracting and retaining talent. Employees appreciate the benefit of a straightforward retirement savings plan, and offering one enhances job satisfaction and loyalty.

When comparing the SIMPLE IRA to other plans like the 401(k) or SEP IRA, businesses often find the SIMPLE IRA to be less burdensome regarding administration and cost. For instance, while 401(k) plans may involve complex compliance requirements and higher contributions limits, the SIMPLE IRA's straightforward structure makes it easier for business owners to manage.

Navigating the new SIMPLE IRA form

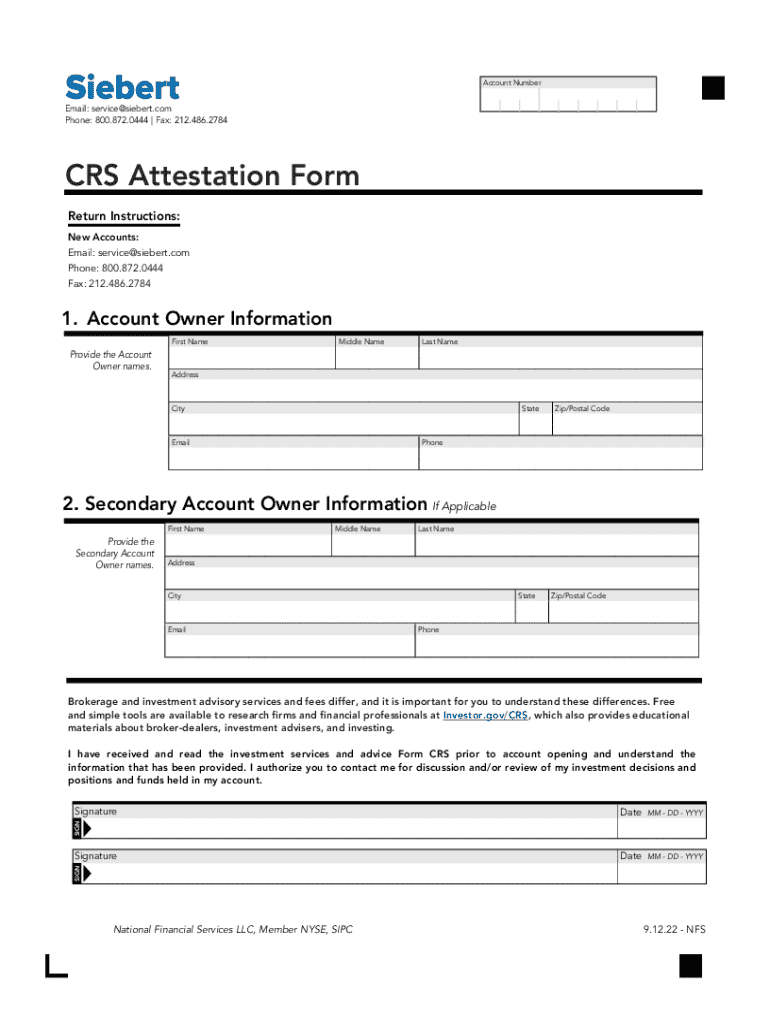

The new SIMPLE IRA form introduced updates aimed at increasing transparency and compliance for both employers and employees. Keeping abreast of these changes is crucial to ensure that your business adheres to IRS regulations. Some key changes in the form clarify the contribution reporting process for employers, making it simpler to document employee contributions and match amounts accurately.

Using the correct form is vital for compliance; incorrect submissions can lead to misunderstandings with financial institutions or potential tax penalties. Accordingly, it’s wise to familiarize yourself with the new SIMPLE IRA form and its requirements to prevent any issues during the filing process.

Step-by-step guide to filling out the SIMPLE IRA form

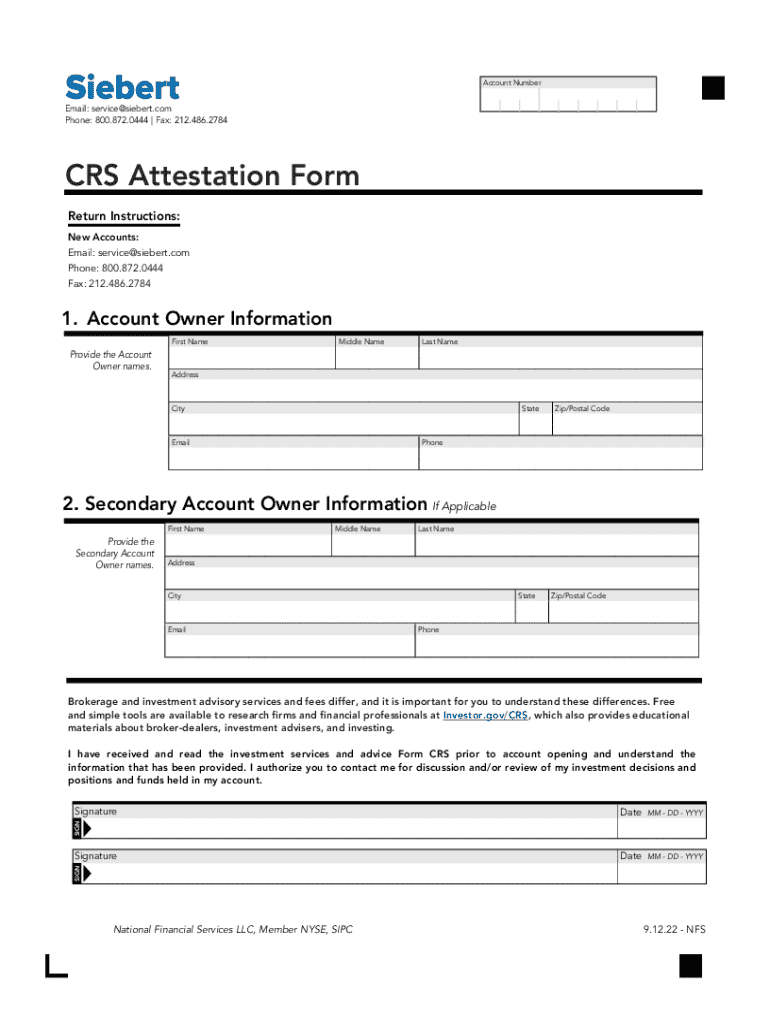

Filling out the SIMPLE IRA form requires attention to detail. Begin by gathering necessary information, including personal details of the employee, employer contact information, and specific contribution details. A successful submission will require accurate data to align with IRS standards.

Make sure to follow detailed instructions for each section, ensuring you accurately report employee contributions. Additionally, include employer match declarations correctly to avoid potential penalties. Many businesses make the common mistake of misfiling or omitting necessary information, which can complicate the review and acceptance process.

Editing and managing your SIMPLE IRA form with pdfFiller

pdfFiller provides interactive tools that can simplify the management of your SIMPLE IRA form. Users find it beneficial for making easy edits and revisions, allowing for seamless collaboration across teams. The platform's user-friendly interface ensures that filled forms meet desired standards and expectations.

pdfFiller also offers eSigning features which streamline the signing process. eSigning not only accelerates the approval stages but also enhances security and accountability, which are crucial in managing retirement plans effectively.

Post-submission steps for your SIMPLE IRA form

After submitting the SIMPLE IRA form, it’s important to confirm receipt and acceptance by financial institutions to safeguard compliance. Keeping records of all submissions can help resolve issues if they arise and will provide a reference for future contributions.

Best practices for record-keeping involve maintaining documentation for at least six years. This duration aligns with the IRS audit timeframe, ensuring you have supporting documentation available if needed. Organizing your retirement plan paperwork in dedicated files can also enhance accessibility for audits or reviews by employees or new management.

Operating your SIMPLE IRA: Key considerations

Maintaining compliance and managing a SIMPLE IRA entails annual requirements. Employers must communicate the plan’s rules to employees and ensure they are aware of their rights and responsibilities. This includes informing employees about their options for contributions and withdrawal.

Common mistakes to avoid with your SIMPLE IRA

Errors in completing the SIMPLE IRA form can result in severe consequences, from misplaced contributions to tax penalties. One common mistake is providing incorrect information, which can disrupt both employer and employee contributions.

Failing to keep up with contribution limits and rules also poses risks. Ensure that both employer and employee contributions adhere to IRS guidelines to avoid penalties. Communication gaps can lead to misunderstandings between employers and employees about eligibility or contributions, so fostering an open atmosphere is critical.

FAQs about SIMPLE IRA forms

Understanding frequently asked questions related to the SIMPLE IRA form can clarify processes and implications. For example, if a mistake is made on a SIMPLE IRA form, it is important to rectify it promptly to avoid complications later. Contact your financial institution for guidance on amendments.

Your SIMPLE IRA plan – a quick reference guide

Having a quick reference guide for your SIMPLE IRA management can facilitate effective execution of your retirement plan. This guide should encompass essential contacts and resources to enhance the simplicity of managing your IRA.

Enhancing your experience with pdfFiller

To streamline your document management process, pdfFiller offers a robust platform suited for managing retirement-related documents. With pdfFiller, users can easily edit, eSign, and manage their retirement forms from a cloud-based platform, making access anywhere a priority.

Particularly for SIMPLE IRA forms, pdfFiller provides solutions that ensure compliance while simplifying form management. Testimonials from satisfied users highlight how pdfFiller has become essential for efficient retirement planning.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get simple ira - new?

How can I fill out simple ira - new on an iOS device?

How do I edit simple ira - new on an Android device?

What is simple ira - new?

Who is required to file simple ira - new?

How to fill out simple ira - new?

What is the purpose of simple ira - new?

What information must be reported on simple ira - new?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.