Get the free FinCEN Urges Money Services Business to Be 'Vigilant'

Get, Create, Make and Sign fincen urges money services

Editing fincen urges money services online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fincen urges money services

How to fill out fincen urges money services

Who needs fincen urges money services?

FinCEN urges money services form: A comprehensive guide

Overview of FinCEN’s role in financial regulation

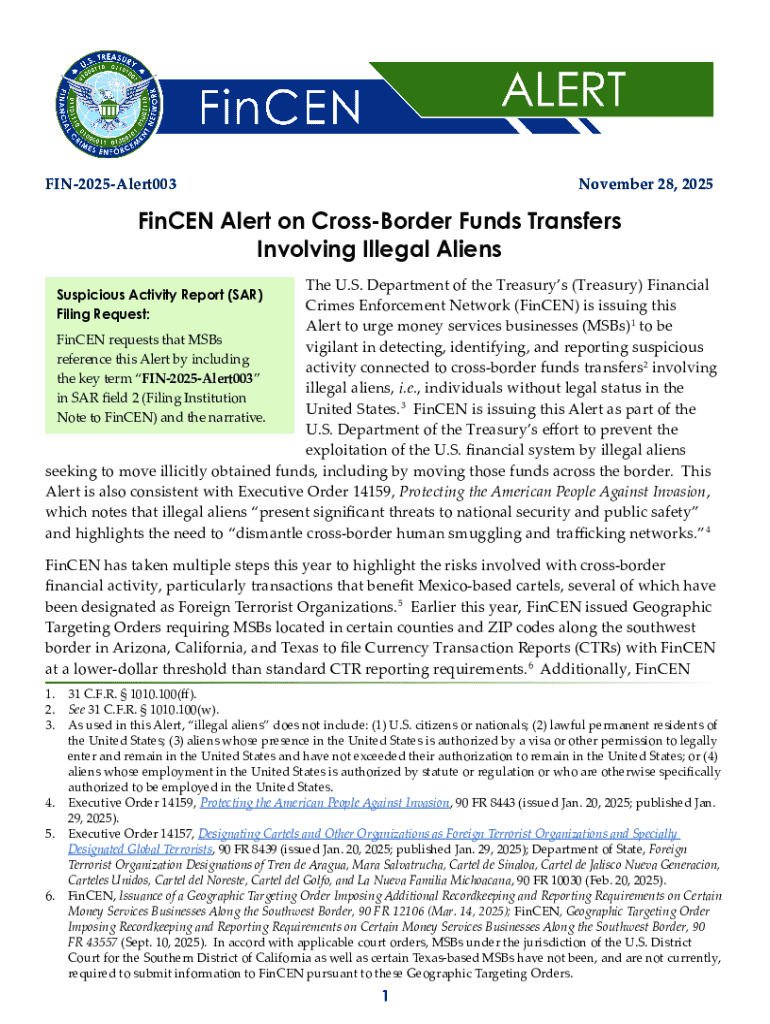

The Financial Crimes Enforcement Network (FinCEN) plays a critical role in safeguarding the financial system against illicit activities such as money laundering and terrorist financing. Established under the Bank Secrecy Act (BSA), FinCEN's mission centers around promoting transparency in financial transactions. Their work involves collaboration with various entities, including financial institutions and state authorities, to monitor suspicious activities that could indicate financial crimes.

Historically, FinCEN has adapted its regulatory frameworks to respond to emerging financial threats. For instance, recent developments highlight heightened scrutiny on money services businesses (MSBs), which include currency exchanges and money transfer services. Alerts and advisories issued by FinCEN reflect a proactive stance in refining compliance expectations, stressing the importance of proper reporting through forms specifically tailored for MSBs.

Importance of using the money services form

Completing the money services form is essential for MSBs to ensure compliance with FinCEN regulations. Non-compliance can result in severe consequences, including heavy fines and legal ramifications that could jeopardize the business's future. When businesses fail to adhere to these requirements, they not only expose themselves to regulatory sanctions but also risk damaging their reputation within the market.

On the other hand, properly completing this form yields significant benefits. It enhances transparency, fostering trust with customers who increasingly seek accountability from the businesses they engage with. Furthermore, a rigorous compliance program protects financial operations from fraudulent activities. Businesses that emphasize thoroughness in their filings often find they are better positioned against financial fraud and are less likely to incur penalties from regulatory bodies.

Step-by-step guide to completing the money services form

When preparing to complete the money services form, it's vital to gather all necessary information beforehand. Essential documents include identification materials for the business and its owners, operational details, and previous transaction logs. This preparatory work ensures a smooth filing process and reduces the chances of error, which could lead to delays or rejections.

The form itself consists of several key sections that require careful attention. The first section pertains to personal identification information of the business owners and principal officers; accurately recording names, social security numbers, and addresses is crucial. Next, detail your business activities and operational scope, providing comprehensive disclosures on financial activities, including types of transactions conducted, frequencies, and volumes.

Common mistakes often involve providing incomplete information or failing to update changes in business operations. Ensuring that each section is thoroughly completed protects against potential rejections and enhances the reliability of your filings. A good practice is to have a second set of eyes review the form to catch errors you may have overlooked.

Interactive tools for form submission

Given the complexities surrounding the money services form, processing it online can streamline workflow significantly. Platforms like pdfFiller offer intuitive interfaces that simplify the completion of regulatory forms, enabling businesses to fill, sign, and manage their documents in one secure location. These cloud-based solutions promote efficient document handling, making it easier to stay compliant and organized.

Moreover, utilizing electronic signature features allows teams to expedite the submission process, securing approvals without the delays often associated with traditional paperwork. Collaboration tools within these platforms enable multiple team members to work on the form together, ensuring that all aspects are addressed before submission.

Compliance monitoring and follow-up actions

Once the money services form has been submitted, it's important to adhere to a post-submission checklist to ensure ongoing compliance. First, keep track of any acknowledgement from FinCEN regarding your submission. Additionally, be aware of renewal timelines for any licenses or registrations related to your business operations. Staying organized with documentation will ease future audits or inspections.

Remaining informed about regulatory changes is also critical in the financial services industry. Subscribing to updates from FinCEN and utilizing available resources for continuous training can help businesses navigate evolving compliance landscapes. Engaging in regular education and training sessions protects against potential pitfalls and keeps key personnel well-informed about their obligations.

Case studies: success stories of compliance

Numerous money service businesses have thrived through stringent adherence to FinCEN regulations. For example, a currency exchange service in New York implemented a comprehensive compliance program, leading to significant growth and reputation enhancement. By committing to transparency and regular reporting, they not only avoided hefty fines but also attracted clients who value compliance.

In stark contrast, companies that neglected to comply with FinCEN regulations faced dire consequences. A remittance service that failed to report suspicious transactions encountered significant legal challenges, resulting in its closure. These scenarios underscore the necessity of compliance and the business advantages that come from maintaining ethical practices in financial operations.

FAQs about FinCEN’s money services form

Despite the clear guidelines established by FinCEN, many individuals still have questions regarding the completion and submission of the money services form. Common queries include the types of transactions that need to be reported and the frequency of required filings. Understanding these aspects can reduce the anxiety surrounding compliance and enhance operational readiness.

Further resources can be invaluable for clarifying doubts. Accessing official guides from FinCEN and platforms like pdfFiller ensures that businesses have up-to-date information and support as they navigate compliance requirements. Engaging with these resources empowers businesses to maintain compliance effectively.

Final thoughts on compliance and financial integrity

The role of money services businesses in the global economy is pivotal, with their activities affecting countless individuals and communities. Ethical practices, including thorough compliance with FinCEN regulations, reinforce trust within the financial system. As customer preferences become increasingly aligned with transparency, the need for robust compliance frameworks will only grow.

Looking ahead, the landscape of money services regulation may face further transformation. The potential for evolving FinCEN policies means that continuous adaptation will be necessary for businesses to remain compliant. By fostering a culture of compliance, MSBs can not only thrive in their operations but also contribute positively to the integrity of the financial ecosystem.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit fincen urges money services in Chrome?

How do I edit fincen urges money services on an iOS device?

How do I fill out fincen urges money services on an Android device?

What is fincen urges money services?

Who is required to file fincen urges money services?

How to fill out fincen urges money services?

What is the purpose of fincen urges money services?

What information must be reported on fincen urges money services?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.