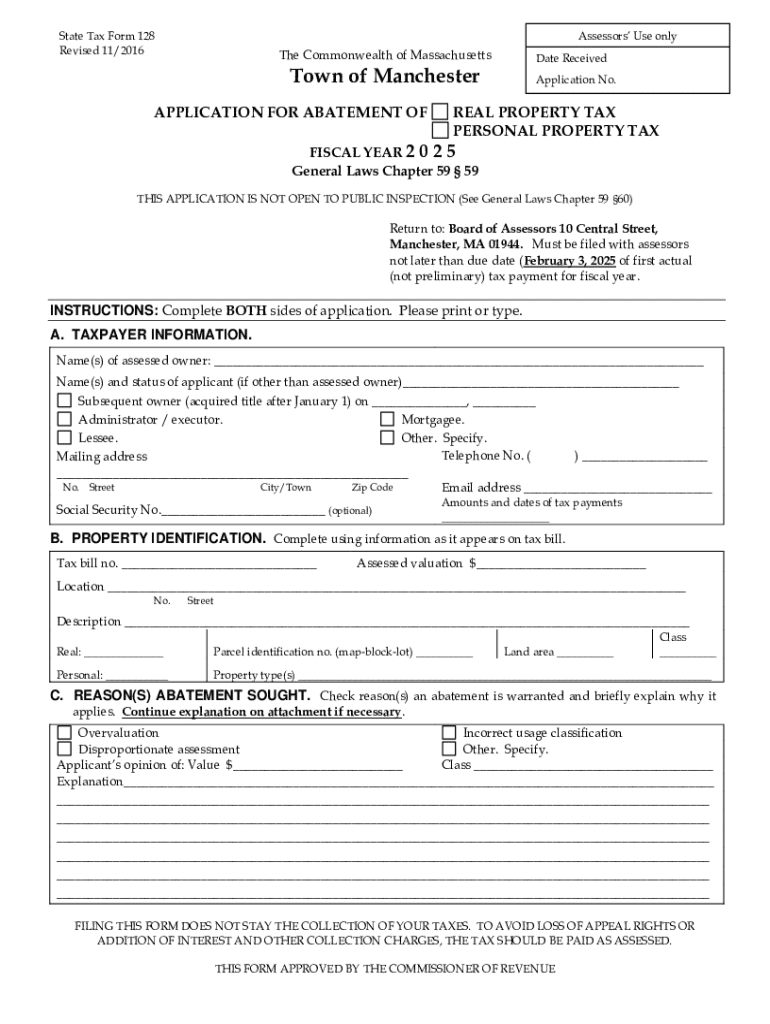

Get the free 2016-2025 MA State Tax Form 128 Fill Online, Printable ...

Get, Create, Make and Sign 2016-2025 ma state tax

How to edit 2016-2025 ma state tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2016-2025 ma state tax

How to fill out 2016-2025 ma state tax

Who needs 2016-2025 ma state tax?

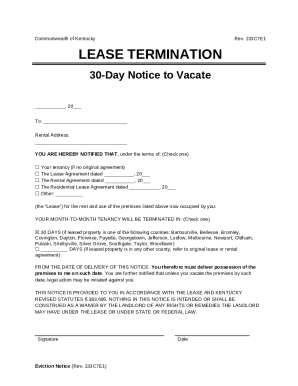

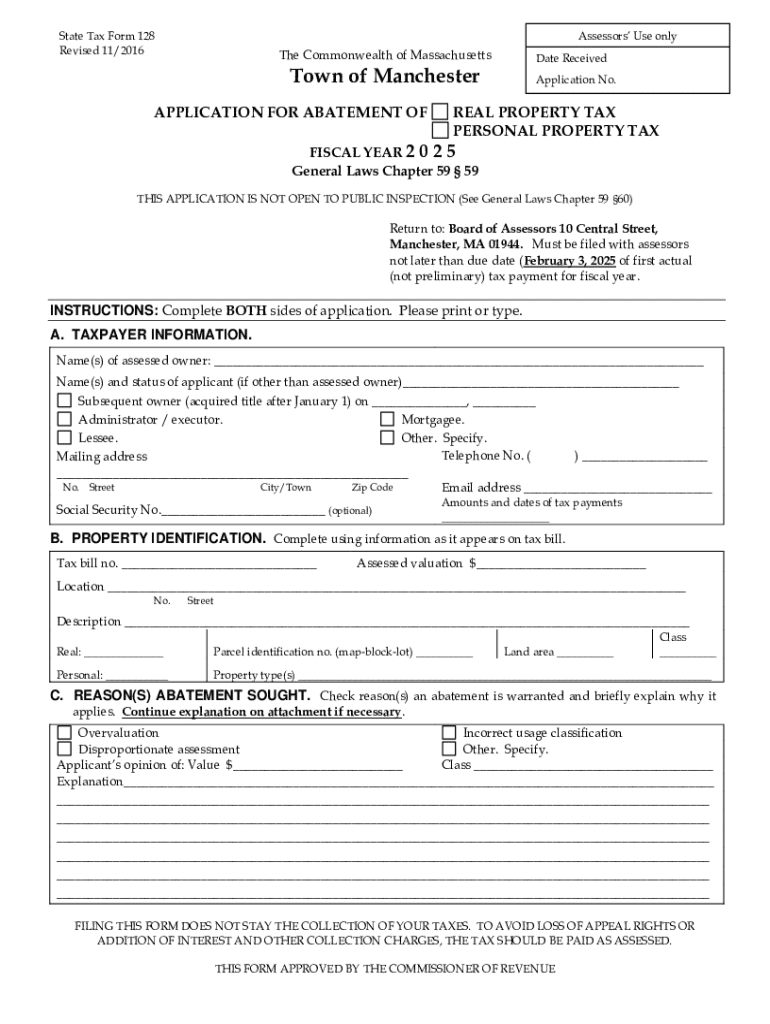

Comprehensive Guide to 2 MA State Tax Forms

Overview of MA state tax forms: Key changes from 2016 to 2025

The Massachusetts state tax landscape has seen significant transformations from 2016 to 2025, reflecting broader economic policy shifts, new tax credits, and changes in deductions that affect both individuals and businesses. Major tax reforms during this period have focused on expanding available credits for low-income residents and increasing compliance measures across various business sectors.

For residents, these changes mean a more complex filing process; however, they also provide opportunities to lower tax liabilities through new deductions. Additionally, the MA Department of Revenue has modernized the filing system to improve accessibility, streamline the submission process, and enhance user experience.

Types of MA state tax forms

Understanding the various MA state tax forms is crucial for accurate filing. The forms are categorized into three main types: Individual Income Tax Forms, Business Tax Forms, and Property Tax Forms. Each category is designed to address specific tax obligations and situations.

These forms play distinct roles, and taxpayers should familiarize themselves with specific forms pertinent to their financial situations to ensure compliance and optimization of tax obligations.

Step-by-step guide to filling out MA state tax forms

Preparation is key to successfully completing your MA state tax forms. First, gather necessary documentation such as W-2s, 1099s, and any receipts related to deductible expenses. Knowing the available deductions and credits between 2016 and 2025 will also aid in optimizing your tax return.

When filling out Form 1, detailed instructions for each section are vital. Start with personal information; ensure your Social Security Number is accurate. Report your income from all sources—wages, interest, and dividends—carefully. Take note of deductions and adjustments, as these can significantly alter your tax computation.

Common mistakes to avoid include misreporting income amounts, overlooking deductions, and failing to sign the return. After filling out the sections on income and deductions, calculate your tax liability accurately.

For submitting your tax return, you have options. Utilizing electronic filing can streamline the process, but if you prefer traditional mail, ensure you dispatch your return well ahead of the April deadline to avoid late penalties.

Navigating specific forms and situations

Certain situations may require specific forms or amended returns. For instance, if you find yourself needing to correct previously reported information, you will need to file Form 1-A.

Filing taxes as a non-resident or part-year resident introduces unique challenges. The Form 1-NR provides instructions tailored for these taxpayers, guiding them on how to calculate taxable income earned in Massachusetts and the eligible credits.

For businesses, understanding the distinctions between corporate and individual tax obligations is vital. Forms designed for LLCs and corporations must reflect their specific income reporting requirements, while individuals might utilize credits that aren't available to businesses.

Tips for maximizing deductions and credits

To lower your overall tax burden, becoming familiar with Massachusetts-specific deductions and credits is crucial. For instance, the Earned Income Credit is a beneficial option for low to moderate-income earners. Additionally, Massachusetts offers property tax exemptions for qualifying seniors and veterans, which can greatly assist those eligible candidates.

Education credits are also available for expenses related to higher education, making them a significant area to explore for parents and students looking to ease the financial strain of education costs.

Utilizing dependents and childcare deductions can further decrease your tax burden. Ensure you gather all necessary documentation, including receipts for childcare expenses, to substantiate your claims.

Interactive tools for MA tax preparation

In today’s high-paced digital environment, making use of online calculators and tools for tax preparation is essential. Tools available through platforms like pdfFiller ensure accurate and thorough filing by offering comprehensive solutions for form completion and submission.

pdfFiller facilitates a user-friendly experience, allowing users to edit, eSign, and manage documents in one location. The cloud-based system alleviates the stress of coordinating separate applications for tax preparation.

Their interactive features help streamline the process, making it efficient for individuals and teams needing access from anywhere.

Frequently asked questions about MA state tax forms

Individuals often have various inquiries regarding MA state tax forms, especially concerning deadlines, submission practices, or eligibility for deductions. Common misconceptions can lead to unnecessary anxiety; thus, it’s essential to clarify these points.

For instance, understanding deadlines is crucial for preventing late fees. Additionally, many residents overlook available resources designed to provide assistance, such as state tax help lines or local tax assistance programs.

Having access to accurate and clear information fosters confidence in the filing process, ensuring that taxpayers can navigate their obligations without stress.

Collaborating with tax professionals

For many, seeking the assistance of a tax advisor can prove invaluable, particularly when complexities arise. Tax professionals bring expertise that can ease the burden of navigating multifaceted tax scenarios, ensuring that individuals maximize their benefits and fulfill their obligations.

Choosing the right tax professional is equally essential. Look for advisors with a strong understanding of MA tax forms and a successful track record of helping clients navigate similar circumstances.

Keeping your taxes organized year-round

Creating a system for document management and secure storage can make tax season significantly less stressful. Maintaining organized financial records year-round ensures that you can compile necessary documentation quickly when the time comes to file.

Utilizing pdfFiller to organize your tax documents allows for efficient management and easy access, keeping everything you might need at your fingertips. Implementing such practices ensures compliance with tax regulations while simplifying future filings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2016-2025 ma state tax in Chrome?

How do I edit 2016-2025 ma state tax straight from my smartphone?

How do I edit 2016-2025 ma state tax on an iOS device?

What is 2016-2025 ma state tax?

Who is required to file 2016-2025 ma state tax?

How to fill out 2016-2025 ma state tax?

What is the purpose of 2016-2025 ma state tax?

What information must be reported on 2016-2025 ma state tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.