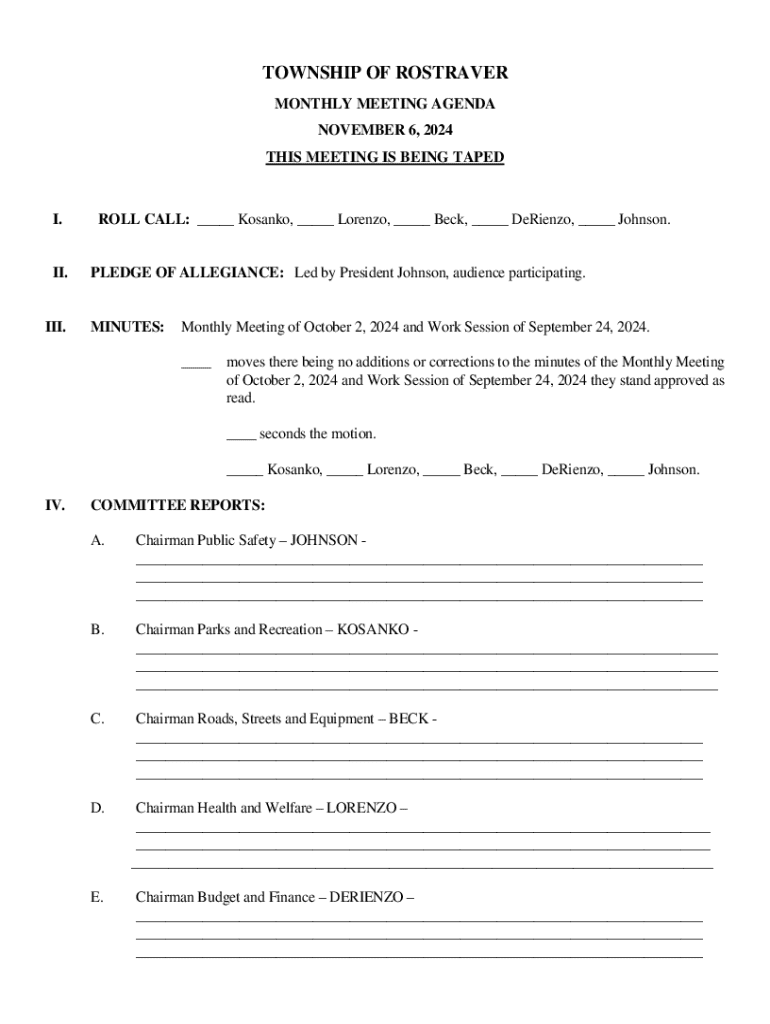

Get the free of October 2, 2024 and Work Session of September 24, 2024 they stand approved as

Get, Create, Make and Sign of october 2 2024

Editing of october 2 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out of october 2 2024

How to fill out of october 2 2024

Who needs of october 2 2024?

Your Guide to the October 2, 2024 Form: Completing and Managing Your Documentation Efficiently

Understanding the October 2, 2024 form

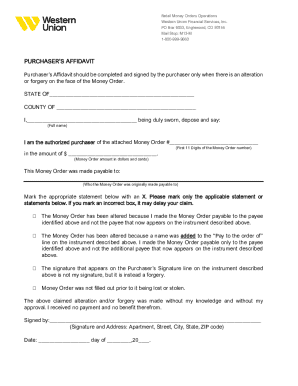

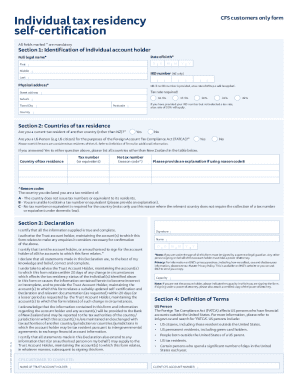

The October 2, 2024 form serves a vital role in various administrative and legal processes, primarily found within the context of regulatory compliance, tax filing, and corporate registrations. This form is designed as a standardized document used by individuals and organizations to report specific information, assess ownership details, and ensure compliance with existing statutes.

Timely submission of this form is crucial to avoid potential penalties and ensure seamless operations without legal complications. Understanding how to correctly fill out and manage your October 2, 2024 form sets the foundation for maintaining compliance and safeguarding your interests.

Who needs to fill out this form?

The target audience for the October 2, 2024 form includes a variety of stakeholders such as independent contractors, small business owners, corporate executives, and non-profit organizations. Scenarios necessitating this form vary widely—from routine tax filings indicating income and ownership structures to specific business registrations that may require additional disclosure of financial data.

Key features of the October 2, 2024 form

Understanding its document structure is crucial for accuracy. The October 2, 2024 form typically includes essential sections covering personal details, ownership statements, income reporting, and a declaration of facts. Each section is often accompanied by specific fields that must be completed thoroughly to ensure compliance.

Common errors arise from misstatements or omissions in filling out these sections. For instance, neglecting to include pertinent facts or failing to provide supporting documents can result in delayed processing or even formal inquiries. Comprehensive reviews and checking against guidelines can help mitigate these frequent mistakes.

Step-by-step instructions for completing the form

Before diving into the completion of the October 2, 2024 form, it is essential to prepare your information accurately. Gather pertinent documents including previous filings, tax statements, and identification papers, which will facilitate a smooth process. Organization is key, so create a checklist of required pieces of information to help maintain clarity.

When filling out the form, begin with personal identification data and ensure that all fields are adequately addressed, paying special attention to financial details required in subsequent sections. Visual guides and screenshots can serve as valuable references, leading you through effectively completing each area.

Finally, reviewing your submission is vital. Utilize a checklist to verify that all sections are filled out accurately. Mistakes can have significant repercussions, hence ensure completeness before officially submitting the form.

Techniques for editing and signing the form

Using pdfFiller provides a straightforward approach to edit the October 2, 2024 form. Start by uploading the document into the platform. From there, you can modify text, input additional information, and make necessary adjustments with ease.

Among the numerous tools available, annotation features allow users to highlight important information or add personal notes directly on the document. These capabilities can enhance clarity and keep reminders visible throughout the editing process, ensuring that significant tasks or corrections are not overlooked.

After editing, eSigning your form through pdfFiller further simplifies the submission process. Step-by-step instructions guide you through adding an electronic signature. It is essential to consider legal definitions of signature authenticity, recognizing that eSignatures can carry the same weight as handwritten ones, provided they meet regulatory standards.

Managing your submitted form

Managing the submitted October 2, 2024 form includes ensuring you can track the status of your submission. pdfFiller features offer real-time progress updates, so you can easily monitor whether your documentation has been received and processed by the respective authorities.

Additionally, safeguarding your submitted form is crucial, particularly as it may contain sensitive information. It is advisable to save digital copies and back them up securely on cloud storage services. Implementing best security practices, such as using strong passwords and enabling two-factor authentication, can further enhance the safety of your information.

If you work in teams, pdfFiller facilitates collaboration so that multiple users can engage with the October 2, 2024 form. Features that support document sharing and comments can improve workflow and ensure that all necessary approvals are obtained efficiently.

Frequently asked questions about the October 2, 2024 form

Errors after submission happen, and knowing how to rectify them is key. If you realize there’s a mistake or missing information after filing your October 2, 2024 form, promptly reach out to the respective authority for guidance on how to correct these misstatements and omissions. They can provide direct instructions which may vary based on your submitter status and circumstances.

Moreover, many individuals prefer electronic submissions. Fortunately, the October 2, 2024 form can be submitted digitally through platforms like pdfFiller. Familiarize yourself with submission requirements to avoid potential rejections.

If you can't locate your form after submission, you can leverage tracking features integrated in pdfFiller to access past documents easily. It’s imperative to maintain a record of submissions to address any queries or necessary follow-ups promptly.

Real-world applications and case studies

Real-world examples highlight the pertinence of the October 2, 2024 form. For various individuals and organizations, timely and accurate submissions have facilitated compliance with local tax regulations or business operational licenses, effectively closing gaps in compliance that could lead to penalties or business disruptions.

Successful case studies often revolve around proactive planning. For instance, a small business owner after running through the consumption of resources needed to file correctly and proactively rectifying mistakes emphasized not only timely submissions but also ensuring accuracy through team collaboration, thereby reducing overall stress.

Interactive tools for enhanced form management

pdfFiller is an integral tool that equips users with features to streamline their experience with the October 2, 2024 form. Its suite of editing and management capabilities is designed for ease of use, allowing individuals to customize their documents effortlessly, ensuring a smooth filing experience.

By leveraging its cloud-based functionalities, users can access their documents anywhere, accommodating the flexibility needed in today’s fast-paced environments. Real-time collaboration features ensure everyone involved can work on the documents simultaneously, vastly improving workflow and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete of october 2 2024 online?

Can I create an electronic signature for signing my of october 2 2024 in Gmail?

How do I edit of october 2 2024 on an Android device?

What is of october 2 2024?

Who is required to file of october 2 2024?

How to fill out of october 2 2024?

What is the purpose of of october 2 2024?

What information must be reported on of october 2 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.