Get the free FP-31 District of Columbia Personal Property Tax Instructions ...

Get, Create, Make and Sign fp-31 district of columbia

Editing fp-31 district of columbia online

Uncompromising security for your PDF editing and eSignature needs

How to fill out fp-31 district of columbia

How to fill out fp-31 district of columbia

Who needs fp-31 district of columbia?

FP-31 District of Columbia Form: A Comprehensive Guide

Overview of the FP-31 District of Columbia Form

The FP-31 District of Columbia Form is an essential document for residents and businesses that need to report and pay personal property tax. Primarily issued by the Office of Tax and Revenue, this form serves as a comprehensive declaration of personal property owned by individuals or businesses within the district. The importance of filing the FP-31 cannot be overstated; timely and accurate submission helps ensure compliance with local tax laws while preventing future legal complications.

For local taxpayers, understanding the FP-31 form is vital to maintaining a good standing with the tax authorities, as it provides a transparent view of your financial responsibilities. Failure to file could result in penalties, interest charges, or even audits. Hence, it is crucial for residents and business owners alike to prioritize the completion and submission of the FP-31 form.

Eligibility for FP-31 Form

Not everyone is required to submit an FP-31 form; eligibility is primarily determined by the ownership of personal property subject to tax in the District of Columbia. Individuals who own items such as machinery, office equipment, or any other assets utilized in business operations must file. For businesses, anything from computers to vehicles used in their operations is included in this assessment.

There are specific criteria for eligibility and exemptions worth noting. For example, certain categories of personal property may be exempt from taxation, such as some non-profit organization assets or personal property with a total value below a specific threshold. Understanding these nuances is vital to avoid unnecessary filing or financial liabilities.

Key components of the FP-31 form

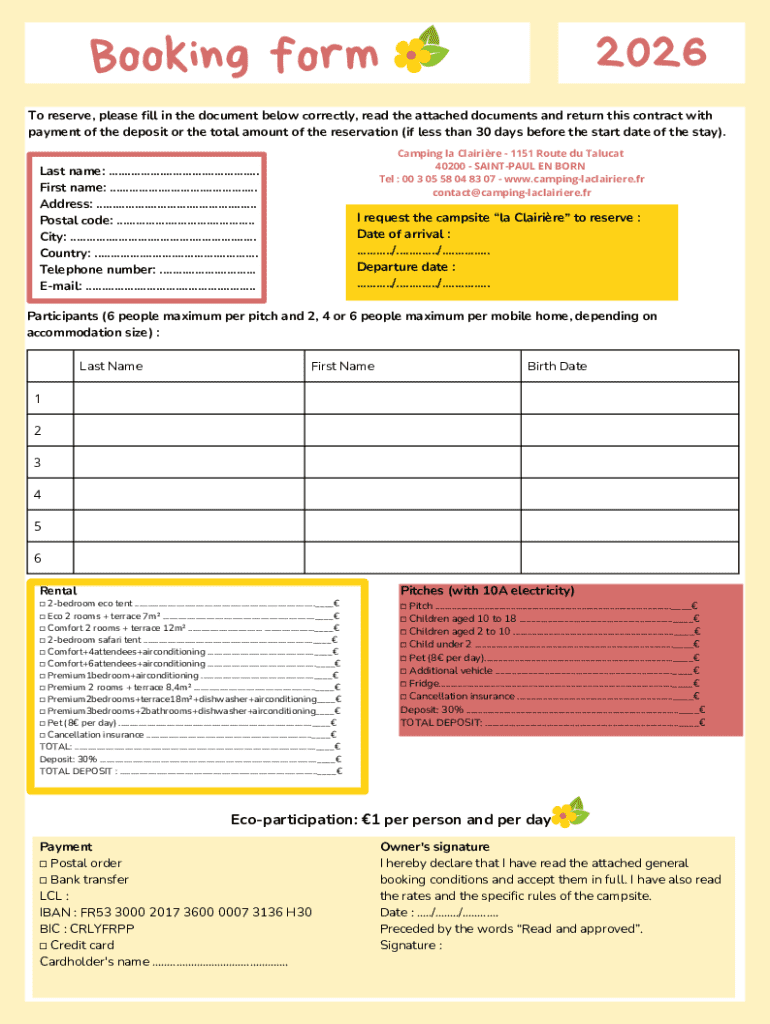

The FP-31 form consists of several critical sections that must be accurately filled out. The first section requires personal information, including your name, address, and contact details. It's essential to ensure this information reflects your current situation to prevent future miscommunication or issues with the customer service office.

Following the personal information, you will find the income reporting section, where you declare all taxable personal property. This includes machinery, office equipment, and any vehicles. It’s followed by deductions and credits, where specific personal property may qualify for tax breaks. The final part of the form includes a signature and declaration affirming the accuracy of the provided information, which is a legally binding commitment.

Step-by-step guide to filling out the FP-31 form

Completing the FP-31 form can seem daunting, but by following a structured process, it becomes manageable. The first step is gathering all necessary documents and information, such as previous tax forms, financial records, and details of personal property owned. Having this information at hand will simplify the subsequent steps.

Step 2 involves completing each section of the form. When filling out personal information, ensure accuracy; even minor mistakes can complicate the filing process. In the income reporting section, it's crucial to detail all assets correctly. Common mistakes to avoid include omitting valuable items or miscalculating their worth.

After completing the form, spend time reviewing for accuracy—this is Step 3. Double-check figures, validate personal data, and ensure all required sections are filled out to mitigate errors. Finally, Step 4 is to submit the form. You can file online, mail it, or even bring it directly to the customer service office.

Tools and resources for managing FP-31

Utilizing digital tools like pdfFiller significantly enhances the experience of managing the FP-31 District of Columbia form. For starters, pdfFiller offers robust editing capabilities for PDF forms, allowing users to fill in the FP-31 form efficiently and accurately. In addition, eSigning features expedite the submission process, eliminating the need for physical signatures.

Collaboration features enable teams to work together seamlessly, sharing the form in real-time, and collecting feedback while ensuring compliance with deadlines. Interactive tools available on the pdfFiller platform guide users through the completion process, making it simpler to navigate complex tax forms with confidence.

Common questions and troubleshooting for the FP-31 form

Many taxpayers have questions when navigating the FP-31 form. A common one is what to do if an error is made on the form. If you notice a mistake after submission, the Office of Tax and Revenue should be contacted as soon as possible. They’ll guide you through the necessary steps for correction.

Another frequent issue arises with missed filing deadlines. Timely submissions are crucial, but life happens. In such cases, immediate communication with the customer service office can often alleviate potential penalties. They may offer options for late filing or guidance based on your specific circumstances.

Filing deadlines and important dates

Filing deadlines for the FP-31 form vary and are crucial for taxpayers to understand. Typically, personal property tax returns are due by April 15 each year, although variations may apply depending on any extensions granted or special situations. Key dates include an awareness of when preliminary tax assessments are mailed and payment deadlines for taxes owed.

Consequences of missing these deadlines can be severe. Taxpayers may incur late fees, penalties, and interest charges, compounding the original tax amount due. Staying informed and proactive about these deadlines is pivotal for ensuring compliance and financial health.

Conclusion of the FP-31 filing process

Wrapping up the FP-31 filing process ensures your compliance with District of Columbia tax laws. This structured approach—from understanding the form to accurately completing and submitting it—profoundly impacts your financial situation. Utilizing tools like pdfFiller can enhance the experience tremendously, aiding users in an efficient and streamlined manner.

By leveraging electronic capabilities, taxpayers can expedite their filing process, reduce errors, and stay organized throughout their document management journey. An efficient filing process directly correlates with maintaining good standing with tax authorities, making tools like pdfFiller invaluable.

Document management after filing the FP-31

After submitting your FP-31 form, proper document management is critical. Taxpayers are advised to store copies of their submitted forms securely, along with any supporting documentation, for future reference. This ensures you have all necessary records in case of any inquiries from the customer service office.

Utilizing services like pdfFiller can help facilitate effective document management and storage. The platform offers cloud-based access to your files, ensuring that your important tax documents are available whenever needed, providing peace of mind that your sensitive information is safeguarded yet accessible.

Additional considerations for FP-31 filers

It's essential for taxpayers to remain informed about their rights and responsibilities when filing the FP-31 form. Staying updated on any changes in tax laws that impact the form ensures compliance and allows taxpayers to maximize potential deductions. Engaging with resources like tax workshops or online study materials can also bolster your understanding of relevant tax issues.

Additionally, proactive communication with tax professionals or customer service can provide tailored guidance for your particular situation. Collecting feedback from prior experiences with the FP-31 form can enhance your future filing endeavors, ensuring you approach tax season with confidence and clarity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute fp-31 district of columbia online?

How do I make changes in fp-31 district of columbia?

Can I create an electronic signature for the fp-31 district of columbia in Chrome?

What is fp-31 district of columbia?

Who is required to file fp-31 district of columbia?

How to fill out fp-31 district of columbia?

What is the purpose of fp-31 district of columbia?

What information must be reported on fp-31 district of columbia?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.