Get the free Worksheets for Tax Credits - 2024Maine Revenue Services

Get, Create, Make and Sign worksheets for tax credits

How to edit worksheets for tax credits online

Uncompromising security for your PDF editing and eSignature needs

How to fill out worksheets for tax credits

How to fill out worksheets for tax credits

Who needs worksheets for tax credits?

Worksheets for Tax Credits Form: A Comprehensive Guide

Overview of tax credits

Tax credits directly reduce the amount of tax owed to the government, providing significant financial relief for both individuals and businesses. Unlike tax deductions, which reduce taxable income, tax credits offer a dollar-for-dollar reduction in tax liability. This makes them incredibly valuable, especially for those looking to maximize their tax returns. Many individuals and businesses often overlook available tax credits, which can lead to missed opportunities for savings.

Utilizing the right tax credits can make a considerable difference when filing taxes, potentially resulting in substantial savings. Some well-known tax credits include the Earned Income Tax Credit (EITC), Child Tax Credit, and various business incentives like the Research and Development (R&D) Tax Credit. Understanding available credits is crucial and can empower taxpayers to make informed financial decisions.

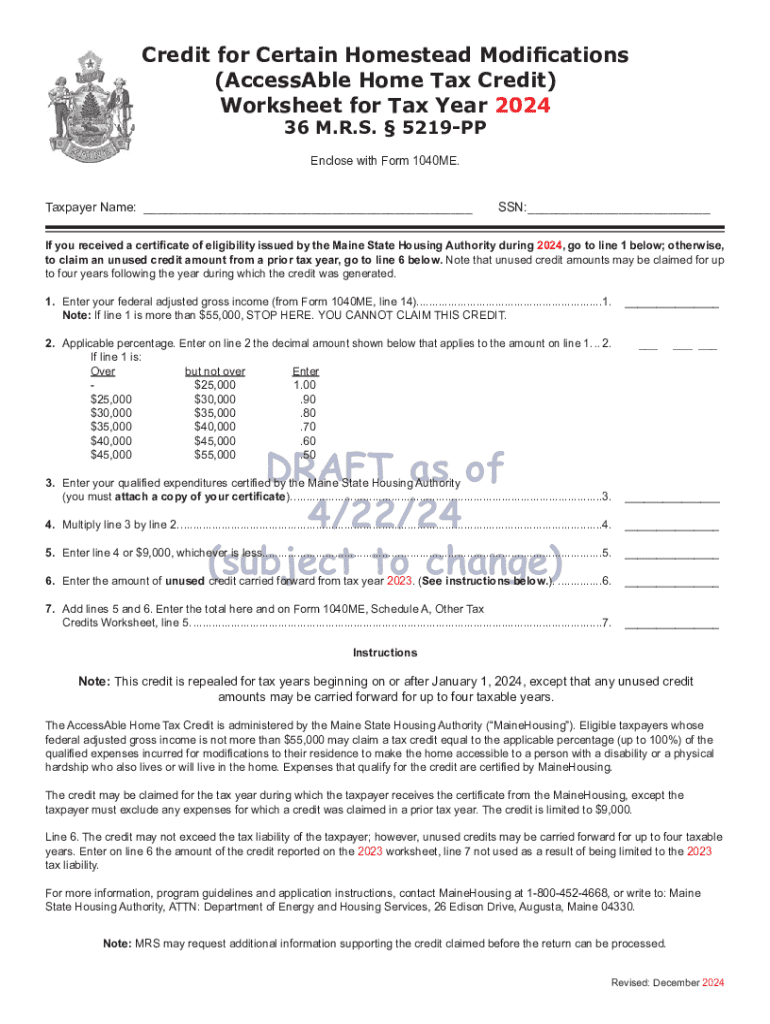

Worksheets for tax credits form

Worksheets for tax credits form serve as essential tools in the tax credit application process. They help ensure that individuals and businesses accurately determine their eligibility and potentially maximize their benefits. By breaking down complicated calculations into manageable steps, these worksheets simplify the overall process and increase the likelihood of securing tax credits.

Various worksheets are tailored to specific tax credits, enabling users to navigate their financial situations efficiently. These include individual tax credits worksheets, which simplify household financial scenarios, as well as business tax credits worksheets that account for corporate financial structures. Knowing which worksheet to use and how to fill it out can be the difference between receiving credits or leaving money on the table.

Key tax credits and their worksheets

Many tax credits are available to different taxpayers; here’s a closer look at essential individual and business tax credits along with their corresponding worksheets.

Common individual tax credits

The Earned Income Tax Credit (EITC) is one of the most significant tax credits available for individuals, particularly those with lower income levels. To be eligible, taxpayers must meet specific income limits, and they must have worked at least part-time during the tax year. The EITC worksheet helps individuals calculate their potential credit based on income, filing status, and the number of children.

Child tax credit

The Child Tax Credit affords families financial relief for each qualifying child under the age of 17. To claim the credit, the taxpayer must provide the child’s Social Security number and meet income thresholds. The corresponding worksheet offers streamlined calculations to determine eligibility and the credit amount, highlighting how many children can be claimed.

Education tax credits

Taxpayers may be eligible for education credits such as the American Opportunity Credit or the Lifetime Learning Credit. Each credit has different requirements concerning tuition paid and the level of education. Relevant worksheets guide taxpayers in identifying which education expenses qualify, ensuring educational costs are optimized for tax benefits.

Business tax credits

Business owners have access to several tax credits designed to stimulate economic growth and reward specific industries. The Research and Development (R&D) Tax Credit is notable as it incentivizes innovation by allowing businesses to reduce tax liabilities from qualified research activities. The R&D credit worksheet provides detailed criteria for eligibility and calculations for the credit.

Work opportunity tax credit

The Work Opportunity Tax Credit is aimed at encouraging the hiring of individuals from specific target groups. Employers claiming this credit must complete a dedicated worksheet that captures employee information, relevant demographics, and employment details. Understanding how to fill out this worksheet can lead to significant savings.

How to fill out worksheets effectively

Filling out tax credit worksheets requires careful attention to detail and understanding of specific requirements. Begin by gathering essential documents such as income statements, identification numbers, and details of applicable expenses. For each worksheet, follow guidelines meticulously, ensuring that calculations are precise and based on up-to-date tax laws.

Common mistakes include incorrect calculations, misreported income, and failure to submit all required documentation. To enhance accuracy, it’s advisable to leverage tools like pdfFiller, which allow for efficient PDF editing and ensuring that all forms are filled out correctly before submission. Familiarize yourself with the language used in tax worksheets to avoid unnecessary errors.

Tools for managing tax credit worksheets

Managing tax credit worksheets effectively can be challenging, but using versatile tools like pdfFiller significantly simplifies the process. pdfFiller provides an all-in-one cloud-based platform that enables users to edit PDFs, eSign documents, and collaborate with team members seamlessly. This efficient document management solution ensures that users can handle tax documents and worksheets from any location.

Features like editing PDFs, eSigning capabilities, and cloud-based access empower users to create professional forms without the need for complicated software. The collaborative features offered by pdfFiller allow teams to work together on tax worksheets, ensuring clarity and accuracy in their submissions, while the document reader ensures that users can easily access their files at any time.

Frequently asked questions (FAQs)

Common concerns arise when dealing with tax credit worksheets, particularly regarding mistakes and document management.

Additional insights and best practices

To maximize tax credits, utilize worksheets wisely by keeping comprehensive records throughout the year. Logging eligible expenses and maintaining income statements can streamline the tax filing process and may increase the credits received. Statistics indicate that individuals who utilize worksheets are more likely to take full advantage of available credits.

Timing can influence credit claims as certain credits have deadlines. Taxpayers should be aware of recent changes to programs, such as the pine tree development zone tax credit and credits related to the rehabilitation of historic properties, to ensure they are maximizing savings.

Interactive tools and resources

Accessing the right resources for filling out worksheets can make significant differences in outcomes. Downloadable worksheets and interactive calculators can estimate credits based on your financial situation. Utilize tutorials provided by pdfFiller to guide you step-by-step during the filling out process, ensuring you understand each section and its requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in worksheets for tax credits?

Can I create an eSignature for the worksheets for tax credits in Gmail?

How do I fill out worksheets for tax credits using my mobile device?

What is worksheets for tax credits?

Who is required to file worksheets for tax credits?

How to fill out worksheets for tax credits?

What is the purpose of worksheets for tax credits?

What information must be reported on worksheets for tax credits?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.