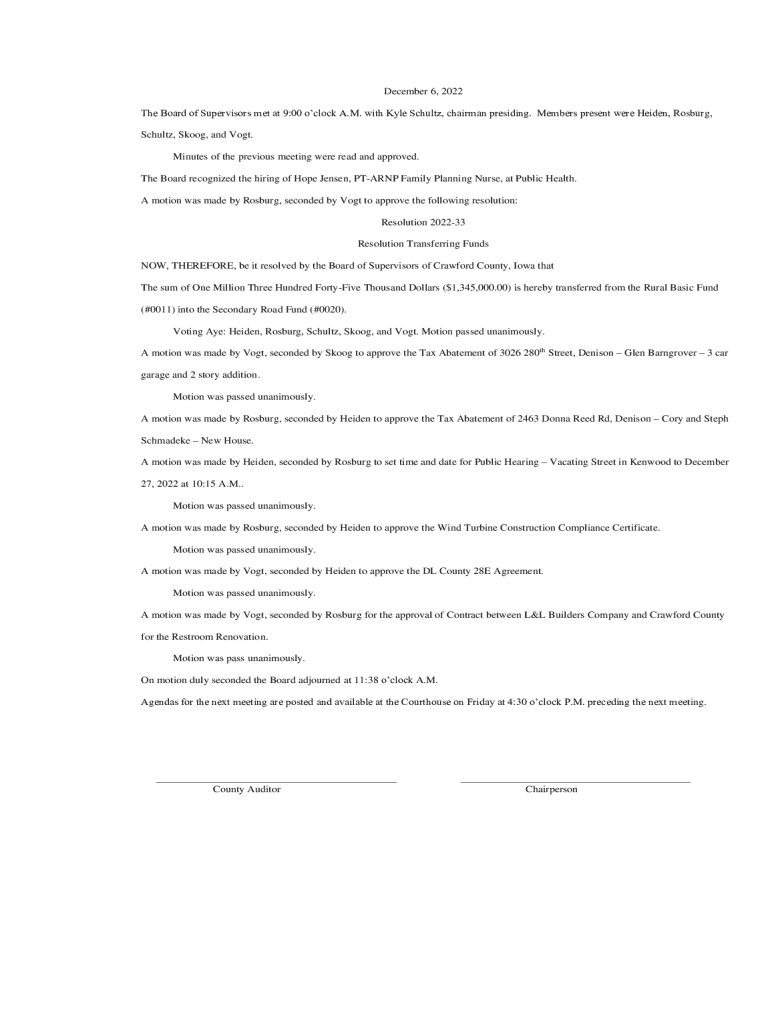

Get the free May 17, 2022 The Board of Supervisors met at 9:00 o'clock ...

Get, Create, Make and Sign may 17 2022 form

Editing may 17 2022 form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out may 17 2022 form

How to fill out may 17 2022 form

Who needs may 17 2022 form?

Everything You Need to Know About the May 17 2022 Form

Understanding the May 17 2022 form: What you need to know

The May 17 2022 Form is crucial for individuals and businesses alike as it serves as a record for various tax-related submissions. This form is primarily tied to the tax return filings in the United States, specifically targeting those claiming benefits such as tax credit payments, or reporting income from a side business. Understanding its purpose can demystify the filing process and help avoid costly mistakes.

Who is required to file this form? Generally, individuals and entities with taxable income or benefits fall under the filing requirement. This includes freelancers, small business owners, and any professional services that earn income. Furthermore, the form will be applicable to various situations in which taxpayers wish to document their deductions or credits.

Key deadlines for filing the May 17 2022 Form should be at the forefront of every taxpayer's mind. Be aware that the original deadline should be strictly adhered to in order to avoid penalties. Moreover, those who apply for extensions should familiarize themselves with the extended timelines.

Preparing to fill out the May 17 2022 form

Before you sit down to complete the May 17 2022 Form, it's essential to gather all the necessary documents. You’ll need your social security number, previous tax returns, income statements such as W-2s and 1099s, and any documentation related to your deductions. These documents form the basis of your tax return and ensure that every figure you enter is backed by evidence.

Common pitfalls to avoid include overlooking certain deductions or failing to report all your income. Many taxpayers underreport income from side businesses due to a lack of clear documentation, which can lead to discrepancies that the IRS flags when processing your paperwork.

Step-by-step guide to completing the May 17 2022 form

Completing the May 17 2022 Form can be straightforward if you break it down into manageable steps.

Step 1: Personal information section

In the personal information section, ensure you enter your full legal name and social security number as they appear on your identification documents. This information is critical as it ties your filing to your identity in the IRS database. Many filers mistakenly transpose their social security numbers or misspell their names, which can lead to complications.

Step 2: Financial information

When reporting financial information, accuracy is paramount. Make sure to include all sources of income, including salaries, freelance earnings, and interest from savings accounts. Each type of income should be documented, such as W-2 forms for employment and 1099 forms for side business earnings.

Step 3: Deductions and credits

In this section, list your itemized deductions or the standard deduction, whichever benefits you more. Don’t forget to claim any tax credits applicable to your situation. For example, educational tax credits can significantly reduce your tax liability. Keeping copies of relevant receipts and records is crucial in case of future audits.

Step 4: Final review and submission

Finally, before submission, conduct a thorough review of the entire form. Double-check all figures, ensuring that income and deductions balances out correctly. Submissions can be done either by mailing the completed form or using electronic filing (e-filing) for quicker processing—each method has its benefits depending on your preference.

Editing and managing your May 17 2022 form

Utilizing pdfFiller ensures an easy editing experience when dealing with the May 17 2022 Form. Their platform offers a variety of features, including drag-and-drop functionality and the ability to annotate or highlight sections requiring attention. With pdfFiller, users can effectively manage their forms without the hassle of traditional paperwork.

Collaboration options are also available through the platform. Users can share forms with tax professionals, making the review process seamless. This feature allows tax professionals to access your completed form, suggest edits, or even finalize submissions while ensuring your information remains confidential.

eSigning the May 17 2022 form: A quick how-to

Electronic signatures are gaining popularity due to their ease and ability to speed up the signing process. To add your eSignature using pdfFiller, simply navigate to the signature field in the form, choose to create a new eSignature or import an existing one, and place it accordingly.

The legal validity of eSignatures is widely accepted, provided they comply with applicable laws. To ensure full compliance, familiarize yourself with your state's regulations regarding eSignatures, especially if you are signing on behalf of a business.

Troubleshooting common issues with the May 17 2022 form

It’s not uncommon to encounter issues when filing the May 17 2022 Form. Commonly asked questions often center around how to rectify errors during submission, such as mismatched information with the IRS records or missing documents. If you find yourself in this situation, promptly address the discrepancies and ensure that all required fields are correctly filled out.

For those who experience rejections or requests for additional information from the IRS, it's imperative to act quickly. Review the communication from the IRS carefully to understand what is needed, and consider contacting a tax professional if you're unsure how to respond.

Resources for further assistance with the May 17 2022 form

Numerous resources are available to help during the filing process. Official IRS websites offer detailed guides and instructional materials that can clarify common uncertainties. Moreover, taxpayer assistance contact information is readily accessible for personalized help regarding the filing process.

User testimonials reflect the experiences of others who successfully navigated the complexities of the May 17 2022 Form. These accounts can provide valuable insights into the practicality of various strategies employed during their tax filing.

Interactive tools to enhance your form-filling experience

pdfFiller provides interactive features specifically designed to enhance your experience with the May 17 2022 Form. Templates are readily available to help streamline your filing process, ensuring that you're not starting from scratch. Guided walkthroughs are another excellent feature that assists you in navigating the form accurately.

Incorporating these tools into your filing process can significantly improve accuracy and ease. Users can find themselves saving time on revisions, ensuring that all information is properly documented beforehand.

Updates and changes to the May 17 2022 form

Staying informed of updates to the May 17 2022 Form is essential for all filers. This particular year saw several updates that reflect changes in regulations, which could influence tax outcomes. For example, changes in tax rates or deductions could affect how individuals approach their filings.

A comparison with previous year’s forms can help users understand what's new. Continued education on these updates through newsletters or subscriptions keeps taxpayers well-informed and prepared for future changes.

Related forms and templates

Understanding related forms can also aid in the successful completion of the May 17 2022 Form. For instance, documents such as 1040s and various state forms may provide context or additional information required for accurate reporting. Familiarity with these forms can streamline submissions across taxes.

pdfFiller offers links to other relevant templates that can simplify your overall filing process. Moreover, integration tips for efficiently managing multiple forms through your pdfFiller account can enhance productivity.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit may 17 2022 form from Google Drive?

Can I create an electronic signature for signing my may 17 2022 form in Gmail?

How do I edit may 17 2022 form on an Android device?

What is may 17 2022 form?

Who is required to file may 17 2022 form?

How to fill out may 17 2022 form?

What is the purpose of may 17 2022 form?

What information must be reported on may 17 2022 form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.