Get the free Treasury Securities Auctions Data

Get, Create, Make and Sign treasury securities auctions data

Editing treasury securities auctions data online

Uncompromising security for your PDF editing and eSignature needs

How to fill out treasury securities auctions data

How to fill out treasury securities auctions data

Who needs treasury securities auctions data?

Understanding Treasury Securities Auctions Data Form

Understanding treasury securities auctions

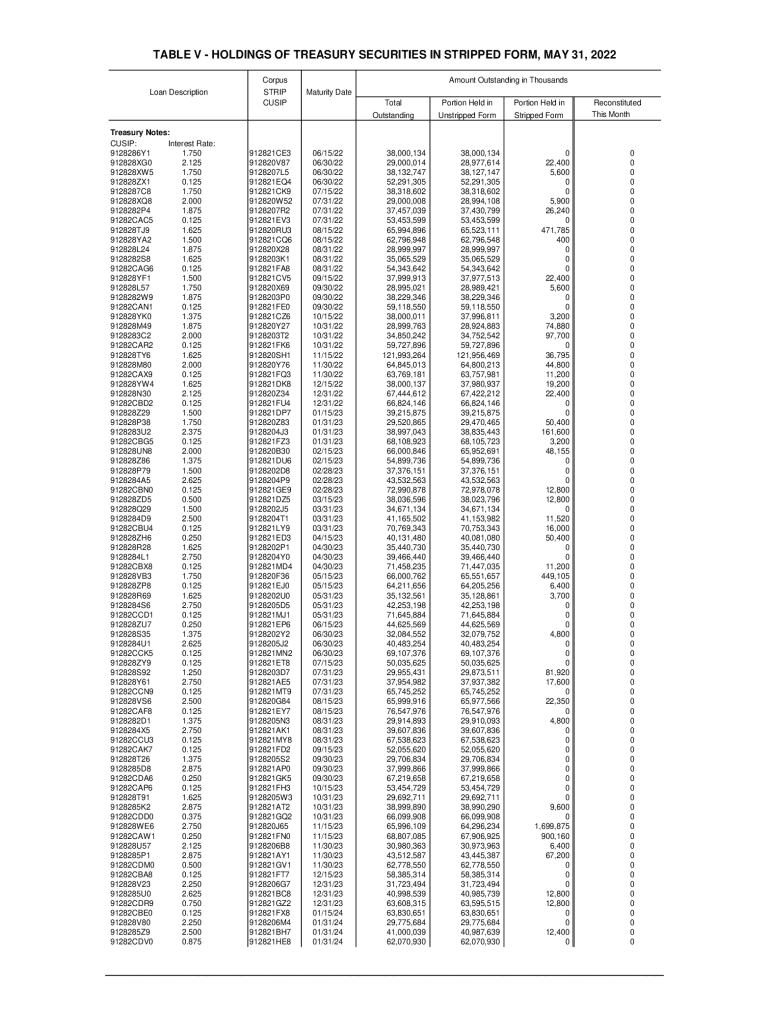

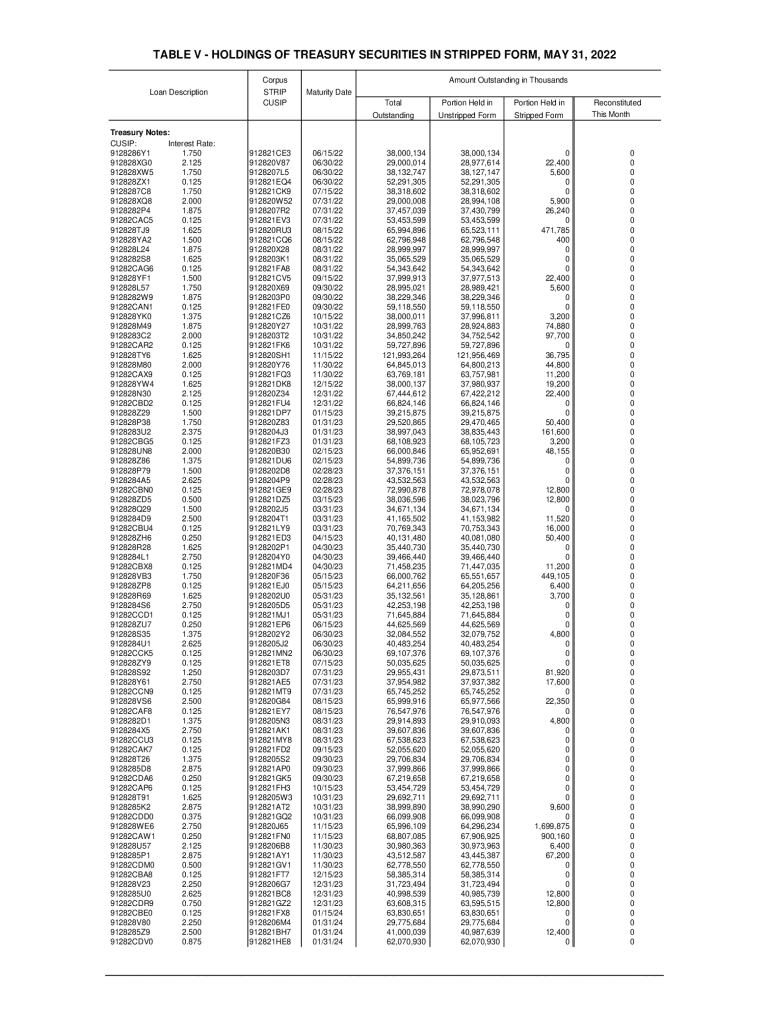

Treasury securities play a crucial role in the financial system, serving as debt obligations issued by the U.S. Department of the Treasury. These instruments are essential not only for funding government operations but also for influencing monetary policy, offering investors a safe, low-risk investment option. The primary types of Treasury securities include Treasury bills (T-bills), Treasury notes (T-notes), and Treasury bonds (T-bonds), each differing in their maturities and yield structures.

The auction process is integral to the issuance of these securities. By selling Treasury securities through auctions, the government raises funds efficiently and transparently. Auctions allow the Treasury to gauge market conditions, manage the debt effectively, and maintain liquidity in the financial markets. Each auction is carefully structured to ensure that it meets the demands of various investors, from individuals to institutional buyers.

Importance of treasury securities auction data

Auction data is critical for both investors and analysts as it provides insight into market conditions and investor sentiment. Key metrics, such as the bid-to-cover ratio, yield rates, and the dynamics of demand and supply, can significantly influence investment strategies and financial planning. Monitoring these metrics post-auction enables participants to understand how much interest there is in a particular security and how this interest might affect future pricing.

For example, a high bid-to-cover ratio indicates strong demand, suggesting that the auction was successful and potentially leading to price increases. Conversely, low demand reflected in lower coverage ratios can indicate market doubts around the economic outlook, potentially leading to rising yields. Overall, understanding auction data enables more informed decisions by highlighting the trends and shifts within the financial landscape.

The treasury securities auction process

The Treasury securities auction process can be broken down into several key steps. Initially, the Treasury issues an auction announcement detailing the type of securities to be sold, the amount, and the bidding details. Interested bidders can then submit either competitive or non-competitive bids. Competitive bidders specify the yield they are willing to accept, while non-competitive bidders accept whatever yield is determined in the auction and are guaranteed to receive the amount of securities they bid for.

Once the bidding period closes, the Treasury evaluates the bids and allocates securities based on the submitted orders and specified yields. The results are then published, including the total amount sold, the average yield, and the bid-to-cover ratio. Staying informed about upcoming auctions is crucial, and many financial platforms provide updated auction schedules and notifications for interested investors.

Accessing treasury securities auctions data

Accessing accurate and timely auction data is essential for effectively participating in Treasury securities auctions. Official sources such as the U.S. Department of the Treasury's website provide detailed auction results and historical data. Key sections to navigate include the auction calendar, where upcoming auctions are listed, and past auction results, which offer insights into trends over time.

Using pdfFiller, users can enhance their experience by not only accessing but also organizing and analyzing auction data with customized forms. The platform allows for easy integration of these results into personal databases or reporting tools, facilitating better decision-making processes.

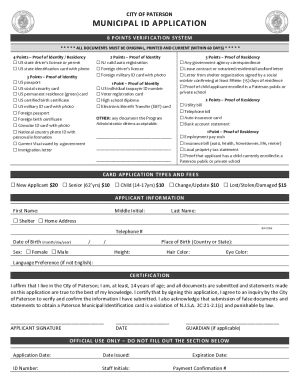

Filling out the treasury securities auctions data form

Completing the treasury securities auctions data form requires careful attention to detail. The form typically includes sections for personal information such as name, contact details, and taxpayer identification number. Additionally, bidders must specify the bid amount, the type of bid (competitive or non-competitive), and their bidding strategy. It's important to check if any documentation, such as proof of funds or previous investment experience, is required before submission.

Common mistakes to avoid include entering incorrect information, misunderstanding bid types, or failing to provide required documentation. By ensuring accuracy and compliance, bidders can facilitate a smoother bidding process and improve their chances of a successful auction outcome.

Editing and customizing your treasury data form

With pdfFiller, users can easily edit and customize their treasury securities auctions data form. The platform provides various tools to modify pre-filled data or templates, allowing for seamless adjustments as situations change. The process involves uploading the form, making the necessary changes directly in the interface, and ensuring that all newly added information is accurate and up to date.

Furthermore, pdfFiller offers a range of saving and exporting options. Once completed and corrected, users can export the form in different formats or save it directly to their cloud storage, ensuring easy access and compliance with record-keeping requirements.

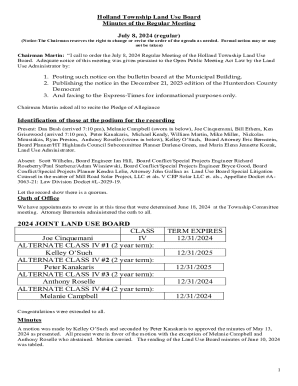

Signing and submitting your auction form

Submitting the treasury securities auctions data form involves various eSignature options, which are not only legally valid but also add convenience to the submission process. Users can sign documents electronically using pdfFiller’s signature tool, which guides them through the steps of creating a signature that meets accepted legal standards.

Moreover, pdfFiller facilitates collaboration by allowing users to invite others to review and sign the form before submission. This streamlined process ensures that all necessary parties are involved, reducing the chance of errors or omissions. Submissions can be made electronically or through traditional paper methods, depending on the user’s preference.

Managing your treasury securities auction documents

Efficiently organizing and managing treasury securities auction documents is vital for both compliance and future reference. Establishing a solid retention policy that dictates how long each document should be kept is important for audit readiness and regulatory compliance. Most financial institutions recommend retaining auction data forms and results for a minimum of several years or until legally specified.

Best practices include categorizing documents by auction date, type of security, and outcomes. This systematic approach enables quick retrieval of information and supports effective analysis of past auction performances, vital for decision-making in future bids.

Interactive tools for auction participants

Interactive tools and calculators can enhance your participation in treasury auctions. Platforms like pdfFiller offer various analytical tools that allow users to simulate different bidding scenarios based on historical data and current market trends. These tools help investors visualize potential outcomes, assess their bidding strategies, and weigh the risks associated with different approaches.

By leveraging these resources, participants can craft a more informed and responsive auction strategy. Data visualizations and detailed reports from auction analyses further empower investors, allowing them to make decisions based on empirical evidence rather than conjecture, ultimately optimizing investment strategies.

Connecting with treasury auction experts

Engaging with treasury auction experts can provide invaluable insights for prospective and current investors. Resources like the Treasury Direct website offer contact information for inquiries and support regarding auctions. Continuous education resources, such as webinars and forums tailored for treasury securities, are also advantageous for deepening understanding of market dynamics.

Networking opportunities abound in various professional forums and community discussions, where industry experts share knowledge and experiences. Engaging with these platforms ensures that you remain informed about best practices, trends, and strategic insights related to treasury auctions.

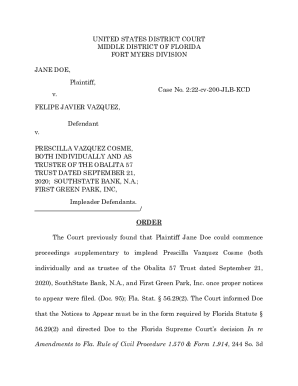

Legal information pertaining to treasury auctions

Before participating in treasury auctions, understanding the legal framework is crucial. Regulations govern how auctions are conducted, including compliance protocols for bidders and the responsibilities associated with submitting a treasury securities auctions data form. Investors must familiarize themselves with these terms and the legal implications of their bidding strategies.

Additionally, recognizing your rights and responsibilities as a bidder is vital for a smooth auction experience. This knowledge includes understanding the consequences of missed obligations or errors in documentation, which can impact future bidding opportunities and access to Treasury securities.

Related forms and resources

In addition to the treasury securities auctions data form, several other forms may be relevant depending on your investment strategy and needs. These can include forms relating to different types of marketable securities, each with specific requirements and layouts.

Leveraging pdfFiller's platform makes navigating between related forms easy, as they offer comprehensive databases and intuitive search capabilities. This streamlining permits users to access all necessary forms without extensive searching, thereby saving time and ensuring all documentation is consolidated in one place.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit treasury securities auctions data from Google Drive?

How can I get treasury securities auctions data?

How do I edit treasury securities auctions data straight from my smartphone?

What is treasury securities auctions data?

Who is required to file treasury securities auctions data?

How to fill out treasury securities auctions data?

What is the purpose of treasury securities auctions data?

What information must be reported on treasury securities auctions data?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.