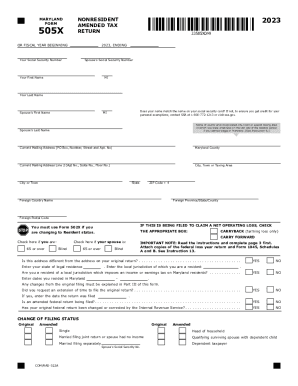

MD Comptroller 505X 2024-2025 free printable template

Get, Create, Make and Sign MD Comptroller 505X

Editing MD Comptroller 505X online

Uncompromising security for your PDF editing and eSignature needs

MD Comptroller 505X Form Versions

How to fill out MD Comptroller 505X

How to fill out 2024 maryland form 505x

Who needs 2024 maryland form 505x?

2024 Maryland Form 505X: A Complete Guide to Amending Your Tax Returns

Understanding Form 505X

Form 505X is designated for Maryland residents looking to amend their personal income tax returns. This form serves a crucial function by allowing taxpayers to correct errors or omissions from previously filed returns, which may affect their tax liability. By filing Form 505X, you can ensure that your tax records are accurate and up-to-date, thereby avoiding potential penalties from the Maryland Comptroller's Office or problems in the future.

Taxpayers who should consider using Form 505X are those who discover inaccuracies in their filed returns. Common examples include changes in income due to late received W-2s or 1099s, overlooked deductions, or previously unreported income. This form becomes necessary when tax errors might affect your taxable income, give rise to a refund, or require additional payment.

Preparing to File Form 505X

Before diving into the filing process, it's essential to gather the necessary information for completing the 2024 Maryland Form 505X. Start by having personal details on hand, including your Social Security Number (SSN) and current address, which are needed to identify your tax records accurately. You also need relevant tax documents from your original filing, such as your W-2s, 1099s, and any other income statements that influenced your previous return.

In addition to this personal information, you must include specific details from your original return. This includes amounts reported for income, deductions taken, and the original filing date. The accuracy of this information is critical, as it directly influences the outcome of your amendment.

Step-by-step instructions to complete Form 505X

Completing Form 505X involves several key sections, starting with the header section where you'll fill out your personal information. It’s crucial to ensure that all the details match your original tax documents for a smooth processing experience. Missing or incorrect information here can lead to delays or rejected amendments.

In the amendments section, you'll detail the corrections you are making to your previous return. This includes providing the new amounts for income, deductions, and any adjustments due to errors found. For clarity, utilize examples of common amendments, such as rectifying reported income or adjusting your filing status.

Finally, do not forget to sign the form as it holds legal implications. Your signature confirms that the information provided is accurate. Remember, submitting false information or omitting facts can lead to severe penalties.

Submitting your amended return

When it comes to submitting your completed 2024 Maryland Form 505X, you have options. Electronic submission is available through the Maryland Comptroller's e-file system, which is often faster and more efficient than traditional forms of mailing. Using pdfFiller, you can quickly fill out the form electronically and submit it with ease.

If you prefer to mail your amendment, ensure it’s sent to the correct address and consider using certified mail for tracking purposes. Additionally, it’s important to be aware of filing deadlines for your amended return to avoid complications. Typically, you can file amendments up to three years after your original filing deadline.

After filing Form 505X

After your Form 505X has been submitted, monitoring the status of your amendment is vital. You can track your amended return through the Maryland Comptroller's website; they provide an online service that allows taxpayers to see the current status of their filings. This can give you peace of mind, knowing where your amendment stands.

In the event that the tax authority requires additional information, be responsive and submit the requested documentation promptly. pdfFiller can assist in managing this process by providing a secure platform for document sharing and tracking, ensuring you remain organized throughout.

Frequently asked questions

Regarding the common queries about Form 505X, many taxpayers wonder what errors can be amended. You can rectify errors such as misreported income, missed deductions, or even procedural mistakes in your original filing. However, you can’t combine amendments for multiple years on a single Form 505X; each year requires its own form for submission.

If you’re uncertain about the filing process or whether an amendment is necessary, it's wise to consult a tax professional or utilize resources available through pdfFiller for assistance with form completion.

Leveraging pdfFiller for document management

Using pdfFiller for filing the 2024 Maryland Form 505X streamlines the entire process. Its cloud-based platform offers various interactive features, allowing users to fill out forms efficiently, eSign documents securely, and collaborate seamlessly. This is particularly beneficial for individuals and teams handling multiple tax documents, as it organizes all necessary paperwork in one easy-access location.

Businesses can also benefit from pdfFiller's collaborative features, allowing team members to access, edit, and share documents securely. This ensures that everyone is on the same page, reducing errors and streamlining the amendment process.

Conclusion on completing Form 505X efficiently

Filing the 2024 Maryland Form 505X doesn’t have to be a daunting task. Utilizing tools like pdfFiller can make the process not only manageable but efficient. By following the outlined steps and leveraging the resources available through pdfFiller, you can amend your tax returns with confidence, ensuring that your records remain accurate and compliant.

Remember, accurate filing protects you from potential issues with the Maryland Comptroller and ensures that you maintain good standing with your tax obligations moving forward.

People Also Ask about

How to calculate tax?

Is Maryland tax friendly?

What is Maryland tax rate 2022?

Are Maryland taxes too high?

How do you calculate Maryland sales tax?

What are Maryland taxes on $30000?

How much federal tax do I pay on $33000?

How much do I pay in taxes for $30000?

What are the taxes like in Maryland?

What is the most tax friendly state?

How much is tax in Maryland?

What is the state income tax for Maryland?

What is Maryland State tax 2022?

What is the Maryland state tax rate for 2022?

What will the 2022 tax rates be?

How much tax is on a dollar in Maryland?

What percentage does Maryland take out for taxes?

What is the Maryland standard deduction for 2022?

Is Maryland a good tax state?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit MD Comptroller 505X in Chrome?

How do I edit MD Comptroller 505X on an iOS device?

Can I edit MD Comptroller 505X on an Android device?

What is 2024 Maryland Form 505X?

Who is required to file 2024 Maryland Form 505X?

How to fill out 2024 Maryland Form 505X?

What is the purpose of 2024 Maryland Form 505X?

What information must be reported on 2024 Maryland Form 505X?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.