Get the free Indian bank new account opening form: Fill out & sign online

Get, Create, Make and Sign indian bank new account

Editing indian bank new account online

Uncompromising security for your PDF editing and eSignature needs

How to fill out indian bank new account

How to fill out indian bank new account

Who needs indian bank new account?

Guide to the Indian Bank New Account Form: A Comprehensive Overview

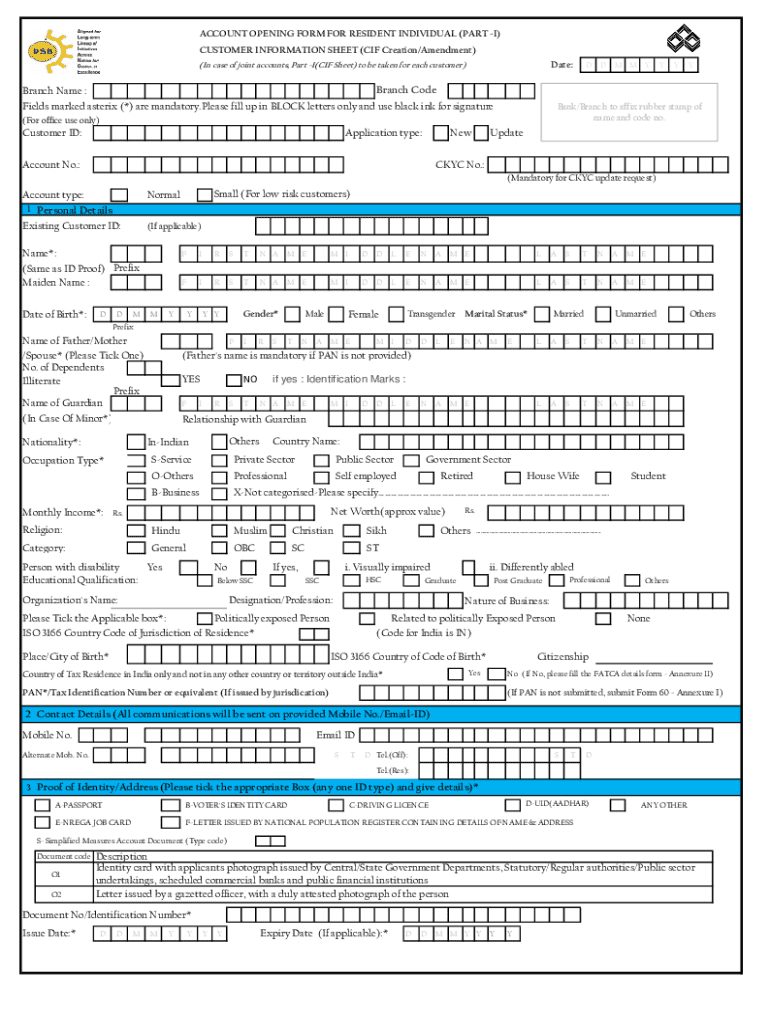

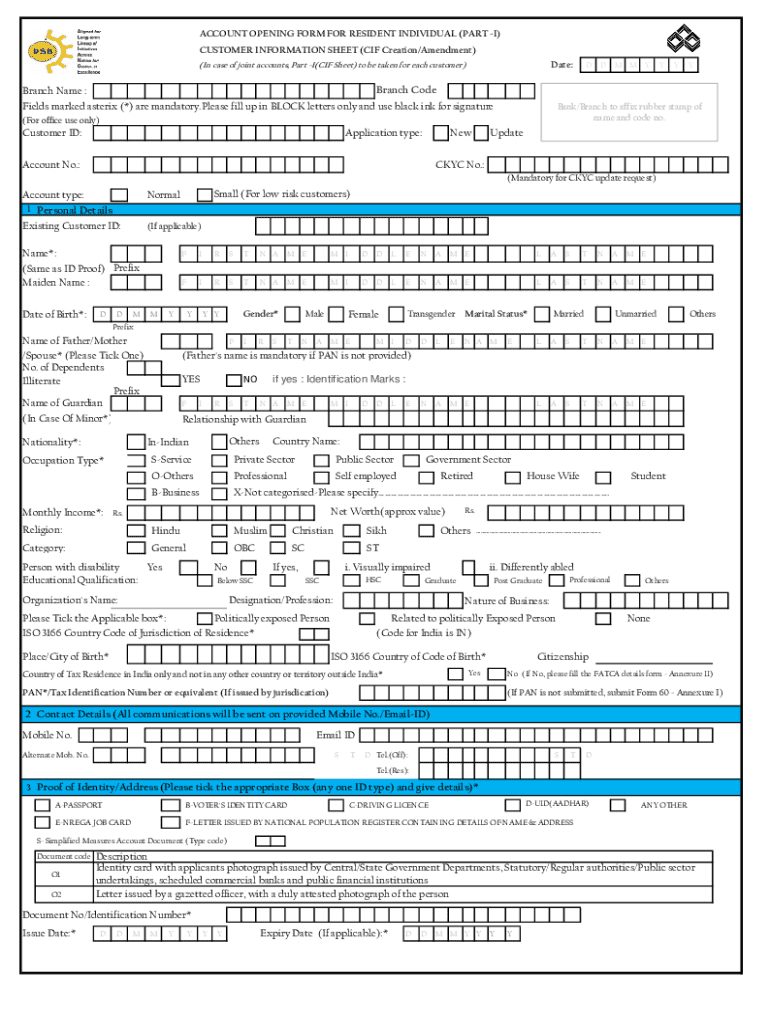

Understanding the Indian Bank New Account Form

The Indian Bank New Account Form is a critical document for anyone wishing to open a bank account in India. This form serves as the official application to initiate your banking journey with Indian Bank, one of the country's leading public sector banks.

Having a bank account in India offers numerous benefits, such as secure savings, easy access to funds, and eligibility for various banking services. It's essential for conducting everyday transactions, contributing to financial stability, and building a credit history. The ease of online transfers, bill payments, and access to loans are additional advantages that contribute to enhancing the financial management of individuals and businesses alike.

Eligibility criteria for opening an account

Before filling out the Indian Bank New Account Form, it's vital to ensure that you meet the eligibility criteria, which are designed to verify the identity and legitimacy of applicants.

### Who can open an account?

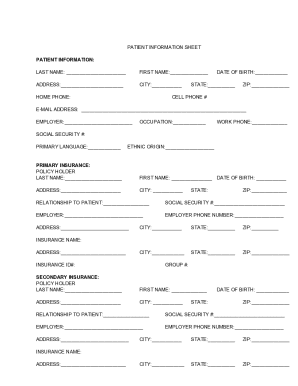

Documentation required

To complete the Indian Bank New Account Form, you need to provide specific documentation, which includes proofs of identity and address.

Types of accounts offered by Indian Bank

Indian Bank provides a diversified range of account options to cater to various customer needs. Understanding these account types will aid in choosing the one that fits your financial goals.

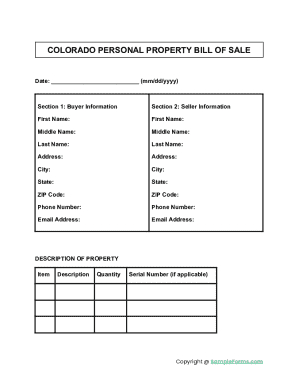

Step-by-step guide to filling out the Indian Bank New Account Form

Filling out the Indian Bank New Account Form is a systematic process. Follow these steps to ensure a smooth application experience.

### Step 1: Accessing the form

### Step 2: Filling in personal information

### Step 3: Providing KYC information

### Step 4: Specifying account preferences

### Step 5: Review and verification of information

Finally, review all the entered information carefully to ensure accuracy before submission.

Tips for successfully completing the form

While filling out the Indian Bank New Account Form may seem straightforward, common pitfalls can arise. Here are some tips to enhance your experience.

Submitting the Indian Bank New Account Form

Once completed, the next step involves submitting your Indian Bank New Account Form. Understanding the submission process is crucial for a hassle-free experience.

### Where to submit the form?

### Understanding the submission process and timeline

After submission, staff will review your documents and form. Ensure you ask for the tracking details and understand the anticipated timeline for account activation, which varies from one to five business days.

What to expect after submission

Upon submitting your Indian Bank New Account Form, several processes kick in. You must be prepared for the verification stages that will follow.

Frequently asked questions (FAQs) regarding the Indian Bank New Account Form

Addressing common queries about the Indian Bank New Account Form can aid new customers in making informed decisions.

Advantages of using pdfFiller for your banking forms

pdfFiller streamlines the process of filling out banking forms like the Indian Bank New Account Form. Here’s why it’s beneficial.

Interactive tools and resources

Leveraging interactive tools and resources can greatly enhance your banking experience. Here’s what you have access to.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send indian bank new account for eSignature?

How do I make changes in indian bank new account?

How do I make edits in indian bank new account without leaving Chrome?

What is indian bank new account?

Who is required to file indian bank new account?

How to fill out indian bank new account?

What is the purpose of indian bank new account?

What information must be reported on indian bank new account?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.