Get the free INFORMATION RETURN OF NOT OWNED PERSONAL ... - forms in

Get, Create, Make and Sign information return of not

How to edit information return of not online

Uncompromising security for your PDF editing and eSignature needs

How to fill out information return of not

How to fill out information return of not

Who needs information return of not?

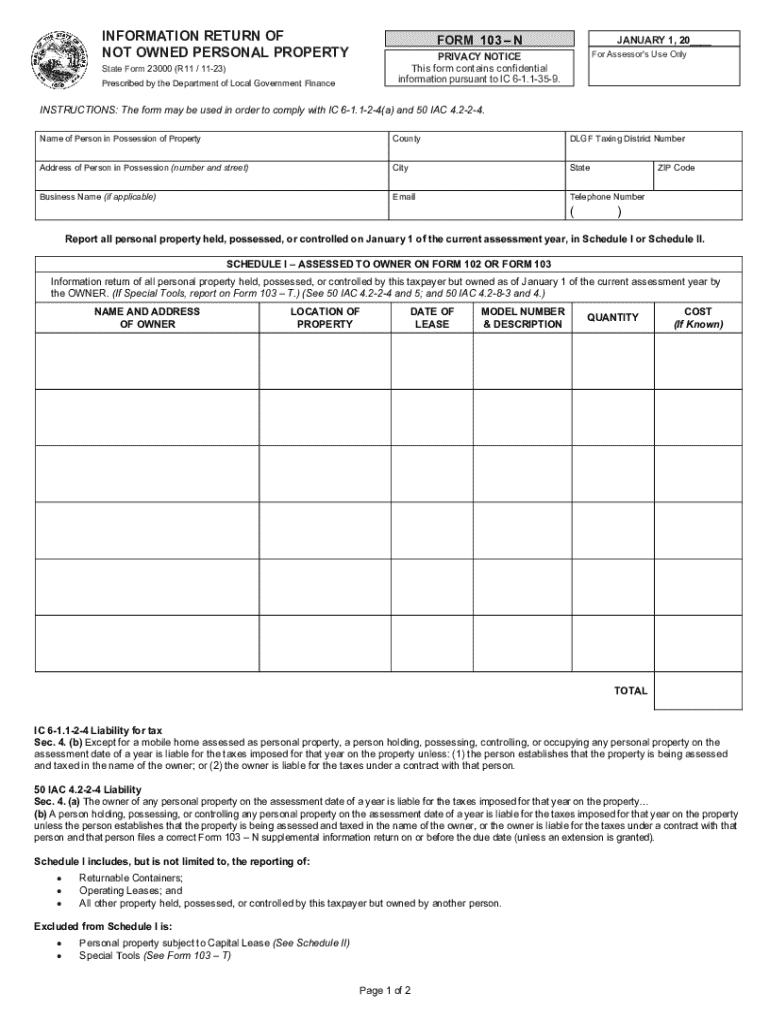

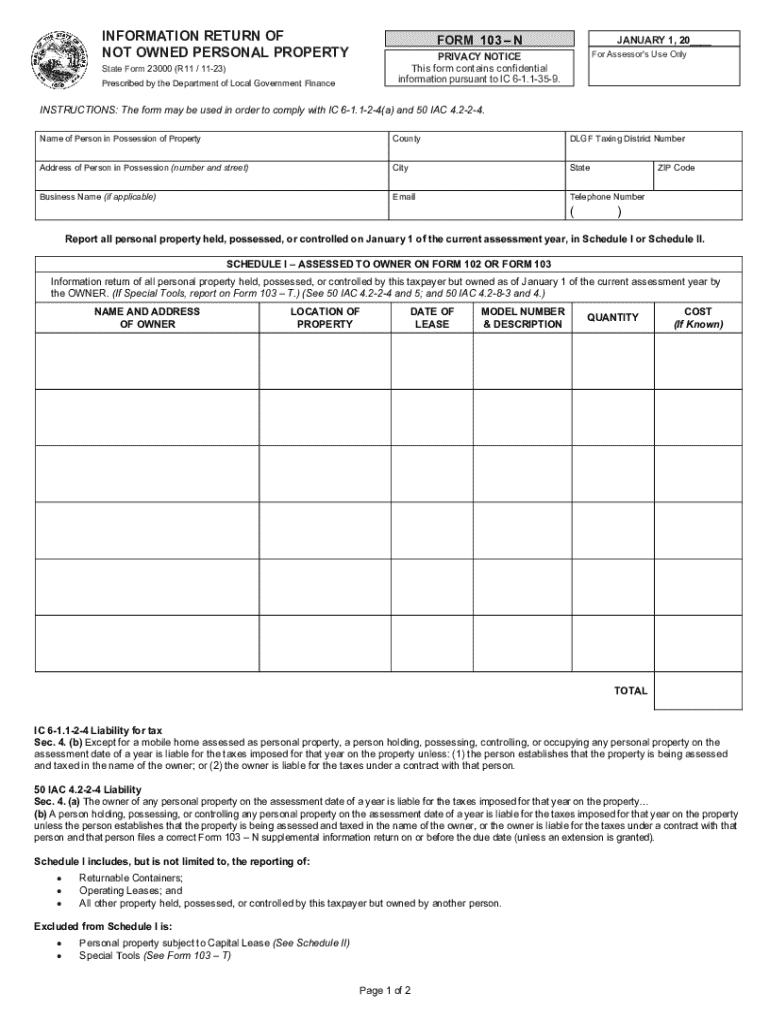

Understanding the Information Return of Not Form

Overview of the information return process

An information return is a document where businesses and individuals report specific information to the government or other authorities. Common examples include forms like the IRS 1099 or W-2. These returns play a crucial role in maintaining transparency in financial activities and ensuring compliance with tax regulations.

For individuals and teams managing financial data, information returns are vital for tracking earnings, verifying income, and meeting tax obligations. Utilizing an organized approach to these documents can significantly reduce the risk of penalties and ensure all necessary data is submitted on time.

Understanding the not form

The Not Form serves a unique purpose in certain contexts, often related to information returns that do not follow traditional formats. Its significance is highlighted when it comes to custom requests or exemption declarations, providing flexibility to users needing special treatment of their submissions.

Common use cases include property tax exemption requests, furthering claims on various government programs, or situations where standard forms are not applicable. It essentially allows users to articulate their needs without the constraints of conventional forms, catering to diverse circumstances.

Differentiating between regular forms and the Not Form often involves understanding the need for specificity. Standard forms generally cover defined criteria, while the Not Form is tailored for cases where applicants must provide unique information or requirements.

Step-by-step guide to completing the not form

Completing the Not Form entails a structured approach to gather and submit your information accurately. Let's break this down step by step.

Step 1: Gather Necessary Information. Ensure you have all relevant documents on hand, such as previous tax returns, identification numbers, and any correspondence from the department of local government finance or other agencies.

Step 2: Access the Not Form. You can conveniently locate the Not Form on pdfFiller by searching through their catalog. Additionally, it’s available through various local government resources.

Step 3: Filling Out the Not Form. Be meticulous while entering your information to avoid errors. Utilize interactive tools on pdfFiller to guide you through the process.

Step 4: Editing and Making Changes. If any errors are spotted, you can use pdfFiller's editing features to amend your submitted data quickly.

Step 5: Signing the Not Form. eSignature options are available for convenience. Ensure you understand the legal implications tied to eSigning.

Step 6: Submitting the Not Form. Choose the best submission method advised by state guidelines and keep track of your submission status for future reference.

Common issues and troubleshooting

While completing the Not Form, users often encounter a range of issues that may relate to incorrect data entry or difficulties with electronic submission. Examples include mismatched identification numbers or missing required fields.

To troubleshoot these problems, double-check the information against your sources to ensure accuracy. Make use of pdfFiller's support resources when in doubt, as they provide helpful guides and customer assistance for various queries.

Tips for efficient document management

To maximize the output from your forms, focus on efficient document management through pdfFiller. Start by organizing completed forms into clearly labeled folders for easy access.

Collaboration is essential when working within teams. Use collaborative features in pdfFiller to share forms and request input from teammates seamlessly, ensuring everyone stays on the same page.

Additionally, always back up your information. Secure storage on cloud platforms ensures safe and easy retrieval when needed.

Leveraging additional features on pdfFiller

pdfFiller offers expanded capabilities beyond just completing the Not Form. You can integrate alternative document types with your submissions for a more holistic approach to documentation.

Using templates for similar forms enhances efficiency, particularly in organizations where repetitive submissions occur. These features allow teams to stay organized and save time while ensuring compliance with regulatory standards.

Real-life application scenarios

Various businesses effectively utilize the Not Form to navigate through unique limitations in standard documentation. For instance, a property management company might leverage it to submit exemption requests, simplifying the process of securing tax benefits.

Individuals also find utility in these forms; perhaps a homeowner applying for a tax reassessment may draft a Not Form to explain the rationale for their request. These practical applications highlight the form's versatility in diverse scenarios.

Conclusion

Utilizing the information return of Not Form through pdfFiller streamlines document management, enhancing access, and organization. As more individuals and teams seek efficient solutions for form handling, the integration of such tools will likely expand.

With continual advancements in digital document management solutions, keeping a keen eye on emerging features in platforms like pdfFiller will position users to better navigate their document needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send information return of not to be eSigned by others?

How do I edit information return of not in Chrome?

How can I edit information return of not on a smartphone?

What is information return of not?

Who is required to file information return of not?

How to fill out information return of not?

What is the purpose of information return of not?

What information must be reported on information return of not?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.