Get the free Grafton County Family Income Verification Form-2025

Get, Create, Make and Sign grafton county family income

Editing grafton county family income online

Uncompromising security for your PDF editing and eSignature needs

How to fill out grafton county family income

How to fill out grafton county family income

Who needs grafton county family income?

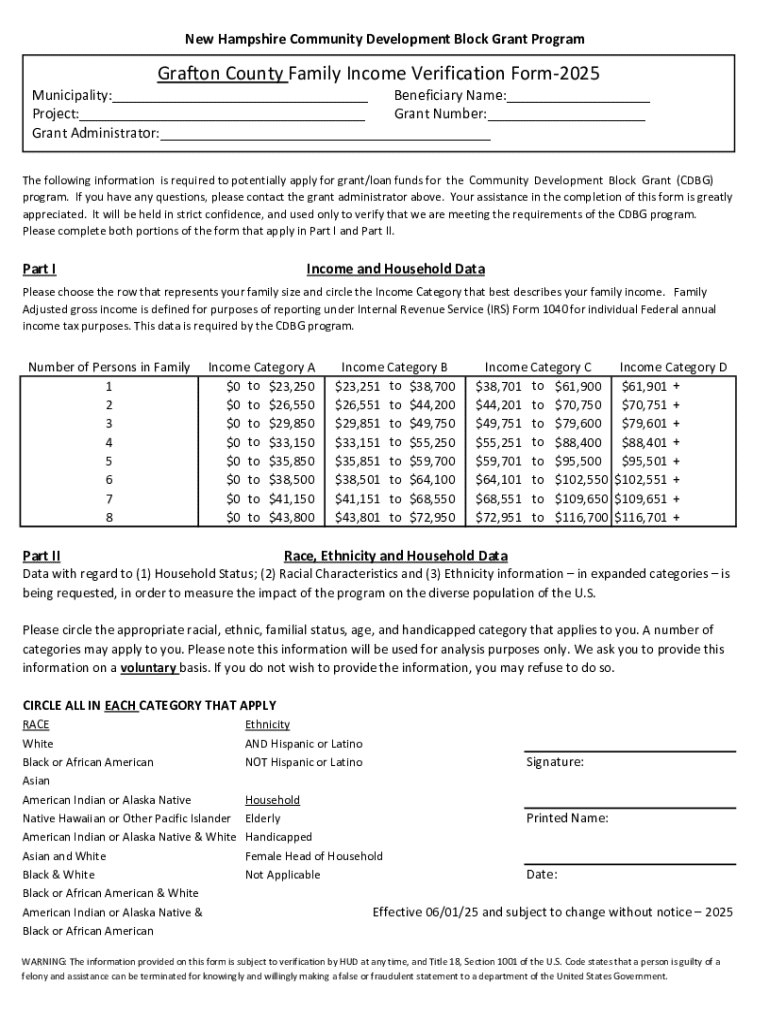

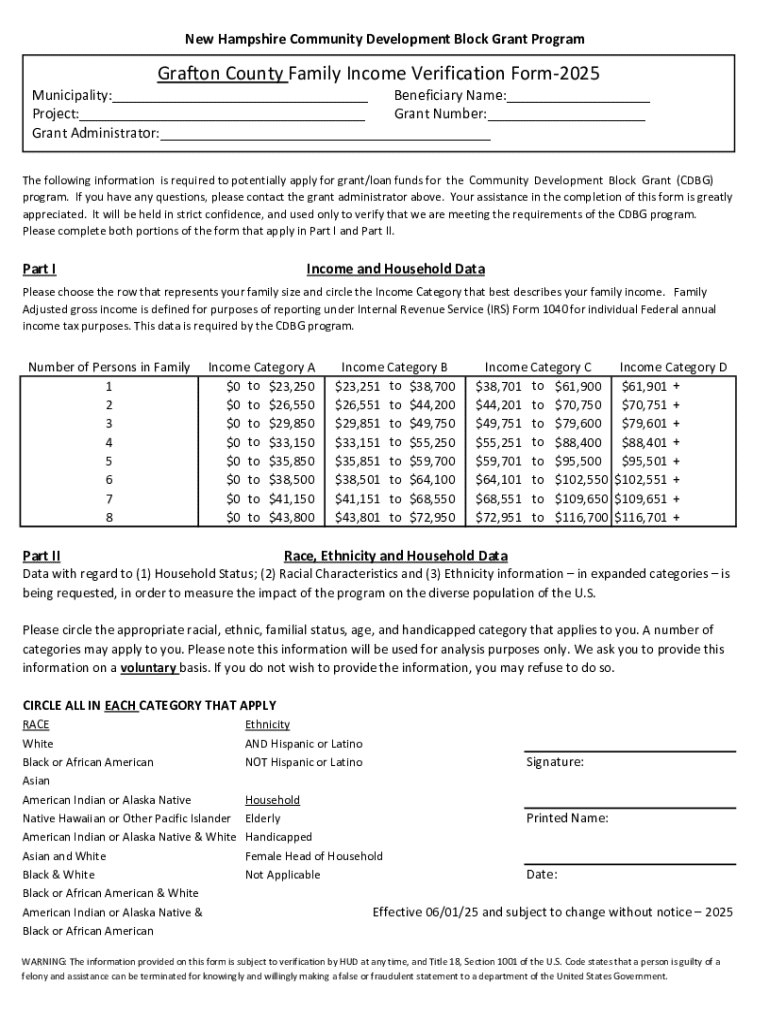

Comprehensive Guide to the Grafton County Family Income Form

Understanding the Grafton County Family Income Form

The Grafton County Family Income Form serves a crucial purpose in ensuring that families in Grafton County can access vital services and support programs. By accurately reporting household income, families make themselves eligible for assistance that can dramatically improve their quality of life. Ensuring precise income reporting is not merely a formality; it’s fundamental for receiving government benefits, educational assistance, healthcare, and various local programs designed to assist low-income families.

Eligibility for specific programs often hinges on the information provided in this form. Whether it involves financial aid for education, housing assistance, or food security programs, understanding the nuances of the Grafton County Family Income Form can help maximize the benefits available for you and your family.

Preparations before filling out the form

Before diving into the filling process of the Grafton County Family Income Form, it is essential to gather all the necessary documentation to ensure accuracy. This preparation phase can significantly reduce mistakes and facilitate smoother processing of your form.

It’s also crucial to identify all relevant income sources that will be reported on the form. This includes:

Step-by-step guide to completing the form

Completing the Grafton County Family Income Form is straightforward if you follow a structured approach. Here's a detailed guide to help you through each section.

Section 1: Personal Information

Start by filling in basic personal information. Ensure that you accurately spell your name, provide your current address, and include contact information. Any misspellings or incorrect data can lead to delays in processing.

Section 2: Household Details

In this section, report household composition. This is where you indicate the number of dependents in your household. If you are in a shared custody situation, be clear about how this affects the custody arrangement and who is financially responsible for each child.

Section 3: Income Information

Here, you will list all sources of income as previously identified. Ensure you detail each type of income; an oversight here can alter eligibility assessments. Be vigilant about common mistakes, such as overestimating your income or omitting sources that may seem minor.

Section 4: Submitting Additional Documentation

Prepare to submit supporting documents that validate your income claims. Acceptable documents typically include tax returns, bank statements, and pay stubs. Keep all documents organized and ensure they are legible, as issues may arise from poor photocopies or digital scans.

Tips for ensuring accurate submission

To ensure your submission is as accurate as possible, here are several beneficial tips:

Common FAQs about the Grafton County Family Income Form

Many individuals have questions regarding the Grafton County Family Income Form. Here are some frequently asked queries.

Interactive tools and resources for managing your form

Utilizing online tools can greatly facilitate the process of managing your Grafton County Family Income Form. Several resources can enhance your experience.

Frequently asked questions

Many people ask if and how they can submit the Grafton County Family Income Form electronically. Yes, electronic forms are generally accepted, especially when submitted through validated platforms like pdfFiller. After submission, you should receive a confirmation, keeping you informed about your application status.

Support and contact information

Navigating through form submission can seem daunting, but multiple avenues for support are available. If you encounter issues, reaching out to local Grafton County offices can provide critical assistance. Additionally, pdfFiller’s customer support is available to guide you in document management and troubleshooting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in grafton county family income?

Can I create an eSignature for the grafton county family income in Gmail?

How do I edit grafton county family income on an Android device?

What is grafton county family income?

Who is required to file grafton county family income?

How to fill out grafton county family income?

What is the purpose of grafton county family income?

What information must be reported on grafton county family income?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.