Get the free Form 990-T - 2024

Get, Create, Make and Sign form 990-t - 2024

Editing form 990-t - 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-t - 2024

How to fill out form 990-t - 2024

Who needs form 990-t - 2024?

Form 990-T - 2024 Form: Your Comprehensive Guide

Understanding Form 990-T: What You Need to Know

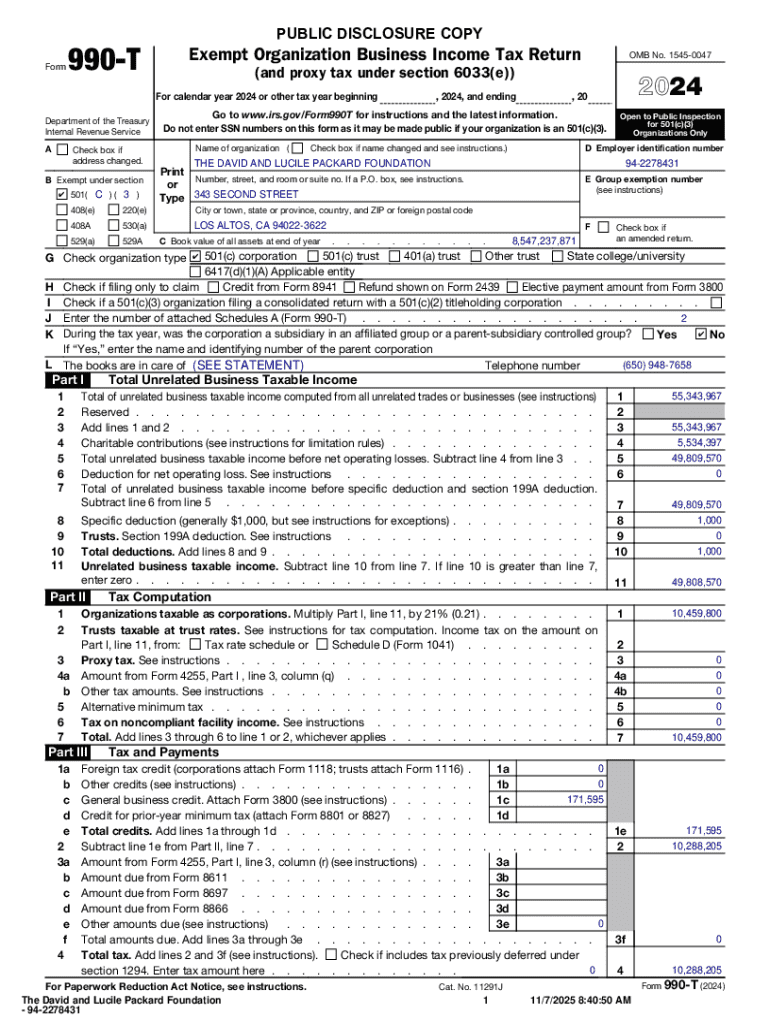

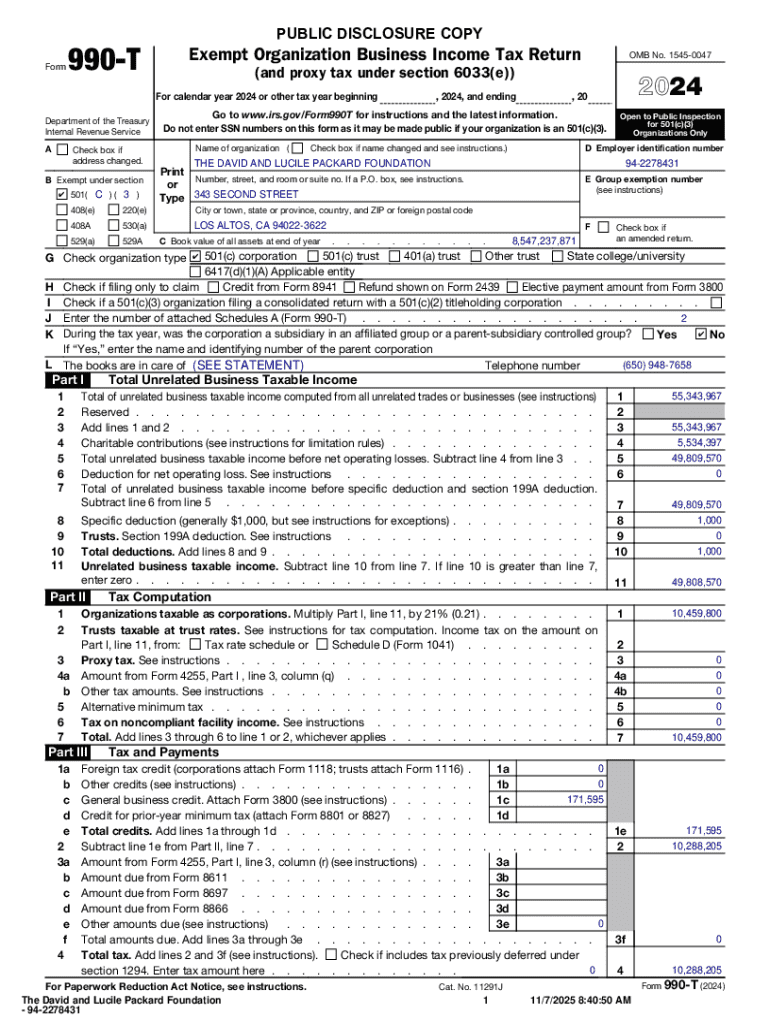

Form 990-T plays a crucial role for tax-exempt organizations, serving as a reporting form specifically designed for income earned from unrelated business activities. This form ensures that even non-profits contribute their fair share of taxes on income generated outside their primary charitable activities, marking significant transparency in the nonprofit sector.

The primary purpose of Form 990-T is to report specific income types that may jeopardize a nonprofit's tax-exempt status. This includes activities like business operations or profit-generating ventures that are not directly related to the organization's core mission. For many organizations, understanding when and why to file Form 990-T can be the difference between maintaining a good standing and facing potential penalties.

Navigating the filing process: Key dates and deadlines

Each tax year comes with specific deadlines for Form 990-T that organizations must adhere to. For filing the 2024 form, the initial deadline is typically the 15th day of the fifth month after the end of the tax year. For most organizations, this means an initial filing due date of May 15, 2024.

And, of course, if your organization isn't able to meet the deadline, it's crucial to file for an extension. Bear in mind that while an extension provides additional time to file, it does not extend the due date for any taxes owed. Late filing can result in penalties, so it’s essential to remain diligent about these deadlines.

Essential tools and features for filing Form 990-T

Filing Form 990-T can be complex, but technology simplifies the process. pdfFiller's platform offers an all-in-one solution, integrating the features one would need to ensure a smooth filing experience. From automated reminders about key filing dates to secure document management, pdfFiller stands out as a champion for efficient tax filing.

Interactive features enable users to fill out the form seamlessly, offering a collaborative workspace for teams managing nonprofit tax returns. Whether you need to gather multiple signatures or ensure accuracy through shared reviews, pdfFiller excels with tools tailored to your organization's unique needs.

Step-by-step guide to completing Form 990-T

Completing Form 990-T requires careful attention to detail. Start by gathering all necessary information. This includes your organization’s employer identification number (EIN), income statements, and details regarding unrelated business income. Make sure to double-check these documents to avoid common pitfalls during the filing process.

It's important to be aware of common mistakes that organizations make, such as incorrectly calculating unrelated business taxable income (UBTI) or failing to report all applicable income streams. Accurate documentation is crucial for maintaining tax-exempt status.

When filling out the form, ensure you complete each section appropriately. Field-by-field instructions can typically be found within the IRS instructions for Form 990-T. Different types of income may have specific considerations, requiring you to pay close attention to what is being reported.

After filling out your form, utilize pdfFiller's editing tools for a thorough review. Ensuring document accuracy is critical; thus, employing best practices such as peer review or utilizing collaborative feedback functions in pdfFiller can enhance the accuracy of your submissions.

E-filing your Form 990-T: Effortless submission

With the rise of digital solutions, e-filing has become the preferred method for submitting Form 990-T. E-filing offers numerous benefits, including quicker processing times and easier tracking of your submission. Many organizations have found that switching from traditional paper filing to e-filing significantly reduces the anxiety associated with tax deadlines.

Using pdfFiller, e-filing is straightforward. Start by securely uploading your completed form to the platform, ensuring all information is accurate. Once you've uploaded the document, you can track your submission and receive confirmation once it has been filed. This streamlined process not only saves time but enhances overall accuracy.

What happens after filing: Understanding the review process

After submitting Form 990-T, organizations can expect a review process initiated by the IRS. Understanding this timeline is essential for effective planning and compliance. Typically, processing times for Form 990-T can range from several weeks to a few months, depending on the IRS's workload at the time.

Organizations can track their submissions through the IRS's online systems. It’s a good idea to keep an eye on this, as follow-up communications from the IRS may require prompt responses to avoid complications or penalties.

Special considerations for tax professionals

Tax professionals play a crucial role in guiding organizations through the complexities of filing Form 990-T. Utilizing tools tailored for tax advisors and CPAs can significantly enhance efficiency and service delivery. pdfFiller offers features that allow tax professionals to manage client documents seamlessly, facilitating easy communication and document sharing between organizations and advisors.

The collaborative tools provided by pdfFiller also enable tax professionals to work alongside their clients in real-time, ensuring all forms are filled out accurately and submitted on time. This level of engagement can demystify the filing process for clients, enhancing their trust and satisfaction with the services provided.

Frequently asked questions about Form 990-T

As organizations prepare to file Form 990-T, numerous questions may arise. Common confusion often centers around what income must be reported, the necessary thresholds for unrelated business income, and how to maintain tax-exempt status effectively. It’s paramount for organizations to seek clarity on these issues to navigate their tax reporting requirements.

In addition to understanding basic filing requirements, nonprofits should be aware of specific scenarios that may complicate their submissions. Engaging with tax professionals or utilizing comprehensive resources can provide further insights to help avoid potential pitfalls.

Updates and changes for the 2024 filing year

Each tax year, the IRS introduces changes to forms that can impact the filing process. For the 2024 Form 990-T, organizations should prepare for significant updates that may include changes to forms, reporting requirements, or relevant thresholds for unrelated business income. Staying up to date with these changes is vital for compliance and successful submissions.

Organizations are advised to review IRS announcements and updates regarding Form 990-T regularly. Implementing updated protocols in response to these changes can streamline your filing process and safeguard against inaccuracies that might lead to disputes or penalties.

Conclusion: Empowering your tax reporting with pdfFiller

As you navigate the intricacies of tax reporting with Form 990-T for 2024, leveraging a platform like pdfFiller can significantly enhance the experience. With features tailored for collaboration, accuracy, and document management, pdfFiller empowers organizations to handle their tax filing processes efficiently.

By understanding the filing requirements and utilizing advanced technological tools, organizations can focus on their core missions without the anxiety of navigating tax code intricacies. Make your filing experience seamless, ensuring compliance and maintaining your nonprofit's tax-exempt status without added stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit form 990-t - 2024 online?

Can I edit form 990-t - 2024 on an iOS device?

How can I fill out form 990-t - 2024 on an iOS device?

What is form 990-t - 2024?

Who is required to file form 990-t - 2024?

How to fill out form 990-t - 2024?

What is the purpose of form 990-t - 2024?

What information must be reported on form 990-t - 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.