Get the free ICICI New Application FormPDFChequeInvesting

Get, Create, Make and Sign icici new application formpdfchequeinvesting

How to edit icici new application formpdfchequeinvesting online

Uncompromising security for your PDF editing and eSignature needs

How to fill out icici new application formpdfchequeinvesting

How to fill out icici new application formpdfchequeinvesting

Who needs icici new application formpdfchequeinvesting?

New Application Form PDF Cheque Investing Form

Understanding the new application process

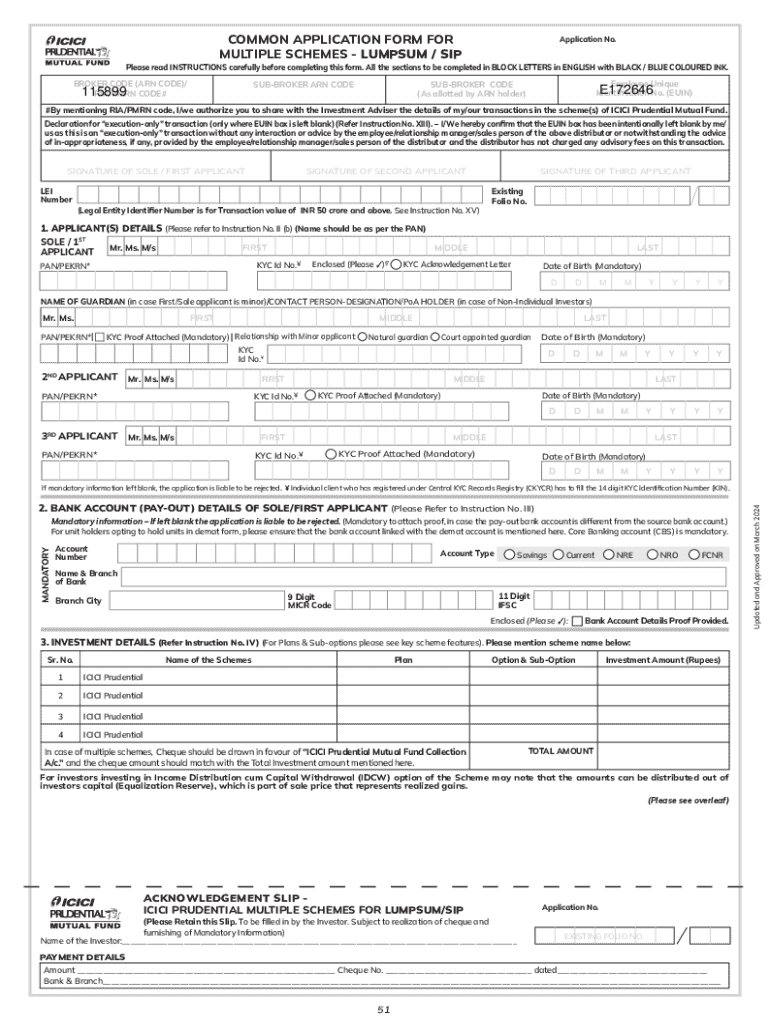

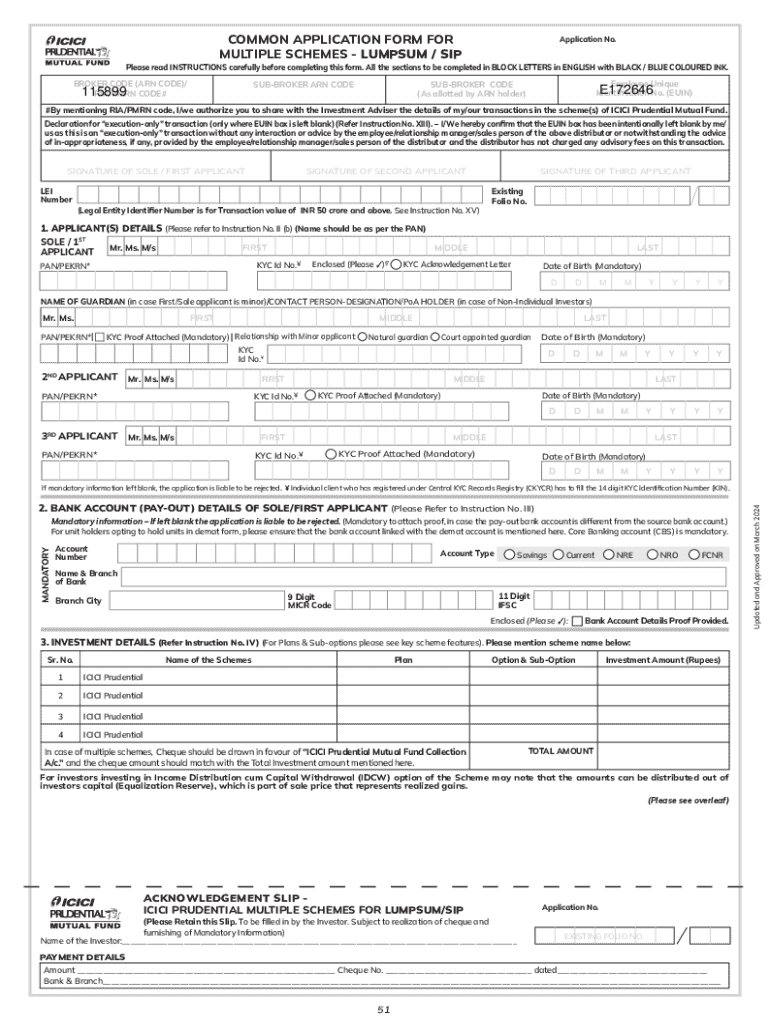

The ICICI new application process is vital for individuals looking to open accounts or invest in various financial products. Banking applications, such as account openings and cheque investments, often require the completion of specific forms that gather crucial data from potential customers.

The ICICI application form is designed with user experience in mind, ensuring that applicants provide all necessary information clearly and concisely. This helps streamline the approval process and reduces the likelihood of errors, which can lead to delays.

Navigating the new application form

Filling out the ICICI new application form is a straightforward process, provided you understand the various components involved. The form typically consists of several sections designed to gather comprehensive information about you and your financial background.

Components of the application form

The primary sections of the form include:

Required documents for submission

Before submitting the application, ensure you have the necessary documents ready. These include:

Step-by-step guide to filling out the new application form

Filling out the ICICI new application form can be done effectively by following these steps:

Step 1: Accessing the new application form

To initiate the process, start by locating the ICICI new application form on PDFfiller. It is readily available as a downloadable PDF form, enabling easy access for all users.

Step 2: Filling out personal information

Carefully complete the personal information section, ensuring you provide accurate data. Common mistakes include typos on names or incorrect date formats.

Step 3: Inputting financial details

In the financial details section, be thorough. Include details on your income sources, outstanding loans, or any other relevant financial information. When detailing cheque investment options, specify the amount, and double-check your figures.

Step 4: Review and edit your application

Use PDFfiller tools to edit your application. Ensure every section is accurately completed. If you notice any mistakes, correct them before finalizing.

Utilizing PDFfiller for enhancing your application experience

PDFfiller acts as a facilitative platform to simplify document creation and management. With robust editing features and tools, users can navigate their applications more efficiently.

One of the standout features is eSigning, which allows you to securely sign documents from anywhere. Collaborating with team members on form submission further enhances the user experience.

Submitting your new application form

Once the application form is complete, you can submit it through several methods, providing flexibility for applicants.

Multiple submission methods

Tracking your application status

After submission, you can track the status of your application through PDFfiller. Utilizing the application tracking features helps you stay informed.

For further assistance, consider reaching out to ICICI customer service. They can offer real-time updates and guidance if needed.

Understanding terms and conditions for cheque investments

Before making any investment, familiarize yourself with the terms and conditions associated with ICICI Bank's cheque investments. Understanding what is required helps mitigate risks and ensures compliance.

ICICI Bank outlines specific clauses in its policy that pertain to cheque investments, emphasizing the importance of reconciling any discrepancies.

Declaration and compliance

The declaration section of the ICICI application form is crucial. By signing this section, you confirm that all provided information is accurate to the best of your knowledge.

It’s essential to be aware of the compliance guidelines laid out by ICICI Bank. Ensure all submitted information remains truthful to avoid penalties.

Troubleshooting common issues

While filling out the ICICI new application form, you may encounter challenges. Addressing these swiftly can facilitate a smoother application process.

FAQs about the new application form

Familiarize yourself with frequently asked questions to prevent common pitfalls in your application. These often cover basic concerns regarding form handling and document requirements.

Problem-solving tips for application submission issues

If you face difficulties, consider these tips:

Explore additional features with PDFfiller

Using PDFfiller not only enhances your experience with the ICICI new application form but also opens doors to additional document management features. Its cloud-based platform allows for seamless document creation and collaborative efforts.

Beyond just the ICICI form, PDFfiller offers a vast array of templates and forms, catering to different financial and legal paperwork needs, making it an all-in-one solution.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit icici new application formpdfchequeinvesting in Chrome?

How do I edit icici new application formpdfchequeinvesting on an iOS device?

Can I edit icici new application formpdfchequeinvesting on an Android device?

What is icici new application formpdfchequeinvesting?

Who is required to file icici new application formpdfchequeinvesting?

How to fill out icici new application formpdfchequeinvesting?

What is the purpose of icici new application formpdfchequeinvesting?

What information must be reported on icici new application formpdfchequeinvesting?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.