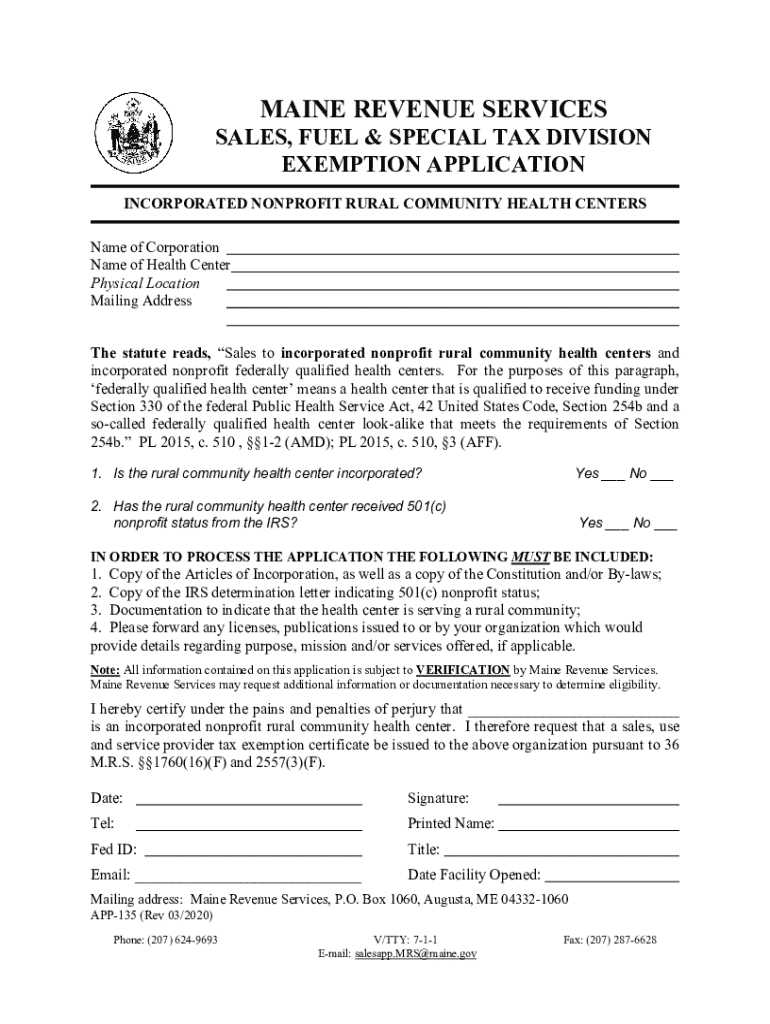

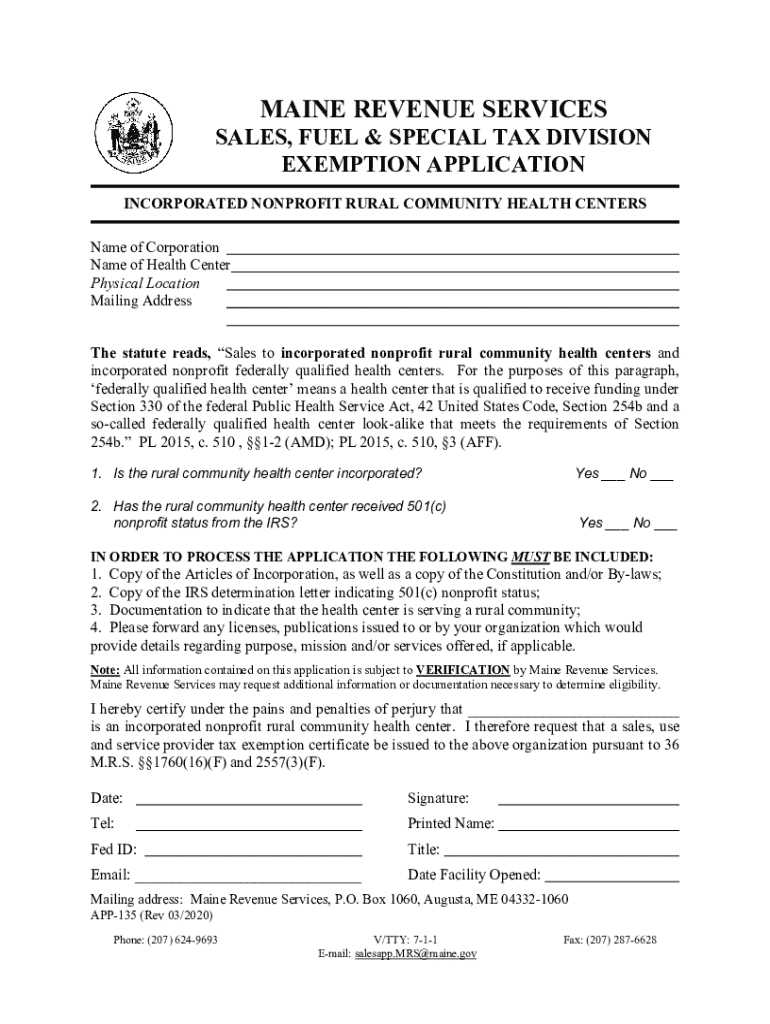

Get the free The statute reads, Sales to incorporated nonprofit rural community health centers and

Get, Create, Make and Sign form statute reads sales

How to edit form statute reads sales online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form statute reads sales

How to fill out form statute reads sales

Who needs form statute reads sales?

Form statute reads sales form: A comprehensive how-to guide

Understanding the sales form statute

A sales form statute outlines the necessary components and guidelines that govern the sale of goods and services. It establishes a legal framework that helps businesses comply with various regulations while facilitating transactions. This statutory guidance is essential for ensuring that all sales activities adhere to applicable laws, thereby protecting both buyers and sellers from potential disputes.

Regulatory requirements vary by jurisdiction, but typically include stipulations around key data that must be present on sales forms, such as product descriptions, prices, taxes applicable like the ad valorem tax, and compliance with local sales tax regimes. Non-compliance can lead to penalties, making it imperative for businesses to be familiar with these requirements.

Types of sales forms

Various sales documents are encompassed by the sales form statute, including invoices, receipts, and purchase orders. Each serves a distinct purpose in the sales process.

Understanding the differences between these forms is crucial for maintaining accurate records and fulfilling compliance requirements, as each document serves different roles in revenue and tax reporting.

Key components of the sales form

Mandatory elements within a sales form include essential fields that must be filled out for legal compliance. These elements typically encompass the seller's and buyer's information, a detailed description of the items sold, quantities, prices, applicable taxes such as utility services and sales taxes, and the total amount payable.

The omission of any required information could jeopardize the validity of the document, leading to issues like tax disputes or legal complications. In jurisdictions with strict tax categories like personal property tax and gas tax, ensuring complete accuracy is even more critical. Regular audits and reviews are recommended to identify areas of improvement.

Optional additions

Optional fields can enhance the utility of the sales form; items like loyalty program numbers or customer feedback sections may personalize the sales experience. Customization based on business needs can also significantly improve operational efficiency. For example, businesses might include fields specific to insurance premium tax or program tax credits, tailored to their customer base and industry.

Step-by-step: Completing the sales form

To ensure a smooth completion of a sales form, it's vital to gather all necessary information beforehand. This includes relevant documents such as previous invoices, tax identification numbers, and customer records. By collating this data, you can significantly reduce the chances of errors upon finalizing the document.

When filling out the sales form, follow clear, structured instructions for each section. The seller information should be accurately filled out, followed by a detailed description of the items being sold. Remember to calculate sales, include any applicable taxpayer exemptions, and break down the total cost clearly to avoid confusion.

Avoiding common errors is essential for a successful submission. Frequent mistakes include incorrect calculations, incomplete fields, and missing terms of sale. Make it a practice to validate the completed form against the initial data collected, which can further ensure accuracy and adherence to compliance checks.

Editing and modifying the sales form

Using pdfFiller provides an intuitive way to edit and collaborate on sales documents. The platform includes features that enhance the document management process, such as templates, version control, and easy sharing options. This streamlines the interaction between different stakeholders, like sales teams and accounting departments.

To make changes in pdfFiller, begin by opening the relevant document and using the editing tools to adjust any necessary information. This could involve fine-tuning the invoice details or adjusting payment terms after negotiations.

Version control

Maintaining records of changes is crucial for legal compliance as well as for historical reference. pdfFiller makes it easy to track versions of sales forms, enabling users to revert to previous iterations if needed. Establish a routine for periodic reviews of document versions to prevent mistakes or miscommunications from occurring.

Signing and finalizing the sales form

With the rise of digital transactions, understanding eSignature options becomes essential. Electronic signatures are legally valid in most jurisdictions, making them a secure and efficient way to finalize sales forms. Integrating eSignatures into your workflow saves time and enhances the authenticity of transactions.

Before the final submission, conduct a comprehensive review of the sales form to ensure completeness. Create a checklist for all necessary components—seller and buyer details, product descriptions, pricing, and tax calculations. Tips on finalizing indicate that confirming all items match the initial agreement is crucial for smooth processing by relevant authorities.

Managing and storing sales forms

Organizing sales forms is essential for both operational efficiency and compliance. Implement best practices for document storage by categorizing files systematically—by date, customer, or transaction type. This practice not only saves time but also aids in retrieval during audits or customer inquiries.

Cloud-based solutions like pdfFiller offer numerous advantages over traditional storage methods. They ensure document accessibility from any location, facilitating easier updates or sharing with relevant team members. Utilizing pdfFiller’s cloud features enables seamless management of sales forms, securing sensitive data and enhancing collaboration.

Troubleshooting common issues

Encountering submission issues with sales forms can be frustrating. Common problems include incorrect filing information or missing signatures, which often lead to rejections from authorities. To rectify these issues, promptly review feedback from the submission process and amend the sales form accordingly.

Understanding compliance and the legal implications of errors is paramount. Non-compliance can result in penalties, such as fines related to improperly documented sales like those involving metals recyclers or unemployment tax cases. Keeping abreast of the legal landscape can help you navigate these challenges effectively.

Frequently asked questions (FAQs)

Many individuals and businesses frequently inquire about specific aspects of filling out, editing, and submitting sales forms. You might wonder what elements are critical for compliance or where to find templates for various types of sales documents. Engaging with experienced users or industry forums can provide practical insights and guidance.

Seeking best practices from seasoned professionals can also aid in navigating the sales form process more efficiently. Learning from others' experiences around common pitfalls can save time and resources. Use these discussions to tailor your own process for better outcomes.

Additional tools for sales form management

Integrating other software solutions with pdfFiller can enhance your workflow, particularly when streamlining customer relationship management (CRM) or accounting tasks. By linking sales forms directly to platforms that manage finances or customer interactions, you can reduce redundancies and ensure consistency in your records.

Using templates is another beneficial approach for efficiency. With pdfFiller, you can create or customize existing templates to suit specific business needs, which dramatically reduces completion time. Take advantage of these templates to standardize transactions, helping to maintain consistency and compliance across your team.

Keeping up with changes in sales form legislation

Staying informed about regulatory updates concerning sales forms is vital for compliance. Resources like governmental websites or industry publications can provide timely information about changes that might affect your sales operations, especially regarding new tax categories or compliance requirements.

pdfFiller plays a significant role in facilitating your compliance efforts with updated sales form requirements. The features within pdfFiller can assist users in maintaining compliance by providing prompts or checklists based on the latest legislative guidelines. This proactive approach helps minimize the risk of errors and ensures that all documentation remains up-to-date.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the form statute reads sales in Gmail?

How do I edit form statute reads sales straight from my smartphone?

How do I edit form statute reads sales on an Android device?

What is form statute reads sales?

Who is required to file form statute reads sales?

How to fill out form statute reads sales?

What is the purpose of form statute reads sales?

What information must be reported on form statute reads sales?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.