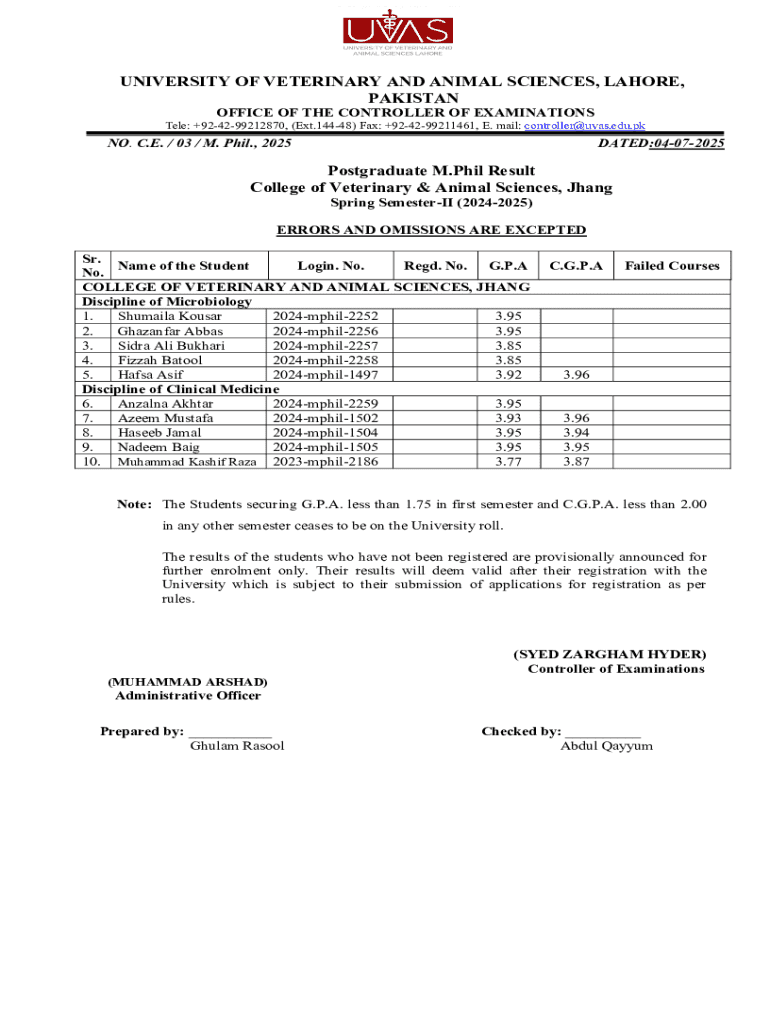

Get the free / 03 / M

Get, Create, Make and Sign 03 m

Editing 03 m online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 03 m

How to fill out 03 m

Who needs 03 m?

Your Comprehensive Guide to the 03 Form

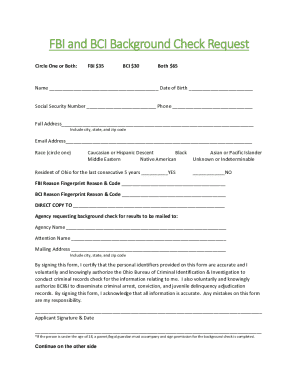

Overview of the 03 form

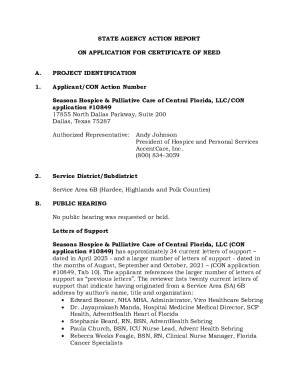

The 03 m form is a crucial document in different contexts, including environmental regulations, corporate reporting, and personal financial disclosures. This form serves multiple purposes depending on the requirements of the issuing body and the jurisdiction in which it is utilized.

Understanding the importance of the 03 m form is essential for compliance in various legal and financial settings. Failing to complete or submit this form correctly can lead to delays, penalties, or legal complications that can affect both individuals and organizations.

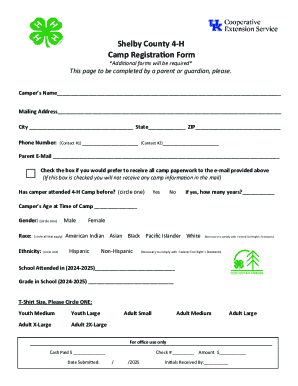

Key features of the 03 m form include sections for personal identification, financial data, and any additional required disclosures, which necessitates an organized approach to data entry.

Preparing to fill out the 03 form

Before filling out the 03 m form, it's critical to gather all necessary information to facilitate a smooth completion process. This ensures that you have everything on hand to avoid any disruptions later in the process.

Understanding the specific sections of the form is equally important. For each section, familiarize yourself with common terms and definitions. For example, the financial section might require terms such as 'gross income' vs. 'net income,' which impacts how you report your earnings.

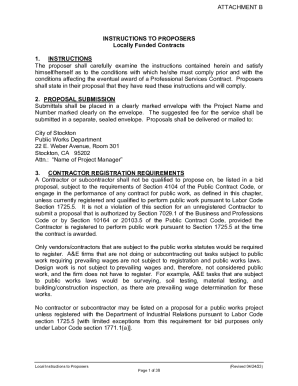

Step-by-step instructions for completing the 03 form

Filling out the 03 m form can seem daunting due to its complexity. However, following a structured approach makes the task manageable.

Editing and signing the 03 form

Once the 03 m form is filled, editing tools can be indispensable. Utilizing pdfFiller’s editing capabilities allows you to amend any inaccuracies efficiently.

You can make changes by highlighting sections and adding comments for clarification. This functionality enhances collaboration if multiple users review the document.

When it comes to signing, pdfFiller offers eSigning options that comply with federal regulations. You can sign your document electronically, ensuring a quick and secure process.

Submitting the 03 form

The submission methods of the 03 m form can vary by jurisdiction. Generally, there are two primary methods: online submission and mailing it to the relevant agency.

Be mindful of any submission deadlines specific to your situation to avoid penalties.

Managing and storing your 03 form

Once submitted, the management of your 03 m form becomes essential. Utilizing pdfFiller’s cloud features can help you stay organized and access necessary documents from anywhere.

Backup options are crucial too. Best practices for digital storage include maintaining an off-site backup, while for physical copies, ensure they are stored in a secure place.

Troubleshooting common issues with the 03 form

Despite best efforts, issues may arise during the submission of the 03 m form. Being aware of common pitfalls can save time and reduce frustration.

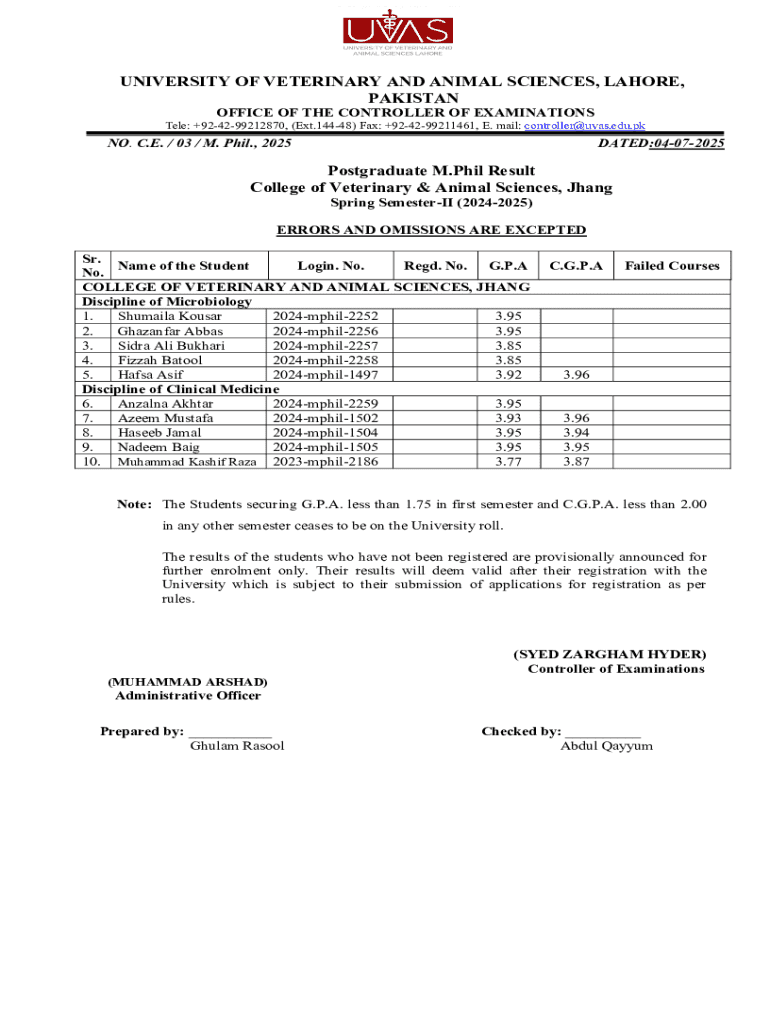

Case studies and examples

Real-life scenarios exemplifying proper utilization of the 03 m form can offer valuable insights. For example, a small business owner who meticulously completed the form secured a loan that significantly improved their operations.

Additionally, visual walkthroughs of filled 03 m forms can serve as educational resources. Annotated examples can help clarify the requirements for subsequent users.

Interactive tools and features on pdfFiller

pdfFiller stands out with its interactive tools tailored specifically for the 03 m form. This includes customizable templates that adapt to your needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify 03 m without leaving Google Drive?

How do I make edits in 03 m without leaving Chrome?

How can I edit 03 m on a smartphone?

What is 03 m?

Who is required to file 03 m?

How to fill out 03 m?

What is the purpose of 03 m?

What information must be reported on 03 m?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.