Get the free Damning New State Auditor Report Outlines Failures at ...

Get, Create, Make and Sign damning new state auditor

How to edit damning new state auditor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out damning new state auditor

How to fill out damning new state auditor

Who needs damning new state auditor?

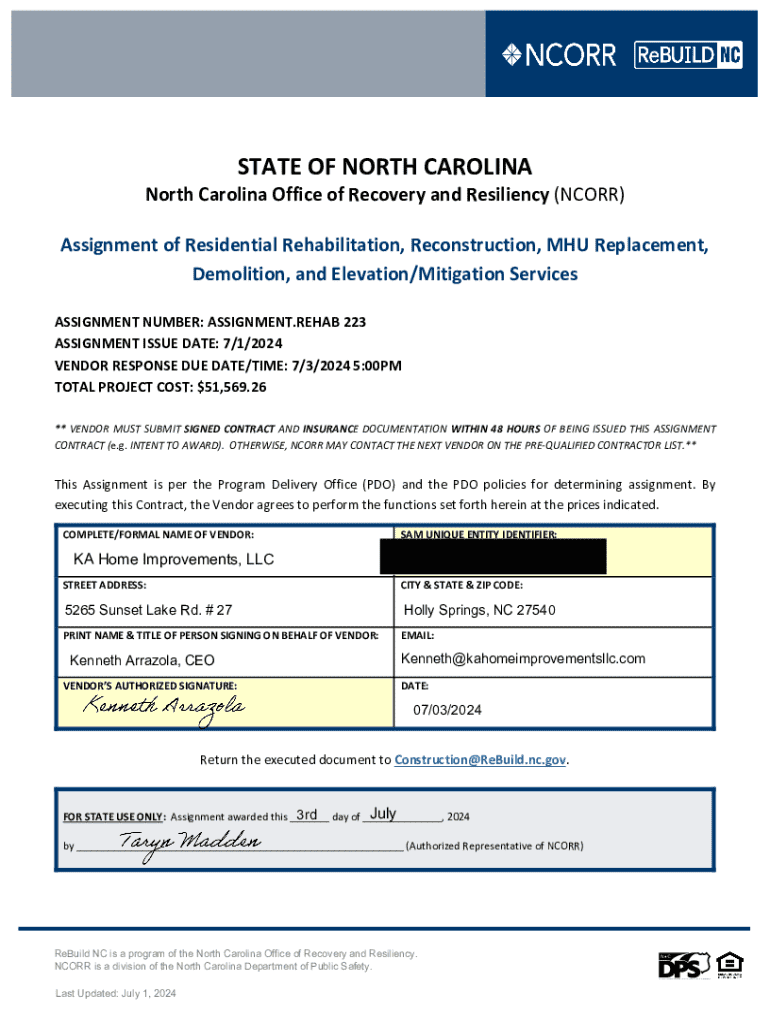

Understanding the Damning New State Auditor Form

Understanding the new state auditor form

The latest iteration of the state auditor form has raised eyebrows across different sectors, primarily due to its comprehensive requirements and stringent compliance measures. Designed to enhance transparency, this form serves as a critical tool for various organizations, including foundations and businesses, to report financial activities. Its importance cannot be overstated, as it directly impacts the allocation of government support and public donations.

With the new form, stakeholders are now confronted with several key changes. These updates not only reflect the evolving financial landscape but also encompass stricter penalties for non-compliance. For instance, failure to meet reporting requirements can result in significant financial repercussions, highlighting the necessity of accurate and timely submissions.

Detailed breakdown of the form sections

The new state auditor form consists of several critical sections, each designed to capture specific information necessary for compliance. The identification information section collects essential data about the organization, while the financial disclosures section requires detailed records of revenues and expenditures. Lastly, the reporting requirements section outlines the obligations for submitting supporting documentation.

Common mistakes arise when users overlook the requirements or fail to provide complete information. It's paramount to thoroughly understand each section to ensure compliance and avoid costly repercussions.

Step-by-step instructions for completing the form

Before diving into the form, preparing is crucial. Begin by gathering all necessary documents, such as financial statements, tax records, and any previous submissions. Familiarizing yourself with the terminology used within the form can also facilitate a smoother experience.

When it’s time to fill out the form, start with Section 1, which focuses on identification information. Next, proceed to Section 2 for financial disclosures where accuracy is paramount. Finally, ensure that you pay close attention to Section 3, which outlines the specific reporting requirements to avoid pitfalls.

Editing and managing your form

pdfFiller offers robust tools to assist in editing and managing your state auditor form. Users can easily modify text and fields to ensure that all information is up-to-date and accurate. Adding comments and annotations directly onto the form is also a breeze, which can be helpful for highlighting areas in need of attention.

Once you’ve completed the form, consider secure storage options provided by pdfFiller. The platform allows for easy access from anywhere, which is a tremendous asset for individuals and teams needing to manage their documents effectively.

Collaborating on form completion

Collaboration is often key to successful form completion, especially for teams managing complex data. pdfFiller allows users to share the form with team members easily, fostering a collaborative atmosphere when filling it out. Tracking changes and providing feedback is straightforward, defaulting to a version-controlled environment.

Comments can be utilized effectively to offer suggestions or request clarifications, making the process smoother and ensuring everyone is on the same page.

Frequently asked questions (FAQs)

Encountering issues with the state auditor form can be frustrating. If you find yourself facing challenges, consult the section of resources dedicated to troubleshooting common problems. Additionally, keep an eye on submission timelines to ensure you do not incur delays.

For more extensive support, various resources are available to assist users, including customer service and community forums that discuss common pitfalls and advice on navigating through the submission process.

Real-world examples and case studies

Examining case studies of successful submissions can provide invaluable insight. For instance, one foundation recently enhanced their reporting clarity through meticulous attention to financial disclosures, directly translating to increased public trust. In contrast, another organization failed to update its records, resulting in compliance issues.

These real-world examples underscore the importance of accuracy and adherence to the requirements outlined in the damning new state auditor form.

Additional features of pdfFiller relevant to state auditor forms

Beyond just filling out the state auditor form, pdfFiller offers features that integrate other documents and forms seamlessly. The platform is designed to empower users in staying compliant with regular updates and notifications regarding changes in regulations.

Utilizing a cloud-based document management platform is an added benefit, as users enjoy the convenience of accessing and managing multiple relevant documents under one hub.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in damning new state auditor without leaving Chrome?

How do I edit damning new state auditor on an Android device?

How do I complete damning new state auditor on an Android device?

What is damning new state auditor?

Who is required to file damning new state auditor?

How to fill out damning new state auditor?

What is the purpose of damning new state auditor?

What information must be reported on damning new state auditor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.