Get the free John Sample Trust - DemoPDF

Get, Create, Make and Sign john sample trust

How to edit john sample trust online

Uncompromising security for your PDF editing and eSignature needs

How to fill out john sample trust

How to fill out john sample trust

Who needs john sample trust?

A comprehensive guide to the John Sample Trust Form

Understanding the John Sample Trust Form

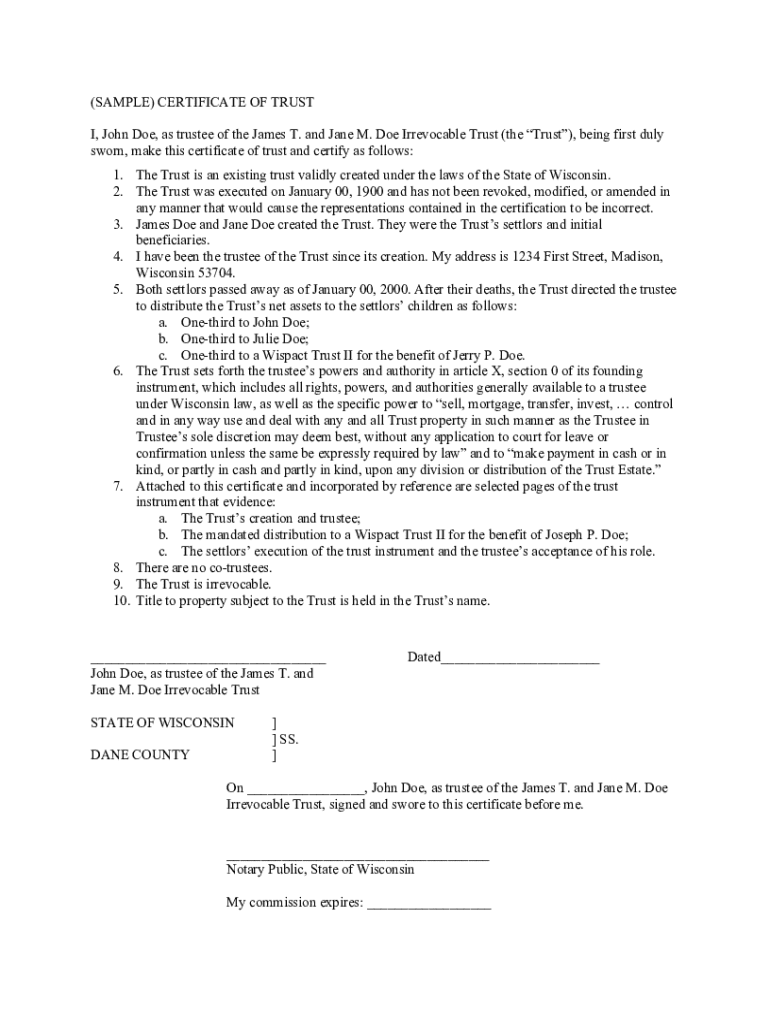

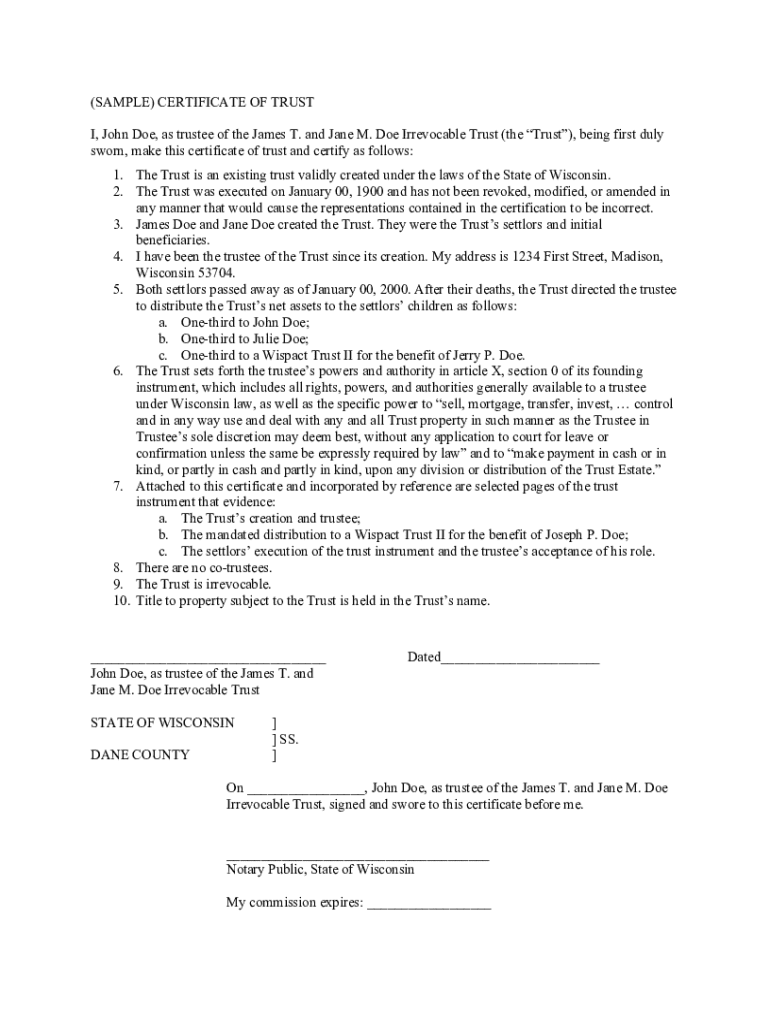

The John Sample Trust Form is a legal document designed to facilitate the creation of a trust, which is an essential component of effective estate planning. This form allows individuals, known as grantors, to outline their intentions concerning asset distribution upon their death or incapacity. Trust forms, such as the John Sample Trust Form, serve to provide clear instructions on how assets should be managed, who will manage them, and who will benefit from them, thereby minimizing potential disputes among family members.

Trust forms play a vital role in estate planning, ensuring that one's wishes are executed as intended. With the appropriate usage of documents like the John Sample Trust Form, individuals can avoid the lengthy and costly process of probate, secure privacy regarding their financial affairs, and reduce tax liability for their heirs. Key components of a trust form include details about the grantor, defined beneficiaries, specific assets to be included, and the powers granted to the trustee.

Types of trusts involving the John Sample Trust Form

Trusts can be broadly categorized into two types: revocable and irrevocable. A revocable trust allows the grantor to retain control over the assets and make changes as deemed necessary during their lifetime. In contrast, an irrevocable trust, once established, cannot typically be altered or dissolved without the consent of the beneficiaries. Understanding the difference is essential when completing the John Sample Trust Form to accurately reflect the grantor’s intentions.

Additionally, testamentary trusts exist as part of wills and take effect upon the death of the grantor, while living trusts are established during the grantor's lifetime, allowing for immediate asset management. For the John Sample Trust Form, special considerations may apply based on the unique requirements of individuals seeking to protect their assets or establish specific directives regarding their estate.

Detailed walkthrough of the John Sample Trust Form

Information required

To complete the John Sample Trust Form, several pieces of personal information are required. The grantor must provide their full name, address, and date of birth, along with identifying details of the beneficiaries, including their names, relationships, and contact information. It’s critical to be thorough at this stage to prevent legal complications later.

In addition to personal information, a comprehensive list of property and assets to be included in the trust must be detailed. This may include real estate, bank accounts, investment portfolios, and personal property. Establishing a clear inventory of assets ensures that the trust can be managed effectively, safeguarding the grantor’s intentions.

Step-by-step instructions for completion

Filling out the John Sample Trust Form requires attention to detail. Firstly, ensure that all personal information is accurate and complete. Next, clearly outline the assets included in the trust, categorizing them if necessary. It can be beneficial to list personal items separately from financial assets. Avoid common mistakes, such as leaving sections incomplete or failing to update beneficiary information, which can lead to confusion and disputes.

Editable sections of the form

The John Sample Trust Form contains interactive features for customization, accommodating the unique preferences of the grantor. Specific sections can be rearranged or segmented to align with the grantor’s estate planning goals, ensuring clarity. Using tools available on pdfFiller, users can manage these edits effectively to create a document that fully represents their intentions.

eSigning the John Sample Trust Form

Electronic signatures (eSignatures) enable quick and convenient signing of the John Sample Trust Form. Many states recognize eSignatures as legally valid, making it an efficient option for grantors seeking to finalize their trust documentation without delays. However, it’s essential to verify local laws in your jurisdiction to ensure compliance.

To eSign the John Sample Trust Form using pdfFiller, follow these steps:

Managing your John Sample Trust Form

Storing and accessing your completed form

Once the John Sample Trust Form is completed and signed, careful storage of the document is paramount. Utilizing cloud storage solutions, such as those offered by pdfFiller, ensures that the document is securely backed up and easily accessible from anywhere. This is particularly beneficial for grantors who may wish to share the document with family members or legal advisors.

Editing and updating the trust form

Trust forms may require updates over time due to changes in assets or beneficiary statuses. It's advisable to review the John Sample Trust Form regularly to ensure it reflects current intentions and legal standards. With pdfFiller, revising the trust form is straightforward, allowing users to leverage version control to track changes and maintain consistency.

Collaborative tools for teams

If multiple advisors or family members are involved in the estate planning process, using collaborative tools can enhance communication and review processes. pdfFiller enables users to invite others to review the John Sample Trust Form, fostering feedback and ensuring that all parties are aligned on the management and distribution of assets.

Common questions about the John Sample Trust Form

Many individuals have questions about the John Sample Trust Form and its application. Here are some frequently asked questions:

Related forms and templates available on pdfFiller

In addition to the John Sample Trust Form, pdfFiller offers a variety of related estate planning forms. These may include wills, powers of attorney, advanced directives, and living wills, all designed to streamline your planning process.

Using templates available on the platform can enhance document management and provide a comprehensive estate planning framework. This integration of various financial forms bolsters the confidence of grantors in managing their trust portfolio efficiently.

Viewer engagement: What others found useful

The John Sample Trust Form has resonated with many users navigating their estate planning journey. Popular documents among users include templates for wills and durable powers of attorney, which complement the trust form effectively.

User stories on how pdfFiller facilitated their estate planning demonstrate the platform's ability to empower individuals and families in managing their documentation with confidence. Engaging with this community offers insight into best practices for completing and managing trust documents.

Consider participating in our interactive poll: Share your experience with trust forms and discover what works best for others in your situation. This exchange of information can help demystify the trust preparation process.

Advanced considerations for legal protection

Engaging legal counsel for trust preparation is crucial, as they can navigate complex legal requirements and ensure the trust complies with state laws. A well-prepared trust often includes stipulations concerning the powers and duties of trustees, the role of a successor trustee, and guidance for managing the assets within the trust portfolio.

Furthermore, legal counsel can mitigate risks associated with common pitfalls in trust management. For instance, undisclosed assets or poorly defined beneficiary designations can lead to legal complications. Ensuring that your John Sample Trust is executed properly protects against future disputes and maintains the integrity of the estate plan.

New features and updates in pdfFiller

Recent advancements on the pdfFiller platform enhance document management capabilities. New tools enable users to create, edit, and sign documents with greater ease and efficiency. Understanding and maximizing these features can streamline the trust creation and management process even further, making it easier to adapt documentation as legal requirements evolve.

As users explore the latest functionalities, revisiting your John Sample Trust Form through pdfFiller can reveal opportunities for improved workflow and document integrity. For example, tools that allow bulk document uploads or enhanced signing features can significantly reduce turnaround time for estate planning tasks.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit john sample trust straight from my smartphone?

How do I edit john sample trust on an iOS device?

How do I fill out john sample trust on an Android device?

What is john sample trust?

Who is required to file john sample trust?

How to fill out john sample trust?

What is the purpose of john sample trust?

What information must be reported on john sample trust?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.