Get the free BLANKET BOND (TEN WELLS OR LESS) - FORM 3B

Get, Create, Make and Sign blanket bond ten wells

How to edit blanket bond ten wells online

Uncompromising security for your PDF editing and eSignature needs

How to fill out blanket bond ten wells

How to fill out blanket bond ten wells

Who needs blanket bond ten wells?

Comprehensive Guide to the Blanket Bond Ten Wells Form

Understanding the Blanket Bond Ten Wells Form

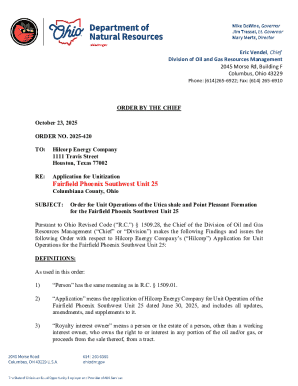

A blanket bond in the oil and gas industry serves as a kind of financial guarantee, allowing operators to cover multiple wells under a single surety bond. This is particularly advantageous for operators managing multiple sites, as it consolidates the bonding process into one manageable form. The Blanket Bond Ten Wells Form specifically streamlines this process, ensuring compliance with governmental regulations while safeguarding against potential financial losses associated with well operations.

For stakeholders, the importance of the Blanket Bond Ten Wells Form cannot be overstated. It not only protects the interests of the state and public but also assures investors and partners of the operator's financial accountability. Effectively, it acts as a form of insurance, guaranteeing that environmental and operational obligations will be met.

Key terminology

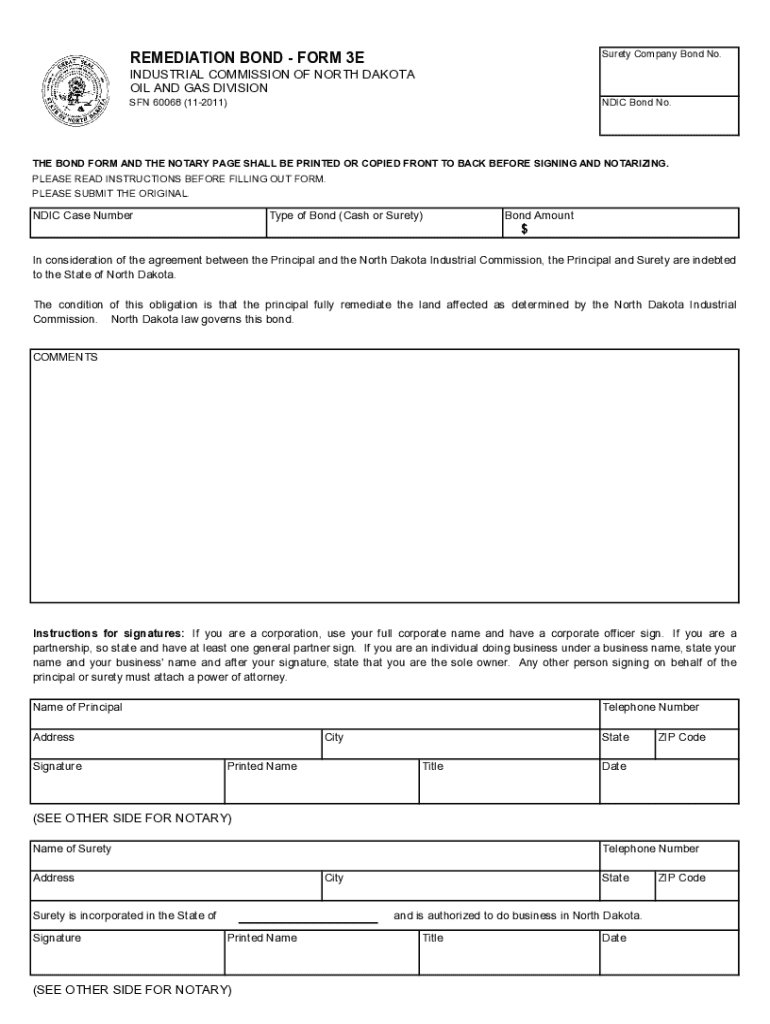

To navigate the complexities of the Blanket Bond Ten Wells Form, it's vital to understand some key terms: 'surety' refers to the company providing the bond, which takes on financial responsibility if the operator fails to meet obligations. 'Collateral' is the asset that the operator must pledge, which can be seized if necessary, while 'bonding capacity' signifies the maximum dollar amount the surety is willing to underwrite based on the operator's financial strength.

Preparing for completion of the form

Before filling out the Blanket Bond Ten Wells Form, operators must gather various essential documents. First, an operator's license is required to establish legal authority to drill. Next, detailed information about each well to be covered under the bond is necessary; this includes the location, purpose, and projected operational timelines for each site. Finally, financial statements demonstrate the operator’s fiscal stability and bonding capacity, a crucial aspect that surety companies assess.

Understanding state-specific requirements is equally important since bonding regulations differ across jurisdictions. For example, while some states may demand higher bond amounts or additional collateral, others may have less stringent rules. Operators should refer to local government websites or resources like the Bureau of Land Management (BLM) for accurate guidelines tailored to their state.

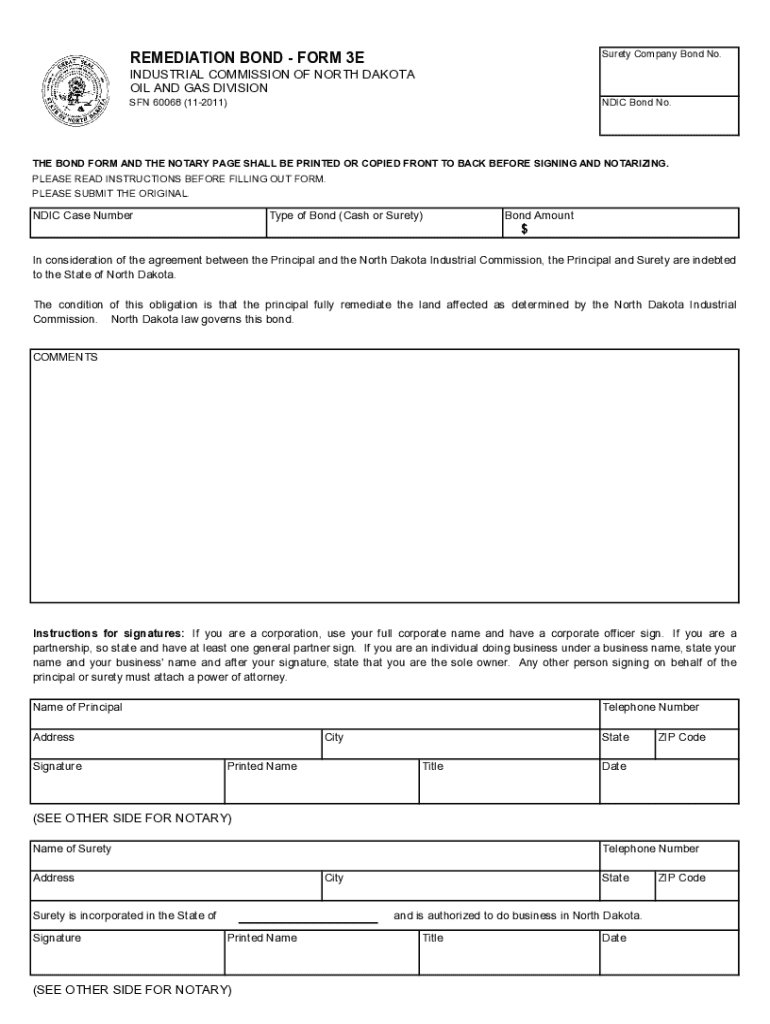

Step-by-step guide to filling out the Blanket Bond Ten Wells Form

Completing the Blanket Bond Ten Wells Form involves multiple sections that require diligent attention to detail. Start with the applicant information section, ensuring the operator's name, address, and contact details are correctly filled out to avoid processing delays. Missteps in providing accurate information can result in unnecessary hurdles.

Common mistakes often stem from omitting necessary details or unclear documentation. Operators should review their entries against provided checklists or guidelines. A final proofreading session can help capture any overlooked errors.

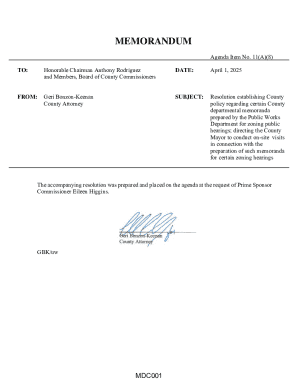

Editing and managing the Blanket Bond Ten Wells Form

Utilizing platforms like pdfFiller can significantly simplify the management of the Blanket Bond Ten Wells Form. With pdfFiller, users can easily edit, fill, and sign their documents online, streamlining collaboration between various stakeholders such as lawyers, financial advisors, and regulatory authorities. This cloud-based solution ensures that all parties have real-time access to the latest version of the form, fostering efficiency.

Additionally, pdfFiller offers interactive tools that enhance document management. Users can access templates tailored specifically for the Blanket Bond Ten Wells Form, enabling quick and straightforward completion. Consistent storage solutions also allow for the quick retrieval of needed documents during audits or compliance checks.

Submitting your Blanket Bond Ten Wells Form

Submission of the Blanket Bond Ten Wells Form can occur through various methods, including online portals, mailed submissions, or in-person deliveries, depending on the state’s specific requirements. It’s critical for operators to track the submission status and confirm receipt with the respective authorities to mitigate the risk of processing delays.

Approval times can vary depending on the jurisdiction and complexity of the bonding request. Operators should anticipate waiting periods and prepare for follow-ups to expedite the review process. Regular communication with the surety company can also clarify if additional documentation or adjustments are necessary to finalize the bond.

Managing your blanket bond post-submission

Post-submission, it's vital for operators to monitor their bond requirements consistently. Regular checks help ensure compliance with any changes in state regulations or operational shifts at the wells. This attention to detail not only preserves the integrity of the bond but also protects the operator from potential fines or penalties.

Renewal and modification of the blanket bond may also be necessary as operations evolve. Operators should be proactive in maintaining documentation and working closely with their surety company to adapt the bond to current needs, ensuring seamless continuity in their operations.

FAQ section on Blanket Bond Ten Wells Form

Frequently asked questions regarding the Blanket Bond Ten Wells Form focus on topics like required documentation, bonding amounts, and timelines. Operators often seek clarity on modifying existing bonds or what happens if their operations expand beyond the initially covered wells.

Obtaining expert insight into common misunderstandings can aid operators in manipulating the form accurately, ensuring compliance and operational success.

Success stories: Effective use of the Blanket Bond Ten Wells Form

Successful case studies demonstrate the impactful role of the Blanket Bond Ten Wells Form in enhancing operational efficiency within the oil and gas sector. Operators who have adeptly navigated the bonding process often report better financial stability and smoother interactions with regulatory bodies.

For instance, operators who implemented a streamlined bonding package utilizing pdfFiller witnessed a substantial reduction in processing times and bureaucratic hurdles, showcasing the strategic advantage that a well-completed Blanket Bond Ten Wells Form can provide.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get blanket bond ten wells?

How do I complete blanket bond ten wells online?

How do I complete blanket bond ten wells on an Android device?

What is blanket bond ten wells?

Who is required to file blanket bond ten wells?

How to fill out blanket bond ten wells?

What is the purpose of blanket bond ten wells?

What information must be reported on blanket bond ten wells?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.