Get the free Rental Criteria & Application Process - Portland Rental Homes

Get, Create, Make and Sign rental criteria amp application

Editing rental criteria amp application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out rental criteria amp application

How to fill out rental criteria amp application

Who needs rental criteria amp application?

Rental Criteria & Application Form: Your Comprehensive Guide

Understanding rental criteria

Rental criteria are the guidelines landlords use to evaluate prospective tenants. This set of standards helps ensure that the selected renters can meet their financial obligations and maintain the property. Clear rental criteria not only protect landlords from potential loss but also provide tenants with a transparent understanding of the application process.

The importance of establishing clear rental criteria cannot be overstated. It sets expectations for both parties, streamlining the application process and reducing misunderstandings. Common rental criteria include income requirements, background checks, rental history, credit reports, and employment verification.

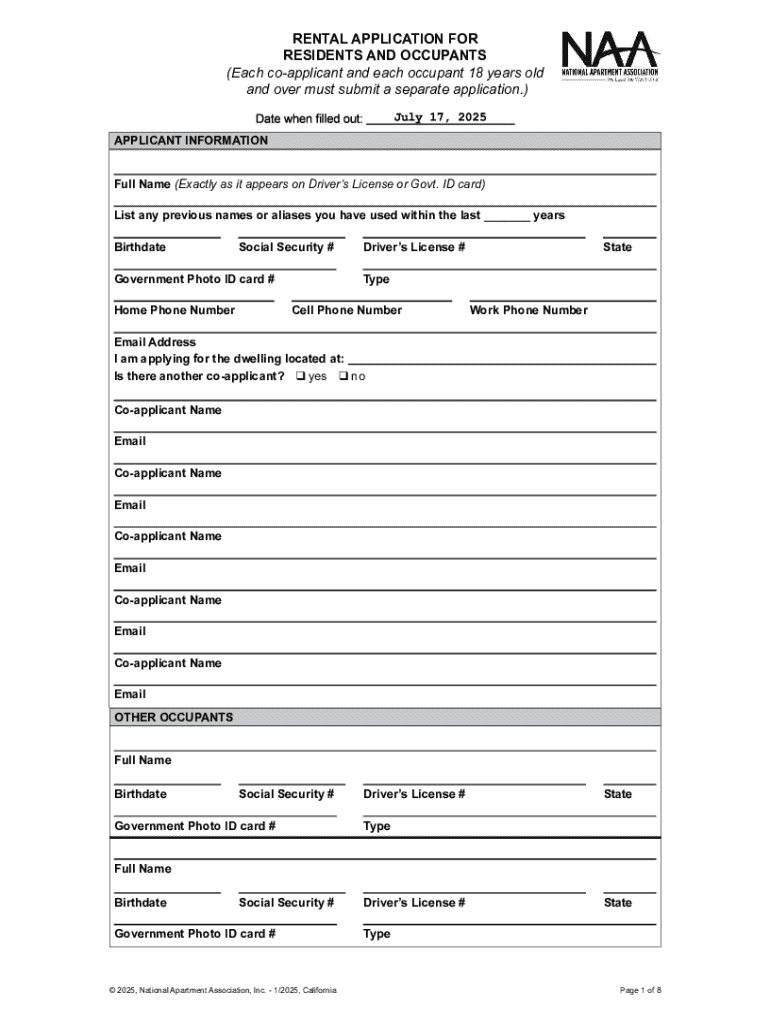

Overview of the rental application form

The rental application form serves vital functions in the tenant screening process. It collects essential information that landlords need to assess applicants effectively. A well-designed application can significantly influence a landlord's decision.

Essential components typically include a personal information section, employment and income information, details about prior rental history, references, and consent for background checks to comply with privacy laws.

Key sections of the rental application

How to fill out personal information section

This section typically requires details such as your full name, current address, contact numbers, and email. It’s crucial to ensure all provided information is accurate to avoid delays or complications during the tenant screening process. Mistakes may lead landlords to question your reliability.

Employment verification process

When providing employment details, clarity is essential. Landlords commonly request proof of income through pay stubs or tax returns, along with contact information for your employer. Be prepared to submit common documentation including recent pay stubs, your employment contract, or a letter from your employer.

Providing rental history

Your rental history should include previous addresses, the duration of stay, and contact details for prior landlords. Always inform your previous landlords that they may be contacted; this preparedness can make a significant impression on potential landlords.

Managing references

Choosing the right references can significantly impact your application. Opt for individuals who can vouch for your character, such as employers or community leaders. Ensure you provide accurate contact information so that landlords can easily reach them.

Addressing common concerns

If you have poor credit, focus on demonstrating your ability to pay rent through other means. You might offer a co-signer with a stronger credit profile or make a larger upfront deposit to alleviate concerns. Providing a solid letter explaining your financial history can also show responsibility.

In cases of incomplete rental history, consider alternative documentation. Letters from past employers or character references can help fill in the gaps to give landlords an insight into your stability as a tenant.

If there are gaps in employment, come prepared with justifications. Reasons such as further education, caregiving responsibilities, or temporary layoffs can help paint a complete picture.

Completing the rental application form

Filling out the rental application form meticulously is imperative. Review all entries for accuracy and ensure legibility. Common mistakes include typos, incomplete fields, and outdated contact information, all of which can hinder your application.

Digital tools like pdfFiller can make this process easier. Features allow users to edit and manage their applications seamlessly, tapping into options like eSignatures which speed up the submission process.

Submitting your rental application

When submitting your application, adhering to landlord preferences is crucial. Some may request physical copies while others might prefer digital submissions. Confirming acceptable formats can help avoid embarrassing mix-ups.

Following up is also significant after submission; a courteous inquiry can keep your application top-of-mind and demonstrate your interest.

After submission, expect to wait for a timeframe that varies by landlord. Understanding these timelines helps you manage expectations while remaining proactive in seeking updates on your application status.

Understanding the application approval process

Landlords evaluate applications using a mix of the above criteria. They scrutinize income, credit history, and references for reliability indicators. Awareness of the factors influencing decisions can empower applicants in presenting their best self.

Common reasons for denial include red flags such as poor credit scores, lack of sufficient income, and insufficient rental history. If your application is denied, don't be discouraged; understanding the reasons can guide improvements for reapplication.

Managing your rental documents post-application

After submitting your application, keeping track of all your documentation is essential. Using a platform like pdfFiller for document management can organize all your applications, lease agreements, and correspondence effectively.

Collaboration with roommates or co-applicants can simplify the process further. Sharing applications and combining documents lets potential landlords see your solid team effort.

FAQs about rental criteria and applications

During the application process, expect inquiries that can clarify your suitability as a tenant. Prepare to communicate essential details regarding your financial stability, rental history, and even lifestyle habits that may impact your tenancy.

Financial readiness is crucial in renting; ensure you have a budget that includes not just rent but other living expenses. If you encounter standard rental applications that seem stringent, remember there are alternatives available, including landlord-specific applications tailored for unique situations.

Interactive tools for practical use

Utilizing interactive features provided by pdfFiller can drastically simplify your rental application process. Templates for rental applications can eliminate guesswork, while budget calculators assist in ensuring you can mitigate expenses effectively.

Additionally, customizable checklists for new renters help ensure no steps are missed before signing a lease. With pdfFiller, you have a unified, cloud-based solution designed for efficient document management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify rental criteria amp application without leaving Google Drive?

Can I create an electronic signature for the rental criteria amp application in Chrome?

How do I edit rental criteria amp application on an Android device?

What is rental criteria & application?

Who is required to file rental criteria & application?

How to fill out rental criteria & application?

What is the purpose of rental criteria & application?

What information must be reported on rental criteria & application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.