Get the free Letter of indemnity - NRI Customers - DCB Bank

Show details

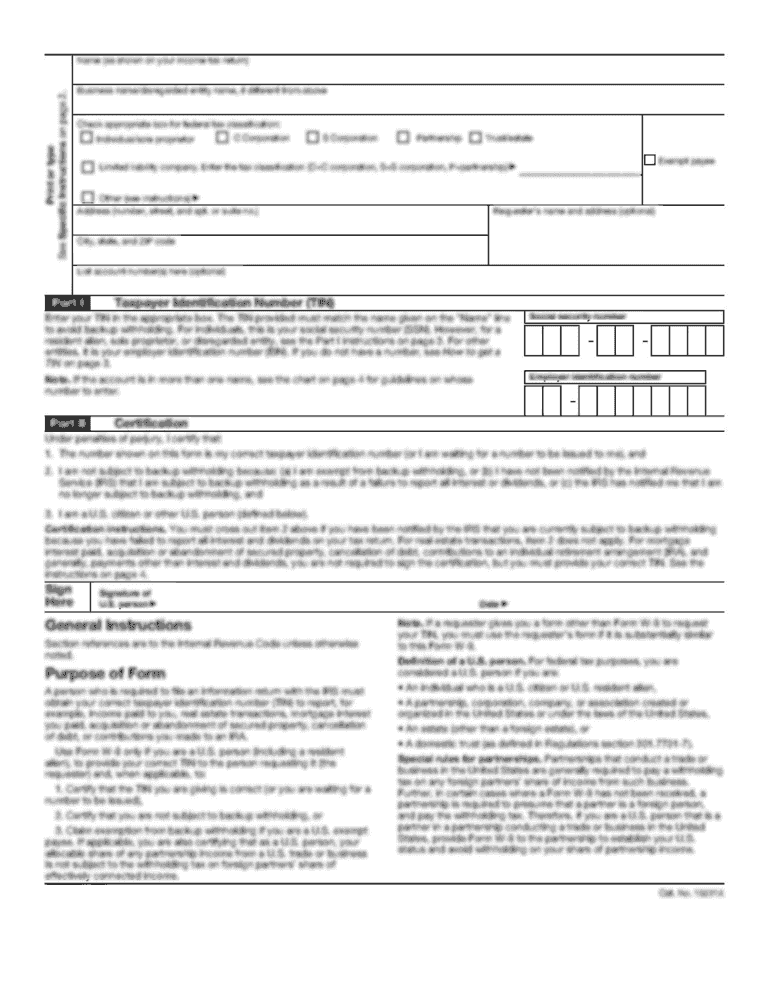

Letter of Indemnity NRI Customers Date: To, The Branch Manager, DCB Bank Limited, (Formerly Development Credit Bank Limited) Branch In consideration of DCB Bank Limited (Formerly Development Credit

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your letter of indemnity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letter of indemnity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing letter of indemnity online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit letter of indemnity. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller.

How to fill out letter of indemnity

How to Fill Out a Letter of Indemnity:

01

Begin by stating your full name, address, and contact information at the top of the letter. This will serve as your identification and make it easier for the recipient to reach out to you if needed.

02

Address the letter to the appropriate party, whether it is an individual or a company. Include their name, title, and address if available. This will ensure that the letter is being directed to the right person.

03

Clearly state the purpose of the letter of indemnity. Explain why you are writing and what specific actions or responsibilities you are assuming. Be concise and straightforward, avoiding any ambiguity or confusion.

04

Provide any necessary background or context related to the indemnity. This can include details about the transaction, agreement, or situation that requires protection through indemnity. Again, clarity is key in order to avoid misunderstandings.

05

Outline the specific risks or liabilities that you are agreeing to indemnify the recipient against. Be thorough and cover all potential scenarios that may arise, ensuring that you are taking full responsibility for those risks.

06

Include any additional terms or conditions that both parties must adhere to regarding the indemnity. This can involve limitations, exclusions, or any other relevant agreements that need to be clarified.

07

Sign the letter with your full legal name and include the date of signing. This signifies your commitment and acknowledgement of the indemnity.

Who Needs a Letter of Indemnity:

01

Businesses involved in international trade may often require a letter of indemnity. This is because goods can be transported across different jurisdictions, and the risks associated with transportation, such as damage or loss, need to be addressed.

02

Shipping companies often request a letter of indemnity from exporters or importers to protect themselves against any potential legal or financial liabilities that may occur during transportation.

03

Banks and financial institutions may also require a letter of indemnity when issuing certain guarantees or providing financial services. This serves as a form of security and protection for them against any unforeseen risks.

In conclusion, understanding how to properly fill out a letter of indemnity is crucial when it comes to protecting yourself or your business from potential liabilities. Additionally, recognizing who may need a letter of indemnity can help ensure that all parties involved are adequately protected in any given transaction or agreement.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is letter of indemnity?

A letter of indemnity is a legal document issued by one party to another which promises to compensate for any potential losses or damages incurred due to a specific action or event.

Who is required to file letter of indemnity?

Letter of indemnity is typically required by parties involved in international trade or shipping to protect against potential risks or liabilities.

How to fill out letter of indemnity?

To fill out a letter of indemnity, one must include specific details such as the parties involved, the reason for indemnification, the potential risks, and the compensation amount.

What is the purpose of letter of indemnity?

The main purpose of a letter of indemnity is to provide financial protection to the parties involved in a transaction or agreement.

What information must be reported on letter of indemnity?

Information such as the names of the parties involved, the reason for indemnification, the potential risks, and the compensation amount must be reported on a letter of indemnity.

When is the deadline to file letter of indemnity in 2023?

The deadline to file a letter of indemnity in 2023 will depend on the specific agreement or transaction involved.

What is the penalty for the late filing of letter of indemnity?

The penalty for the late filing of a letter of indemnity may vary depending on the terms and conditions outlined in the agreement or contract.

Can I create an eSignature for the letter of indemnity in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your letter of indemnity directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How can I edit letter of indemnity on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing letter of indemnity.

Can I edit letter of indemnity on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share letter of indemnity from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your letter of indemnity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.