AU NAT9599 2013-2025 free printable template

Show details

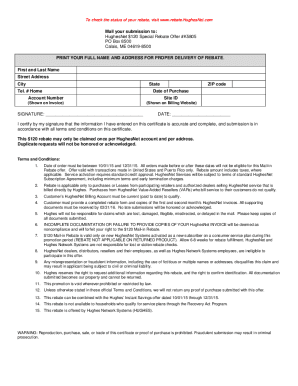

Superannuation guarantee charge statement quarterly HOR 27 Office use only Before filling in this statement please read How to complete the The instructions include examples and calculation worksheets to help you to complete this statement. Instructions and statements are available at www. ato. gov*au/super or by phoning our information line on 13 10 20. Cheques should be made payable to the Deputy Commissioner of Taxation and crossed Not Negotiable. This statement is for the quarter ended...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign nat9599 form

Edit your super guarantee charge statement excel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your AU NAT9599 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing AU NAT9599 online

To use the services of a skilled PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit AU NAT9599. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

AU NAT9599 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out AU NAT9599

How to fill out AU NAT9599

01

Read the instructions provided for the AU NAT9599 form carefully.

02

Gather all necessary personal information, including your full name, address, and tax file number (TFN).

03

Complete each section of the form with accurate information.

04

Ensure any required supporting documents are attached to the form.

05

Review the completed form for any errors or omissions before submission.

06

Submit the form by the specified deadline, using either online methods or by mailing it to the appropriate address.

Who needs AU NAT9599?

01

Anyone who is applying for certain government benefits or services in Australia may need to fill out the AU NAT9599 form.

02

Individuals seeking to confirm their tax status or eligibility for specific tax concessions may also need this form.

Fill

form

: Try Risk Free

People Also Ask about

How do I submit a SGC statement?

If you're a tax professional you can lodge the SGC statement through Online services for agents by: going into Practice mail and selecting New. selecting Superannuation as the topic. selecting Lodge SGC statement as the subject. attaching the relevant files.

How do I submit a super guarantee charge statement?

(via ATO Online Services for Agents) Log into ATO Online Services for Agents. Go to Communication > Practice Mail. Click on [New] è The Practice Mail screen. Select/Enter the following details: Topic > Select: Superannuation. Select/Enter the following details: Select the Privacy Declaration and click on.

How do I lodge a SGC charge statement?

(via ATO Online Services for Agents) Log into ATO Online Services for Agents. Go to Communication > Practice Mail. Click on [New] è The Practice Mail screen. Select/Enter the following details: Topic > Select: Superannuation. Select/Enter the following details: Select the Privacy Declaration and click on.

What is the superannuation guarantee charge in Australia?

The super guarantee (SG) is the minimum amount that employers have to pay into eligible employees' super accounts. It is currently 10% of an employee's ordinary time earnings (what they earn for their normal hours of work), having risen from 9.5% on 1 July, 2021.

How is superannuation guarantee charge calculated?

The super guarantee charge is calculated as: super guarantee shortfall + nominal interest + administration fee.

What is an SGC statement?

1.5 The Superannuation Guarantee Charge (SGC) Employers who do not pay superannuation contributions for an employee for a quarter are liable to pay a penalty via the superannuation guarantee charge.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find AU NAT9599?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific AU NAT9599 and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute AU NAT9599 online?

Easy online AU NAT9599 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit AU NAT9599 on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign AU NAT9599 right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is AU NAT9599?

AU NAT9599 is a form used in Australia for reporting the income of individual taxpayers, typically for those who have received payments for work or services rendered.

Who is required to file AU NAT9599?

Individuals or entities that have received income from sources such as employment or contracts and are liable for income tax in Australia are required to file AU NAT9599.

How to fill out AU NAT9599?

To fill out AU NAT9599, taxpayers should enter their personal details, the income received during the financial year, and any relevant deductions. It is essential to follow the instructions provided in the form accurately.

What is the purpose of AU NAT9599?

The purpose of AU NAT9599 is to ensure that all income earned by individuals is reported to the Australian Taxation Office (ATO) for the accurate assessment of tax obligations.

What information must be reported on AU NAT9599?

On AU NAT9599, taxpayers must report their personal identification details, total income earned, any deductions claimed, and any other relevant financial information required by the ATO.

Fill out your AU NAT9599 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

AU nat9599 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.