Get the free E VALUATION OF - economics uci

Show details

E VALUATION OF C CONVERTIBLE S SECURITIES REVISED VERSIONS. T. KISSOFF Ph.D. UNIVERSITY OF CALIFORNIAPUBLI S HED ANALYTICAL PUBLISHERS CO. 602 VANDERBILT STREET BROOKLYN, NEW YORK 11218COPYRIGHT 1969

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your e valuation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your e valuation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing e valuation of online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit e valuation of. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

How to fill out e valuation of

How to fill out e valuation of?

01

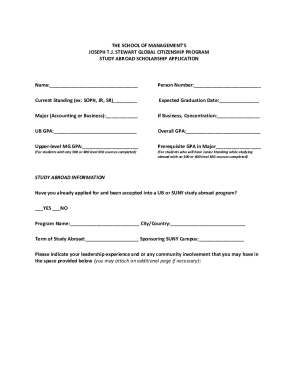

Start by gathering all relevant information and documentation related to the item or property that requires evaluation. This may include financial records, invoices, receipts, and any other supporting documents.

02

Carefully review the evaluation form and ensure you understand each section and its purpose. This will help you in providing accurate and relevant information.

03

Begin filling out the form by providing basic details about the item or property being evaluated. This may include its name, description, date of purchase, and any unique identifying factors.

04

Proceed to provide comprehensive information about the current condition or state of the item. Highlight any damages, wear and tear, or improvements made.

05

If applicable, include information about any additional features or accessories that may affect the value of the item.

06

Proceed to provide relevant financial information such as purchase price, current market value, and any outstanding loans or mortgage associated with the item.

07

In case the evaluation requires you to compare the item to similar ones in the market, conduct thorough research to gather accurate market data and provide a fair comparison.

08

Double-check the entire form for accuracy, ensuring you have filled in all the required fields and provided all necessary details.

09

Once you are satisfied with the information provided, sign and date the evaluation form.

Who needs e valuation of?

01

Individuals who are looking to sell their property or assets and want to determine its fair market value.

02

Businesses and organizations that require valuation for financial reporting purposes, such as including assets in balance sheets or determining net worth.

03

Insurance companies that need to evaluate the value of insured items or properties in order to determine appropriate coverage and premiums.

04

Financial institutions that need to determine the value of assets for loan collateral evaluation or investment decisions.

05

Government agencies and tax authorities that require valuation for taxation purposes, property assessments, or estate settlements.

By following the step-by-step process outlined above, individuals and organizations can successfully fill out their e valuation forms, ensuring accuracy and relevancy. This information is crucial for various purposes, including selling properties, financial reporting, insurance coverage, and legal matters.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is e valuation of?

E valuation is a process of determining the value of a particular asset or property.

Who is required to file e valuation of?

Individuals or businesses who own assets or properties that need to be valued.

How to fill out e valuation of?

E valuation forms can be filled out manually or electronically, providing all required information about the asset or property.

What is the purpose of e valuation of?

The purpose of e valuation is to accurately determine the value of an asset or property for various reasons such as taxation, insurance, or investments.

What information must be reported on e valuation of?

Information such as the description of the asset, its condition, any improvements made, and its current market value must be reported on e valuation forms.

When is the deadline to file e valuation of in 2023?

The deadline to file e valuation of in 2023 is typically April 15th, but it is always best to verify with the relevant authorities.

What is the penalty for the late filing of e valuation of?

The penalty for late filing of e valuation forms can vary depending on the jurisdiction, but it may include additional fees or fines.

How can I modify e valuation of without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including e valuation of, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send e valuation of to be eSigned by others?

To distribute your e valuation of, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

Can I create an eSignature for the e valuation of in Gmail?

Create your eSignature using pdfFiller and then eSign your e valuation of immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your e valuation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.